Fill and Sign the State of Hawaii Tax Form G 45 2015

Practical advice on finalizing your ‘State Of Hawaii Tax Form G 45 2015’ online

Are you fed up with the inconvenience of handling paperwork? Your search ends here with airSlate SignNow, the premier electronic signature tool for individuals and small to medium-sized businesses. Say farewell to the tedious routine of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Take advantage of the powerful features integrated into this user-friendly and cost-effective platform and transform your method of document handling. Whether you need to sign documents or collect signatures, airSlate SignNow manages it all effortlessly, requiring only a couple of clicks.

Follow this comprehensive tutorial:

- Access your account or initiate a free trial of our service.

- Click +Create to upload a file from your device, cloud, or our template library.

- Open your ‘State Of Hawaii Tax Form G 45 2015’ in the editor.

- Click Me (Fill Out Now) to set up the form on your side.

- Add and designate fillable fields for other participants (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

No need to worry if you need to work with others on your State Of Hawaii Tax Form G 45 2015 or send it for notarization—our solution has everything you need to accomplish those tasks. Sign up with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

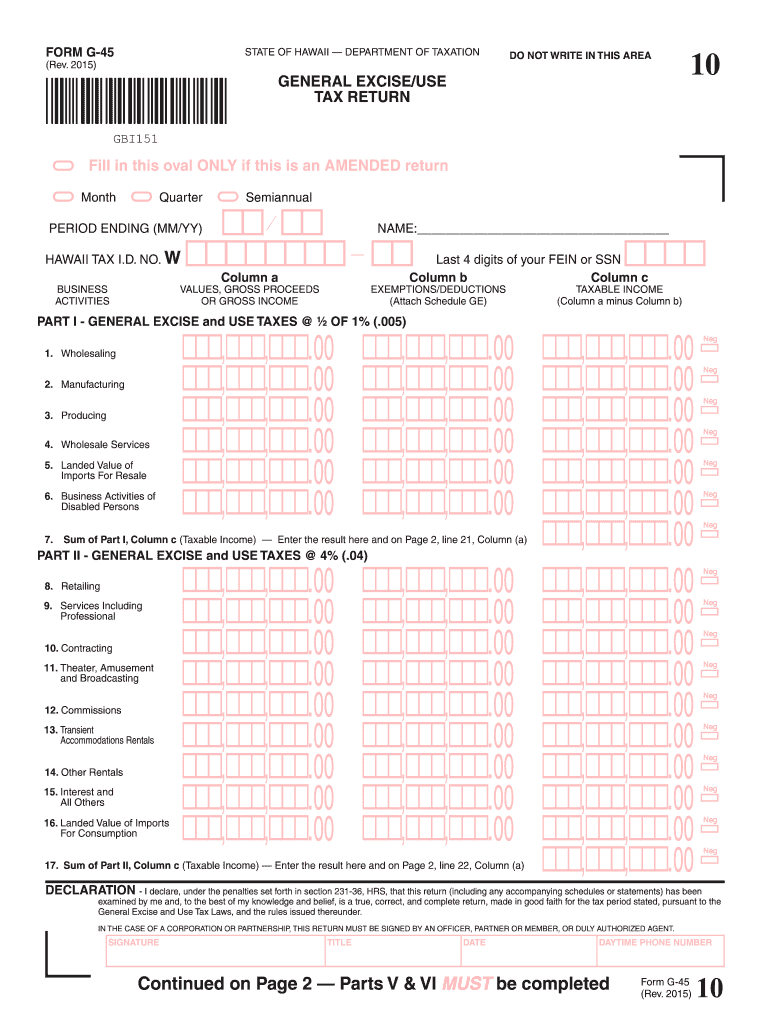

What is the State Of Hawaii Tax Form G 45?

The State Of Hawaii Tax Form G 45 is a tax form used by businesses to report and pay their general excise tax. It is essential for compliance with Hawaii tax regulations. Using airSlate SignNow, you can easily access and eSign this form, ensuring your submissions are timely and accurate.

-

How can airSlate SignNow help me with the State Of Hawaii Tax Form G 45?

airSlate SignNow streamlines the process of completing and submitting the State Of Hawaii Tax Form G 45. With our platform, you can fill out the form digitally, eSign it, and submit it directly to the state, all in one seamless workflow. This saves you time and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the State Of Hawaii Tax Form G 45?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Our cost-effective solutions include features specifically designed to assist with the State Of Hawaii Tax Form G 45 and other essential documents. Visit our pricing page to find the plan that suits you best.

-

Can I integrate airSlate SignNow with other software when handling the State Of Hawaii Tax Form G 45?

Absolutely! airSlate SignNow supports a variety of integrations with popular software solutions. This allows you to streamline your workflow when managing the State Of Hawaii Tax Form G 45, making it easier to keep your financial records organized and up to date.

-

What features does airSlate SignNow offer for managing the State Of Hawaii Tax Form G 45?

airSlate SignNow provides a range of features, including customizable templates, eSigning capabilities, and document tracking. These tools make it simple to prepare and submit the State Of Hawaii Tax Form G 45, ensuring that your business meets all regulatory requirements efficiently.

-

Is it secure to use airSlate SignNow for the State Of Hawaii Tax Form G 45?

Yes, security is a top priority at airSlate SignNow. Our platform uses advanced encryption and secure cloud storage to protect your sensitive information while you complete the State Of Hawaii Tax Form G 45. You can eSign and manage your documents with confidence knowing your data is safe.

-

How quickly can I complete the State Of Hawaii Tax Form G 45 using airSlate SignNow?

With airSlate SignNow, you can complete the State Of Hawaii Tax Form G 45 in just a few minutes. Our user-friendly interface and efficient eSigning process allow you to fill out and submit your tax forms quickly, ensuring you meet deadlines without hassle.

Find out other state of hawaii tax form g 45 2015

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles