PUBLIC VERSION

Appendix A

The empirical analyses in this Addendum use the publicly-available DB1B ticket database

maintained by the U.S. Department of Transportation. The DB1B data are a 10% random sample of

tickets either ticketed by a U.S. carrier or where a U.S. carrier operated at least one flight in the

ticket=s itinerary. The data are compiled quarterly. The only information provided by a ticket in DB1B

is the purchased price (in dollars), number of coupons in the ticket’s itinerary,1 number of sampled

passengers traveling the itinerary at the particular fare, and, for each coupon, the fare class,2 origin

and destination airports as well as the operating and marketing carriers. Tickets ticketed by foreign

carriers that include no flights operated by U.S. carriers are not reported in DB1B.

I.

Price Effects from the Loss of Nonstop Competition in Transatlantic Routes.

Our empirical evidence shows that a reduction in the number of competing airlines offering

nonstop transatlantic flights may result in large, statistically significant price increases.

To determine the effects from changes in the number of competing airlines offering nonstop

transatlantic flights, we analyze the DB1B data for the 3rd quarter of 2008. We define a route as a nondirectional city pair with one endpoint in the U.S. and the other endpoint in Europe (that is,

transatlantic routes). We extract from DB1B 1-coupon coach-class tickets (one-way tickets) and 2coupon coach-class round-trip tickets that have the same starting and ending city.3 We split the roundtrip tickets into one-way tickets and divide the fare by two, so that the data are on a one-way basis.

Following Brueckner and Whalen (2000),4 we drop tickets with one-way fares below $50 since these

may represent trips purchased with frequent-flyer miles or made by airline employees at significantly

reduced fares. We then compute the passenger-weighted average fare for each route.

The object of the empirical analysis is to analyze how the average fare varies across

transatlantic routes based on the number of airlines offering nonstop flights in a route, controlling for

other factors that may affect fares. In the hub-and-spoke networks that the major transatlantic carriers

operate, the majority of nonstop service that an airline offers radiates from its hubs, and the airline

relies on connections through its hubs to serve thousands of other routes. Given this structure, the

major network carriers provide overlapping transatlantic nonstop service on routes between their hubs

or from the same hub airport if they share a hub airport. To control for the economics of hubs, we

focus our attention on routes between two hubs of an immunized alliance and routes served by multiple

1

A coupon may denote a nonstop flight or a direct flight. A direct flight is a connecting flight (that

is, a flight with a stop at an intermediate transit airport) with no change of aircraft or flight number.

2

The DB1B data reports the generic fare class for each coupon in a ticket. The most common fare

classes are C, D, X, and Y, where C and D are business fare classes, X is the main coach cabin fare class,

and Y typically stands for full-fare coach fare. DB1B provides no other data on passenger mix.

3

We focus on tickets in which all coupons have coach fare class X. These tickets represent 90% of

all tickets in our data. Our results are not affected if we also include tickets with Y fare class coupons (only

1.5% of tickets have coupons with Y fare classes).

4

Brueckner, J., and Whalen, T., 2000, “The Price Effects of International Alliances,” Journal of

Law and Economics, 43, 503-454. These authors analyze the price effects of immunity grants in

transatlantic routes with nonstop service using 1997 quarter three data from DOT. They estimate that

average fares rise by about 5% when immunity is granted to two previously competitive carriers.

�PUBLIC VERSION

carriers with a hub airport in the route. Our sample data include 65 routes (see the Attachment for a

list).

To identify the number of nonstop competitors in these routes, we use flight listing data from

the Official Airline Guide. An airline is counted as serving a route nonstop if it offers at least 60

flights in each direction during the quarter. Different airlines serving the route nonstop are counted as

competing unless they were immunized members of the same alliance during the quarter, in which case

they count as a single competitor.5 We define dummy variables to denote the number of competitors

in a route. Monopoly routes are the reference group. The competitive variables equal one when there

are, respectively, 2, 3, 4, or 5 or more nonstop competitors in the route and zero otherwise. Eighteen

of the 65 routes in our data are nonstop monopolies, 28 have 2 nonstop competitors, 13 have 3 nonstop

competitors, 4 have 4 nonstop competitors, and 2 have 6 nonstop competitors.6 Having already

controlled for hub effects, following Brueckner and Whalen (2000), we include as additional control

variables the mileage of the route and the route’s population potential, which is computed as the

geometric mean of the population at the two endpoint cities in the route.7 Lastly, the airports in our

transatlantic routes are major U.S. and European airports, at which, to begin with, members of all of

the major airline alliances have flight operations. These alliances include multiple members that make

available a large number of single-connect and double-connect travel itineraries to passengers across

the sample routes.8 That is, there is significant connecting service offered across all of our routes.

We use the ordinary least squares method to estimate how average fares vary across routes

based on the number of nonstop competitors in a route. In particular, we estimate how the natural

logarithm transformation of the average fare varies as a function of the dummy variables denoting the

number of nonstop competitors, the natural logarithm transformation of the mileage distance, and the

population potential.9 Results are listed in Table 1. The model explains 59% of the variation in

5

This assumes that non-immunized members of the same alliance remain vigorous competitors. If

not, then the price effects we estimate from the loss of a nonstop competitor may underscore the magnitude

of the true price effects.

6

In seven routes, an airline, such as Air India, Eurofly, Malaysia, Kuwait or Pakistan International

Airlines, offers less than 60 nonstop flights in each direction (it typically offers 30 to 40 flights during the

quarter). Dropping these routes from our data does not affect our findings: the estimated price effects are

statistically significant and, if anything, slightly larger in magnitude than those reported in Table 1. We note that,

over the past three years, there is only one instance of a non-hub carrier beginning to serve any of the 46

transatlantic hub routes that have one or two nonstop competitors in quarter three 2008. Chicago-Frankfurt had

two nonstop competitors in quarter three 2008; during quarter four 2008, Air India increased its ChicagoFrankfurt service (part of its longer haul service to India) to about 90 flights.

7

The mileage is the great circle distance mileage between the endpoints of the route. We use the 2008

U.S. metropolitan area population data at http://www.census.gov/popest/metro/metro.html. European population

data is from European Spatial Planning Observation Network, Study on Urban Functions (Project 1.4.3), Final

Report, Chapter 3, (ESPON, 2007), located at

http://www.espon.eu/mmp/online/website/content/projects/261/420/index EN.html.

8

Additional connecting travel itineraries are also available as a result of traditional interline

agreements or bilateral arrangements between airlines not in alliances or across different alliances.

9

We assume that the number of airlines offering nonstop flights in a transatlantic route is

determined prior to these airlines’ pricing decisions. This assumption is reasonable at several levels. First,

given that airline demand is revealed over time, and the high costs associated with establishing transatlantic

nonstop service, airlines who enter a transatlantic route will publish their flight schedule and advertise their

�PUBLIC VERSION

average fares across routes (R2=0.59), which means that the model fits the data well.

We estimate that reducing the number of nonstop competitors in a route from 2 to 1 raises

average nonstop fares in the route by 15.0%, all else equal.10 This effect is statistically significant at

the 1% level. In addition, we estimate that reducing the number of nonstop competitors in a route from

3 to 2 (4 to 3, respectively) raises average nonstop fares by 6.6% (6.3%, respectively), all else

equal.11 These findings are consistent with both previously published work and internal DOJ analyses

on the price effects from the loss of a nonstop carrier in domestic hub routes.12 Moreover, across our

routes, the vast majority of coach-class passengers (73%) fly nonstop, even though average connecting

fares are 10% lower than average nonstop fares. Hence, even if connecting service is in the relevant

market, the loss of nonstop competition significantly increases concentration levels in the market, and

we have evidence of large, statistically significant price effects from the loss of nonstop competition

on the fares paid by the vast majority of passengers.

II.

Price Differences across Tickets within a Route.

The parties claim that immunity grants to airline alliances are necessary to reduce a double

marginalization problem, which otherwise arises from the uncoordinated choice of alliance fares in

the absence of immunity. To support their claim, they cite empirical evidence in the economics

literature that finds that immunized alliance fares for connecting travel itineraries were lower in the

1990s than non-immunized alliance fares.13 Since the 1990s, however, the airline industry has

undergone major global changes, including, but not limited to, an increase in the global demand for

travel and consolidation in Europe. Airlines have also grouped into three major global alliances

(Oneworld, Skyteam, Star) and, within these alliances, non-immunized carriers appear to have made

significant strides towards managing more efficiently their yield management and capacity. In this

new service well-ahead of actual departure dates. Second, the number of airlines with nonstop flights in our

hub routes is quite stable over time, and almost exclusively made of airlines with a hub at an endpoint of the

route. Moreover, across our sample routes, over the period 2005-2008, the number of nonstop airlines

during quarter three equals that in quarter two 99% of the time. We also note that if we delete from the data

routes with entry or exit in other quarters in 2008, we obtain similar, statistically significant effects.

10

We obtain similar results running the model on quartile fares (25th , 50th , or 75th percentile fare)

rather than on the average fare. We also obtain similar results if we expand the sample to include all 129

transatlantic nonstop routes for which we have data (adding to the model a dummy variable to control for

the presence of dual hubs on the 65 routes of focus in the text). The itinerary in a DB1B ticket is reported in

terms of coupons, and the estimated effects apply to passengers in nonstop and, if any, direct flights. In only

7 of the 65 routes, there are 1-stop direct flights reported in the Official Airline Guide data. In the text, for

parsimony, we discuss the estimates in terms of their effect on the fares paid by nonstop passengers.

11

There are few routes in our data with 3 or more competitors, and the 3-to-2 and 4-to-3 effects

are not statistically significant.

12

See, e.g., Peters, C., 2006, “Airline Merger Simulation,” Journal of Law and Economics, 49,

pp.627-649. He computes actual price increases of between 7.2% and 29.4% following the loss of nonstop

competition in overlap domestic routes involved in mergers.

13

See, e.g., Brueckner and Whalen (2000), Brueckner, J., 2003, “International Airfares in the Age

of Alliances,” Review of Economics and Statistics, 85, pp.105-118, and Whalen, T., 2007, “A Panel Data

Analysis of Code-Sharing, Antitrust Immunity, and Open Skies Treaties in International Aviation Markets,”

Review of Industrial Organization, 30, 39-61.

�PUBLIC VERSION

Section, using quarter three DB1B data for 2005 through 2008, we provide newer empirical evidence

on pricing. Our evidence, which shows that immunized alliance fares are higher than non-immunized

ones, does not support the parties’ claims on immunity grants and double marginalization.

We define a route as a city-pair in a quarter, with origin in the U.S. and destination in Europe.

As in Brueckner and Whalen (2000), Brueckner (2003) and Whalen (2007), we drop from the data

(i) routes from U.S. cities where foreign carriers offer at least one nonstop flight per business day to

Europe, because the DB1B data do not report tickets ticketed by foreign carriers, and (ii) routes that

have nonstop flights between their endpoints, to focus on routes where service by domestic and foreign

airlines is complementary. 14 We extract from DB1B tickets with itineraries that represent round-trip

travel with same starting and ending city. Itineraries may have up to 6 coupons, but no more than 3

coupons one-way and no surface transfers. Tickets with round-trip fares below $100 (in 2008 quarter

three dollars) are dropped, since these may represent trips purchased with frequent-flyer miles or

made by airline employees at significantly reduced fares. We then differentiate between tickets that

are either online tickets, immunized alliance tickets, non-immunized alliance tickets, or interline

tickets. A ticket is an online ticket if all of the coupons in the ticket are operated and marketed by a

single airline (including its regional affiliates).15An immunized alliance ticket is a ticket that lists two

or more airlines as operating or marketing carriers and all of the airlines listed on the ticket are

immunized members of the same alliance. A non-immunized alliance ticket is a ticket that lists two or

more airlines, and all listed airlines are members of the same alliance, and at least one of the airlines

is not an immunized alliance member. Lastly, a ticket is an interline ticket if it is none of the above.16

Using these definitions, 67.8% of all tickets in the sample are online, 7.4% are non-immunized

alliance tickets, 17.4% are immunized alliance tickets, and the other 7.4% are interline tickets.

We use ordinary least-squares regression to analyze how prices vary across tickets based on

the type of ticket, the major U.S. airline reporting the ticket17, and the mileage and number of coupons

in the ticket’s itinerary. We use dummy variables to denote each of the type of ticket (online,

immunized alliance, non-immunized alliance, or interline ticket) and carriers. Online tickets are the

reference group. We also include in the model route fixed effects to control for all of the factors that

are invariant in a route, including, but not limited to, the level of competition in the route. We estimate

the model using: (i) all of the tickets in the data, and (ii) coach-class tickets only. 18 Results for both

14

Within the U.S., we exclude Hawaii. Within Europe, we focus on destinations in the European

Union, Switzerland, Norway, and Croatia. Our data include approximately 23,000 routes.

15

A coupon in a ticket is online if the operating carrier is the marketing carrier on the coupon. If the

carriers do not match, the coupon may yet be online since the operating carrier may be a regional affiliate of

the marketing carrier. We use the flight listing data in the Official Airline Guide to identify regional carrier

affiliations for major airlines on an individual coupon basis. If all of the coupons in a ticket are online

coupons from the same carrier, then the ticket is online.

16

These tickets include traditional interline tickets and tickets that obtain from bilateral

arrangements between airlines not in alliances or in different alliances.

17

To be included in the DB1B data, a ticket must be either ticketed by a U.S. airline or include at

least one flight operated by a U.S. airline. We identify the major U.S. airline listed as marketing or operating

carrier across the coupons in the ticket. For tractability, we drop the few tickets (5% of tickets) that list two

or more major U.S. carriers.

18

The coach class tickets are tickets in which all coupons have coach fare class X. In this Section,

these tickets represent 93% of all tickets sold. We note that Brueckner and Whalen (2000), Brueckner

�PUBLIC VERSION

data are reported in Table 2. We discuss below the results based on the coach class tickets; the

estimated fare differentials are slightly larger if we look at the results based on all of the tickets.

We estimate that interline tickets have the highest sales prices. Interline fares are, for instance,

6.3% higher than online fares, all else equal. We also find that non-immunized alliance fares are 1.5%

lower than online fares. This difference is not statistically significant. More importantly, controlling

for other factors, we estimate that immunized alliance fares are 2.1% higher than online fares and

3.6% higher than non-immunized alliance fares. Both of these fare differentials are statistically

significant at the 1% level.

(2003), and Whalen (2007) estimate a model similar to ours using all of the tickets in the DOT data, but for

first-class tickets. First-class tickets account for only 0.2% of all the tickets in our data. Dropping these

tickets is inconsequential for the results in Table 2 that use all of the tickets in the data.

�PUBLIC VERSION

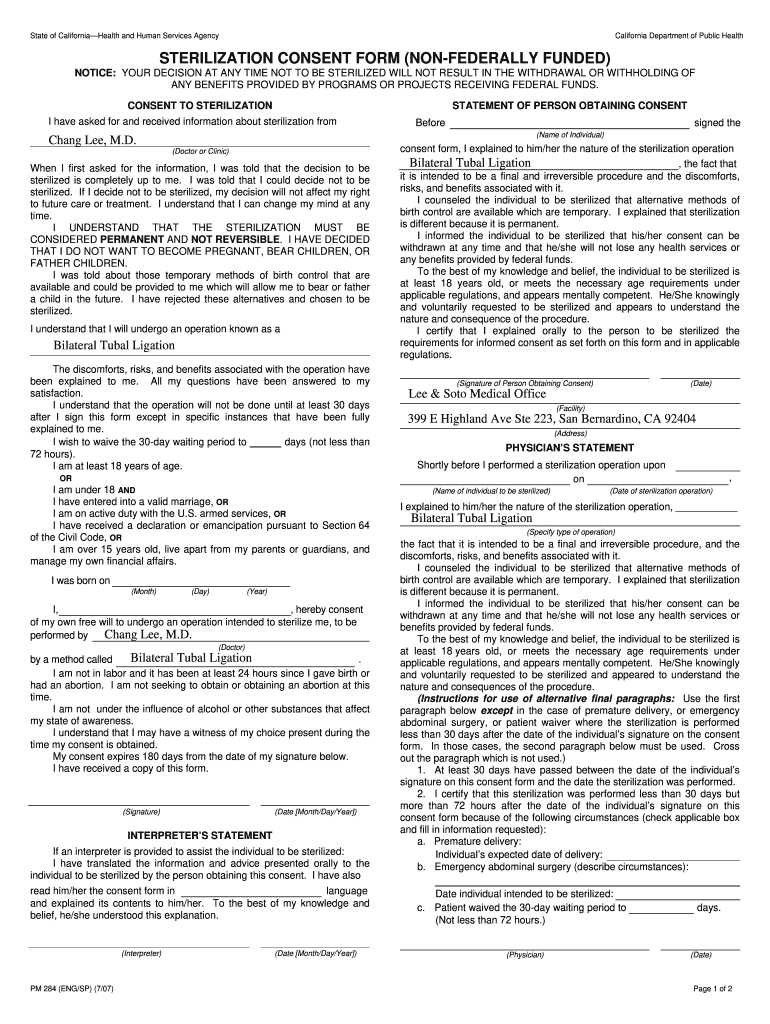

Table 1

Price Effects from Loss of Nonstop Competition on Transatlantic Routes.

The Dependent Variable is ln (Average Fare)

Estimate

(Standard error)

Change in # of

nonstop

competitors

Estimated

price effect in

percentages

1

---

---

---

2

-.140*

(.043)

2 to 1 #

+15.0% *

3

-.204*

(.044)

3 to 2 ##

+6.6%

4

-.265*

(.064)

4 to 3 ###

+6.3%

Explanatory Variables

Number of

Nonstop

Competitors

5 or more

-.422*

(.081)

ln(Mileage of the Route)

.638*

(.114)

Mean of City Populations

in the Route

.948

(.731)

Constant term

1.218*

(.953)

R2 = 0.59. Number of observations (routes) = 65.

Standard errors computed with White heteroskedasticity correction.

The population variable is divided by 100 million, for scaling purposes.

* Indicates statistical significance at a 1% level.

#

The 2 to 1 percentage effect equals exp(.140) - 1 = 15.0%.

##

The 3 to 2 percentage effect equals exp(-.140+.204) - 1 = 6.6%.

###

The 4 to 3 percentage effect equals exp(-.204+.265) - 1 = 6.3%

�PUBLIC VERSION

Table 2

Price Differences Across Tickets based upon the Type of Ticket.

The Dependent Variable is ln( Ticket Fare )

All Tickets

Explanatory variables:

Coach Class

Tickets

Coach Class Tickets

Estimate

(Standard

error)

Estimate

(Standard

error)

Estimated

Price Differentials

Type of ticket:

Online tickets

(reference group)

---

---

---

Non-immunized alliance

tickets

-.017

(0.010)

-.015

(0.009)

relative to

online tickets

-1.5%

Immunized alliance

tickets

.035*

(0.008)

.021*

(0.007)

relative to

online tickets

+2.1%*

Interline tickets

.070*

(0.009)

.061*

(0.007)

relative to

online tickets #

+6.3%*

Mileage of itinerary

in ticket

-.046

(0.044)

-0.096*

(0.036)

Number of coupons

in itinerary

-.054*

(0.005)

-0.046*

(0.004)

0.25

0.30

126,520

117,494

R2

Number of tickets

Standard errors computed with White heteroskedasticity correction.

Estimates for route and carrier fixed effects not shown in the Table.

* Indicates statistical significance at a 1% level.

#

The percentage effect is computed as exp(0.061) - 1 = 6.3%

�PUBLIC VERSION

Attachment

Price Effects from Loss of Nonstop Competition on Transatlantic Routes.

List of Transatlantic Routes in the Sample Data.

U.S.

endpoint

Atlanta

Atlanta

Atlanta

Atlanta

Atlanta

Cincinnati

Cincinnati

Cincinnati

Dallas*

Dallas*

Denver

Detroit

Detroit

Detroit

Washington

Washington

Washington

Washington

Washington

Washington

Houston

Houston

Houston

Los Angeles

Los Angeles

Memphis

Miami

Miami

Miami

Minneapolis - St Paul

Minneapolis - St Paul

New York City

European

endpoint

Amsterdam

Paris

Rome

Frankfurt

London

Amsterdam

Paris

Rome

Frankfurt

London

London

Amsterdam

Paris

Frankfurt

Amsterdam

Paris

Frankfurt

London

Munich

Zurich

Amsterdam

Paris

London

Frankfurt

London

Amsterdam

Paris

London

Madrid

Amsterdam

Paris

Amsterdam

U.S.

endpoint

New York City

New York City

New York City

New York City

New York City

New York City

New York City

New York City

New York City

New York City

New York City

New York City

New York City

New York City

New York City

New York City

New York City

New York City

New York City

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Philadelphia

Philadelphia

Philadelphia

San Francisco

San Francisco

Salt Lake City

European

endpoint

Stockholm

Athens

Barcelona

Brussels

Budapest

Paris

Copenhagen

Dublin

Edinburgh

Rome

Frankfurt

Lisbon

London

Madrid

Manchester

Milan

Shannon

Berlin

Zurich

Amsterdam

Paris

Dublin

Rome

Frankfurt

London

Manchester

Munich

Paris

Frankfurt

London

Frankfurt

London

Paris

* In Appendix B to DOJ’s June 26, 2009 filing in the Star proceeding, these city pairs were incorrectly

identified as Detroit-Frankfurt and Detroit-London.

�