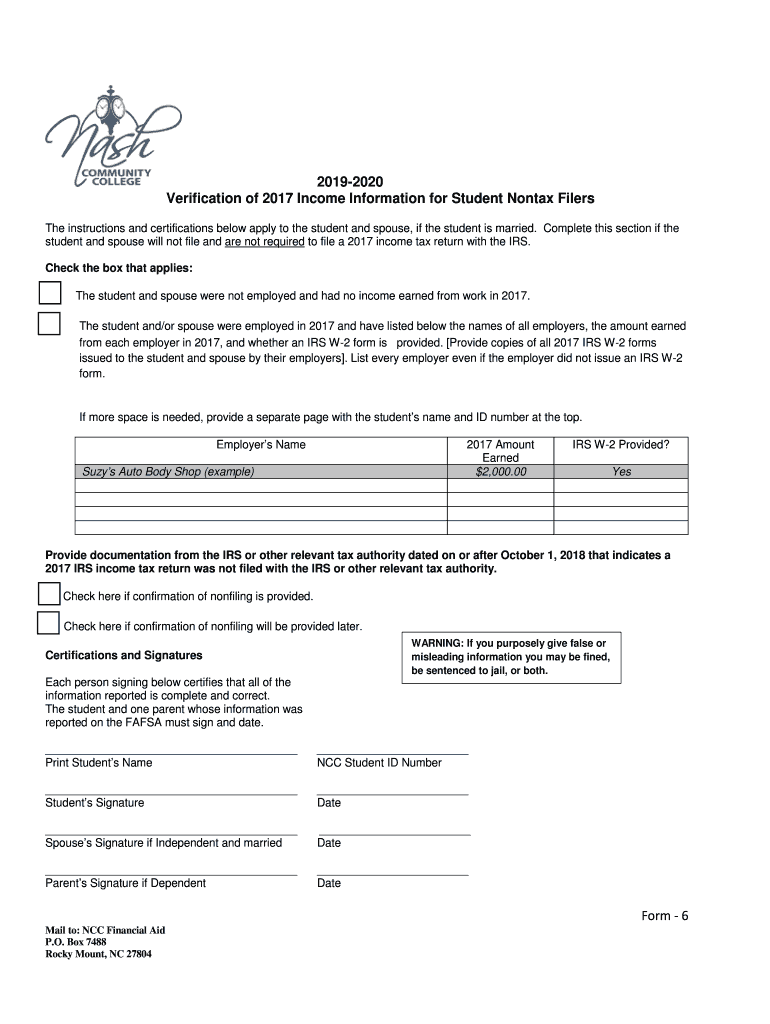

Fill and Sign the Student and Spouse Will Not File and Are Not Required to File a 2017 Income Tax Return with the Irs Form

Valuable advice on setting up your ‘Student And Spouse Will Not File And Are Not Required To File A 2017 Income Tax Return With The Irs’ online

Are you fed up with the stress of managing paperwork? Search no further than airSlate SignNow, the leading electronic signature option for individuals and businesses. Say farewell to the tedious task of printing and scanning files. With airSlate SignNow, you can effortlessly complete and sign documents online. Take advantage of the powerful features packed into this user-friendly and affordable platform and transform your method of document management. Whether you need to authorize forms or collect eSignatures, airSlate SignNow takes care of it all effortlessly, needing just a few clicks.

Follow this comprehensive guide:

- Log into your account or sign up for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud, or our form collection.

- Access your ‘Student And Spouse Will Not File And Are Not Required To File A 2017 Income Tax Return With The Irs’ in the editor.

- Click Me (Fill Out Now) to finalize the form on your side.

- Insert and allocate fillable fields for other participants (if required).

- Continue with the Send Invite settings to request eSignatures from others.

- Download, print your version, or convert it into a reusable template.

No need to worry if you need to work with others on your Student And Spouse Will Not File And Are Not Required To File A 2017 Income Tax Return With The Irs or send it for notarization—our solution provides everything you need to achieve such tasks. Register with airSlate SignNow today and take your document management to a higher level!

FAQs

-

What should I do if my Student And Spouse Will Not File And Are Not Required To File A Income Tax Return With The IRS?

If your Student And Spouse Will Not File And Are Not Required To File A Income Tax Return With The IRS, you generally do not need to take any action regarding filing taxes. However, it might be beneficial to consult with a tax professional to discuss any potential benefits or credits you could claim. Consider using tools that can assist in managing your documents efficiently.

-

How can airSlate SignNow help students and their spouses who are not filing taxes?

AirSlate SignNow provides an easy-to-use platform that enables students and their spouses, who Will Not File And Are Not Required To File A Income Tax Return With The IRS, to manage their important documents electronically. This can streamline the process of preparing any required paperwork, even if you do not need to file a tax return. Efficiency in document management is essential for students balancing studies and personal responsibilities.

-

What features does airSlate SignNow offer for document management?

AirSlate SignNow offers features like eSignature, document templates, and secure storage, which are particularly useful for users, including those whose Student And Spouse Will Not File And Are Not Required To File A Income Tax Return With The IRS. These features allow you to smoothly create, sign, and manage documents without the hassle of paper. It's a comprehensive solution for all your document needs.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows you to explore its features and determine if it meets your needs, especially if you or your Student And Spouse Will Not File And Are Not Required To File A Income Tax Return With The IRS. This trial can help you understand how the platform can facilitate your document management and signing process before committing to a subscription.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow provides flexible pricing options, catering to various needs, including those of students and spouses who Will Not File And Are Not Required To File A Income Tax Return With The IRS. With competitive plans, you can choose a package that suits your budget while benefiting from the essential features for document management and eSigning.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers integrations with numerous applications, making it easier for users whose Student And Spouse Will Not File And Are Not Required To File A Income Tax Return With The IRS to connect their document workflows. Whether you use cloud storage or project management tools, integrations enhance productivity and streamline processes.

-

What benefits can I expect from using airSlate SignNow?

Using airSlate SignNow can signNowly benefit individuals, especially if your Student And Spouse Will Not File And Are Not Required To File A Income Tax Return With The IRS. The platform enables secure and efficient document handling, reduces the time spent on paperwork, and enhances collaboration with others, all while ensuring compliance with legal standards.

Find out other student and spouse will not file and are not required to file a 2017 income tax return with the irs form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles