- 1 - Prepared by U.S. Legal Forms, Inc.Copyright 2016 - U.S. Legal Forms, Inc.

STATE OF MINNESOTA SUMMARY ADMINISTRATION PACKAGE

Control Number – MN – ET20

- 2 - NOTE ABOUT COMPLETING THE FORMS The forms in this packet contain “form fields” created using Microsoft Word. “Form fields”

facilitate completion of the forms using your computer. They do not limit you ability to print the

form “in blank” and complete with a typewriter or by hand.If you do not see the gray shaded form fields, go the View menu, click on Toolbars, and then

select Forms. This will open the forms toolbar. Look for the button on the forms toolbar that

resembles a shaded letter “a”. Click in this button and the form fields will be visible.The forms are locked which means that the content of the forms cannot be changed. You can

only fill in the information in the fields. If you need to make any changes in the body of the form, it is necessary for you “unlock” or

“unprotect” the form. IF YOU INTEND TO MAKE CHANGES TO THE CONTENT, DO

SO BEFORE YOU BEGIN TO FILL IN THE FIELDS. IF YOU UNLOCK THE

DOCUMENT AFTER YOU HAVE BEGUN TO COMPLETE THE FIELDS, WHEN

YOU RELOCK, ALL INFORMATION YOU ENTERED WILL BE LOST. To unlock

click on “Tools” in the Menu bar and then selecting “unprotect document”. You may then be

prompted to enter a password. If so, the password is “uslf”. That is uslf in lower case letters

without the quotation marks. After you make the changes relock the document before you

being to complete the fields.

After any required changes and re-protecting the document, click on the first form field and enter

the required information. You will be able to navigate through the document from form field to

form field using your tab key. Tab to a form field and insert your data. If problems, please let us

know.

- 3 - DISCLAIMER

These materials were developed by U.S. Legal Forms, Inc. based upon statutes and forms for the

State of Disclaimer. All Information and Forms are subject to this Disclaimer: All forms in this

package are provided without any warranty, express or implied, as to their legal effect and

completeness. Please use at your own risk. If you have a serious legal problem we suggest that

you consult an attorney. U.S. Legal Forms, Inc. does not provide legal advice. The products

offered by U.S. Legal Forms (USLF) are not a substitute for the advice of an attorney.

THESE MATERIALS ARE PROVIDED "AS IS" WITHOUT ANY EXPRESS OR IMPLIED

WARRANTY OF ANY KIND INCLUDING WARRANTIES OF MERCHANTABILITY,

NONINFRINGEMENT OF INTELLECTUAL PROPERTY, OR FITNESS FOR ANY

PARTICULAR PURPOSE. IN NO EVENT SHALL U. S. LEGAL FORMS, INC. OR ITS

AGENTS OR OFFICERS BE LIABLE FOR ANY DAMAGES WHATSOEVER

(INCLUDING, WITHOUT LIMITATION DAMAGES FOR LOSS OF PROFITS, BUSINESS

INTERRUPTION, LOSS OF INFORMATION) ARISING OUT OF THE USE OF OR

INABILITY TO USE THE MATERIALS, EVEN IF U.S. LEGAL FORMS, INC. HAS BEEN

ADVISED OF THE POSSIBILITY OF SUCH DAMAGES.

- 4 - SUMMARY ADMINISTRATION PACKAGE MN-ET20 INCLUDED:Form One-Petition for Summary Administration.Form Two -Order Approving Petition and Distribution Form Three-Inventory and Accounting FormForm Four-Sworn Closing Statement Selected Minnesota StatutesPLEASE NOTE: The following is a limited set of instructions regarding the use of the included

forms. This in no way should be considered a complete discussion of the process of probating an

estate. Minnesota statutes regarding probate are complex, and care should be taken to read and

understand applicable statutes. Consultation with a knowledgeable attorney is always advised.Step One – Submit a petition to the probate court requesting to be named as the estate

administrator and requesting summary administration of the estate Step Two –Contact the court administrator regarding a hearing date for the petition.Step Three –Upon approval of petition by probate judge, tender to the judge an order

approving the petition.Step Four – Prepare an accounting of the estate and provide a copy to any interested

party. Step Six –File a closing statement.

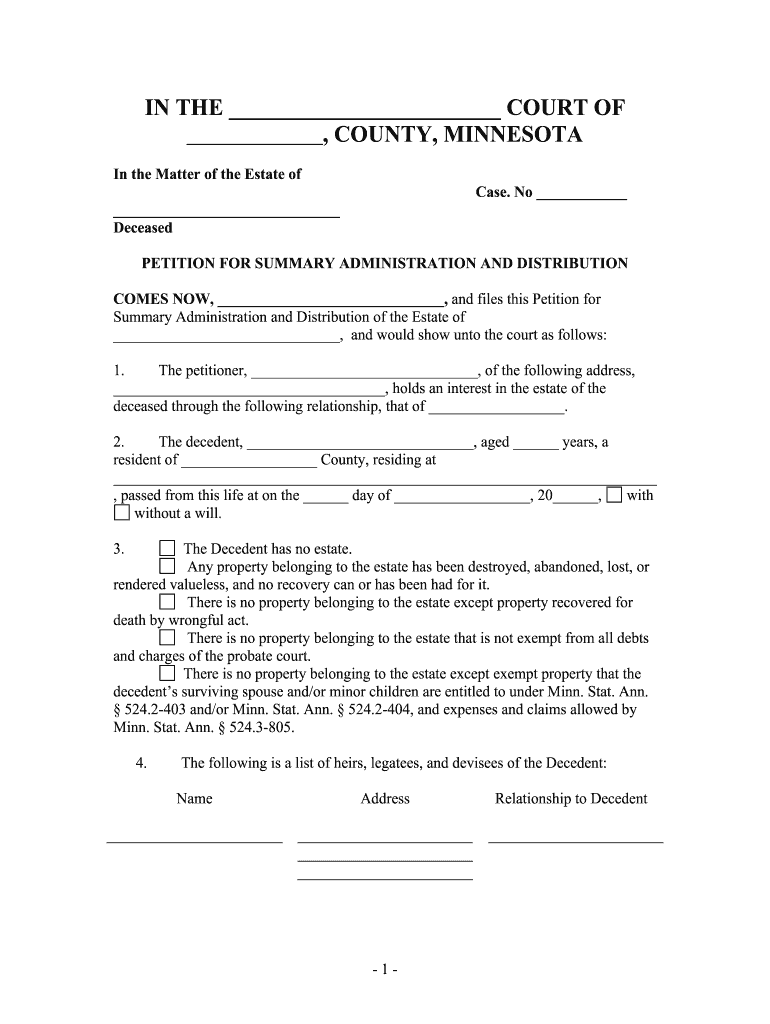

- 1 - IN THE ________________________ COURT OF

__________________, COUNTY, MINNESOTA In the Matter of the Estate of Case. No ____________ ______________________________Deceased PETITION FOR SUMMARY ADMINISTRATION AND DISTRIBUTION COMES NOW, ______________________________, and files this Petition for Summary Administration and Distribution of the Estate of

______________________________, and would show unto the court as follows:1. The petitioner, ______________________________, of the following address,

____________________________________, holds an interest in the estate of the

deceased through the following relationship, that of __________________.2.The decedent, ______________________________ , aged ______ years, a

resident of __________________ County, residing at

________________________________________________________________________

, passed from this life at on the ______ day of __________________, 20______, with

without a will.

3. The Decedent has no estate. Any property belonging to the estate has been destroyed, abandoned, lost, or

rendered valueless, and no recovery can or has been had for it. There is no property belonging to the estate except property recovered for

death by wrongful act. There is no property belonging to the estate that is not exempt from all debts

and charges of the probate court. There is no property belonging to the estate except exempt property that the

decedent’s surviving spouse and/or minor children are entitled to under Minn. Stat. Ann.

§ 524.2-403 and/or Minn. Stat. Ann. § 524.2-404, and expenses and claims allowed by

Minn. Stat. Ann. § 524.3-805. 4. The following is a list of heirs, legatees, and devisees of the Decedent: NameAddress Relationship to Decedent

- 2 - NameAddress Relationship to Decedent NameAddress Relationship to Decedent NameAddress Relationship to Decedent NameAddress Relationship to Decedent NameAddress Relationship to Decedent NameAddress Relationship to Decedent 5. The Petitioner, ______________________________, is a just and fitting party to

administer this estate and further that the estate of the Decedent should be closed

summarily for the reason that all of the property in the estate is exempt from all debts and

charges in the probate court.

- 3 - WHEREFORE, PREMISES CONSIDERED, the petitioner would respectfully request

that this Court issue an order:A.Naming the Petitioner, ______________________________ as the

personal representative of the estate. B.Providing that the administration of this estate should be closed summarily

for the reason that all the property of the estate is exempt from all debts and charges in

the probate court, C.That the property of the decedent, if any, be immediately distributed,

without further notice, to persons entitled to it under the terms of the decedent’s will, if

any, or if there is no will, under the law of intestate succession in force at the time of the

decedent’s death,D. Summarily determine the heirs, legatees, and devisees of the decedent and

further order that said heirs, legatees, and devisees, be assigned their share of the

proceeds of the estate, if any. Under penalties of perjury, the undersigned declares that he is the petitioner

named in the foregoing petition and knows the contents thereof; that the pleading is true

of his own knowledge, except as to those matters stated on information and belief, and

that as to such matters he believes it to be true. This the ______ day of __________________ , 20______. ____________________________________Petitioner STATE OF MINNESOTACOUNTY OF __________________ This instrument was acknowledged before me on ____________ day of

__________________, 20______ by ______________________________. Notary PublicMy commission expires: Type or Print Name

- 1 - IN THE ________________________ COURT OF

__________________, COUNTY, MINNESOTA In the Matter of the Estate of Case. No ____________ ______________________________Deceased ORDER APPROVING PETITION Upon consideration of the petition of ______________________________, this

Court finds that said Petition is well taken and it is hereby ordered and adjudged that 1. The Petitioner, ______________________________ shall act as the

personal representative for the summary administration of this estate. 2.The administration of this estate should be closed summarily for the

reason that all the property of the estate is exempt from all debts and charges of this

Court. 3.The property of the decedent, if any, shall be immediately distributed,

without further notice, to persons entitled to it under the terms of the decedent’s will, if

any, or if there is no will, under the law of intestate succession in force at the time of the

decedent’s death,4. The heirs, legatees, and devisees of the decedent are summarily found by

this to be as follows, and further it is hereby ordered that said heirs, legatees, and

devisees, be assigned their share of the proceeds of the estate, if any, as follows: Name Relationship Share or Part of Estate ORDERED AND ADJUDGED THIS THE _______ DAY OF _________________,

20_____. _______________________________ Judge of the Probate Court

- 1 - Inventory and Distribution COMES NOW, ______________________________, as duly appointed administrator of

the estate of ______________________________, deceased, and pursuant to Minnesota

statute, provides the following inventory and appraisement of the assets of the estate. ASSET DESCRIPTIONFAIR MARKET VALUE DEBTS OWED ON ASSET, IF ANY. 2. The above assets of the estate have been distributed as follows:Asset ValueDistributed to:

- 2 - This the ______ day of _____________________, 20_____. _________________________________ Personal Administrator IN THE ________________________ COURT OF

__________________, COUNTY, MINNESOTA In the Matter of the Estate of Case. No ____________ ______________________________Deceased Sworn Closing Statement 1. COMES NOW, ______________________________, as the Personal

Representative of the estate of the Decedent, ______________________________, and

hereby files this sworn closing statement pursuant to Minnesota Statute §524.3-1204.2. To the best knowledge of the personal representative, the value of the entire

estate, less liens and encumbrances, did not exceed an exempt homestead as provided for

in §524.2-402, the allowances provided for in §524.2-403 and §524.2-404, costs and

expenses of administration, reasonable funeral expenses, and reasonable, necessary

medical and hospital expenses of the last illness of the decedent. 3.The personal representative has fully administered the estate by disbursing and

distributing it to the persons entitled thereto.4. The personal representative has sent a copy of the closing statement to all

distributees of the estate and to all creditors or other claimants whose claims are neither

paid nor barred and has furnished a full account in writing of the personal

representative’s administration to the distributees whose interests are affected.

- 3 - I have read the foregoing Statement and know of my own knowledge that the

facts stated therein are true and correct.This the ______ day of __________________ , 20______. ___________________________________ SignatureSubscribed and sworn to or affirmed before me at ______________________________on the ______ day of __________________, 20______. ____________________________________________ Signature of Officer ____________________________________________ Title of Officer

- 4 - STATE OF MINNESOTACOUNTY OF __________________ This instrument was acknowledged before me on ____________ day of

__________________, 20______ by ______________________________. Notary PublicMy commission expires: Type or Print Name

- 5 - Minnesota Statutes as of February 23, 2004524.2-403 Exempt property. (a) If there is a surviving spouse, then, in addition to the homesteadand family allowance, the surviving spouse is entitled from the estate to: (1) property not exceeding $10,000 in value in excess of any securityinterests therein, in household furniture, furnishings, appliances, andpersonal effects, subject to an award of sentimental value property undersection 525.152; and (2) one automobile, if any, without regard to value. (b) If there is no surviving spouse, the decedent's children areentitled jointly to the same property as provided in paragraph (a),except that where it appears from the decedent's will a child was omittedintentionally, the child is not entitled to the rights conferred by thissection. (c) If encumbered chattels are selected and the value in excess ofsecurity interests, plus that of other exempt property, is less than$10,000, or if there is not $10,000 worth of exempt property in theestate, the surviving spouse or children are entitled to other personalproperty of the estate, if any, to the extent necessary to make up the$10,000 value. (d) Rights to exempt property and assets needed to make up a deficiencyof exempt property have priority over all claims against the estate, butthe right to any assets to make up a deficiency of exempt property abatesas necessary to permit earlier payment of the family allowance. (e) The rights granted by this section are in addition to any benefitor share passing to the surviving spouse or children by the decedent'swill, unless otherwise provided, by intestate succession or by way ofelective share. (f) No rights granted to a decedent's adult children under this sectionshall have precedence over a claim under section 246.53, 256B.15, 256D.16,261.04, or 524.3-805, paragraph (a), clause (1), (2), or (3). HIST: 1994 c 472 s 33; 1996 c 338 art 2 s 2; 1996 c 451 art 2 s 54; 1997c 9 s 7; 1998 c 262 s 9524.1-401 Notice; method and time of giving. (a) If notice of a hearing on any petition is required and except forspecific notice requirements as otherwise provided, the petitioner shallcause notice of the time and place of hearing of any petition to be givento any interested person or the person's attorney if the person hasappeared by attorney or requested that notice be sent to the attorney.Notice shall be given: (1) by mailing a copy thereof at least 14 days before the time set forthe hearing by certified, registered or ordinary first class mail

- 6 - addressed to the person being notified at the post office address givenin the demand for notice, if any, or at the demander's office or place ofresidence, if known; (2) by delivering a copy thereof to the person being notifiedpersonally at least 14 days before the time set for the hearing; or (3) if the address, or identity of any person is not known and cannotbe ascertained with reasonable diligence, by publishing once a week fortwo consecutive weeks, a copy thereof in a legal newspaper in the countywhere the hearing is to be held, the last publication of which is to beat least 10 days before the time set for the hearing. (b) The court for good cause shown may provide for a different methodor time of giving notice for any hearing. (c) Proof of the giving of notice shall be made on or before thehearing and filed in the proceeding. (d) No defect in any notice nor in publication or in service thereofshall limit or affect the validity of the appointment, powers, or otherduties of the personal representative. Any of the notices required bythis section and sections 524.3-306, 524.3-310, 524.3-403 and 524.3-801may be combined into one notice. HIST: 1974 c 442 art 1 s 524.1-401; 1975 c 347 s 20; 1986 c 444524.3-805 Classification of claims. (a) If the applicable assets of the estate are insufficient to pay allclaims in full, the personal representative shall make payment in thefollowing order: (1) costs and expenses of administration; (2) reasonable funeral expenses; (3) debts and taxes with preference under federal law; (4) reasonable and necessary medical, hospital, or nursing homeexpenses of the last illness of the decedent, including compensation ofpersons attending the decedent, a claim filed under section 256B.15 forrecovery of expenditures for alternative care for nonmedical assistancerecipients under section 256B.0913, and including a claim filed pursuantto section 256B.15 ; (5) reasonable and necessary medical, hospital, and nursing homeexpenses for the care of the decedent during the year immediatelypreceding death; (6) debts with preference under other laws of this state, and statetaxes; (7) all other claims.

- 7 - (b) No preference shall be given in the payment of any claim over anyother claim of the same class, and a claim due and payable shall not beentitled to a preference over claims not due, except that if claims forexpenses of the last illness involve only claims filed under section256B.15 for recovery of expenditures for alternative care for nonmedicalassistance recipients under section 256B.0913, section 246.53 for costsof state hospital care and claims filed under section 256B.15, claimsfiled to recover expenditures for alternative care for nonmedicalassistance recipients under section 256B.0913 shall have preference overclaims filed under both sections 246.53 and other claims filed undersection 256B.15, and claims filed under section 246.53 have preferenceover claims filed under section 256B.15 for recovery of amounts otherthan those for expenditures for alternative care for nonmedicalassistance recipients under section 256B.0913. HIST: 1975 c 347 s 58; 1982 c 621 s 2; 1982 c 641 art 1 s 19; 1983 c 180s 19; 1986 c 444; 1987 c 325 s 2; 1 Sp 2003 c 14 art 2 s 52524.3-1203 Summary proceedings. Subdivision 1. Petition and payment. Upon petition of an interestedperson, the court, with or without notice, may determine that the decedenthad no estate, or that the property has been destroyed, abandoned, lost, orrendered valueless, and that no recovery has been had nor can be had forit, or if there is no property except property recovered for death bywrongful act, property that is exempt from all debts and charges in theprobate court, or property that may be appropriated for the payment of theproperty selection as provided in section 524.2-403, the allowances to thespouse and children mentioned in section 524.2-404, and the expenses andclaims provided in section 524.3-805, paragraph (a), clauses (1) to (6),inclusive, the personal representative by order of the court may pay theestate in the order named. The court may then, with or without notice,summarily determine the heirs, legatees, and devisees in its final decreeor order of distribution assigning to them their share or part of theproperty with which the personal representative is charged. Subd. 2. Final decree or order. If upon hearing of a petition forsummary assignment or distribution, for special administration, or forany administration, or for the probate of a will, the court determinesthat there is no need for the appointment of a representative and thatthe administration should be closed summarily for the reason that all ofthe property in the estate is exempt from all debts and charges in theprobate court, a final decree or order of distribution may be entered,with or without notice, assigning that property to the persons entitledto it under the terms of the will, or if there is no will, under the lawof intestate succession in force at the time of the decedent's death. Subd. 3. Summary distribution. Summary distribution may be made underthis section in any proceeding of any real, personal, or other propertyin kind in reimbursement or payment of the property selection as providedin section 524.2-403, the allowances to the spouse and children mentionedin section 524.2-404, and the expenses and claims provided in section524.3-805, paragraph (a), clauses (1) to (6), inclusive, in the ordernamed, if the court is satisfied as to the propriety of the distributionand as to the valuation, based upon appraisal in the case of real estateother than homestead, of the property being assigned to exhaust the

- 8 - assets of the estate. Subd. 4. Personal representative. Summary proceedings may be had withor without the appointment of a personal representative. In all summaryproceedings in which no personal representative is appointed, the courtmay require the petitioner to file a corporate surety bond in an amountfixed and approved by the court. The condition of the bond must be thatthe petitioner has made a full, true, and correct disclosure of all thefacts related in the petition and will perform the terms of the decree ororder of distribution issued pursuant to the petition. Any interestedperson suffering damages as a result of misrepresentation or negligence ofthe petitioner in stating facts in the petition pursuant to which animproper decree or order of distribution is issued, or the terms of thedecree or order of distribution are not performed by the petitioner asrequired, has a cause of action against the petitioner and the surety torecover those damages in the court in which the proceeding took place.That court has jurisdiction of the cause of action. Subd. 5. Exhaustion of estate. In any summary, special, or otheradministration in which it appears that the estate will not be exhaustedin payment of the priority items enumerated in subdivisions 1 to 4, theestate may nevertheless be summarily closed without further notice, andthe property assigned to the proper persons, if the gross probateestate, exclusive of any exempt homestead as defined in section 524.2-402,and any exempt property as defined in section 524.2-403, does not exceedthe value of $100,000. If the closing and distribution of assets is madepursuant to the terms of a will, no decree shall issue until a hearing hasbeen held for formal probate of the will as provided in sections 524.3-401to 524.3-413. No summary closing of an estate shall be made to any distributee underthis subdivision, unless a showing is made by the personal representativeor the petitioner, that all property selected by and allowances to thespouse and children as provided in section 524.2-403 and the expenses andclaims provided in section 524.3-805 have been paid, and provided,further, that a bond shall be filed by the personal representative or thepetitioner, conditioned upon the fact that all such obligations have beenpaid and that all the facts shown on the petition are true, withsufficient surety approved by the court in an amount as may be fixed bythe court to cover potential improper distributions. If a personalrepresentative is appointed, the representative's bond shall besufficient for such purpose unless an additional bond is ordered, and thesureties on the bond shall have the same obligations and liabilities asprovided for sureties on a distribution bond. In the event that an improper distribution or disbursement is made in asummary closing, in that not all of said obligations have been paid orthat other facts as shown by the personal representative or thepetitioner, are not true, resulting in damage to any party, the court mayvacate its summary decree or closing order, and the petitioner or thepersonal representative, together with the surety, shall be liable fordamages to any party determined to be injured thereby as hereinprovided. The personal representative, petitioner, or the surety, may seekreimbursement for damages so paid or incurred from any distributee orrecipient of assets under summary decree or order, who shall be requiredto make a contribution to cover such damages upon a pro rata basis or as

- 9 - may be equitable to the extent of assets so received. The court is herebygranted complete and plenary jurisdiction of any and all such proceedingsand may enter such orders and judgments as may be required to effectuatethe purposes of this subdivision. Any judgment rendered for damages or the recovery of assets in suchproceedings shall be upon petition and only after hearing held thereon on14 days' notice of hearing and a copy of petition served personally uponthe personal representative and the surety and upon any distributee orrecipient of assets where applicable. Any action for the recovery ofmoney or damages under this subdivision is subject to the time and otherlimitations imposed by section 525.02. HIST: 1974 c 442 art 3 s 524.3-1203; 1975 c 347 s 69; 1995 c 130 s 20;2000 c 362 s 3 524.3-1204 Small estates; closing by sworn statement of personalrepresentative. (a) Unless prohibited by order of the court and except for estatesbeing administered by supervised personal representatives, a personalrepresentative may close an estate administered under the summaryprocedures of section 524.3-1203 by filing with the court, at any timeafter disbursement and distribution of the estate, a statement statingthat: (1) to the best knowledge of the personal representative, the entireestate, less liens and encumbrances, did not exceed an exempt homesteadas provided for in section 524.2-402, the allowances provided for insections 524.2-403 and 524.2-404, costs and expenses of administration,reasonable funeral expenses, and reasonable, necessary medical andhospital expenses of the last illness of the decedent; (2) the personal representative has fully administered the estate bydisbursing and distributing it to the persons entitled thereto; and (3) the personal representative has sent a copy of the closingstatement to all distributees of the estate and to all creditors or otherknown claimants whose claims are neither paid nor barred and hasfurnished a full account in writing of the personal representative'sadministration to the distributees whose interests are affected. (b) If no actions or proceedings involving the personal representativeare pending in the court one year after the closing statement is filed,the appointment of the personal representative terminates. (c) A closing statement filed under this section has the same effect asone filed under section 524.3-1003 . HIST: 1974 c 442 art 3 s 524.3-1204; 1975 c 347 s 70; 1976 c 161 s 14;1986 c 444; 1996 c 305 art 1 s 114 524.1-310 Verification of filed documents.

- 10 - Every document filed with the court under this chapter or chapter 525shall be verified except where the requirement of verification is waived byrule and except in the case of a pleading signed by an attorney inaccordance with the rules of civil procedure. Whenever a document isrequired to be verified: (1) such verification may be made by the unsworn written declaration ofthe party or parties signing the document that the representations madetherein are known or believed to be true and that they are made underpenalties for perjury, or (2) such verification may be made by the affidavit of the party orparties signing the document that the representations made therein aretrue or believed to be true. A party who makes a false material statement not believing it to betrue in a document the party verifies in accordance with the precedingsentence and files with the court under this chapter or chapter 525 shallbe subject to the penalties for perjury. HIST: 1974 c 442 art 1 s 524.1-310; 1976 c 161 s 3; 1986 c 444