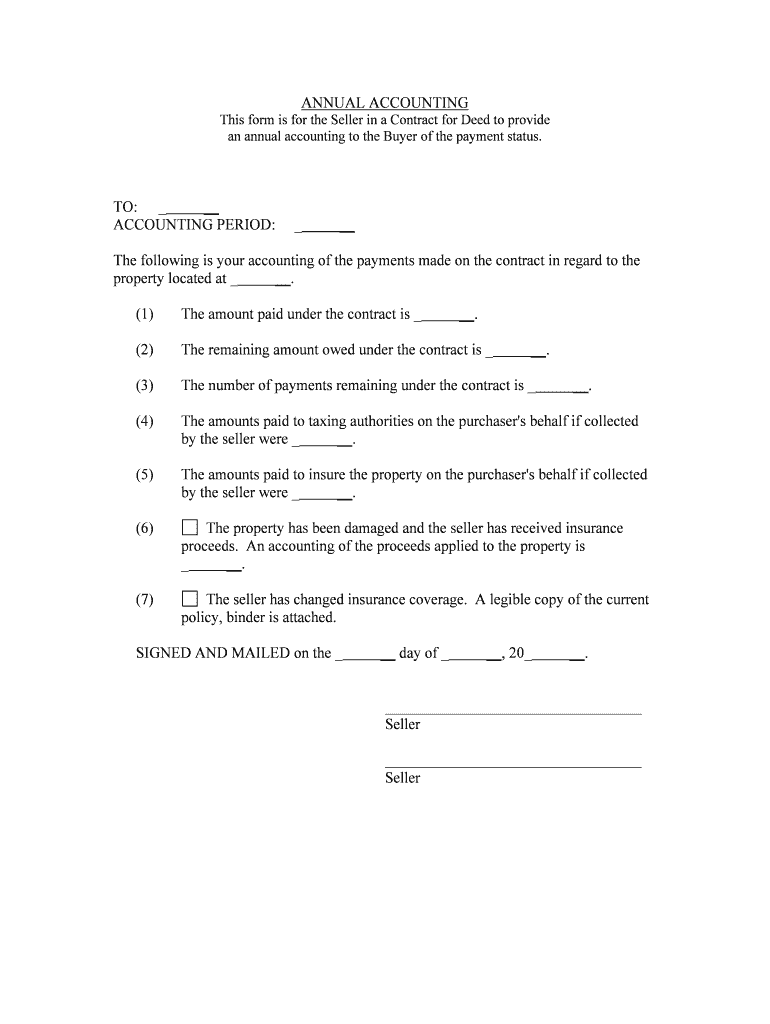

Fill and Sign the Amounts Paid to Taxing Authorities on the Purchasers Behalf If Collected Form

Valuable advice on finalizing your ‘The Amounts Paid To Taxing Authorities On The Purchasers Behalf If Collected’ online

Are you fed up with the inconvenience of managing paperwork? Search no more than airSlate SignNow, the premier digital signature solution for individuals and small to medium-sized businesses. Wave farewell to the tedious routine of printing and scanning documents. With airSlate SignNow, you can seamlessly finish and endorse paperwork online. Take advantage of the powerful tools integrated into this user-friendly and cost-effective platform and transform your method of document organization. Whether you need to approve forms or collect electronic signatures, airSlate SignNow manages it all effortlessly, needing just a few clicks.

Follow this comprehensive guide:

- Sign in to your account or initiate a free trial with our platform.

- Click +Create to upload a document from your device, cloud storage, or our forms library.

- Edit your ‘The Amounts Paid To Taxing Authorities On The Purchasers Behalf If Collected’ in the workspace.

- Select Me (Fill Out Now) to finalize the document on your end.

- Incorporate and designate fillable fields for other participants (if needed).

- Proceed with the Send Invite options to solicit electronic signatures from others.

- Download, print your version, or convert it into a reusable template.

Don’t be concerned if you need to collaborate with your colleagues on your The Amounts Paid To Taxing Authorities On The Purchasers Behalf If Collected or send it for notarization—our platform offers everything necessary to accomplish such objectives. Sign up with airSlate SignNow today and take your document management to the next level!

FAQs

-

What are the amounts paid to taxing authorities on the purchaser's behalf if collected?

The amounts paid to taxing authorities on the purchaser's behalf if collected refer to the taxes that are remitted by a seller on behalf of the buyer during a transaction. This ensures compliance with tax regulations and simplifies the purchasing process for customers. Understanding these amounts is crucial for businesses to maintain accurate financial records.

-

How does airSlate SignNow help in managing the amounts paid to taxing authorities?

airSlate SignNow provides tools that streamline the documentation process, making it easier to track and manage the amounts paid to taxing authorities on the purchaser's behalf if collected. With our eSignature capabilities, businesses can ensure that all tax-related documents are signed and stored securely, facilitating compliance and reducing errors.

-

Are there any additional fees associated with the amounts paid to taxing authorities?

While airSlate SignNow does not impose additional fees specifically for the amounts paid to taxing authorities on the purchaser's behalf if collected, businesses should be aware of any applicable tax regulations. Our platform is designed to provide transparency in pricing, ensuring that users understand all costs involved in their transactions.

-

What features does airSlate SignNow offer to assist with tax compliance?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure storage that assist businesses in managing the amounts paid to taxing authorities on the purchaser's behalf if collected. These tools help ensure that all necessary documentation is completed accurately and efficiently, reducing the risk of compliance issues.

-

Can airSlate SignNow integrate with accounting software for tax management?

Yes, airSlate SignNow can integrate with various accounting software solutions, allowing businesses to manage the amounts paid to taxing authorities on the purchaser's behalf if collected seamlessly. This integration helps streamline financial processes and ensures that tax data is accurately reflected in accounting records.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents offers numerous benefits, including enhanced efficiency, reduced paperwork, and improved accuracy in managing the amounts paid to taxing authorities on the purchaser's behalf if collected. Our platform simplifies the eSigning process, making it easier for businesses to stay compliant with tax regulations.

-

Is airSlate SignNow suitable for small businesses dealing with tax payments?

Absolutely! airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses managing the amounts paid to taxing authorities on the purchaser's behalf if collected. Our user-friendly interface and affordable pricing make it accessible for small business owners looking to streamline their tax documentation processes.

The best way to complete and sign your the amounts paid to taxing authorities on the purchasers behalf if collected form

Find out other the amounts paid to taxing authorities on the purchasers behalf if collected form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles