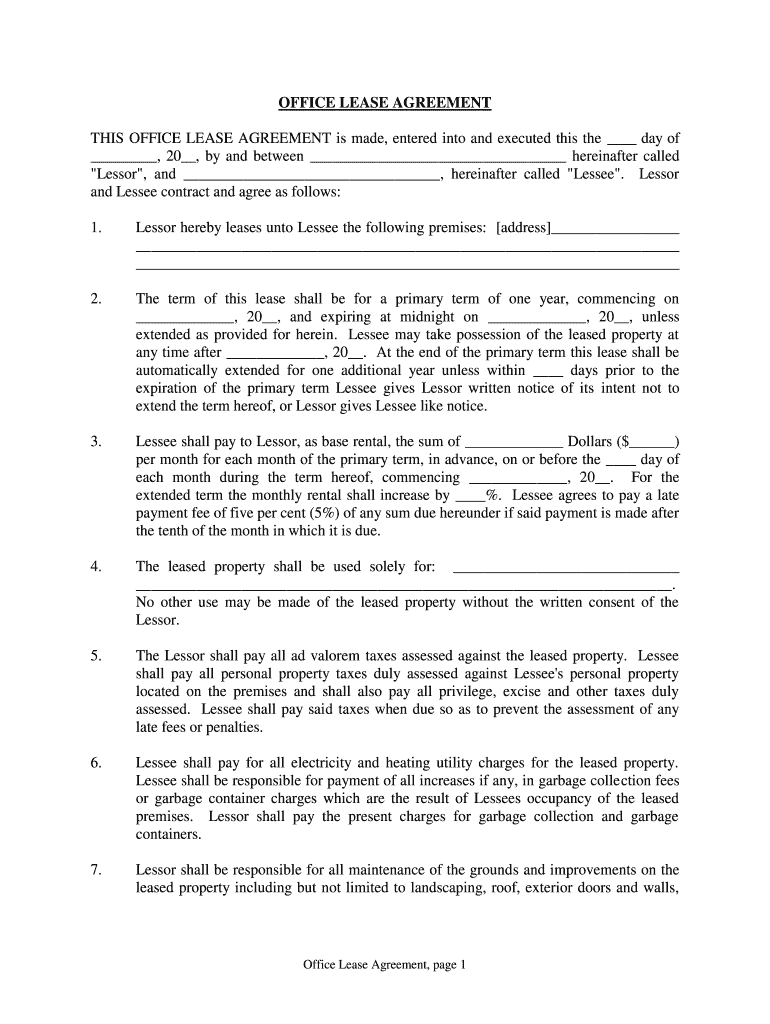

Fill and Sign the Lessor Shall Pay All Ad Valorem Taxes Assessed Against the Leased Property Form

Helpful tips on finalizing your ‘The Lessor Shall Pay All Ad Valorem Taxes Assessed Against The Leased Property’ online

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the leading electronic signature solution for individuals and small to medium-sized businesses. Bid farewell to the laborious process of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and approve paperwork online. Utilize the extensive features embedded in this user-friendly and economical platform and transform your approach to document management. Whether you need to approve forms or gather electronic signatures, airSlate SignNow takes care of it all seamlessly, with just a few clicks.

Adhere to this detailed guide:

- Log into your account or register for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘The Lessor Shall Pay All Ad Valorem Taxes Assessed Against The Leased Property’ in the editor.

- Click Me (Fill Out Now) to prepare the document on your end.

- Add and designate fillable fields for other participants (if necessary).

- Proceed with the Send Invite settings to request eSignatures from others.

- Save, print your version, or convert it into a reusable template.

No need to worry if you need to collaborate with others on your The Lessor Shall Pay All Ad Valorem Taxes Assessed Against The Leased Property or send it for notarization—our solution offers everything you need to accomplish such tasks. Sign up with airSlate SignNow today and enhance your document management to a new height!

FAQs

-

What does 'The Lessor Shall Pay All Ad Valorem Taxes Assessed Against The Leased Property' mean?

This phrase indicates that the lessor is responsible for paying all property taxes assessed on the leased property. Understanding this clause is crucial for both lessors and lessees to ensure compliance and avoid unexpected costs.

-

How can airSlate SignNow help with lease agreements involving ad valorem taxes?

airSlate SignNow provides a streamlined platform for creating, sending, and eSigning lease agreements that include clauses like 'The Lessor Shall Pay All Ad Valorem Taxes Assessed Against The Leased Property.' This ensures clarity and legal compliance in your contracts.

-

What features does airSlate SignNow offer for managing lease documents?

With airSlate SignNow, you can easily create templates, automate workflows, and track document status. These features help ensure that all parties understand their obligations, including the stipulation that 'The Lessor Shall Pay All Ad Valorem Taxes Assessed Against The Leased Property.'

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow offers competitive pricing plans that cater to small businesses. By using our platform, you can efficiently manage documents related to clauses like 'The Lessor Shall Pay All Ad Valorem Taxes Assessed Against The Leased Property,' saving both time and money.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing your workflow. This allows you to manage lease agreements and ensure compliance with terms like 'The Lessor Shall Pay All Ad Valorem Taxes Assessed Against The Leased Property' alongside your existing tools.

-

What are the benefits of using airSlate SignNow for eSigning documents?

Using airSlate SignNow for eSigning documents offers numerous benefits, including increased efficiency, enhanced security, and legal compliance. This is particularly important for agreements that include terms like 'The Lessor Shall Pay All Ad Valorem Taxes Assessed Against The Leased Property.'

-

How does airSlate SignNow ensure the security of my documents?

airSlate SignNow employs advanced encryption and security protocols to protect your documents. This is vital for sensitive agreements that contain clauses such as 'The Lessor Shall Pay All Ad Valorem Taxes Assessed Against The Leased Property,' ensuring that your information remains confidential.

The best way to complete and sign your the lessor shall pay all ad valorem taxes assessed against the leased property form

Find out other the lessor shall pay all ad valorem taxes assessed against the leased property form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles