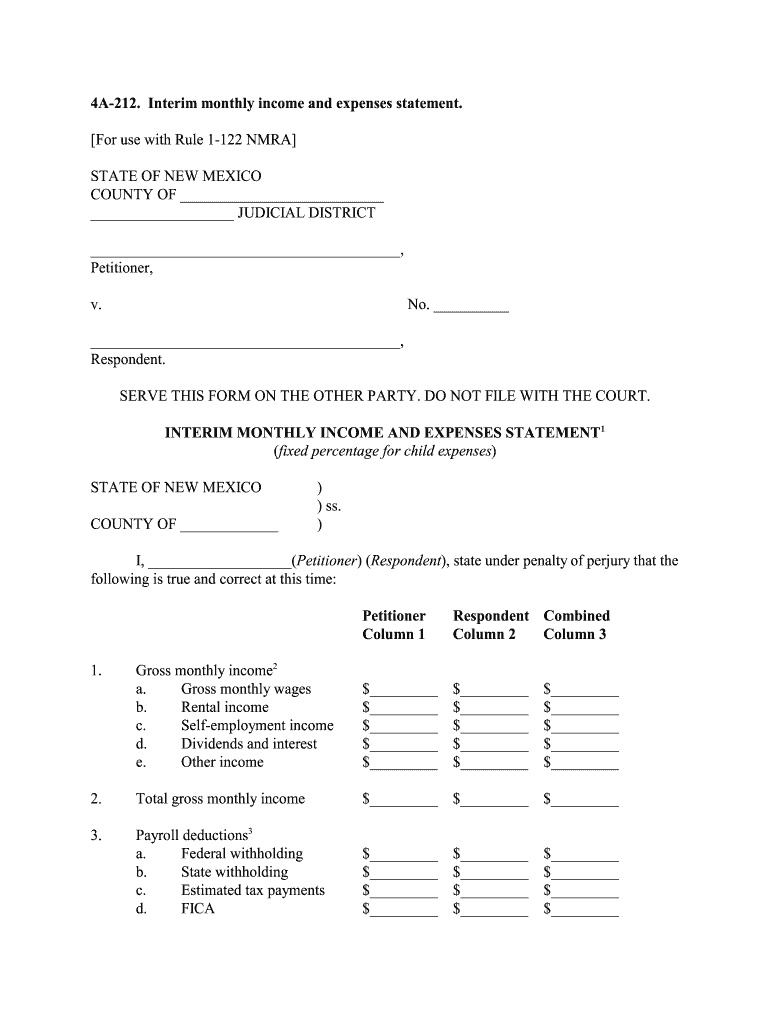

4A-212. Interim monthly income and expenses statement.

[For use with Rule 1-122 NMRA]

STATE OF NEW MEXICO

COUNTY OF ___________________________

___________________ JUDICIAL DISTRICT _________________________________________, Petitioner, v. No. __________

_________________________________________, Respondent. SERVE THIS FORM ON THE OTHER PARTY. DO NOT FILE WITH THE COURT.

INTERIM MONTHLY INCOME AND EXPENSES STATEMENT 1

( fixed percentage for child expenses )

STATE OF NEW MEXICO ) ) ss.

COUNTY OF _____________ )

I, ___________________( Petitioner) (Respondent ), state under penalty of perjury that the

following is true and correct at this time:

Petitioner Respondent Combined

Column 1 Column 2 Column 3

1. Gross monthly income 2

a. Gross monthly wages $_________ $_________ $_________

b. Rental income $_________ $_________ $_________

c. Self-employment income $_________ $_________ $_________

d. Dividends and interest $_________ $_________ $_________

e. Other income $_________ $_________ $_________

2. Total gross monthly income $_________ $_________ $_________

3. Payroll deductions 3

a. Federal withholding $_________ $_________ $_________

b. State withholding $_________ $_________ $_________

c. Estimated tax payments $_________ $_________ $_________

d. FICA $_________ $_________ $_________

e. Medicare $_________ $_________ $_________

f. Health insurance $_________ $_________ $_________

g. Life and disability insurance $_________ $_________ $_________

h. Union dues $_________ $_________ $_________

i. Mandatory retirement $_________ $_________ $_________

j. Other_____________ $_________ $_________ $_________

4. Total payroll deductions $_________ $_________ $_________ (Add items in #3 )

5. Net monthly income $_________ $_________ $_________ (Subtract Line 4 from Line 2 )

6. Monthly fixed expenses 4

:

a. Residence 5

$_________ $_________ $_________

b. Utilities 6

$_________ $_________ $_________

c. Car payments $_________ $_________ $_________

d. Insurance premiums $_________ $_________ $_________

(1) Car or other vehicle $_________ $_________ $_________

(2) Life 7

$_________ $_________ $_________

(3) Health 7

$_________ $_________ $_________

(4) Homeowners 8

or renters $_________ $_________ $_________

(5) Other $_________ $_________ $_________

e. Day care 9

$_________ $_________ $_________

f. Credit card payments 10

$_________ $_________ $_________

g. Loan payments $_________ $_________ $_________

h. Child support payments 11

$_________ $_________ $_________

i. Medical $_________ $_________ $_________

j. Other ___________ $_________ $_________ $_________

7. Total monthly fixed expenses $_________ $_________ $_________ (Add items in #6 and #7 )12

8. Net spendable income $_________ $_________ $_________ (Line 5 minus Line 7 )

9. 1/2 of combined net spendable income ( 1/2 of Line 8 Column 3 )13

$_________ $_________

10. Amount transferred and received 14

$_________ $_________

11. Child support adjustment 15

$_________ $_________

( see table, Use Note 15 )

12. Total to be transferred 16

$_________ $_________

I, _______________________, affirm under penalty of perjury under the laws of the

State of New Mexico that I am the [ ] Petitioner ( or) [ ] Respondent in the above-entitled

cause, and I know and understand that the contents of this Statement are true to the best of my

knowledge and belief.

___________________________________

Signature Date

USE NOTE

1. This form is to be used with an Interim Order Allocating Income and Expenses,

Form 4A-213 NMRA. Unless, upon motion of a party, the court orders the division of separate

income and expenses, only community income and expenses should be included on this form. In

minimal or negative income cases, the court will have discretion to fashion an appropriate order.

2. “Gross monthly income” is income from all sources except child support received

from a prior court order. For self-employed individuals, gross monthly income means gross

receipts less reasonable and ordinary business expenses. For varying income and expenses use

the average of the last three (3) months’ income and expenses. Gross monthly income is to be computed by using one of the following: hourly wage x

average hours worked per week x 52 divided by 12; weekly wage x 52 divided by 12; every two

weeks wage x 26 divided by 12; twice monthly x 2. For varying wages, use the average of thelast three months’ income.

3. “Deductions” are payroll deductions for taxes, social security, health insurance,

union dues, retirement and other employer-related deductions. Payroll deductions are to be

computed on a monthly basis as described in Use Note 2. 4. “Monthly fixed expenses” include periodic expenses even though paid quarterly,

semiannually or yearly. Fixed expenses are to be computed on a monthly basis by using one of

the following: annual income or expenses divided by 12. For varying expenses, use the average

of the last three months’ receipts or expenses. 5. Residence fixed expense is mortgage or rent actually paid. If a party receives free

rent, e.g., by living with parents, that party’s rent is imputed as zero. If residence expense is a

mortgage payment for the residence of a party, unless already separately stated, include insurance

and taxes.

6. Include monthly average payments for gas, electricity, water, sewer, refuse, and

basic telephone bill, if not paid as part of rent. Use average for last 12 months if known.

7. Do not include medical, dental, liability, life, or other insurance that is deducted

by payroll deduction.

8. Do not include homeowners insurance premiums if the premium is included as

part of the residence expense, Line 6(a). 9. Day care fixed expense is work-related day care and does not include baby-sitting

or occasional day care. 10. “Credit card payments” is listed as a fixed expense and includes only the

minimum monthly payment as of the date of the filing of the petition. 11. Any regular monthly payment ordered by a prior order of child support or

alimony, which is actually paid, is a fixed expense.

12. Line 8. “Net spendable income” and “combined net spendable income” are

determined by subtracting Line 7, “total monthly fixed expenses,” from Line 5, “net monthly income.”

Negative combined net spendable income. If the “combined net spendable income” (Line

8, Column 3) is a negative number, and there are no children, adjust the allocations of income or

expenses between the parties, or transfer an amount from one party to another so that the amount

of net spendable income for the petitioner and respondent on Line 9 is equal. Do not complete

Lines 10, 11, and 12. If Line 8, Column 3 has a negative or minimal “combined net spendableincome,” and there are children, the court will need to fashion an appropriate form to divide

interim income and expenses of the parties.

13. Line 9. Equalizing spendable income. If “net spendable income” on Line 8,

Column 3, is a positive number, divide “combined net spendable income” by two and enter the

result in each column of Line 9. 14. Line 10. Amount transferred and received. The party with the larger net

spendable income will transfer an equalizing amount to the party with the smaller net spendable

income. To determine the amount of the transfer or receipt, subtract Line 9 (one-half of

combined net spendable income) from Line 8, “net spendable income” and enter the amount on

Line 10. This is the amount to be transferred by the party with the larger net spendable income to

the party with the lower net spendable income. For example, if the petitioner has a net spendable income of $1,000.00 per month and the

respondent has a net spendable income of $500.00 per month, divide the total, $1,500.00, by two.

Since the petitioner has the larger net spendable income, enter the result, $750.00, on Line 9,

under Column 1. To determine the amount the petitioner transfers, subtract Line 9 of Column 1

from Line 8 of Column 1 ($1,000.00 minus $750.00 = $250.00) and this amount ($250.00) will

be transferred each month by the petitioner to the respondent. 15. Line 11. Children. If Line 8, Column 3, is a positive number, an adjustment for

child support is made by multiplying the amount on Line 8, Column 3 (combined “net spendable

income”) by the applicable percentage in the table below and enter the amount in the party

column of the party with primary custody of the child or children. Do not count children who

are covered by a prior child support order.

One child 10%

Two children 15%

Three children 19%

Four children 22%

Five children 25%

Six children 28%

If more than six children, add three percent (3%) for each additional child.

For example, if the combined “net spendable income” of the petitioner and respondent

(Column 3, Line 8) is $1,500.00 and there is one child, multiply Column 3, Line 8 ($1,500.00) by

ten percent (10%) and enter the result ($150.00) on Line 11 in the petitioner and respondentcolumns. 16. Line 12. Total amount transferred. Line 11 is used to adjust the amount to be

transferred by a party or received by a party on Line 10 by the parties. Using the example in Use

Notes 14 and 15, if there is one child and the combined net spendable income of the parties is $1,500.00, an adjustment of ten percent (10%) of $1,500.00 ($150.00) is made for child support.

If the respondent has primary custody, the respondent will receive another $150.00. If the

petitioner has primary custody, subtract $150.00 from the amount the respondent is to receive on

Line 10. Using the example in Use Notes 14 and 15, if the respondent has primary custody, the

petitioner will transfer $400.00 to the respondent. If the petitioner has primary custody, thepetitioner will transfer $100.00 to the respondent.

[Approved, effective November 1, 2000 until November 1, 2001; approved, effective November

1, 2001; 4A-122 recompiled and amended as 4A-212 by Supreme Court Order No. 13-8300-010,

effective for all pleadings and papers filed on or after May 31, 2013, in all cases pending or filed

on or after May 31, 2013; as amended by Supreme Court Order No.14-8300-011, effective for all

pleadings and papers filed on or after December 31, 2014, in all cases filed or pending on or afterDecember 31, 2014.]

Valuable advice on preparing your ‘The Santa Fe New Mexican May 24 2013 By The New Issuu’ online

Are you fed up with the inconvenience of managing paperwork? Search no more than airSlate SignNow, the premier eSignature platform for individuals and businesses. Bid farewell to the lengthy procedure of printing and scanning documents. With airSlate SignNow, you can swiftly complete and sign documents online. Utilize the powerful tools included in this user-friendly and cost-effective platform and transform your method of document management. Whether you need to sign forms or collect signatures, airSlate SignNow manages everything effortlessly, with just a few clicks.

Follow these comprehensive instructions:

- Access your account or sign up for a complimentary trial with our service.

- Hit +Create to upload a file from your device, cloud storage, or our form library.

- Open your ‘The Santa Fe New Mexican May 24 2013 By The New Issuu’ in the editor.

- Click Me (Fill Out Now) to set up the form on your end.

- Add and allocate fillable fields for other users (if needed).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download, print your version, or convert it into a reusable template.

Don’t fret if you need to work with others on your The Santa Fe New Mexican May 24 2013 By The New Issuu or send it for notarization—our platform provides you with everything necessary to accomplish such tasks. Create an account with airSlate SignNow today and enhance your document management to new levels!