JDF 885 SC R6/19 CONSERVATOR’S ANNUAL/FINAL REPORT Page 1 of 12

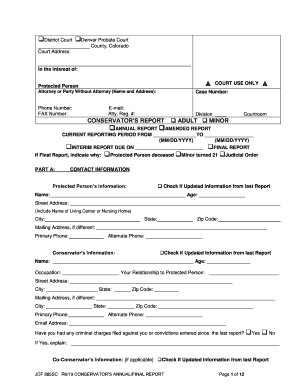

❑ District Court ❑ Denver Probate Court

___________________ County, Colorado

Court Address:

In the Interest of:

Protected Person

COURT USE ONLY

Attorney or Party Without Attorney (Name and Address):

Phone Number: E -mail:

FAX Number : Atty. Reg. #:

Case Number:

Division ____ Courtroom

CONSERVATOR’S REPORT ❑ ADULT ❑ MINOR

❑ ANNUAL REPORT ❑ AMENDED REPORT

CURRENT REPORTING PERIOD FROM ________________TO __________________

(MM/DD/YYYY) (MM/DD/YYYY)

❑ INTERIM REPORT DUE ON _________________________ ❑ FINAL REPORT

If Final Report, indicate why: ❑ Protected Person deceased ❑ Minor turned 21 ❑ Judicial Order

PART A: CONTACT INFORMATION

Protected Person’s Information: ❑ Check if Updated Information from last Report

Name: __________________________________________________ Age : _________________

Street Address:

(Include Name of Living Center or Nursing Home)

City: State: Zip Code:

Mailing Address, if different: _______________________________________________________________

Primary Phone : Alternate Phone : _____________________

Conservator’s Information: ❑Check if U pdated Information from last Report

Name: ____________________________________________________ Age : ________ __ ______

Occupation: _____________________ Your Relationship to Protected Person: ____________ ____ _________ _

Street Address: ______________ _________ ____ _________________________________

City: ___________________ State: ______ Zip Code: _________

Mailing Address, if different: __________________________________________________________________

City: _________________ State: __________ Zip Code: _________ __________________________

Primary Phone : Alternate Phone: _____________________

Email Address: __________________________________________________________

Have you had any criminal charges filed against you or convictions entered since the last report? ❑ Yes ❑ No

If Yes, explain: _____________________________________________________________________________

Co -Conservator’s Information: (if applicable) ❑Check if Updated Information from last Report

JDF 885 SC R6/19 CONSERVATOR’S ANNUAL/FINAL REPORT Page 2 of 12

Name: _____________ _____ ___ __ _____ ___ ___ __________________ Age : _____ __________

Occupation: _____________________ Your Relationship to Protected Person: __ _______ _______________ _

Street Address: ___________ ___________________________________ ____ _______

City: ______________________ State: ____ Zip Code: ________

Mailing Address, if different: ______________________________________________________________

City: ___________________ State: __________ Zip Code: _________________________

Primary Phone : Alternate Phone: _____________________

Email Address: ________________________________________________________________________

Have you had any criminal charges filed against you or convictions entered since the last report? ❑ Yes ❑ No

If Yes, explain: ____________________________________________________________________________ __

*** Notice to Interested Person s: Interested persons have the responsibility to protect their own rights and

interests within the time and in the manner provided by the Probate Code, including the appropriateness of

disbursements, the compensation of fiduciaries, attorneys, and others, and the distribution of estate assets.

Interested persons may file an objection with the court. The court will not review or adjudicate these or other

matters unless specifically requested to do so by an interested person.

PART B: CONSERVATORSHIP ISSUES

1. Is there a continued need for the conservatorship? ❑ Yes ❑ No If No , describe why and what steps

should be taken. If you would like the court to take action, you must file a motion with the court.

2. Are the remaining assets in the estate sufficient to provide for the present and future care of the protected

person? ❑ Yes ❑ No If No , describe why and what steps sh ould be taken. If you would like the court

to take action, you must file a motion with the court.

3. Should there be a change in scope of the conservatorship? ❑ Yes ❑ No If Yes , describe why and what

steps should be taken. If you would like the court to take action, you must file a motion with the court.

4. Attach a copy of the bond to this report, unless the bond was waived or not required by the court .

What is the amount of the bond? $ ________________. Is the amount of the bond sufficient to cover all

unrestricted assets? ❑ Yes ❑ No If No , describe why and what steps should be taken. If you are

requesting a change to the bond, you must file a motion with the court.

INSTRUCTIONS ON HOW TO COMP LETE THIS FORM

The Conservator’s Report must be filed annually pursuant to §15 -14 -420, C.R.S. Part C of this report concerns

the information necessary to satisfy the court that the conservator has maintained a complete accountin g of all

financial transactions and managed the protected person’s estate responsibly.

Step 1 is a financial transaction detail and should be completed for each bank or investment account. A

spreadsheet or report from personal accounting software may also be submitted in lieu of completing the

transaction detail.

JDF 885 SC R6/19 CONSERVATOR’S ANNUAL/FINAL REPORT Page 3 of 12

Steps 2 and 3 summarize the income a nd expense for the reporting period and compare those amounts to the

previous period or the Financial Plan. Explain the cause for any changes between the current period amounts

and amount s from the prior period or the Financial Plan.

Step 4 reports a dditional detail for fees paid to professionals including the hourly rate, number of hour worked,

and description of services provided.

Steps 5 and 6 summarize assets and liabilities as of the reporting date and compare those amounts to the

previous peri od or the Inventory. In addition to explaining the cause for any changes between the current period

amounts and amounts from the prior period or the Inv entory, provide specific detail regarding any asset

purchases or sales.

Step 7 is a summary. T ransfer the respective income and expense totals from Steps 2 and 3 as well as the asset

and liability totals in steps 5 and 6 to the appropriate lines in Step 7 to calculate the net income and net worth.

Part C: FINANCIAL INFORMATION

Step 1: Detail Listing of Receipts/Income and Disbursements/Expenses

Complete this Detail f or all bank account s. Make additional copies of this form as necessary. Alternatively,

Check Regist er form JDF 871, a spreadsheet, or a report from personal accounting software m ay be attached .

Please l ist all transactions , includ ing Income (deposits) and Expenses ( withdrawals) , for the entire reporting

period. Each Receipt/Income item should be listed in the Amount Received column and each

Disbursement/Expense item should be listed in the Amount Disbursed column. ** Note: This report should

resemble a check register for each bank account.

Name of Bank: __________________________________ Account Number (last 4 -digits only): __________

Date Check

or

I.D. No.

Description of item Received or Disbursed,

include Name of Payee (if Disbursement)

Amount

Received

Amount

Disbursed

Page ____________ of _______

May continue entries on Check Register Form JDF 871

$ $

JDF 885 SC R6/19 CONSERVATOR’S ANNUAL/FINAL REPORT Page 4 of 12

❑ Check here if additional detailed spreadsheets are attached to this report .

Individual Bank Account Summary

Beginning Cash Balanc e $ _____________ (Balance from prior year Report or Inventory)

Add: Total Amount of Income + $ _____________ (Total Income received from detail above )

Add: Total Amount Received as Transfer + $ _____________ (Total transferred from other bank accounts)

Less: Total Amount Disbursed - $ _____________ ( Total disbursements from detail above )

Less: Total Amount Transferred out - $ _____________ (Total transfers moved to other accounts)

Ending Cash Balance = $ _____________ (Transfer this account balance to Step 5.)

(This will be the beginning balance on next year’s report)

Step 2: Receipts and Income

Column A: Is this the first annual Conservator’s Report filed? ❑ Yes ❑ No

If Yes , use the amounts from the Inventory with Financial Plan (JDF 882) to complete Col umn A that is marked

with an asterisk (*) below. If No , use the amounts from the prior Conservator’s Report filed to complete Column

A that is marked with an asterisk (*) below.

Column B : Transfer all individual income category totals from completed Detail Listing in Step 1 or attached

spread sheet.

Column C: Calculate and record the difference between Column A and Column B.

Description of Receipt/Income Category

List Total Receipts/Income from

Detail Listing ( From Step 1 or Separate

Spreadsheet)

Column A

*Total Amount of

Receipts / Income from

❑ Prior Reporting

Period or

❑ Financial Plan

Column B

Total Amount of

Receipts /

Income for

Current

Reporting Period

Column C

Change in

Amount of

Receipt/

Income

Indicate

+/-

Asset Not Previously Reported

Business Income

Court Order Repayment

Disability /Unemployment /Worker’s Comp

Distribution - Annuity

Distribution – Pension s/Retirement Plan

Distribution – Trust

Farm/Ranch Income

Gifts from Others

Inheritance

Insurance Settlement/Benefit

Interest/Dividends

Loan Repayment

Oil/Gas /Mineral Royalties

Other Public Assistance

Other Receipts/Income

Proceeds from Sale of Assets

JDF 885 SC R6/19 CONSERVATOR’S ANNUAL/FINAL REPORT Page 5 of 12

Rental Income

Reverse Mortgage Payment

Social Security

Tax Refunds

VA Benefits

Wages

TOTALS (Move to Step 7)

Have Total Receipts/Income in Column B changed from the Prior Reporting Period or Financial Plan totals

in Column A ? ❑ Yes ❑ No

If Yes, explain the changes below. Please include a description of any changes or unanticipated transactions. If

income and expenses are anticipated to differ going forward, it may be necessary to file an Amended Inventory

with Financial Plan and Motion for Approval ( JDF 882) or a separate petition for approval with the court.

Step 3: Disbursements/Expenses

Column A: Use the amounts from the Inventory with Financial Plan (JDF 882) or from the prior Conservator ’s

Report filed to complete Column A that is marked with an asterisk (*) below.

Column B: Transfer all individual expense category “totals” from completed Detail Listing in Step 1 or attached

spread sheet.

Column C: Calculate and record the difference between Column A and Column B.

Description of Disbursement / Expense

Category

List Total Disbursements/Expenses from

Detail Listing (From Step 1 or Separate

Spreadsheet )

Column A

*Total Amount of

Disbursement /

Expense from

❑ Prior Reporting

Period or

❑ Financial Plan

Column B

Total Amount of

Disbursement /

Expense for

Current Reporting

Period

Column C

Change in

amount of

Disbursement/

Expense

Indicate

+/-

Assisted Living/Care Facility

Bank/Investment Account Fees

Caregiver/In -Home Provider

Charitable Contributions

Clothing

Collectibles

Debt Repayment (excluding CC)

Debt Repayment (Credit Card)

Distributions - Protected Person

Education/Tuition/Student Loan

Entertainment/Movies

Equipment

Farm/Ranch Expense

Fees – Accountant/CPA

JDF 885 SC R6/19 CONSERVATOR’S ANNUAL/FINAL REPORT Page 6 of 12

Fees – Conservator – Non -Prof

Fees – Conservator -Prof

Fees – Court Visitor

Fees – Guardian – Non -Prof

Fees – Guardian - Prof

Fees – Guardian Ad Litem (GAL)

Fees -Investment Acct Management

Fees – Legal for Conservator

Fees – Legal for Guardian

Fees – Legal for GAL

Fees – Legal for Protected Person

Fees –Other Professional

Funeral

Gifts

Groceries/Hygiene/Household Supplies

HOA Fees

Hobbies

Home Furnishings

Insurance – Home/Renter

Insurance – Life

Insurance – Long Term Care

Insurance – Other

Jewelry

Livestock

Loan Interest

Loans

Medical -Doctor/Prof/Hospital

Medical Furnishings/Supplies

Medical -Insurance

Medical -Medicab/Transportation

Medical -Medications

Medical -Other

Mortgage

Motor Vehicle – Insurance

Motor Vehicle – Loan Payments

Motor Vehicle – Registration/Other

Motor Vehicle – Repairs/Maint/Fuel

Moving Expenses

Other Disbursement/Expense

Other Transportation

Pet Care

Property Repairs/Maintenance

Rent

Restaurants/Dining Out

School Supplies

Services – Cleaning

Services – Personal Care

JDF 885 SC R6/19 CONSERVATOR’S ANNUAL/FINAL REPORT Page 7 of 12

Subscriptions/Dues

Taxes – FICA and Medicare

Taxes – Income

Taxes – Property and Assessments

Travel/Vacations

Utilities (Including Phone/Cell)

TOTALS (Move these totals to Step 7)

Step 4: Conservator, Guardian, and Professional Fees Detail

List all conservators, guardians, and professionals paid. Include the hourly r ate, number of hours worked,

fees and costs , as well a description of the services provided and the benefit to the estate .

Name of Conservator,

Guardian, and Professional

Hourly

Rate

(Range)

No. of

Hours

Worked

Total

Hourly

Fees

Other

Costs

Charged

Brief Description of Services

Provided and Benefit to the

Estate

Account Management –

Professional

Accountant/CPA

Conservator –Non -Professional

Conservator - Professional

Court Visitor

Guardian – Non -Professional

Guardian - Professional

Guardian Ad Litem (GAL)

Legal Fees -Conservator

Legal Fees -Guardian

Legal Fees -GAL

Legal Fees - Protected Person

Other Professional Fees

TOTAL ( Fees and Costs ) ( Move these totals to

Step 3)

Ha ve Total Disbursements/Expenses in Step 3, Column B ❑ Increased or ❑ Decreased from the Prior

Reporting Period or Financial Plan in Step 3, Column A ?

Explain the changes below. Please include a description of any changes or unanticipated transactions. A

separate petition for approval may need to be filed with the court for significant changes outside the amounts

allowed in t he Inventory and Financial Plan.

JDF 885 SC R6/19 CONSERVATOR’S ANNUAL/FINAL REPORT Page 8 of 12

Step 5: Assets

Column A: List the last 4 digits of all bank , investment or other financial accounts.

Column B : List name of the bank or financial institution in which accounts are being held , or describe specific

asset .

Column C: Use amounts from the original Inventory with Financial Plan (JDF 882) or from the pri or

Conservator’s Report filed, to complete C olumn C marked with an asterisk (*) below.

Column D: List all cash and investment account balances. These should coincide and be transferred from the

Ending Cash Balances on the Detail Listing in Step 1 .

Column E: Calculate and record the difference between Column C and Column D.

Vehicles, real estate, and all other assets should be valued at what the asset could be sold for in its current

condition (i.e. Fair Market Value) .

Description of Asset

(Identify all accounts)

Column A

Account

Number

(last 4

digit s)

Column B

Name of Financial

Institution or

Description of Asset

Column C

* Fair Market

Value

❑as of Last

Day of Prior

Reporting

Period or

❑Inventory

Column D

Fair Market

Value

(as of Last

Day of

Current

Reporting

Period)

Column E

Change in

Value of

Asset

Indicate

+/-

Checking Accounts

Balance from Step 1

Savings Accounts

Balance from Step 1

Certificate of Deposit

Money Market

Pre -Paid Debit Card

Cash On Hand

Stocks

Bonds

Mutual Fund

Oth er Financial

Investments

Life Insurance

(Cash Value)

Pension /Retirement

(Vested)

IRA / 401(k)

Annuities

Loans from Estate

JDF 885 SC R6/19 CONSERVATOR’S ANNUAL/FINAL REPORT Page 9 of 12

Motor Vehicle

Real Estate

Home Furnishings

Collect ibles (e.g.,

stamps or coins)

Jewelry

Livestock

Equipment

Oil/Gas/Mineral

Interest

Other Personal

Property

List Other Assets

TOTALS (Move these

totals to Step 7)

Have Total Assets in Step 5, Column D changed from the last day of the Prior Reporting Period or

Inventory in Step 5, Column C ? ❑ Yes ❑ No

Provide additional detail for any assets on the preceding schedule that were purchased during the reporting

period. Include a description of the asset purchased , the purchase price, purchase date, and source of funding

for the purchase (e.g. cash, loan, sale of another other asset , etc. ).

Description of Asset Purchase Price Purchase Date Purchase method

Provide detail for any assets on the preceding schedule that were sold during the reporting period. Include a

description of the asset sold , the sale price, sale date, and use of funds proceeds from the sale (e.g. living

expenses, extinguish debt, purchase of anothe r asset, etc. ).

Description of Asset Sale Price Sale Date Use of Proceeds

JDF 885 SC R6/19 CONSERVATOR’S ANNUAL/FINAL REPORT Page 10 of 12

Please include a description of any other changes to the value of estate assets .

Step 6: Liabilities /Debts

Column A: List the last 4 digits of all account or loan numbers.

Column B: List the name of the bank or financial institution to which loans or debts are being paid.

Column C: Use amounts from the original Inventory with Financial Plan (JDF 882) or from the prior

Conservator’s Report filed, to complete Column C marked with an asterisk (*) below.

Column D: List all current balances due on loans and debts.

Column E: Calculate and record the difference between Column C and Column D.

Description of

Liability /Debt

(Identify all accounts)

Column A

Account

Number

(last 4 -digits

only)

Column B

Name of Financial

Institution

Column C

*Balance Due

on Last day of

❑ Prior

Reporting

Period or

❑ Inventory

Column D

Balance Due

on Last Day

of

Current

Reporting

Period

Column E

Change in

Amount of

Liability

Indicate

+/-

Mortgage

(princ ipal due only)

Motor Vehicle Loan

2nd Mortgage/ Home

Improvement

Student Loan /Tuition

Reverse Mortgage

HELOC

Credit Card

Federal Taxes

State / Local Taxes

Other

Loan/ Liabilit y/Debt

TOTALS (Move these

totals to Step 7)

JDF 885 SC R6/19 CONSERVATOR’S ANNUAL/FINAL REPORT Page 11 of 12

Have Total Liabilities/Debts changed from the last day of the Prior Reporting Period or Inventory ?

❑ Yes ❑ No If Yes , explain the changes below. Please include a description of any changes or unanticipated

transactions. A separate petition for approval may need to be filed with the court for significant changes outside

the amounts allowed in the Inventory and Financial P lan.

Step 7: Summary

Summary of Financial Activity

*Prior Reporting Perio d Current

(or Financial Plan) Reporting Period

(A) Total Receipts/Income from Step 2 $ _____________ $ _____________

(B) Total Disbursements/Expenses from Step 3 $ _____________ $ _____________

(A) minus (B) = Net Income $ _____________ $ _____________

Summary of Net Worth

Fair Market Value of Assets Minus Liabilities/Debts

*Last Day of Last Day of

Prior Reporting Period Current Reporting Period

(or Inventory)

(A) Total Assets from Step 5 $ _____________ $ _____________

(B) Total Liabilities/Debts from Step 6 $ _____________ $ _____________

(A) minus (B) = Net Worth $ _____________ $ _____________

❑ By checking this box, I am acknowledging I am filling in the blanks and not changing anything else on the

form.

❑ By checking this box, I am acknowledging that I have made a change to the original content of this form.

*** *****

REPORT MUST BE SIGNED AND DATED BY ALL CONSERVATORS

AND SERVED ON TH E PROTECTED PERSON AND ALL INTERESTED PARTIES

AS INDIC ATED BY THE ATTACHED CERTIFICATE OF SERVICE

********

JDF 885 SC R6/19 CONSERVATOR’S ANNUAL/FINAL REPORT Page 12 of 12

IMPORTANT

THIS SECTION MUST BE COMPLETED CORRECTLY AND SIGNED

OR THE REPORT MAY BE REJECTED.

Colorado Law REQUIRES that the Conservator’s Report be served on the PROTECTED PERSON AND

INTERESTED PERSONS pursuant to Order Appointing Conservator, including minors 12 years of age or older

(§15 -14 -404(4), C.R.S.) . In the space below, list the names, addresses, and method of delivery for each party

listed on the Order Appointing Conservator and provide each party with a copy of this Report.

VERIFICATION

I declare under penalty of perjury under the law of Colorado that the foregoing is true and correct.

Executed on the ______ day of Executed on the ______ day of

(date) (date)

_______________________, _________, _______________________, _________,

(month) (year) (month) (year)

at ______________________________________ at ______________________________________

(city or other location, and state OR country) (city or other location, and state OR country)

_______________________________ _______________________________

(printed name) (printed name)

_______________________________ _______________________________

(Signature of Conservator/Successor) (Signature of Co -Conservator/Successor , if any)

________________________________________ __________________

Attorney Signature, (if any) Date

CERTIFICATE OF SERVICE

I certify that on ___________________ (date), a copy of this _______________ (name of document) was served

as follow s on each of the following:

Name and Address Relationship to Decedent, Ward,

or Protected Person Manner of Service*

*Insert one of the following: hand delivery, first -class mail, certified mail, e -service , or fax.

___________________________________ ___ ___ ________

Signature

Practical advice on finalizing your ‘Title 4 Civil Division Department Of Justice’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the premier electronic signature service for individuals and small to medium-sized businesses. Bid farewell to the lengthy procedure of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Utilize the powerful features embedded in this user-friendly and cost-effective platform and transform your method of document handling. Whether you need to sign forms or collect signatures, airSlate SignNow makes it all simple, requiring just a few clicks.

Follow this comprehensive guide:

- Sign in to your account or register for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template collection.

- Open your ‘Title 4 Civil Division Department Of Justice’ in the editor.

- Click Me (Fill Out Now) to set up the form on your end.

- Add and designate fillable fields for other participants (if needed).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download, print your version, or convert it into a reusable template.

Don’t be concerned if you need to collaborate with your coworkers on your Title 4 Civil Division Department Of Justice or send it for notarization—our service provides everything necessary to handle such activities. Create an account with airSlate SignNow today and take your document management to new heights!