Fill and Sign the Tn Form Certificate Exemption

Practical advice on preparing your ‘Tn Form Certificate Exemption’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the premier electronic signature solution for individuals and businesses. Bid farewell to the monotonous procedure of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign paperwork online. Utilize the extensive capabilities embedded in this intuitive and cost-effective platform and transform your method of paperwork management. Whether you need to authorize forms or collect eSignatures, airSlate SignNow manages it all with ease, requiring just a few clicks.

Adhere to this comprehensive guide:

- Sign in to your account or sign up for a complimentary trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our template library.

- Open your ‘Tn Form Certificate Exemption’ in the editor.

- Click Me (Fill Out Now) to finalize the form on your end.

- Add and allocate fillable fields for other participants (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download, print your version, or convert it into a reusable template.

Don’t be concerned if you need to collaborate with your teammates on your Tn Form Certificate Exemption or send it for notarization—our solution provides you with all the resources necessary to accomplish such tasks. Sign up with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

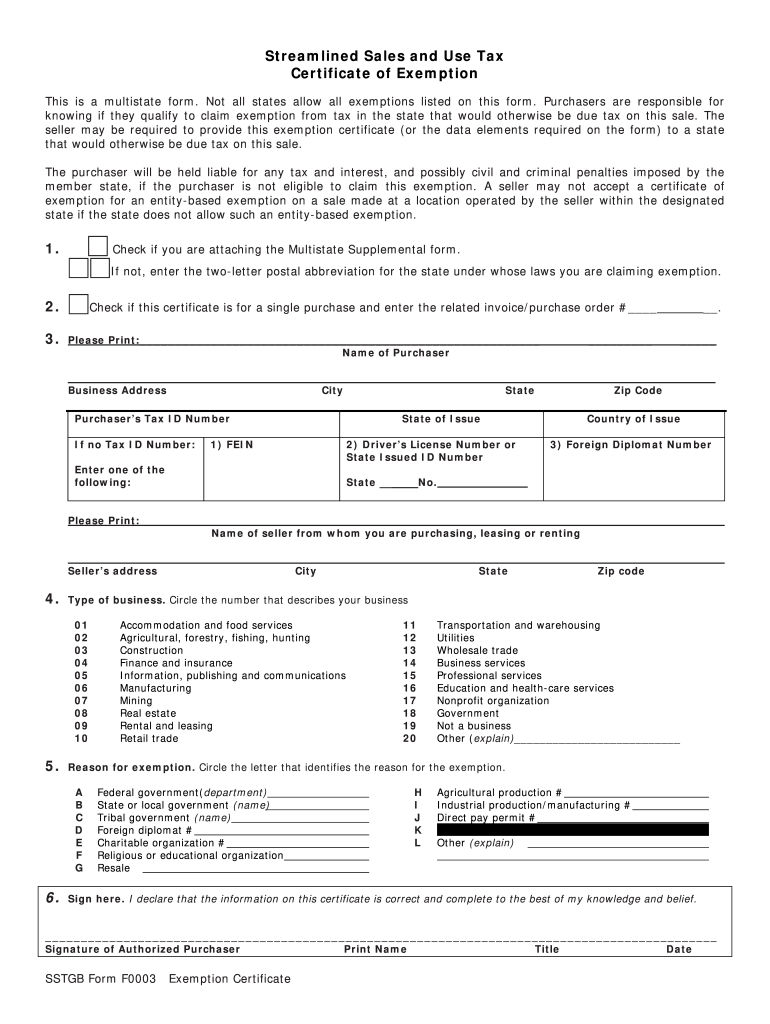

What is the Sstgb Form F0003 Exemption Certificate State Of Tennessee?

The Sstgb Form F0003 Exemption Certificate State Of Tennessee is a crucial document that allows businesses to claim sales tax exemptions on certain purchases. It is utilized by organizations in Tennessee to ensure compliance with state tax regulations while minimizing costs. By using airSlate SignNow, you can easily manage and eSign this form securely.

-

How can airSlate SignNow help with the Sstgb Form F0003 Exemption Certificate State Of Tennessee?

airSlate SignNow streamlines the process of filling out and signing the Sstgb Form F0003 Exemption Certificate State Of Tennessee. Our platform provides templates and easy-to-use tools that enable you to complete this essential document quickly. Plus, you can store and track your forms electronically for future reference.

-

Is there a cost associated with using airSlate SignNow for the Sstgb Form F0003 Exemption Certificate State Of Tennessee?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. While the exact cost may vary based on the selected plan, the platform is designed to be a cost-effective solution for managing documents like the Sstgb Form F0003 Exemption Certificate State Of Tennessee. You can explore our pricing options on our website.

-

What features does airSlate SignNow offer for managing the Sstgb Form F0003 Exemption Certificate State Of Tennessee?

airSlate SignNow provides features such as customizable templates, electronic signatures, and document tracking for the Sstgb Form F0003 Exemption Certificate State Of Tennessee. These tools simplify the signing process and enhance collaboration between parties. Additionally, our platform ensures secure storage and easy retrieval of your documents.

-

Can I integrate airSlate SignNow with other applications for the Sstgb Form F0003 Exemption Certificate State Of Tennessee?

Absolutely! airSlate SignNow supports integration with various applications and services, making it easy to manage your Sstgb Form F0003 Exemption Certificate State Of Tennessee alongside your existing workflows. Integrating with tools like CRM systems or accounting software can streamline your document management process.

-

What are the benefits of using airSlate SignNow for the Sstgb Form F0003 Exemption Certificate State Of Tennessee?

Using airSlate SignNow for the Sstgb Form F0003 Exemption Certificate State Of Tennessee offers numerous benefits, including time savings, enhanced security, and improved compliance. Our platform allows for quick eSigning and easy sharing of documents, which can greatly increase efficiency in handling your exemption certificates.

-

How secure is the airSlate SignNow platform for handling the Sstgb Form F0003 Exemption Certificate State Of Tennessee?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and security protocols to ensure that your Sstgb Form F0003 Exemption Certificate State Of Tennessee and other documents are safe from unauthorized access. You can trust that your sensitive information is well protected while using our services.

Find out other tn form certificate exemption

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles