Fill and Sign the Transaction Dispute Form Icici Bank

Valuable tips for finishing your ‘Transaction Dispute Form Icici Bank’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the premier eSignature platform for individuals and businesses. Bid farewell to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can easily complete and sign documents online. Utilize the robust features included in this user-friendly and cost-effective solution and transform your document handling process. Whether you need to authorize forms or gather eSignatures, airSlate SignNow manages everything seamlessly, needing just a few clicks.

Adhere to this detailed guide:

- Sign in to your account or create a free trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our template collection.

- Access your ‘Transaction Dispute Form Icici Bank’ in the editor.

- Click Me (Fill Out Now) to set up the document on your end.

- Add and assign fillable fields for others (if necessary).

- Proceed with the Send Invite settings to request eSignatures from others.

- Download, print your version, or transform it into a reusable template.

No need to worry if you have to work with your teammates on your Transaction Dispute Form Icici Bank or send it for notarization—our platform provides you with everything you need to complete such tasks. Sign up for airSlate SignNow today and enhance your document management to a new level!

FAQs

-

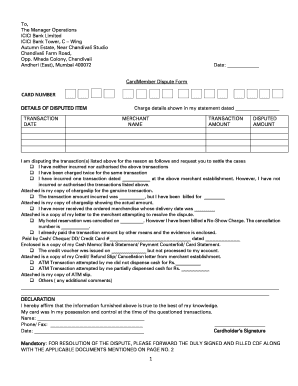

What is the Transaction Dispute Form ICICI Bank?

The Transaction Dispute Form ICICI Bank is a document used by customers to report unauthorized transactions or discrepancies in their banking statements. This form allows users to formally request a review and resolution of disputed transactions with ICICI Bank, ensuring their concerns are addressed efficiently.

-

How can I access the Transaction Dispute Form ICICI Bank?

You can easily access the Transaction Dispute Form ICICI Bank through the ICICI Bank official website or by visiting your nearest branch. Additionally, airSlate SignNow offers a convenient way to eSign and submit this form online, streamlining the dispute process.

-

What are the benefits of using the Transaction Dispute Form ICICI Bank?

Using the Transaction Dispute Form ICICI Bank helps customers protect their finances by formally addressing unauthorized transactions. It ensures that your disputes are documented and processed quickly, providing peace of mind and financial security.

-

Is there a cost associated with submitting the Transaction Dispute Form ICICI Bank?

There is no fee for submitting the Transaction Dispute Form ICICI Bank. However, if you choose to use airSlate SignNow for eSigning and submitting your form, you may incur minimal costs associated with the service, which is known for its ease of use and cost-effectiveness.

-

Can I track the status of my Transaction Dispute Form ICICI Bank?

Yes, once you submit the Transaction Dispute Form ICICI Bank, you can track its status through your ICICI Bank online banking account or by contacting customer service. Using airSlate SignNow, you can also receive notifications regarding the status of your submitted form for added convenience.

-

What features does airSlate SignNow offer for the Transaction Dispute Form ICICI Bank?

airSlate SignNow provides features such as eSigning, document sharing, and secure storage for the Transaction Dispute Form ICICI Bank. These features facilitate a seamless user experience, allowing you to complete and submit your form quickly and securely.

-

How does airSlate SignNow improve the process of submitting the Transaction Dispute Form ICICI Bank?

airSlate SignNow streamlines the process of submitting the Transaction Dispute Form ICICI Bank by enabling users to eSign documents digitally. This eliminates the need for printing and scanning, making it easier and faster to resolve disputes while maintaining security and compliance.

Find out other transaction dispute form icici bank

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles