Fill and Sign the Transfer on Death Deed 481377926 Form

Useful suggestions for preparing your ‘Transfer On Death Deed 481377926’ online

Are you frustrated by the burden of handling paperwork? Look no further than airSlate SignNow, the premier eSignature solution for individuals and small to medium-sized businesses. Bid farewell to the arduous task of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign documents online. Take advantage of the extensive features offered by this intuitive and cost-effective platform and transform your method of document management. Whether you need to sign forms or collect eSignatures, airSlate SignNow manages everything with ease, requiring just a few clicks.

Adhere to this step-by-step guide:

- Sign in to your account or initiate a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template collection.

- Edit your ‘Transfer On Death Deed 481377926’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and designate fillable fields for additional individuals (if necessary).

- Continue with the Send Invite options to request eSignatures from others.

- Download, print your copy, or transform it into a reusable template.

Don’t be concerned if you need to collaborate with your colleagues on your Transfer On Death Deed 481377926 or send it for notarization—our platform provides everything necessary to complete such tasks. Sign up with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

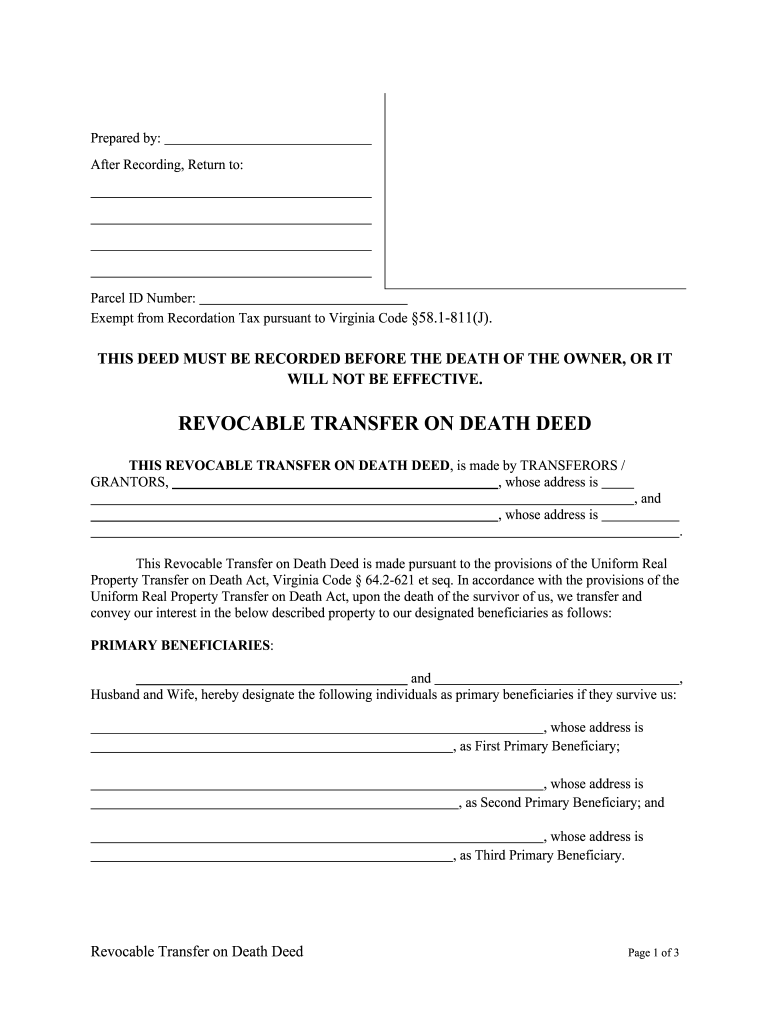

What is a Virginia transfer on death deed form?

A Virginia transfer on death deed form is a legal document that allows property owners to designate a beneficiary to inherit their property upon their death, avoiding the probate process. This form is a straightforward solution for estate planning and ensures that your assets are passed on as per your wishes.

-

How do I complete a Virginia transfer on death deed form using airSlate SignNow?

To complete a Virginia transfer on death deed form using airSlate SignNow, simply upload your document to our platform, fill in the necessary details, and eSign it securely. Our intuitive interface makes it easy to navigate through the form, ensuring that all required information is accurately captured.

-

Is there a cost associated with the Virginia transfer on death deed form?

Yes, while the Virginia transfer on death deed form itself may not have a direct cost, using airSlate SignNow to prepare and eSign the document involves a subscription fee. We offer various pricing plans that are cost-effective, ensuring you can manage your documents without breaking the bank.

-

What are the benefits of using airSlate SignNow for the Virginia transfer on death deed form?

Using airSlate SignNow for the Virginia transfer on death deed form offers numerous benefits, including streamlined eSigning, secure storage, and easy access to your documents anytime, anywhere. Our platform is designed to simplify the process, making estate planning more efficient and less stressful.

-

Can I save my Virginia transfer on death deed form for later use?

Absolutely! With airSlate SignNow, you can save your Virginia transfer on death deed form and access it whenever you need. Our secure cloud storage ensures your documents are safe and retrievable, allowing you to make updates or changes whenever necessary.

-

Does airSlate SignNow integrate with other applications for managing the Virginia transfer on death deed form?

Yes, airSlate SignNow offers seamless integrations with various applications such as Google Drive, Dropbox, and Microsoft Office. This allows you to manage your Virginia transfer on death deed form alongside your other essential documents, enhancing your workflow and productivity.

-

How can I ensure my Virginia transfer on death deed form is legally binding?

To ensure your Virginia transfer on death deed form is legally binding, it must be signed by the property owner and signNowd. airSlate SignNow provides options for secure eSigning and notary services, helping you comply with Virginia's legal requirements effortlessly.

The best way to complete and sign your transfer on death deed 481377926 form

Find out other transfer on death deed 481377926 form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles