Paul Trampe

Econ Journal Watch,

Volume 4, Number 3,

September 2007, pp 308-320.

The EITC Disincentive:

The Effects on Hours Worked from the

Phase-out of the Earned Income Tax Credit

Paul Trampe1

Abstract

The biggest expansion to date of the Earned Income Tax Credit, legislated

in 1993, was taking effect just as the welfare reform of 1996 was removing the

federal entitlement to AFDC benefits and devolving the program to the states,

resulting in a large drop in caseloads and spending on the program. As a result,

the EITC has become the largest US assistance program to the poor in terms of

dollars and in terms of number of recipients, surpassing AFDC (now Temporary Assistance to Needy Families or TANF) (Eissa and Hoynes 2005, 1). Long

neglected in academic literature, the program has been receiving a great deal of

attention recently, particularly its incentives and disincentives to work. Researchers have focused on the incentives of phase-in of the program, however, and have

been less precise about the phase-out.

The EITC phase-in range, where benefits increase as income increases,

would tend to encourage work, while the phase-out range, where benefits are

withdrawn above an income threshold, would discourage work. This paper focuses on the phase-out. Most studies have not found solid evidence of discouraged work, but some of those papers have focused on the wrong population and

two seem to have overlooked facets of their own data. The most thorough study

of the phase-out, which did not find a discouragement effect from the increase

in the EITC contained in the 1986 tax reform bill, has not been repeated for the

much larger expansion legislated in 1993. After reviewing the literature on the issue I show a regression which does suggest an effect on hours worked for those

in the EITC phase-out range from the 1993 expansion of the program, albeit a

small effect.

1 Ph.D. candidate, School of Public Policy, George Mason University. Arlington, VA 22201.

Econ Journal Watch

308

� Earned Income Tax Credit

The EITC in Brief

The EITC was created in 1976 as part of an economic stimulus package.

The idea grew out of theories from Milton Friedman and others that a negative

income tax, such that poor families receive payments from the government which

increase as their income rises, would encourage participation in the workforce by

the poor. The idea was to reverse the perceived disincentive of traditional welfare

programs which pay the most to those with zero income – i.e. those who do not

work at all (Green 1968, 28). At first the program was quite small but it was expanded in 1984, 1986, 1988 and especially 1993, at which time the benefits were

also indexed to inflation so in nominal terms it has continued to grow.

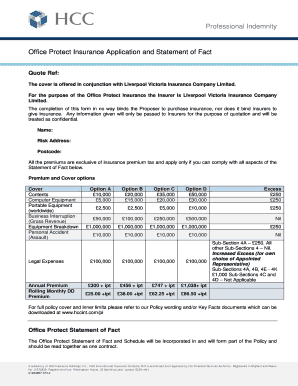

Figure 1: The EITC for Single Parent - Two Child Families

As of 2007, the program pays a benefit equal to 40 percent of income for the

first $11,000 for families with two children ($4400 maximum benefit) and 34 percent

of nearly $7900 income for families with one child ($2662 maximum benefit). In 2001

legislation intended to reduce the inherent marriage penalty in EITC moved the beginning point of the phase-out up $2000 for two-parent families. Therefore, the phaseout now begins around $14,400 for single parent families and $16,400 for two parents.

309

Volume 4, Number 3, September 2007

�Paul Trampe

Above that threshold, families with two or more children lose 21 cents of benefits for

each additional dollar of income (see Figure 1). One-child families lose benefits above

the threshold at a rate of 16 cents per dollar of income. This means that a single parent family with two or more children receives some benefits until reaching $35,263

in income while a single parent with one child receives some benefit until reaching

$31,030 income. Two parent families’ benefits are reduced at the same rates, so the

benefits end at an income level $2000 above their single parent counterparts.

It is a “refundable” tax credit meaning it is paid through the regular income

tax system but if those eligible do not have any tax liability against which to take the

credit (and most eligible do not) they receive cash from the government. As a kind

of reverse withholding, it can be paid into the person’s regular paycheck, but most

choose to receive it in one lump sum when filing an IRS form 1040 each year.

Previous Studies: Labor Force Expansion

The phase-in percentage being larger than the phase-out percentage means

that the incentive is larger than the disincentive, but it also means that the disincentive covers a larger band of income and therefore affects more people. In

fact, 65 percent of those receiving benefits have incomes in the phase-out range

(Liebman 1998, 104). It is logical to ask which effect is greater. Does the program

produce a net gain in work or a net loss?

The literature appears to be unanimous in reporting that each expansion in the

Earned Income Tax Credit has brought about an increase in labor force participation

by single mothers with children. The bulk of the AFDC and EITC population is

made up of such families, so scholars have studied that group to measure the effects.

According to Nada Eissa and Jeffrey Liebman, labor force participation by single

women with children, controlled for participation rates of single women without

children who were not eligible for the EITC at that time, rose 2.4 percent after the

EITC expansion contained in the tax overhaul of 1986 (Eissa and Liebman 1996,

616). An earlier paper by Eissa and Liebman bunched the three years before the

1986 reform and the three years after and found a 1.4 percent increase in labor force

participation by single women with children (Eissa and Liebman 1995, 2). In a separate paper written by Liebman, he found that the participation rate of women with

children increased from 72.7 percent in 1984 to 82.1 percent in 1996 with three major

expansions of EITC in between (Liebman 1998, 97). In a 2005 paper which Eissa

wrote with Hilary Hoynes they find that labor force participation by women with

children, defined as any work over a 12 month period, shows a jump from 73 percent

in 1984 to 85 percent in 2003 (Eissa and Hoynes 2005, 12). They report that most

of the change occurred between 1992 and 1999 as employment jumped 16 percent.

Eissa and Hoynes state that there was not much change in labor force participation

of single women without children during that period (Eissa and Hoynes 2005, 12).

Econ Journal Watch

310

� Earned Income Tax Credit

Eissa and Hoynes and other authors treating the changes of the mid 1990s do

not mention one caveat, namely, that over this same time period, AFDC was being

reformed with the main effect being to push recipients into jobs. Even before the

1996 welfare reform at the federal level, the states had been using the waiver process

to introduce all of the same reforms that would later be enacted nationally. Therefore since the EITC expansion and the welfare reform were happening virtually

simultaneously, separating the effects is very difficult. However, Robert Greenstein

reports that survey evidence suggests that more than half of the increase in labor

force participation is connected to the EITC expansion (Greenstein 2005, 3).

Previous Studies: Hours Worked

While there have been many studies detailing the positive effects on workforce

participation of the phase-in of benefits, they have been much less systematic in studying the negative effects of the phase-out. Several studies address the negative effects

by looking at the average number of hours worked by all single women with children

regardless of income. The rationale for doing so is, as Eissa and Hoynes put it, “that

about three quarters of single EITC recipients have earnings in the flat and phase-out

regions of the credit – thus the expectation is that the EITC will reduce the number

of hours worked by most eligible single taxpayers already in the workforce” (Eissa and

Hoynes 2005, 8). However, those in the flat range do not face a disincentive and the

studies, including the one quoted above, use families from all income levels, those in

the flat and phase-out ranges as well as the phase-in range and those outside the EITC

program altogether.

Of course it is also possible to observe what appears to be a disincentive throughout the income scale due to the simple fact that the subjective marginal benefit of

each additional dollar of income declines as income rises. However, the disincentive

directly attributable to the EITC does not affect all single women with children. The

phase out of EITC benefits is only going to affect the level of work for those who are

actually in the income range to which those marginal tax rates apply. In fact, for those

in the phase-in range, an expansion of the program would be expected to cause an

increase in hours worked due to an increase in the subsidy for each hour worked.

Most papers on the subject do address the point that the disincentive only

exists for those in the phase-out range but seem to regard it as a minor nuance

in the data, when in fact it makes most of the studies doubtful for measuring the

effects of that disincentive. Eissa and Liebman (1996), which I discuss below, was

the one major study which focused exclusively on those in the phase-out income

range. It found no effect and that seems to have settled the question for other researchers. Researchers have continued to conduct studies involving single women

throughout the income range, but, since Eissa and Liebman (1996), no one has

isolated the families actually affected by the phase-out range.

311

Volume 4, Number 3, September 2007

�Paul Trampe

The literature is almost as unanimous in the claim that EITC has no disincentive effect on hours worked as it is on the claim that the phase-in encourages women

to enter the workforce. One exception is a study by John Karl Scholz, who projected

that the 1993 expansion would reduce hours worked by 21 hours per year for each

family in the phase-out range (Scholz 1996, 159). He was making the prediction from

his model of the labor market before the data was in, although the prediction was

based on past responses by the labor market to changes in marginal tax rates.

Jesse Rothstein (2007) reports that he could not find a difference in hours

worked among women with children compared to women without. That study used

the entire income spectrum (except zero, i.e. those who did not work at all), presumably including the phase-in range and those altogether beyond the EITC range. Bruce

Meyer and Dan Rosenbaum (2001) found mixed results on hours worked for women with children – also using the entire income spectrum (Meyer and Rosenbaum

2001). Eissa and Liebman’s 1995 paper also found no decrease in hours worked by

single women with children after the expansions of the 1980s (Eissa and Liebman

1995, 28-29). Again, none of these studies focused on the phase-out range.

Three years later, in a single author paper, Liebman argues that studying the

effects on hours for expansions other than the one legislated in 1986 is difficult because the changes in the program were phased in gradually (Liebman 1998, 100). After

discussing the lack of empirical evidence for a decrease in hours among women with

children, throughout all income strata, presumably, he then dismisses the idea that the

Figure 2: Average Annual Hours Worked for Single Women in the

Phase-Out Region of the EITC, 1984-2003 By Presence of Children

Reprinted from Eissa and Hoynes 2001, 31.

Econ Journal Watch

312

� Earned Income Tax Credit

study might yield different results if it focused solely on those with incomes in the

phase-out range by referring back to his and Eissa’s 1996 paper (Liebman 1998, 104).

More recently Eissa and Hoynes find “no evidence that hours of work decreased for

single mothers relative to single mothers without children as the EITC expanded”

(Eissa and Hoynes 2005, 14). Although they do not focus on those in the phase-out

range, they do include a figure, (reproduced here as Figure 2) specific to that group.

The authors’ conclusion from this figure is as follows: “Strikingly, this figure

shows no pattern of a reduction in hours worked for single women with children

relative to single women without children” (Eissa and Hoynes 2005, 14). However, they do not comment on the dramatic increase in hours worked by single

women without children starting in 1984 which was not accompanied by a similar

increase for those with children. They also do not comment on the dramatic rise

and subsequent fall in hours for those without children between 1997 and 2000

while the hours of those with children stay relatively constant. Interestingly there

were no such divergence among all single women with children apparent in the

Figure 3:

Average Annual Hours Worked for Working Single Women

by Presence of Children, 1984-2000

Reprinted from Eissa and Hoynes 2005, 30.

figure Eissa and Hoynes print just one page earlier, reprinted here as Figure 3.

In fact, between 1996 and 2000, hours worked appear to have increased

faster for single women with children than for those without when looking at all

incomes, whereas in the income range specific to the phase-out of EITC there

was no increase at all for those with children but a dramatic rise in 1997 for those

313

Volume 4, Number 3, September 2007

�Paul Trampe

without (the expansion of the program legislated in 1993 was fully implemented

by 1996). Little wonder, then, that researchers basing their evaluations of the EITC

phase-out on all single women with children get false results. For the years 19962000 at least, a researcher looking at all such families regardless of income would

conclude that women with children increased their hours faster than those without.

But those basing their conclusions only on families in the phase-out range would

conclude the opposite, at least for the years 1996-1998. At least Eissa and Hoynes

did include the figure in Figure 3, yet even they based their own conclusions on the

total population of single women with children. The only other reference by Eissa

and Hoynes to the issue of the phase-out range is, as by Liebman (1998), to refer

back to the Eissa and Liebman paper of 1996 which will be discussed below.

Eissa and Hoynes are not the only authors who seem to overlook facets of

their own figure. One other method of determining whether the phase-out has an

effect is to chart incomes to see if people tend to congregate at the “bend points” –

i.e. just after reaching maximum benefits and at the end of the plateau range – just

before the phase-out begins. Liebman’s 1998 paper included figures showing the

distribution of households by income distribution separated according to whether

they filed their income taxes in a joint return (married) or as a head of household (single with dependents), reproduced here as Figure 4. Liebman reports that

“There is little if any bunching at the kink at the beginning of the EITC phaseout

range” (Liebman 1998, 105). In the lower figure, for two-parent families, that is

Figure 4:

1992 Distribution of Tax Returns for Taxpayers with Children

Reprinted from Liebman 1998, 106

Econ Journal Watch

314

� Earned Income Tax Credit

certainly true. However, it is difficult to understand why Liebman does not see in

the upper figure, representing single parent families, what plainly appears to be a

concentration of incomes in the EITC plateau range (the rectangle just before the

phaseout region). The implication of this figure would be that head-of-household

taxpayers have learned how much they need to earn to gain the maximum EITC

benefit and are able to arrange their hours such that they do not have to work extra

hours for diminished after tax remuneration in the EITC phase-out range.

However, Liebman is using IRS data which likely includes a great deal of

fraud. The IRS spends much time making sure that all genuine income gets reported. It is much less practiced in making sure that all reported income is genuine. The only Americans with an incentive to over-report income are those in the

phase-in range. There is believed to be considerable fraud in the EITC, and using

IRS data may create a false appearance of bunching. In preparing this paper, I

prepared similar figures using CPS data and did not find any bunching.

The 1996 Eissa and Liebman paper presents the one extensive study of

the effect on hours worked of the EITC on the phase-out range alone. The 1986

EITC expansion was unique in that, while the maximum benefit was increased,

the phase-out range was decreased. The result was that the income range of the

phase-out increased dramatically, from a range of $6500 to $11,000 before the expansion to a range of $8510 to $15,432 after. This created a large group of families

subject to the EITC phase-out who had not been before. Eissa and Liebman used

that fact to run a regression using a binary variable to differentiate between cases

before the EITC expansion and after. The correlation coefficients (they ran more

than one regression using populations defined more narrowly than just single

women with children, e.g. single women without a high school diploma) came

out positive, meaning single women with children in the new phase-out range increased their hours anyway; however, the 95 percent confidence intervals for the

coefficients crossed zero, making the findings inconclusive (Eissa and Liebman

1996, 633). I regard the method to be sound, but it has not been repeated for later

EITC expansions. Researchers have run new studies of hours worked by single

women with children for all incomes, and they brush off questions about the

phase-out with a reference to this one study, as if the difference between those in

the phase-out range and those not is not an important distinction.

Measuring the Effects of the 1993 Expansion on Hours Worked

Therefore, I sought to create something along the lines of the Eissa and

Liebman study of 1996, using, as they did, data from the Census Bureau’s Current

Population Survey March Supplement, only analyzing the much larger increase in

the EITC legislated in 1993. Unlike every previous study, however, I did not limit

my sample to women. Most researchers base their study on single women with

children because they make up the bulk of the EITC recipient population. How315

Volume 4, Number 3, September 2007

�Paul Trampe

ever, those studies were primarily concerned with the phase-in and since most of

them did not distinguish the income level, using female headed households was

the only way to hone in on the EITC population. In the phase-out income range,

which today reaches past $35,000 a year, female headed households are much less

dominant. In the 600 randomly selected households for my study 197 were single

parent households headed by women.

I generated a random selection of 200 households with incomes corresponding to the phase-out range of the EITC from the 1993 survey, 200 from the

1994 survey, and 200 from the 2006 survey. The legislation passed in 1993, and

that, therefore, was the last year before the increased phase-out rates. The legislation set 1994 and 1995 as transition years, though by 1995 the phase-out rates

were nearly identical to the permanent ones. The three years I chose were the last

year before the expansion of the program began, the transition year 1994, and the

most recent year for which data was available.

Rather than a before/after binary variable as Eissa and Liebman used, I

established the EITC phase-out rate that applied for each household. Those in

the 1993 survey with one child faced a 13.1 percent phase-out rate and those with

more than one child a 13.9 percent rate. Among the households from 1994, they

had a phase-out rate of 16 percent if they had one child and 17.7 if they had two

or more. For those from the 2006 survey, the rates were 16 percent and 21 percent

for one and two child families. Unlike Eissa and Liebman, I did not have a control

group of people without children.

My dependent variable in the regression was hours worked at all jobs last

week. I controlled for age, gender, number of children, education level, whether

or not the parent was currently enrolled in school (and if so whether it was part

time or full time) and marital status. It should be noted that the Current Population Survey (CPS) has a seven point scale of marital status. As the point of including this item as a control variable is to account for the assumption that, for women

in particular, unmarried individuals have to work more hours, the CPS scale was

rearranged such that it was in the order of likelihood of receiving income from a

spouse. CPS had number 1 as married and spouse at home – civilian, and number

2 married with spouse at home – military. For purposes of this study, this was not

a meaningful distinction so 2 was recoded as 1. Also, CPS coded legally separated

at number 6, above divorced or widowed. I recoded legally separated as number 3,

since legally separated is closer to married than are divorced or widowed.

Two cases, both from 1994 had to be dropped as the respondent apparently

did not answer the question regarding hours worked last week. Further caution

needs to be taken in recognizing the fact that the EITC phase-out is far from the

only marginal tax rate faced by households in the sample. Those who are in the

EITC phase-out income range and are also eligible for Food Stamps would be

facing an income based phase out of Food Stamps as well. Those in public housing pay 30 percent of their income in rent. Those at the higher end of the EITC

Econ Journal Watch

316

� Earned Income Tax Credit

phase-out range have liability under the income tax. Such factors alter work disincentives and are not controlled for here. I see no other significant data issues.

Results

The results of the regression are shown in Table 1. The EITC phase-out

rate variable (eitcrate) carries a small but statistically significant (to the .05 level)

negative coefficient. Although relatively small, the coefficient is important. Since

the variable was entered as a number signifying the percent of income lost in

benefits, the coefficient represents the number of hours per week a typical person

in the phase-out range will forgo for each percentage point of marginal tax rate.

The implication is that, all other factors being equal, the 1993 expansion of EITC

caused those in the phase-out range to reduce their hours of work by 2.7 hours

per week if they have two children (0.38 times a 7.2 percentage point increase

in the phase-out range). Those with one child would be expected to reduce their

hours by roughly 1.1 hour per week, as the phase-out rate was increased 2.9 points

compared to 7.2 for two-child families. Measuring the effects of the entire phaseout disincentive, with a negative 0.38 coefficient, a person facing a 21.1 percent

phase-out rate, all else being equal will reduce her work by 8 hours per week as

Table 1: Effect on Hours Worked

Source

Sum sqs.

dgs. fr.

Mean sqs.

Model

8995

7

1285

Residual

69083

590

117

Total

78078

597

130

Coef.

Std. err.

t

P>|t|

Beta

Variable

Number of obs = 598

F( 7, 590) = 10.98

Prob > F = 0.0000

R-squared = 0.115

Adj R-squared = 0.104

Root MSE = 10.821

age

.08

.04

1.66

0.097

.065

sex

-7.56

.97

-7.78

0.000

-.325

maritalst

.68

.21

3.17

0.002

.134

children

.21

.55

0.38

0.706

.016

-.28

.19

-1.25

0.211

-.049

enroll

-9.44

3.46

-2.73

0.007

-.106

eitcrate

-3.86

.18

-2.12

0.034

-.092

cons

59.63

8.23

7.25

0.000

education

Data provided in link at Appendix.

317

Volume 4, Number 3, September 2007

�Paul Trampe

compared to what they would be doing in the absence of the EITC altogether.

It may seem unfair to estimate the implied effects of the entire program

when most studies have reported only the effects of an expansion of the program.

If the results from studies which show the positive effects on workforce participation from merely expanding the EITC are extrapolated we can see that the

effect of the entire program must be enormous. If, as studies suggest, the 1993

expansion of the EITC reduced the unemployment rate for women with children

by 12 percent, we can only assume that the effect as compared to the absence of

the program altogether would be more than a quarter of that population working

when otherwise it would not.

Policy Implications

This article, then, is not anti-EITC. Although the regression found a statistically significant negative effect from the phase-out of the program, that effect is

dwarfed by the positive effect of the phase-in. It does indicate that families would

be helped, and economic efficiency improved, if the disincentive from the phase

out of the EITC can be reduced without harming those aspects of the program

which encourage work.

Opportunities to do that passed us by when the $500 per child tax credit

was created and expanded to $1000. Because the EITC does not pay additional

benefits for having more than two children, the $500 credit was made refundable only to the point where it cancels out payroll taxes that have not already

been cancelled out by EITC payments, but only for families with three or more

children. The dollar-width of the income range over which families do not have

income tax liability against which to take the new credit but have enough earnings

such that their EITC does not cancel out all of their payroll taxes is about $2500.

Only families with more than three children in that narrow income band benefit

from refundability of the $1000 credit. If, instead, the credit was made part of the

EITC, but the $1000 per child remained a universal refundable credit, the EITC

would only have to be phased down to that amount rather than to zero, enabling

a smaller marginal tax rate in the phase-out income band.

Furthermore, if the personal exemption for children were eliminated, the universal credit could be in the neighborhood of $1600 without reducing revenues to the

government. Then only $1200 of the EITC amount for two children would have to

be phased out and that could be done with perhaps a 5 percent rate without extending the phase out range much beyond the income level it reaches now. Replacing the

current $1000 credit and personal exemption with a universal credit of $1600 would

be a significant tax cut for low income families and a corresponding increase for

those with children in the top brackets, for whom the personal exemption is worth

more than for those in the lower brackets. Politically, this would be controversial.

Econ Journal Watch

318

� Earned Income Tax Credit

Conclusion

The original question was whether or not the positive incentives from the

phase in of the EITC had a greater effect than the disincentives of the phase-out,

given that the phase-in was a higher percentage but the phase-out affected more

people. Previous researchers have focused on the positive effects and treated the

phase-out more as an afterthought. Except for the landmark study by Eissa and

Liebman (1996), researchers have also tended to ignore the fact that only those

actually in the phase-out income range face the disincentive. Using hours worked,

as some have, is bound to bring about mixed results since an expansion encourages those already in the phase-in range to increase hours. The study by Eissa and

Liebman (1996) of the response to the 1986 expansion had not been repeated for

later expansions.

This paper conducted a study similar to Eissa and Liebman (1996), with

some differences, surrounding the major expansion of 1993. The result was a

small but statistically significant negative affect on work by those in the phaseout range. However, in answer to the original question, this effect appears much

smaller than the positive effects on workforce participation found in numerous

other studies. Therefore, on the whole, the EITC seems to encourage work – if

I have doubts about that it would only be because we might be misled by fraudulently reported income in the phase-in range and unreported income in the phaseout range. Assuming the numbers are not terribly misleading, some changes to

the program and integration with other tax advantages for families with children

could make it an even more effective work incentive.

Appendix

The data from the 598 Current Population Survey cases used for Table 1

can be found here. Included is a brief explanation of the scale for variables that

may not be self explanatory. Link.

References

Blumenthal, Marsha, Brian Erard, and Chih-Chin Ho. 2005. Participation and Compliance with the Earned Income Tax Credit. National Tax Journal 58(2): 189-213.

Eissa, Nada, and Hilary Hoynes. 2005. Behavioral Responses To Taxes: Lessons

From the EITC and Labor Supply. NBER Working Paper No. 11729. Cambridge,

MA: National Bureau of Economic Research. Published in 2006 with the same

title in Tax Policy and the Economy, 20: 74-110.

Eissa, Nada, and Jeffrey Liebman. 1996. Labor Supply Response to the Earned

319

Volume 4, Number 3, September 2007

�Paul Trampe

Income Tax Credit. Quarterly Journal of Economics 111(2): 605-637.

Eissa, Nada, and Liebman, Jeffrey. 1995. Labor Supply Response to the Earned

Income Tax Credit. NBER Working Paper No. 5158. Cambridge, MA: National

Bureau of Economic Research.

Green, Christopher. 1968. Taxes and Monetary Incentives to Work: The Static Theory.

The Journal of Human Resources 3(3): 280-288.

Greenstein, Robert. 2005. The Earned Income Tax Credit: Boosting Employment, Aiding the Working Poor. Washington, D.C.: Center on Budget and Policy Priorities

Liebman, Jeffrey. 1998. The Impact of the Earned Income Tax Credit on Incentives

and Income Distribution. In Tax Policy and the Economy, Volume 12, ed. James

Poterba, 97-107. Cambridge: MIT Press.

Meyer, Bruce and Dan Rosenbaum. 2001. Welfare, the Earned Income Tax Credit,

and the Labor Supply of Single Mothers. Quarterly Journal of Economics 116(3):

1063-1114.

Meyer, Bruce. 2002. Labor Supply at the Extensive and Intensive Margins: The EITC,

Welfare, and Hours Worked. American Economic Review 92(2): 373-379.

Rothstein, Jesse. 2007. The Mid-1990s EITC Expansion: Aggregate Labor Supply Effects and Economic Incidence. Working Paper.

Scholz, John Karl. 1996. In-Work Benefits in the United States: The Earned Income

Tax Credit. Economic Journal 106(434): 159-169.

About the Author

Paul Trampe has worked for the federal government

for 19 years, as an economist in the executive branch and

an economic policy advisor in the legislative branch. He

holds an MA in history from George Mason University

and is currently enrolled in the Ph.D. program at George

Mason’s School of Public Policy. His email is ptrampe@

gmu.edu.

Go to Reply by Hilary Hoynes

Go to September 2007 Table of Contents with links to articles

Econ Journal Watch

320

�