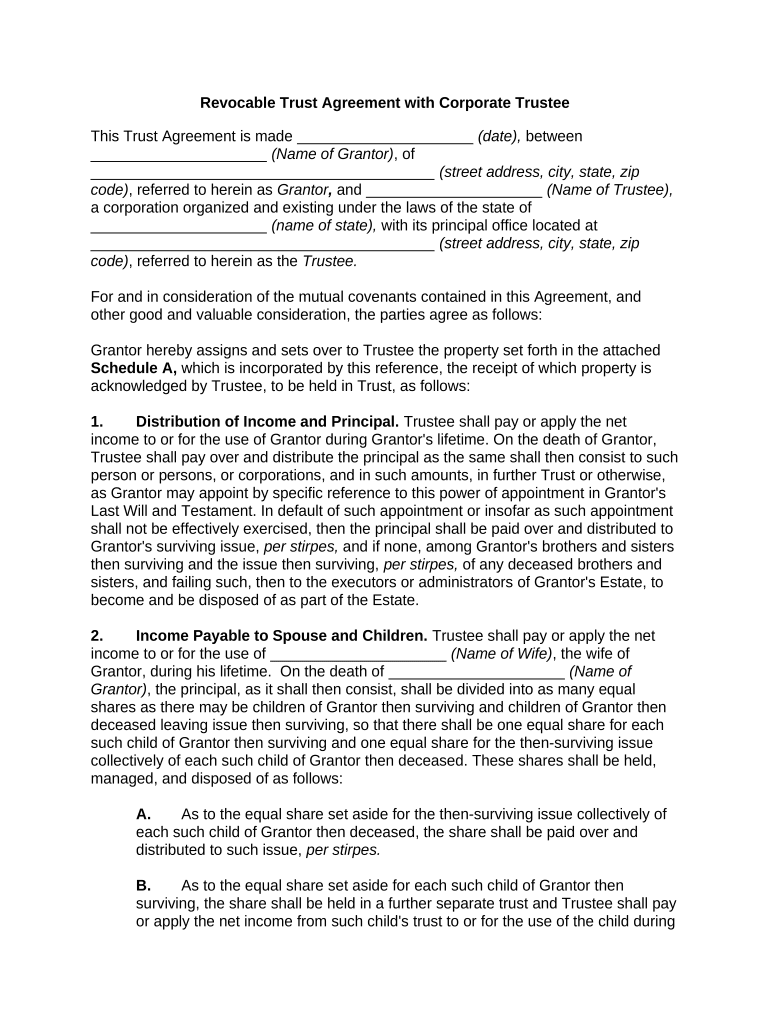

Revocable Trust Agreement with Corporate Trustee

This Trust Agreement is made _____________________ (date), between

_____________________ (Name of Grantor) , of

_________________________________________ (street address, city, state, zip

code) , referred to herein as Grantor , and _____________________ (Name of Trustee) ,

a corporation organized and existing under the laws of the state of

_____________________ (name of state), with its principal office located at

_________________________________________ (street address, city, state, zip

code) , referred to herein as the Trustee.

For and in consideration of the mutual covenants contained in this Agreement, and

other good and valuable consideration, the parties agree as follows:

Grantor hereby assigns and sets over to Trustee the property set forth in the attached

Schedule A, which is incorporated by this reference, the receipt of which property is

acknowledged by Trustee, to be held in Trust, as follows:

1. Distribution of Income and Principal. Trustee shall pay or apply the net

income to or for the use of Grantor during Grantor's lifetime. On the death of Grantor,

Trustee shall pay over and distribute the principal as the same shall then consist to such

person or persons, or corporations, and in such amounts, in further Trust or otherwise,

as Grantor may appoint by specific reference to this power of appointment in Grantor's

Last Will and Testament. In default of such appointment or insofar as such appointment

shall not be effectively exercised, then the principal shall be paid over and distributed to

Grantor's surviving issue, per stirpes, and if none, among Grantor's brothers and sisters

then surviving and the issue then surviving, per stirpes, of any deceased brothers and

sisters, and failing such, then to the executors or administrators of Grantor's Estate, to

become and be disposed of as part of the Estate.

2. Income Payable to Spouse and Children. Trustee shall pay or apply the net

income to or for the use of _____________________ (Name of Wife) , the wife of

Grantor, during his lifetime. On the death of _____________________ (Name of

Grantor) , the principal, as it shall then consist, shall be divided into as many equal

shares as there may be children of Grantor then surviving and children of Grantor then

deceased leaving issue then surviving, so that there shall be one equal share for each

such child of Grantor then surviving and one equal share for the then-surviving issue

collectively of each such child of Grantor then deceased. These shares shall be held,

managed, and disposed of as follows:

A. As to the equal share set aside for the then-surviving issue collectively of

each such child of Grantor then deceased, the share shall be paid over and

distributed to such issue, per stirpes.

B. As to the equal share set aside for each such child of Grantor then

surviving, the share shall be held in a further separate trust and Trustee shall pay

or apply the net income from such child's trust to or for the use of the child during

the child's life or until the earlier termination of the trust as provided below. When

the child attains the age of _____________________ (number) years, or if the

child shall have attained that age at the time of the division provided for above,

Trustee shall pay over and distribute to the child absolutely the principal of his or

her trust. If the child shall die prior to becoming entitled to receive the principal of

his or her separate trust, then on the child's death Trustee shall pay over and

distribute the principal of the trust, as the same shall then consist, to such person

or persons, or corporations, and in such amounts, as the child may appoint by

specific reference to this power of appointment in his or her Last Will and

Testament (excluding, however, the child's estate, the child's creditors or the

creditors of the child's estate), and in default of such appointment, or in so far as

the appointment shall not be effectively exercised, then, per stirpes, to his or her

issue then surviving, and failing any such issue, then, per stirpes, to Grantor's

issue then surviving; provided, however, that if in default of appointment any

portion of the principal shall be payable to a child of Grantor for whom a share is

then held in trust under this instrument, such portion shall, instead of being paid

outright to the child, be added to the Trust created by this instrument for the

child's benefit and be held and disposed of as part of that Trust.

C. Anything in this Agreement to the contrary notwithstanding, the trust as to

any share set aside for a child of Grantor who shall not have been in being at the

creation of this Trust shall terminate in any event on the death of the youngest

child of Grantor living at the date of this Agreement who shall survive (Name of

Spouse) . In that event, Trustee shall pay over and distribute the principal of the

Trust to such after-born child, absolutely.

3. Simultaneous Death. If the income beneficiary and any remainderman of any

Trust created by this Agreement shall die in a common accident under such

circumstances that it is difficult or impossible to determine who predeceased the other,

then the terms and conditions of this Agreement shall be construed as though the

income beneficiary had survived any such remainderman and the Trust created by this

Agreement shall be administered and distributed in all respects accordingly.

4. Discretion of Trustee to Invade Principal. Trustee is authorized at any time or

from time to time to pay to or apply to the use of the person then entitled to the income

of any Trust under this Agreement, out of the principal of the Trust, such sum or as

Trustee may deem appropriate (without any duty to take into consideration the person's

other resources or other income) for that person's maintenance, education, and welfare,

or for any other purpose in the discretion of Trustee. Trustee shall be the sole judge of

whether the occasion exists for the withdrawal of principal under this Agreement,

whether principal shall be withdrawn, and the amount of principal and its use.

5. Children and Issue. The words child, children and issue wherever used in this

Agreement shall include for all purposes not only the child, children, and issue of the

person or persons designated, but also the legally adopted child and children of such

designated person or persons and of such issue, and also all the legally adopted

children and issue of the legally adopted children.

6. Minor Beneficiaries. If any person becoming entitled to any property under this

Agreement shall be under the age of 18 years, the same shall vest in the person, but in

the discretion of Trustee the payment may be deferred in whole or in part until the

person attains such age, Trustee meanwhile holding and retaining the property for the

benefit of that person, and applying so much of the property and any income from it as

Trustee, in Trustee's discretion, may determine for that person's benefit or other use.

The retention of any property for any person pursuant to the foregoing shall not be

considered as a continuation of any prior trust and Trustee shall be entitled to receive

for its services to any such person pursuant to this power separate compensation at the

rates and in the manner allowed to a sole guardian of the property of a minor under the

laws of _____________________ (name of state) .

7. Payment to or for Minor or Incompetent. In making payment of property,

whether principal or income, to a person under the age of 18 years or to an

incompetent, or in applying property, whether principal or income, to the use of any

such person under any provision of this Agreement, Trustee may make the payment or

application by payment to such person directly or to a natural or foster parent, or to the

person with whom such person shall reside, or to the guardian, committee, or other

legal representative, wherever appointed, of such person. The payment to any of the

foregoing shall be a full discharge of Trustee and binding in all respects on such person.

8. Powers of Trustee. In addition to any powers given to it by law or otherwise,

Trustee is authorized and empowered with respect to any property at any time held

under any provision of this Agreement, including accumulated income, if any, and any

property held pursuant to any power in Trust, and until the actual distribution of the

property:

A. To sell on such terms and conditions as it in its sole discretion may

determine.

B. To retain property of any kind received by it without regard to

diversification and without being limited to the investments authorized by law for

the investment of Trust funds.

C. To invest and reinvest in and to acquire by exchange or otherwise

property of any character including stocks of any classification, obligations, or

other property, real or personal, whether or not of the same kind, and

participations in any common trust fund administered by

_____________________ (Name of Trustee) , without regard to diversification

and without being limited to the investments authorized by law for the investment

of Trust funds.

D. To join in, consent to, or become a party to any reorganization, merger,

consolidation, dissolution, readjustment, exchange, or other transaction and any

plan or action under or in connection with the same; to deposit any such property

with any protective, reorganizational, or similar committee; to delegate

discretionary powers to the committee and to share in the payment of its

expenses and compensation and to pay any assessments levied with respect to

the property and to receive property under any reorganization, merger,

consolidation, dissolution, readjustment, exchange or other transaction whether

or not the same is authorized by law for the investment of Trust funds.

E. To make and retain joint investments and investments of undivided

interests in any property, real or personal, whether or not all the property is held

under this Agreement and whether or not the provisions under which such other

property is held are similar.

F. To exercise all conversion, subscription, voting, and other rights of

whatsoever nature pertaining to any such property and to grant proxies,

discretionary or otherwise, with respect to those rights.

G. With respect to any real property (including real property acquired on

foreclosure or by deed in lieu of foreclosure) at any time held under this

Agreement, to sell, exchange, partition, lease, sublease, mortgage, improve, or

otherwise alter on such terms as it may deem proper, and to execute and deliver

deeds, leases, mortgages, or other instruments relating to the real property. Any

lease may be made for such period of time, including a lease beyond a (number)

period, as it may deem proper and without the approval of any court.

H. To borrow money to provide funds for any purpose without resorting to the

sale of any assets; and for the purpose of securing the repayment of the

borrowed money, to pledge, mortgage, or otherwise encumber any and all such

property on such terms, covenants, and conditions as it may deem proper and

also to extend the time of payment of any loans or encumbrances which at any

time may be encumbrances on any such property irrespective of by whom the

same were made or where the obligations may or should ultimately be borne on

such terms, covenants, and conditions as it may deem proper.

I. To extend the time of payment of any bond (or other obligation) and

mortgage held by it, or of any installment of principal or interest or hold such

bond (or other obligation) and mortgage after maturity as past due; to consent to

the alteration or modification of any terms of the same, waive defaults in the

performance of the terms of the same; to foreclose any such mortgage or

compromise or settle claims under the mortgage; to take over, take title to, or

manage the property, or any part of it, affected by any such mortgage, either

temporarily or permanently, and in partial or complete satisfaction of any claim

under the mortgage; to protect the property against or redeem it from foreclosure

or nonpayment of taxes, assessments, or other liens; to insure, protect, maintain,

and repair the property; and generally without limitation by the foregoing

specification to exercise with respect to such bond (or other obligation) and

mortgage on such property all rights and powers as may be exercised by a

person owning similar property in his or her own right.

J. Without limitation by the specification of the following, to exercise any and

all the powers, authorities, and discretions provided in this Agreement in respect

of any shares of stock of _____________________ (Name of Trustee) and any

successor corporation whether by merger, consolidation, reorganization, sale, or

otherwise.

K. To distribute in cash or in kind or partly in cash and partly in kind.

L. To register any property belonging to any trust created by this Agreement

in the name of its nominee, or to hold the same unregistered, or in such form that

title shall pass by delivery.

9. Principal and Income. All dividends or distributions in stock or other securities

shall, to the extent legally permissible, be added to principal. All cash dividends of

whatever kind, except liquidating dividends, shall be treated as income. Trustee is

authorized and empowered to determine, except as may be prohibited by law, whether

any other receipts which may be payable to it shall be treated as and allocable to

principal or income, or partly to principal and partly to income. Any determination made

by Trustee shall be binding and conclusive on all persons interested in the Trust created

under this Agreement.

10. Direction of Grantor . During the life of Grantor, the powers set forth in Section

8 above shall be exercised by Trustee only in accordance with the written directions of

Grantor. Trustee shall not be liable or responsible in any way for any loss or

depreciation incurred by sales, exchanges, investments, reinvestments, or other action

taken in accordance with such written directions or because it shall fail to take any

action in the absence of the directions of Grantor.

11. Premiums or Discounts on Securities. Premiums or discounts on any

securities purchased or otherwise received under this Agreement shall not be

amortized.

12. Accrued Income. Notwithstanding anything set forth above concerning the

allocation of dividends by Trustee, Trustee shall treat as income all rents, interest, and

income accrued, and dividends declared, but unpaid prior to the within or any

subsequent transfer or delivery of securities or other property by Grantor to Trustee,

except that dividends which have been declared on any stocks so transferred or

delivered to Trustee and which are payable to stockholders of record as of a date prior

to the transfer or delivery to Trustee shall belong to Grantor.

13. Additions to Trust. Grantor shall have the right, with the consent of Trustee, to

deliver additional property to Trustee which then shall become a part of the Trust,

subject in every respect to the terms and conditions of this Agreement.

14. Revocation or Amendment. Grantor reserves and retains the right at any time

and from time to time by a notice in writing signed by Grantor and acknowledged

(unless Trustee, in its discretion, shall waive the acknowledgment) and filed with

Trustee:

A. To withdraw any or all of the property held under this Agreement or to

revoke the Trust created by this Agreement in whole or in part, subject to the

payment of Trustee's compensation and the expenses of the Trust.

B. To alter, amend, and modify this Agreement in any and every respect;

provided, however, that the rights, duties, and responsibilities of Trustee under

this Agreement shall not be changed without its written consent.

15. Power of Delegation.

A. Grantor reserves the right at any time and from time to time by revocable

power of attorney in writing filed with Trustee to delegate to any person or

persons, including Trustee, the power retained by Grantor to direct or consent to

sales, investments, and reinvestments, or to the exercise of any of the powers

granted to Trustee under this Agreement which are subject to the direction or

consent of Grantor and whether any such delegation relates to a discretionary or

ministerial power. The revocation of any such delegation of power shall be in

writing and filed with Trustee.

B. Any individual trustee acting under this Agreement is authorized at any

time and from time to time by a revocable power of attorney in writing filed with

the corporate trustee to delegate to any one or more of his or her co-trustees any

duty or power conferred on Trustee under this Agreement, and whether any such

delegation relates to a discretionary or ministerial power. The revocation of any

such delegation shall be in writing and delivered to the Corporate Trustee.

16. Trustee Decisions. In all matters pertaining to the administration of any Trust

under this Agreement, Grantor directs that the decision of the Trustee shall be final and

binding on the Trustee then acting.

17. Powers of Successor of Trustees. Any successor Trustee at any time acting

under this Agreement shall have the same powers, authorities, and discretions as

though named originally in this Agreement.

18. Electronic Communication. In any case in which Trustee is authorized or

required to take any action with the consent or on the direction or authority (whether or

not otherwise required to be in writing) of Grantor or any other person, the Trustee is

authorized to act on any fax, e-mail, telegraphic, cable, or radio communication,

purporting to or which in the judgment of Trustee purports to come from such person,

without any duty to inquire into the authenticity or genuineness of the communication.

19. Compensation of Trustee. Trustee shall be entitled to deduct and retain without

court approval the compensation allowed a sole trustee by law from time to time. If any

person shall, pursuant to the provisions of this Agreement, be entitled to exercise a

power of appointment with respect to any Trust created by this Agreement and shall

exercise the power of appointment by appointing the property subject to it in further trust

with a Trustee or Trustees of which _____________________ (Name of Trustee) shall

not be one, then _____________________ (Name of Trustee) shall be entitled to the

same compensation it would have received if the Trust had then terminated and been

finally distributed.

20. Preparation of Reports and Returns. Trustee shall be entitled to make a

reasonable charge for the preparation of any report or return which may be required of it

by any governmental authority, federal, state, or otherwise, excluding annual fiduciary

income-tax returns, and such charge may be made to the principal of the Trust or to the

income of it or partly to principal and partly to income in the discretion of Trustee.

21. Agents and Advisors. Trustee may consult with legal counsel (who may be of

counsel to Grantor) concerning any question which may arise with reference to its

duties under this Agreement. The opinion of such counsel shall be a full and complete

authorization and protection in respect of any action taken or suffered by Trustee under

this Agreement in good faith and in accordance with the opinion of such counsel.

Trustee may employ such accountants and other agents as it shall deem advisable and

may rely on information or advice furnished by them, and charge compensation of such

accountants and other agents, as well as any other expenses and charges, against

either principal or income or in part against both as Trustee shall determine.

22. Accounting. Trustee may at any time and from time to time render an account of

its transactions with respect to any Trust created under this Agreement to Grantor.

Grantor shall have full power to settle finally any such account or to waive the same,

and, on the basis of such account or waiver, to release Trustee, individually and as

Trustee, from all liability, responsibility, or accountability for its acts or omissions as

Trustee. Any such settlement and release or waiver and release shall be binding on all

persons interested in either the income or the principal of the Trust and shall have the

force and effect of a final decree, judgment, or order of a court of competent jurisdiction

rendered in an appropriate action or proceeding for the judicial settlement of such an

account in which jurisdiction was obtained of all necessary and proper parties. The

foregoing provision, however, shall not preclude Trustee from having its accounts

judicially settled if it shall so desire.

23. Tax Clause. Following the death of Grantor and on the written request of the

legal representative of Grantor's Estate [including _____________________ (Name of

Trustee) should it be such legal representative] prior to the distribution of the Trust

property, Trustee shall pay to the legal representative such sum or sums from principal

as shall be certified by the legal representative to be the equitable proportion

chargeable to the Trust or Trusts created under this Agreement, of any and all Estate,

transfer, inheritance, or other similar death taxes (including interest and penalties, if

any) due as a result of the death of Grantor. Trustee shall have no duty to determine the

propriety of the payment of any sum or sums so certified to it, or to see to the

application of the same by the legal representative, or to withhold any distribution in

anticipation of any such request.

24. Funeral Expenses. On the death of Grantor, Trustee is authorized and

empowered to pay from the principal of the Trust prior to its disposition the expenses of

Grantor's last illness, including funeral and burial expenses, unless Trustee shall

determine in its absolute discretion that other provisions have been made or other

means are available for the payment of those expenses.

25. Merger by Trustee. Any corporation into which Trustee may be merged or with

which it may be consolidated, or any corporation resulting from any merger,

reorganization, or consolidation to which Trustee may be a party, or any corporation to

which all or substantially all the Trust business of Trustee may be transferred shall be

the successor of Trustee under this Agreement, without the execution or filing of any

instrument or the performance of any further act.

26. Resignation of Trustee. Trustee shall have the right at any time to resign.

Without limitation as to any other methods Trustee may resign by giving a written notice

of its resignation to Grantor, if living, and if Grantor is deceased, to the then-income

beneficiary of the Trust. In the event of such resignation, the person to whom notice

shall have been given shall have the power by an instrument in writing to appoint any

person or bank or Trust company, wherever located, as successor Trustee who, on

accepting the appointment by an instrument in writing, shall have the same powers,

authorities, and discretions as though originally designated under this Agreement. No

bond or other security shall be required of any such successor Trustee in any

jurisdiction.

27. Acceptance of Trust by Trustee. Trustee, by joining in the execution of this

Agreement, signifies its acceptance of this Trust, which shall be construed and

regulated in all respects in accordance with the laws of (Name of State) .

WITNESS our signatures as of the day and date first above stated.

_____________________

(Name of Trustee)

________________________ By:_______________________________

(P rinted Name of Grantor) (P rinted Name & Office)

_____________________ _____________________

(Signature of Grantor ) (Signature of Officer)

Acknowledgements

Attach Schedule A