Fill and Sign the Uniform Sales Use Tax Certificate Form Mtc

Useful Advice for Completing Your ‘Uniform Sales Use Tax Certificate Form Mtc’ Online

Are you fed up with the inconvenience of dealing with paperwork? Discover airSlate SignNow, the premier eSignature platform for individuals and organizations alike. Bid farewell to the tedious process of printing and scanning documents. With airSlate SignNow, you can effortlessly fill out and sign documents online. Take advantage of the extensive features incorporated into this easy-to-use and economical platform and transform your approach to document management. Whether you need to sign forms or gather eSignatures, airSlate SignNow manages everything seamlessly, requiring just a few clicks.

Follow these detailed instructions:

- Log into your account or initiate a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘Uniform Sales Use Tax Certificate Form Mtc’ in the editor.

- Click Me (Fill Out Now) to prepare the document on your end.

- Add and designate fillable fields for others (if necessary).

- Proceed with the Send Invite settings to request eSignatures from others.

- Save, print your copy, or convert it into a multi-usable template.

No need to worry if you have to collaborate with your colleagues on your Uniform Sales Use Tax Certificate Form Mtc or send it for notarization—our solution is equipped with everything necessary to complete such tasks. Sign up with airSlate SignNow today and elevate your document management to the next level!

FAQs

-

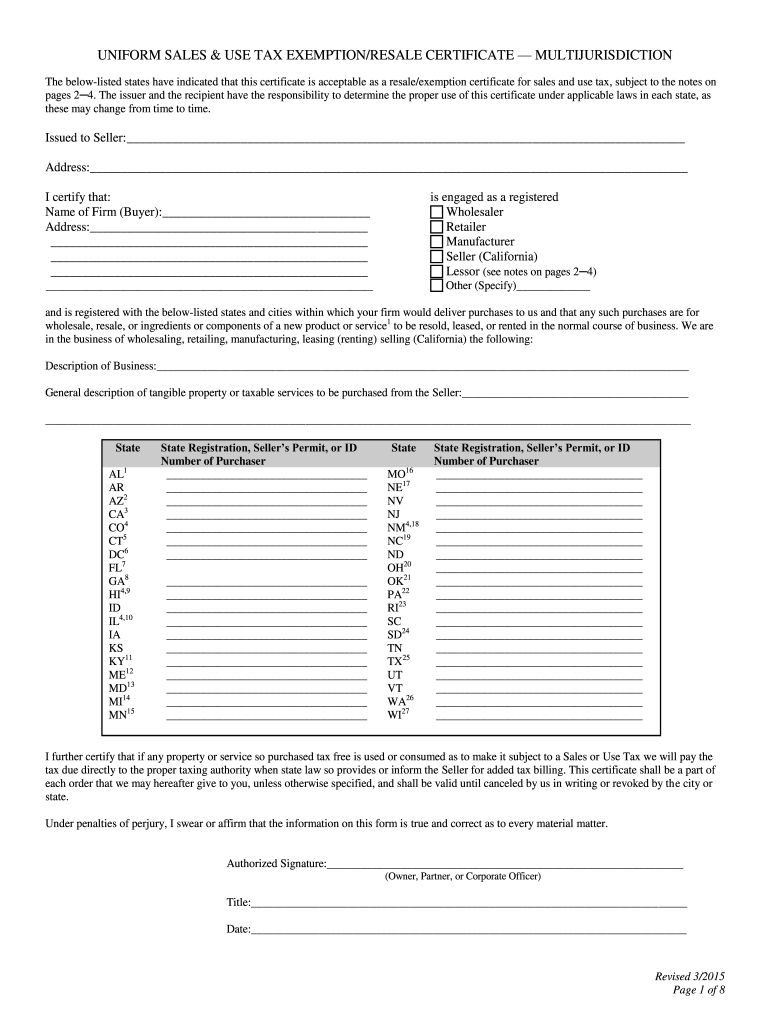

What is the Uniform Sales Use Tax Certificate Multijurisdiction Form Fillable?

The Uniform Sales Use Tax Certificate Multijurisdiction Form Fillable is a standardized document designed to simplify the process of claiming sales tax exemptions across multiple jurisdictions. By using this fillable form, businesses can efficiently manage their tax obligations and ensure compliance with various state regulations.

-

How can I access the Uniform Sales Use Tax Certificate Multijurisdiction Form Fillable?

You can easily access the Uniform Sales Use Tax Certificate Multijurisdiction Form Fillable through the airSlate SignNow platform. Simply sign up for an account, navigate to the forms section, and locate the fillable certificate to start using it for your tax exemption needs.

-

Is the Uniform Sales Use Tax Certificate Multijurisdiction Form Fillable customizable?

Yes, the Uniform Sales Use Tax Certificate Multijurisdiction Form Fillable is fully customizable to meet your specific business requirements. You can add your company details, adjust sections as needed, and save your changes for future use, making the process efficient and tailored to your needs.

-

What are the benefits of using the Uniform Sales Use Tax Certificate Multijurisdiction Form Fillable?

Using the Uniform Sales Use Tax Certificate Multijurisdiction Form Fillable offers several benefits, including saving time on paperwork, ensuring compliance with various jurisdictions, and reducing the risk of errors. This form streamlines the tax exemption process, allowing businesses to focus on their core operations.

-

Are there any fees associated with the Uniform Sales Use Tax Certificate Multijurisdiction Form Fillable?

The Uniform Sales Use Tax Certificate Multijurisdiction Form Fillable is included in the airSlate SignNow subscription plans, which are competitively priced. We offer various pricing tiers to accommodate different business sizes and needs, ensuring you receive great value for your investment.

-

Can I integrate the Uniform Sales Use Tax Certificate Multijurisdiction Form Fillable with other software?

Absolutely! The airSlate SignNow platform allows seamless integration with various applications and software tools, enabling you to incorporate the Uniform Sales Use Tax Certificate Multijurisdiction Form Fillable into your existing workflows. This integration enhances efficiency and keeps your tax management streamlined.

-

How can I ensure my data is secure when using the Uniform Sales Use Tax Certificate Multijurisdiction Form Fillable?

At airSlate SignNow, we prioritize data security with advanced encryption and compliance with industry standards. When using the Uniform Sales Use Tax Certificate Multijurisdiction Form Fillable, you can trust that your sensitive information is protected against unauthorized access.

Find out other uniform sales use tax certificate form mtc

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles