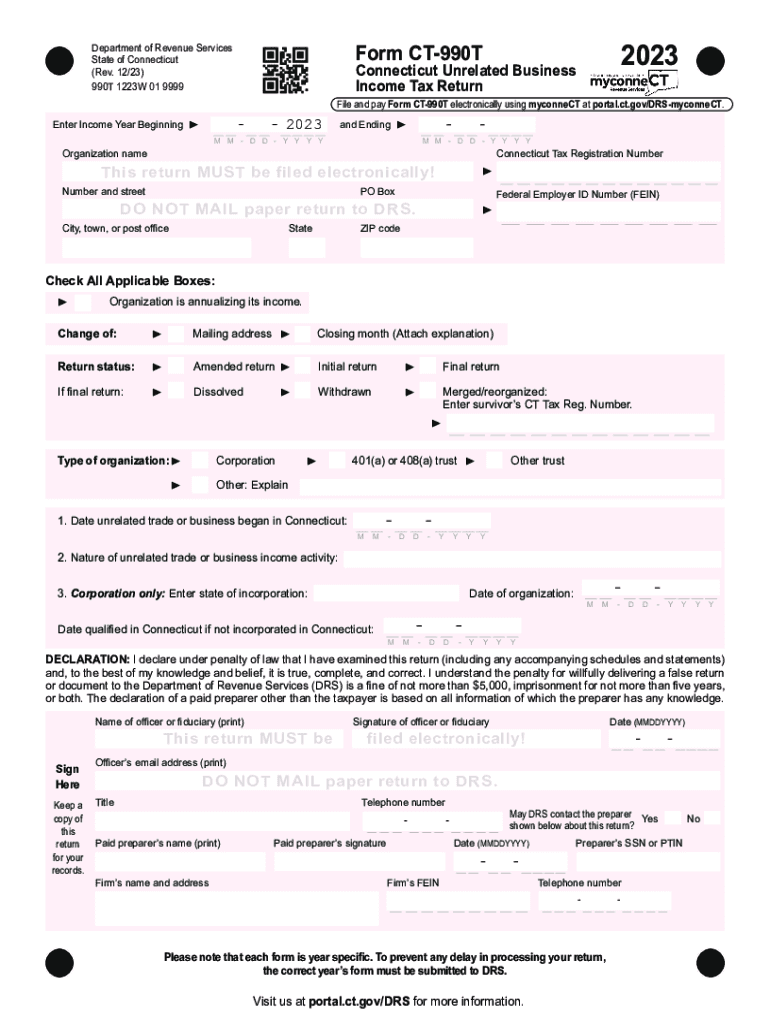

Fill and Sign the Unrelated Business Income Tax Information

Valuable tips for preparing your ‘Unrelated Business Income Tax Information’ online

Are you fed up with the inconvenience of dealing with paperwork? Look no further than airSlate SignNow, the premier eSignature solution for individuals and organizations. Wave goodbye to the lengthy process of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign documents online. Take advantage of the comprehensive features embedded in this user-friendly and economical platform and transform your approach to document management. Whether you need to approve forms or gather signatures, airSlate SignNow manages it all efficiently, with just a few clicks.

Follow this thorough guide:

- Access your account or sign up for a complimentary trial with our service.

- Select +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘Unrelated Business Income Tax Information’ in the editor.

- Click Me (Fill Out Now) to finish the document on your end.

- Add and assign fillable fields for others (if necessary).

- Proceed with the Send Invite settings to request eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

Don’t fret if you need to collaborate with your colleagues on your Unrelated Business Income Tax Information or submit it for notarization—our platform has everything you require to accomplish these tasks. Sign up with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

What is Unrelated Business Income Tax Information and why is it important?

Unrelated Business Income Tax Information refers to the tax implications that organizations must consider when generating income from activities not substantially related to their exempt purposes. Understanding this information is crucial to ensure compliance and avoid penalties. Organizations should stay informed about these tax rules to manage their finances effectively.

-

How can airSlate SignNow help with managing Unrelated Business Income Tax Information?

airSlate SignNow provides an efficient way to manage documents related to Unrelated Business Income Tax Information. With its user-friendly interface, you can easily send, eSign, and store necessary tax documents securely. This streamlines your workflow, ensuring that all important information is accessible when needed.

-

What features does airSlate SignNow offer for handling tax documents?

airSlate SignNow offers features such as customizable templates, secure eSignatures, and real-time document tracking, which are essential for managing Unrelated Business Income Tax Information. These features enhance efficiency and ensure that all tax-related documents are processed accurately and swiftly.

-

Is airSlate SignNow cost-effective for managing Unrelated Business Income Tax Information?

Yes, airSlate SignNow is a cost-effective solution for managing Unrelated Business Income Tax Information. With various pricing plans tailored to different organizational needs, you can choose an option that fits your budget while still gaining access to powerful document management tools.

-

Can I integrate airSlate SignNow with other tools for Unrelated Business Income Tax Information management?

Absolutely! airSlate SignNow offers seamless integrations with various applications such as CRM systems, accounting software, and cloud storage services. These integrations enhance your ability to manage Unrelated Business Income Tax Information efficiently by centralizing all your data in one place.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for managing Unrelated Business Income Tax Information provides several benefits, including improved efficiency, reduced paperwork, and enhanced security. By digitizing your document processes, you can ensure that all tax-related information is organized and easily accessible, helping you stay compliant with tax regulations.

-

How secure is airSlate SignNow when handling sensitive tax information?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive Unrelated Business Income Tax Information. The platform uses advanced encryption methods and complies with industry standards to protect your documents, ensuring that your data remains confidential and secure.

Find out other unrelated business income tax information

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles