Form B26, Instructions (12/1/08)

Instructions for Periodic Report Concerning Related Entities

General Instructions

1.

This form periodic report (“Periodic Report”) on value, profitability, and operations of

entities in which the estate holds a substantial or controlling interest (the “Form”)

implements § 419 of the Bankruptcy Abuse Prevention and Consumer Protection Act of

2005, Pub. L. No. 19-8, 119 Stat. 23 (April 20, 2005)(“BAPCPA”). This Form should be

used when required by Fed. R. Bankr. P. 2015.3, with such variations as may be

approved by the court pursuant to subdivisions (d) and (e) of that rule.

2.

In a chapter 11 case, the trustee or debtor in possession shall file Periodic Reports of the

value, operations, and profitability of each entity that is not also a debtor in a case under

title 11, and in which the estate holds a substantial or controlling interest. The reports

shall be prepared as prescribed by this Form, and shall be based upon the most recent

information reasonably available to the trustee or debtor in possession.

3.

Rule 2015.3 provides that, where the estate controls or owns at least a 20 percent interest

of an entity, the estate’s interest is presumed to be substantial or controlling. Where the

estate controls or owns less than a 20 percent interest, the rule presumes that the estate’s

interest is not substantial or controlling. The question of substantial or controlling

interest is, however, a factual one to be decided in each case.

4.

The first Periodic Report required by subdivision (a) of Rule 2015.3 shall be filed no later

than five days before the first date set for the meeting of creditors under § 341 of the

Code. Subsequent Periodic Reports shall be filed no less frequently than every six

months thereafter, until a plan of reorganization becomes effective or the case is closed,

dismissed, or converted. Copies of the Periodic Report shall be served on the U.S.

Trustee, any committee appointed under § 1102 of the Code, and any other party in

interest that has filed a request therefor.

5.

The source of the information contained in each Periodic Report shall be indicated.

Specific Instructions

6.

Each entity subject to the reporting requirement of Rule 2015.3 shall be listed in the table

contained on the first page of the form. Reports for each such entity shall be placed

behind separate tabs, and each such report shall consist of three exhibits. Exhibit A shall

provide valuation information; Exhibit B shall provide financial statements; and Exhibit

C shall provide a description of operations.

�Form 26 Instr. (12/08) – Cont.

2

Instructions for Exhibit A – Valuation

7.

Provide a statement of the entity’s value and the value of the estate’s interest in the entity,

including a description of the basis for the valuation, the date of the valuation, the

valuation method used and the source or preparer of the information. This valuation must

be no more than two years old.

Instructions for Exhibit B – Financial Statements and Profitability

8.

The financial statements may be unaudited. The financial statements should be prepared

in accordance with generally accepted accounting principles in the United States

(“USGAAP”); deviations, if any from USGAAP, shall be disclosed. Indicate the source

or preparer of the information.

9.

Exhibit B shall include the following financial statements, and shall indicate the source of

the information presented:

(a) A balance sheet dated as of the end of the most recent six-month period of the current

fiscal year and as of the end of the preceding fiscal year.

(b) A statement of income (loss) for the following periods:

(i) For the initial report:

a. the period between the end of the preceding fiscal year and the end of

the most recent six-month period of the current fiscal year; and

b. the prior fiscal year.

(ii) For subsequent reports, since the closing date of the last report.

(c) A statement of changes in cash flows for the following periods:

(i) For the initial report:

a. the period between the end of the preceding fiscal year and the end of

the most recent six-month period of the current fiscal year; and

b. the prior fiscal year.

(ii) For subsequent reports, since the closing date of the last report.

(d) A statement of changes in shareholders’/partners’ equity (deficit) for the following

periods:

(i) For the initial report:

a. the period between the end of the preceding fiscal year and the end of

the most recent six-month period of the current fiscal year; and

b. the prior fiscal year.

(ii) For subsequent reports, since the closing date of the last report.

10. The balance sheet contained in Exhibit B-1 may include only major captions with the

exception of inventories. Data as to raw materials, work in process, and finished goods

inventories should be included either on the face of the balance sheet or in the notes to

�Form 26 Instr. (12/08) – Cont.

3

the financial statements, if applicable. Where any major balance sheet caption is less than

10% of total assets, the caption may be combined with others. An illustrative example of

such a balance sheet is set forth below:

XYZ Company

Balance Sheet

As of__________

Assets

Year to date

Prior Fiscal Year

Cash and cash items

Marketable securities

Accounts and notes receivable

(non-affiliates), net of allowances

Accounts due from affiliates

Inventories

Raw materials

Work in Process

Finished goods

Long-term contract costs

Supplies

LIFO reserve

Total inventories

_____________

_____________

Prepaid expenses

Other current assets

Total current assets

_____________

_____________

_____________

Securities of affiliates

Indebtedness of affiliates (non-current)

Other investments

Property, plant and equipment, net of

accumulated depreciation and amortization

Intangible assets

Other assets

_____________

_____________

_____________

_____________

_____________

_____________

_____________

_____________

_____________

_____________

_____________

_____________

_____________

_____________

_____________

Total Assets

Liabilities and Shareholders’/Partners’ Equity

Accounts and notes payable (non-affiliates)

Payables to affiliates

Other current liabilities

Total current liabilities

_____________

Year to date

Prior Fiscal Year

______________

______________

______________

______________

�Form 26 Instr. (12/08) – Cont.

4

Bonds, mortgages, and other long-term debt,

including capitalized leases

Indebtedness to affiliates (non-current)

Other liabilities

Commitments and contingencies

Deferred credits

Minority interests in consolidated subsidiaries

Preferred stock subject to mandatory redemption

or whose redemption is outside the control

of the issuer

Total liabilities

Shareholders' equity

Total liabilities and shareholders’/partners’ equity

11.

_____________

_____________

_____________

_____________

_____________

_____________

_____________

_____________

_____________

_____________

The statement of income (loss) contained in Exhibit B-2 should also include major

captions. When any major statement of income (loss) caption is less than 15% of net

income (loss) for the most recent fiscal year, the caption may be combined with others.

Notwithstanding these tests, de minimis amounts need not be shown separately. An

illustrative example of such a statement of income (loss) is set forth below:

XYZ Company

Statement of income (loss)

For the periods ending__________

Year to date

Prior Fiscal Year

Net sales and gross revenues

Costs and expenses applicable to sales and revenues

Gross profit

_____________

_____________

_____________

Selling, general, and administrative expenses

Provision for doubtful accounts

Other general expenses

Operating income (loss)

_____________

_____________

_____________

_____________

Non-operating income (loss)

Interest and amortization of debt discount

Non-operating expenses

_____________

_____________

_____________

Income or loss before income tax expense

_____________

Income tax expense

Minority interest in income of

consolidated subsidiaries

Equity in earnings of unconsolidated subsidiaries

_____________

_____________

�Form 26 Instr. (12/08) – Cont.

5

and 50 per cent or less owned persons

Income or loss from continuing operations

_____________

_____________

Discontinued operations

Income or loss before extraordinary items and

cumulative effects of changes in

accounting principles

Extraordinary items, net of tax

Cumulative effects of changes in

accounting principles

Net income (loss)

Earnings per share data

_____________

12.

_____________

_____________

_____________

_____________

_____________

The statement of cash flows in Exhibit B-3 may be abbreviated, starting with a single

figure of funds provided by operations and showing other changes individually only

when they exceed 10% of the average of funds provided by operations for the most recent

fiscal year. Notwithstanding this test, de minimis amounts need not be shown separately.

An illustrative example of such a statement of cash flows is set forth below:

XYZ Company

Statement of cash flows

For the periods ending__________

Year to date

Net cash provided (used) by operating activities

Cash flows from investing activities

Capital expenditures

Sale of ___________

Other (describe)

Net cash provided (used) in investing

activities

Cash flows provided (used) by financing activities

Net borrowings under line-of-credit

Principal payments under capital leases

Proceeds from issuance of long-term debt

Proceeds from sale of stock

Dividends paid/Partner Distributions

Net cash provided (used)

in financing activities

Net increase (decrease) in cash and cash equivalents

Cash and cash equivalents

Prior Fiscal Year

_____________

_____________

_____________

_____________

_____________

_____________

_____________

_____________

_____________

_____________

_____________

_____________

�Form 26 Instr. (12/08) – Cont.

6

Beginning of period

End of period

_____________

_____________

13.

Subject to paragraph 11 above, an illustrative example of such a statement of changes in

shareholders’/partners’ equity in Exhibit B-4 is set forth below:

XYZ Company

Statement of changes in shareholders’/partners’ equity (deficit)

For the periods ending

Year to date

Balance, beginning of period

Comprehensive net income

Net income

Other comprehensive

income, net of tax

Unrealized gains (losses) on

securities

Foreign translation adjustments

Minimum pension liability

adjustment

Issuance of stock

Prior Fiscal Year

_____________

_____________

___________

_____________

___________

_____________

_____________

_____________

_____________

Dividends paid

_____________

Balance, end of period

_____________

14.

The financial information in the financial statements shall include disclosures either on

the face of the statements or in accompanying footnotes sufficient to make the

information not misleading. Disclosures should encompass, but not be limited to, for

example, accounting principles and practices; estimates inherent in the preparation of

financial statements; status of long-term contracts; capitalization including significant

borrowings or modification of existing financing arrangements; and the reporting entity

resulting from business combinations or dispositions. Where material contingencies exist,

disclosure of such matters shall be provided.

15.

If appropriate, the statement of income (loss) should show earnings (loss) per share and

dividends declared per share applicable to common stock. The basis of the earnings per

share computation should be stated together with the number of shares used in the

computation.

�Form 26 Instr. (12/08) – Cont.

16.

7

In addition to the financial statements required above, entities in the development stage

should provide the cumulative financial statements (condensed to the same degree as

allowed above) and disclosures required by Statement of Financial Accounting Standards

No. 7, “Accounting and Reporting by Development Stage Enterprises,” to the date of the

latest balance sheet presented.

Instructions for Exhibit C – Description of Operations

17.

The description of operations contained in Exhibit C of this Form should describe the

nature and extent of the estate’s interest in the entity, as well as the business conducted

by and intended to be conducted by the entity, focusing on the entity’s dominant business

segment(s) including, but not limited to the following as applicable:

· Principal product produced or services rendered and methods of distribution

· Description of the status of a new product or segment if a public announcement has

been made or information publicly disseminated

· Sources and availability of raw materials

· Any significant patents, trademarks, licenses, franchises, and concessions held

· Seasonality of the business

· Dependence upon a single customer or a few customers

· Dollar amount of backlog orders believed to be firm

· Exposure to renegotiation or redetermination or termination of significant contracts

· Competitive conditions facing the entity

. Description of properties owned

. Significant legal proceedings

. Material purchase commitments

. Identified trends events or uncertainties that are likely to have a material impact on the

entity’s short-term liquidity, net sales, or income from continuing operations

18.

The source preparer of the information should be indicated.

�

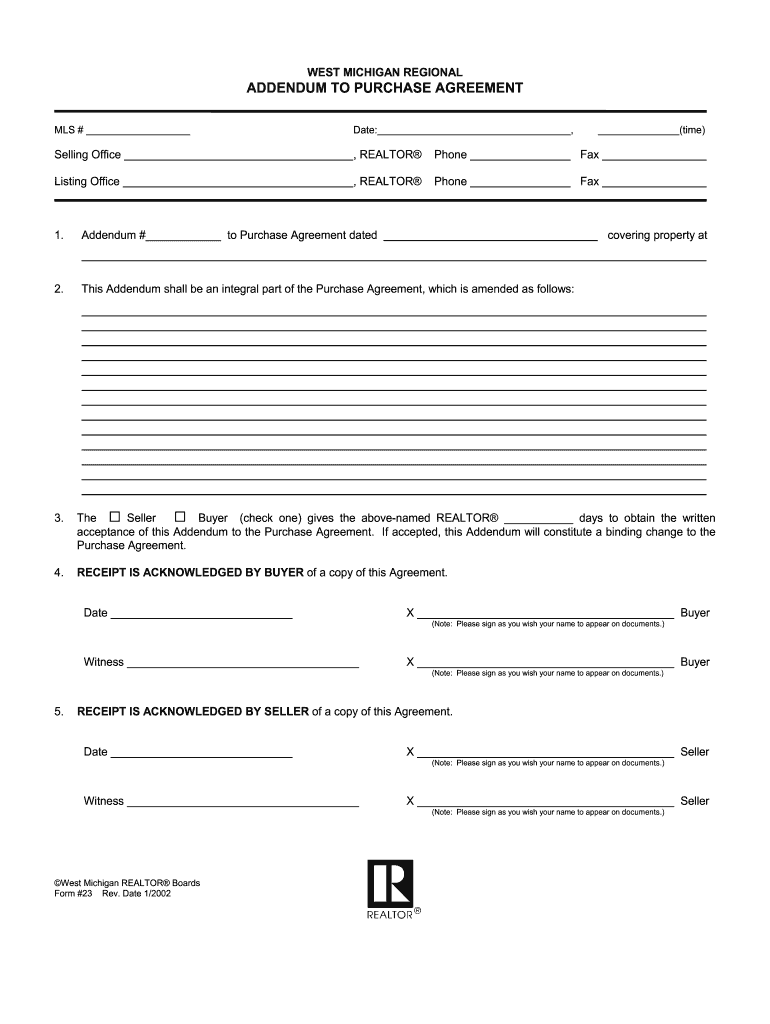

Helpful tips on setting up your ‘West Michigan Regional Addendum To Purchase Agreement Westcentralaor’ online

Are you fed up with the inconvenience of dealing with paperwork? Look no further than airSlate SignNow, the premier electronic signature solution for individuals and businesses. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can easily complete and approve paperwork online. Utilize the powerful features embedded in this intuitive and cost-effective platform and transform your method of document handling. Whether you need to approve forms or collect signatures, airSlate SignNow manages everything effortlessly, with just a few clicks.

Follow this comprehensive guide:

- Log into your account or register for a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form library.

- Open your ‘West Michigan Regional Addendum To Purchase Agreement Westcentralaor’ in the editor.

- Click Me (Fill Out Now) to prepare the document on your end.

- Add and assign fillable fields for others (if necessary).

- Proceed with the Send Invite settings to request eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

No need to worry if you need to collaborate with others on your West Michigan Regional Addendum To Purchase Agreement Westcentralaor or send it for notarization—our solution has everything you need to complete such tasks. Sign up with airSlate SignNow today and elevate your document management to a new level!