OFFERING CIRCULAR SUPPLEMENT DATED February 25, 2011

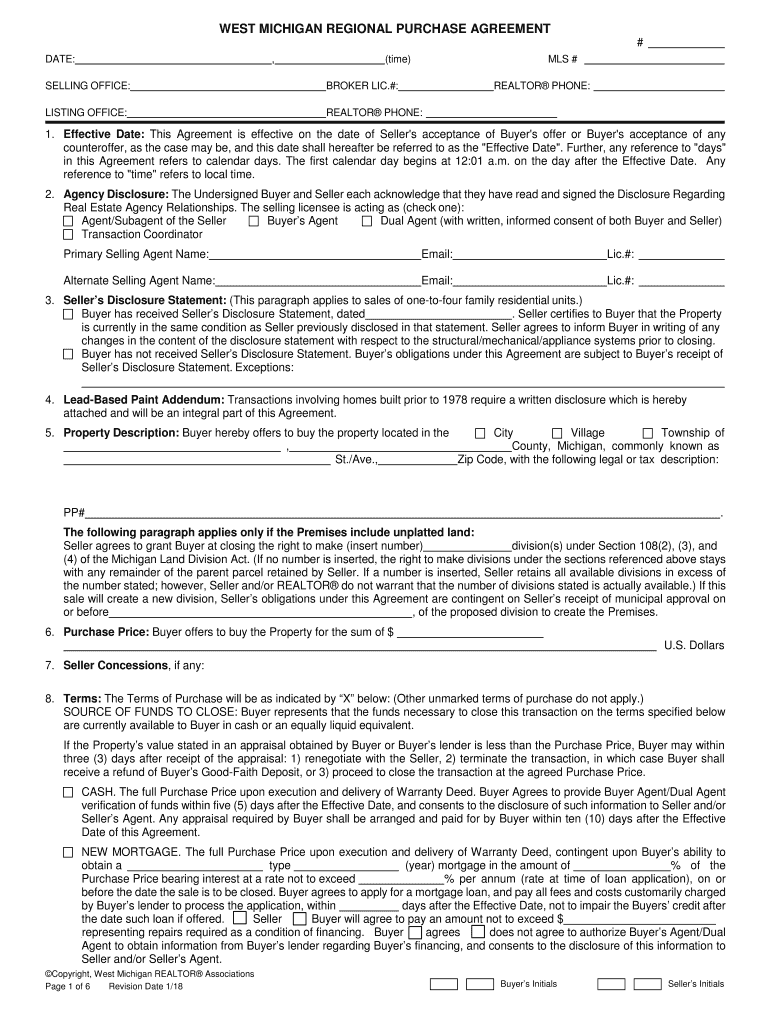

(to Offering Circular Dated February 25, 2011)

FreddieNotes

»

Due From Twelve Months to Thirty Years from Issue Date

Periodically repayable on a restricted basis at the option of Survivor Representatives and

redeemable at the option of Freddie Mac as described in “Description of FreddieNotes”

We plan to offer and sell notes with various terms, which may include the following:

• maturity of twelve months or more from the date of issue;

• interest at a fixed rate;

• interest payment dates at monthly, quarterly, semi-annual or annual intervals;

• book-entry form (through The Depository Trust Company);

• redemption provisions, if applicable, whether mandatory or at our option; and

• minimum denominations of $1,000 or integral multiples of $1,000.

We will specify the final terms of each note, which may be different from the terms described in

this Offering Circular Supplement, in the applicable Pricing Supplement.

Investing in the notes involves certain risks. See “Risk Factors” beginning on page 14 of

the accompanying Offering Circular and on page 39 of our Annual Report on Form 10-K for

the year ended December 31, 2010 and appearing on page S-3 of this Offering Circular

Supplement.

We may sell notes to the agents as principal for resale at varying or fixed offering prices or

through the agents as agent using their reasonable best efforts on our behalf. You must pay for the

notes by delivering the purchase price to an agent, unless you make other payment arrangements.

FreddieNotes are obligations of Freddie Mac only. FreddieNotes, including any interest or

return of discount on FreddieNotes, are not guaranteed by and are not debts or obligations of

the United States or any agency or instrumentality of the United States other than Freddie Mac.

Incapital LLC

BofA Merrill Lynch

Citi

Edward D. Jones & Co., L.P.

Morgan Stanley

UBS Securities, LLC

Wells Fargo Advisors, LLC

RBC Wealth Management

* “FreddieNotes»” is a registered trademark of Freddie Mac.

�TABLE OF CONTENTS

Page

Offering Circular Supplement

About This Offering Circular Supplement and Pricing Supplements .

Risk Factors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Description of FreddieNotes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

General . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Payment of Principal and Interest . . . . . . . . . . . . . . . . . . . . . . . . .

Redemption . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Repayment Upon Death . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Book-Entry System . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Supplemental Plan of Distribution . . . . . . . . . . . . . . . . . . . . . . . . . .

Validity of Notes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Annex A: Repayment Election Form. . . . . . . . . . . . . . . . . . . . . . . . .

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

.

.

.

.

.

.

.

.

.

.

.

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

..

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

S-3

S-3

S-3

S-3

S-4

S-5

S-5

S-7

S-9

S-10

A-1

Offering Circular

The Table of Contents for the Offering Circular can be found on page 3 of the Offering Circular.

S-2

�ABOUT THIS OFFERING CIRCULAR

SUPPLEMENT AND PRICING

SUPPLEMENTS

page 14 of the Offering Circular and on

page 39 of our Annual Report on Form 10-K

for the year ended December 31, 2010.

You should read this Offering Circular Supplement together with Freddie Mac’s Global

Debt Facility Offering Circular, dated February 25, 2011 (the “Offering Circular”), which

accompanies this Offering Circular Supplement,

and all documents that are incorporated by

reference in the Offering Circular, which contain

important detailed information about FreddieNotes and Freddie Mac. See “Additional Information” in the Offering Circular. Capitalized

terms used in this Offering Circular Supplement

have the meanings we gave them in the Offering

Circular, unless we specify otherwise.

FreddieNotes will clear and settle through

the Depository Trust Company rather than the

Federal Reserve Banks.

Investors should note that, unlike most

Freddie Mac debt securities, FreddieNotes will

not clear and settle on the book-entry system of

the Federal Reserve Banks. Instead, FreddieNotes will clear and settle on the book-entry

system operated by The Depository Trust Company or its successor (the “Depository”). Consequently, the secondary market for

FreddieNotes may be less liquid than the secondary market for comparable Freddie Mac debt

securities which clear and settle on the bookentry system of the Federal Reserve Banks.

This Offering Circular Supplement sets forth

certain terms of the FreddieNotes that we may

offer and supplements the Offering Circular that

is attached to the back of this Offering Circular

Supplement. This Offering Circular Supplement

supersedes the Offering Circular and all prior

Offering Circular Supplements to the Offering

Circular to the extent it contains information that

is different from the information in the Offering

Circular and any prior Offering Circular

Supplements.

DESCRIPTION OF FREDDIENOTES

The obligations we are offering by this

Offering Circular Supplement and the related

Pricing Supplement (collectively, “FreddieNotes”) constitute a series of debt securities for

purposes of the Global Debt Facility Agreement.

FreddieNotes will rank equally in all respects

with all unsubordinated debt securities issued

under the Global Debt Facility Agreement. For a

summary of that agreement and the rights of

the Holders of debt securities thereunder,

including FreddieNotes, see “Description of the

Debt Securities” and “The Agreements” in the

Offering Circular.

Each time we offer FreddieNotes, we will

attach a Pricing Supplement to this Offering

Circular Supplement. The Pricing Supplement

will contain the specific description of the FreddieNotes we are offering and the terms of the

offering. The Pricing Supplement will supersede

this Offering Circular Supplement or the Offering

Circular to the extent it contains information that

is different from the information contained in this

Offering Circular Supplement or the Offering

Circular.

The following description of the terms and

conditions of FreddieNotes supplements, and to

the extent inconsistent with replaces, any

description of any general terms of FreddieNotes otherwise contained in the Offering Circular. The terms and conditions described in this

section will apply to each FreddieNote unless

the applicable Pricing Supplement states

otherwise.

RISK FACTORS

FreddieNotes may not be suitable

investments for you. You should not purchase FreddieNotes unless you understand

and are able to bear the redemption, yield,

market, liquidity and other possible risks

associated with FreddieNotes. You should

read and evaluate the discussion of risk factors (especially those risk factors that may

be particularly relevant to this security) that

appear below as well as those beginning on

General

FreddieNotes will be unsecured general

obligations of Freddie Mac having the same

priority as all of our other unsecured and unsubordinated debt and ranking senior to any subordinated debt. FreddieNotes will mature up to

30 years from the Issue Date, as we determine

S-3

�Payment of Principal and Interest

at the time of sale. We will issue FreddieNotes

only in the form of one or more global securities

registered in the name of the Depository except

as specified in “Book-Entry System” below. For

more information on certificated and global

securities, see “Book-Entry System” below.

We will make payments on FreddieNotes

held on the DTC Book-Entry System to the

Depository in immediately available funds. The

Depository will be responsible for crediting the

payment to the accounts of the appropriate

Depository Participants in accordance with its

normal procedures. Each Depository Participant

and each other financial intermediary in the

chain to the beneficial owner of a FreddieNote

will be responsible for remitting payments to the

beneficial owner. See “Book-Entry System”

below.

FreddieNotes may be issued as original

issue discount notes. An original issue discount

note is a note, including any zero-coupon note,

that is issued at more than a de minimis discount from the principal amount payable at

maturity. Upon redemption, repayment or acceleration of the maturity of an original issue discount note, normally an amount less than its

principal amount will be payable. For additional

information regarding payments upon acceleration of the maturity of an original issue discount

note and regarding the United States federal

income tax consequences of original issue discount notes, see “Payment of Principal and

Interest” below and “Certain United States Federal Tax Consequences — U.S. Owners — Debt

Obligations with Original Issue Discount” in the

Offering Circular.

Each FreddieNote, other than a zero-coupon note, will bear interest from, and including,

its Issue Date and from, and including, the most

recent Interest Payment Date to which interest

on such FreddieNote has been paid or for which

such interest has been duly provided. Interest

will be payable at the interest rate per year

stated in such FreddieNote and in the applicable

Pricing Supplement until the principal of such

FreddieNote is paid or made available for payment. Interest will be payable on each Interest

Payment Date and at maturity. Interest will be

payable to the Holder in whose name a FreddieNote is registered at the close of business on

the 15th calendar day next preceding each

Interest Payment Date, which date we refer to

as a regular record date; provided, however,

that interest payable at maturity or upon

redemption or repayment will be payable to the

person to whom principal is payable. The first

payment of interest on any FreddieNote originally issued between a regular record date and

an Interest Payment Date will be made on the

Interest Payment Date following the next succeeding regular record date to the registered

owner of such FreddieNote on such next succeeding regular record date. If the Interest Payment Date or the maturity for any FreddieNote

falls on a day that is not a Business Day, the

payment of principal and interest may be made

on the next succeeding Business Day, and no

interest on such payment shall accrue for the

period from such Interest Payment Date or

maturity, as the case may be, to the actual date

of the payment. Unless the applicable Pricing

Supplement states otherwise, interest on FreddieNotes will be computed on the basis of a

360-day year of twelve 30-day months.

FreddieNotes may be registered for transfer

or exchange at the principal office of the Corporate Trust Services Department of U.S. Bank

Trust National Association (the “Global

Agent”), St. Paul, MN. The Global Agent is

acting solely as registrar, transfer agent and

paying agent for FreddieNotes, and does not

assume any obligation or relationship of agency

or trust for or with any Holder of a FreddieNote,

except that any moneys held by the Global

Agent for payment on a FreddieNote shall be

held for the benefit of the Holder thereof as

provided in the Global Agency Agreement

between Freddie Mac and the Global Agent.

The transfer or exchange of global securities will

be effected as specified in “Book-Entry System”

below.

The Global Debt Facility Agreement does

not limit our ability to incur debt, nor does it

contain any provision that would protect Holders

of FreddieNotes in the event of any transaction

that may adversely affect our creditworthiness.

S-4

�FreddieNotes we purchase in this manner may,

at our discretion, be held, resold or cancelled.

The Interest Payment Dates for a FreddieNote, other than a zero-coupon note, will be as

follows:

Interest Payments

Repayment Upon Death

Interest Payment

Dates

If the Pricing Supplement relating to a

FreddieNote so states, the Survivor Representative, as defined below, of that FreddieNote will

have the right to require us to repay such

FreddieNote prior to its maturity date upon the

death of its beneficial owner under the procedures and restrictions described herein. Thereafter, Freddie Mac will repay any FreddieNote

(or portion thereof) properly requested to be

repaid by or on behalf of the person with authority to act on behalf of the deceased owner of

the beneficial interest in such FreddieNote under

the laws of the appropriate jurisdiction (including, without limitation, the personal representative, executor, surviving joint tenant or surviving

tenant by the entirety of such deceased beneficial owner) (the “Survivor Representative”) at

a price equal to 100% of the principal amount of

such beneficial interest plus accrued interest to

the date of such repayment, subject to certain

limitations as described below. We call this right

the “Survivor’s Option.”

Monthly . . . . . . . . . . . Typically on the fifteenth day of

each calendar month,

commencing in the first

succeeding calendar month

following the month in which the

FreddieNote is issued.

Quarterly . . . . . . . . . . Typically on the fifteenth day of

every third month, commencing in

the third succeeding calendar

month following the month in

which the FreddieNote is issued.

Semi-annual . . . . . . . Typically on the fifteenth day of

every sixth month, commencing in

the sixth succeeding calendar

month following the month in

which the FreddieNote is issued.

Annual . . . . . . . . . . . Typically on the fifteenth day of

every twelfth month, commencing

in the twelfth succeeding calendar

month following the month in

which the FreddieNote is issued.

The interest rates on FreddieNotes may

differ depending upon, among other things, prevailing market conditions at the time of issuance

as well as the aggregate principal amount of

FreddieNotes issued in any single transaction.

Although we may change the interest rates and

other terms of FreddieNotes from time to time,

no change will affect any FreddieNote already

issued or as to which we have accepted an offer

to purchase.

Upon exercise of the Survivor’s Option, we

will, at our option, either repay or purchase the

related FreddieNote properly delivered for repayment by or on behalf of the Survivor Representative at a price equal to the sum of:

• 100% of the principal amount of such

FreddieNote (or, for zero-coupon notes,

the accrued face amount), and

Redemption

• accrued and unpaid interest, if any, to the

date of such repayment,

Unless the applicable Pricing Supplement

states otherwise, we may not redeem the

related FreddieNotes prior to maturity. FreddieNotes will not be subject to any sinking fund. If,

however, the applicable Pricing Supplement provides that we may redeem the related FreddieNotes prior to maturity at our discretion, that

Pricing Supplement will also specify the

redemption date(s) and price(s). If applicable,

FreddieNotes may be redeemed in whole or in

part from time to time upon not less than five

Business Days’ nor more than 60 calendar days’

notice.

subject to the following limitations.

The Survivor’s Option may not be exercised

until at least 12 months following the Issue Date

of the applicable FreddieNote. In addition, we

may limit the aggregate principal amount of

FreddieNotes as to which the Survivor’s Option

may be exercised as follows:

• In any calendar year, we may limit the

aggregate principal amount to the greater

of 1% of the outstanding aggregate principal amount of FreddieNotes as of December 31 of the most recently completed

We may at any time purchase FreddieNotes

at any price in the open market or otherwise.

S-5

�payment. Each FreddieNote delivered for repayment that is not accepted in any calendar year

due to the application of the Annual Put Limitation will be deemed to be delivered in the following calendar year in the order in which all such

notes were originally delivered, unless any such

FreddieNote is withdrawn by the representative

for the deceased beneficial owner prior to its

repayment. Other than as described in the

immediately preceding sentence, FreddieNotes

delivered upon exercise of the Survivor’s Option

may not be withdrawn. In the event that a

FreddieNote delivered for repayment pursuant to

valid exercise of the Survivor’s Option is not

accepted, the Global Agent will deliver a notice

by first-class mail to the Holder that states the

reason that the FreddieNote has not been

accepted for repayment. Following receipt of

such notice from the Global Agent, the Survivor

Representative may withdraw any such FreddieNote and the exercise of the Survivor’s Option.

year or $1,000,000. We call this limitation

the “Annual Put Limitation.”

• For any individual deceased beneficial

owner of FreddieNotes, we may limit the

aggregate principal amount to $200,000

for any calendar year. We call this limitation the “Individual Put Limitation.”

We will not make principal repayments pursuant to the exercise of the Survivor’s Option in

amounts that are less than $1,000. If the limitations described above would result in the partial

repayment of any FreddieNote, the principal

amount of the FreddieNote remaining outstanding after repayment must be at least $1,000.

Each FreddieNote delivered pursuant to a

valid exercise of the Survivor’s Option will be

accepted promptly in the order all such FreddieNotes are delivered, unless the acceptance of

that FreddieNote would contravene the Annual

Put Limitation or the Individual Put Limitation. If,

as of the end of any calendar year, the aggregate principal amount of FreddieNotes that have

been accepted pursuant to exercise of the

Survivor’s Option during that year has not

exceeded the Annual Put Limitation for that

year, any FreddieNotes not accepted during that

calendar year because of the Individual Put

Limitation will be accepted in the order all such

FreddieNotes were delivered, to the extent that

any such acceptance would not trigger the

Annual Put Limitation for such calendar year.

In the case of repayment pursuant to the

exercise of the Survivor’s Option of a FreddieNote represented by a global security, the

Depository or its nominee will be the Holder of

such FreddieNote and, therefore, will be the only

entity that can exercise the Survivor’s Option for

such FreddieNote.

Subject to the Annual Put Limitation and

the Individual Put Limitation, all questions as to

the eligibility or validity of any exercise of the

Survivor’s Option will be determined by Freddie

Mac, either directly or through the Global Agent.

We will make quarterly repayments on any

FreddieNotes accepted for repayment pursuant

to the exercise of the Survivor’s Option. Any

FreddieNote accepted for repayment pursuant

to exercise of the Survivor’s Option will be

repaid no later than the first January 15, April 15,

July 15 or October 15 to occur at least 20

calendar days after the date of acceptance. For

example, if the acceptance date for FreddieNotes delivered pursuant to the Survivor’s

Option were February 1, 2012, we would be

obligated to repay those FreddieNotes by

April 15, 2012. However, if the acceptance date

were April 1, 2012, we would be obligated to

repay those FreddieNotes by July 15, 2012. If

any date on which a FreddieNote is to be repaid

is not a Business Day, payment will be made on

the next succeeding Business Day, and no interest on such payment shall accrue for the period

from such repayment date to the actual date of

The death of a person owning a FreddieNote in joint tenancy or tenancy by the entirety

will be deemed the death of the beneficial owner

of the FreddieNote, and the entire principal

amount of the FreddieNote so held will be subject to the Survivor’s Option. The death of a

person owning a FreddieNote by tenancy in

common will be deemed the death of the beneficial owner of a FreddieNote only with respect

to the deceased holder’s interest in the FreddieNote so held by tenancy in common. However,

if a FreddieNote is held by husband and wife as

tenants in common, the death of either will be

deemed the death of the beneficial owner of the

FreddieNote, and the entire principal amount of

the FreddieNote so held will be subject to the

Survivor’s Option. The death of a person who,

during his or her lifetime, was entitled to

S-6

�We have attached as Annex A to this Offering Circular Supplement the forms to be used

by a Survivor Representative’s Financial Institution to exercise the Survivor’s Option on behalf

of a deceased beneficial owner of a FreddieNote. In addition, a representative may obtain

these forms from U.S. Bank Corporate Trust

Services, Attn: Specialized Finance,

EP-MN-WS2N, 60 Livingston Avenue, St. Paul,

MN 55107, or call (800) 934-6802 during normal

business hours.

substantially all of the beneficial interests of

ownership of a FreddieNote will be deemed the

death of the beneficial owner for purposes of

the Survivor’s Option, regardless of the Holder,

if such beneficial interest can be established to

the satisfaction of Freddie Mac, acting either

directly or through the Global Agent. Such beneficial interest will be deemed to exist in typical

cases of nominee ownership, ownership under

the Uniform Gifts to Minors Act, community

property or other joint ownership arrangements

between a husband and wife and trust arrangements where one person has substantially all of

the beneficial ownership interest in the FreddieNote during his or her lifetime.

Book-Entry System

Upon issuance, all FreddieNotes having the

same Issue Date, interest rate, stated maturity,

CUSIP number and other terms, if any, will be

represented by a single global security. Each

global security will be deposited with or on

behalf of the Depository and registered in the

name of the Depository’s nominee. Except as

described below, global securities may be transferred, in whole and not in part, only by the

Depository to a nominee of the Depository or by

a nominee of the Depository to the Depository

or another nominee of the Depository. So long

as the Depository or its nominee is the registered owner of any global security, the Depository or its nominee will be considered the sole

Holder of the FreddieNote for all purposes under

the Global Debt Facility Agreement.

Subject to the foregoing, in order to validly

exercise a Survivor’s Option, the Survivor Representative must tender to the appropriate financial institution (“Financial Institution”):

• a written request for repayment signed by

the Survivor Representative, with the signature guaranteed by a member firm of a

registered national securities exchange or

of the National Association of Securities

Dealers, Inc. (“NASD”) or a commercial

bank or trust company having an office or

correspondent in the United States;

• the FreddieNote (or portion thereof) to be

repaid;

The Depository has advised us as follows:

the Depository is a limited-purpose trust company organized under the New York Banking

Law, a “banking organization” within the meaning of the New York Banking Law, a member of

the Federal Reserve System, a “clearing corporation” within the meaning of the New York

Uniform Commercial Code, and a “clearing

agency” registered pursuant to the provisions of

Section 17A of the Securities Exchange Act of

1934. The Depository holds securities that its

Depository Participants deposit with the Depository. The Depository also facilitates the settlement among Depository Participants of

securities transactions, such as transfers and

pledges, in deposited securities through electronic computerized book-entry changes in

Depository Participants’ accounts, eliminating

the need for physical movement of securities

certificates. “Direct participants” include securities brokers and dealers, banks, trust companies, clearing corporations and certain other

• appropriate evidence that (1) the Survivor

Representative has authority to act on

behalf of the deceased beneficial owner;

(2) the death of such beneficial owner

has occurred; and (3) the deceased was

the beneficial owner of the FreddieNote at

the time of death;

• if applicable, a properly executed assignment or endorsement; and

• if the beneficial interest in the FreddieNote is held by a nominee of the

deceased beneficial owner, a certificate

from such nominee attesting to the

deceased’s ownership of a beneficial

interest in the FreddieNote.

The Depository Participant will be responsible for disbursing any payments it receives pursuant to exercise of the Survivor’s Option to the

appropriate representative. See “Book-Entry

System” below.

S-7

�organizations. The Depository is owned by a

number of its Depository Participants and by the

New York Stock Exchange, Inc., the American

Stock Exchange, Inc. and the NASD. Access to

the Depository’s system is also available to others such as securities brokers and dealers,

banks and trust companies that clear through or

maintain a custodial relationship with a Depository Participant, either directly or indirectly,

which we refer to as “indirect participants.”

indirect participants to beneficial owners will be

governed by arrangements among them, subject

to any statutory or regulatory requirements as

may be in effect from time to time.

Purchases of interests in the global securities under the Depository’s system must be

made by or through Depository Participants,

which will receive a credit for such interests on

the Depository’s records. The ownership interest

of each beneficial owner is in turn to be

recorded on the Depository Participants’

records. Beneficial owners will not receive written confirmation from the Depository of their

purchase, but beneficial owners are expected to

receive written confirmations providing details of

the transaction, as well as periodic statements

of their holdings, from the Depository Participant

through which the beneficial owner entered into

the transaction. Transfers of ownership interests

in the global securities are to be accomplished

by entries made on the books of Depository

Participants acting on behalf of beneficial owners. Beneficial owners will not receive certificates representing their ownership interests in

the global securities, except as described below.

Neither the Depository nor Cede & Co. will

consent or vote with respect to the global securities. Under its usual procedures, the Depository mails an omnibus proxy to the issuer as

soon as possible after the record date. The

omnibus proxy assigns Cede & Co.’s consenting

or voting rights to those Depository Participants

to whose accounts interests in the global securities are credited on the record date (identified in

a listing attached to the omnibus proxy).

Redemption notices will be sent to

Cede & Co. If less than all of the interests in a

global security are being redeemed, the Depository’s practice is to determine by lot the amount

of the interest of each Depository Participant in

such global security to be redeemed.

Principal and interest payments on the global securities will be made to the Depository.

The Depository will then credit Depository Participants’ accounts on the payment date in

accordance with their respective holdings shown

on the Depository’s records. Payments by

Depository Participants to beneficial owners will

be governed by standing instructions and customary practices, and will be the responsibility

of such participant and not of the Depository,

the Global Agent or us, subject to any statutory

or regulatory requirements as may be in effect

from time to time. Payment of principal and

interest to the Depository is our responsibility

acting directly or through the Global Agent. Disbursement of such payments to Depository Participants is the responsibility of the Depository.

Disbursement of such payments to the beneficial owners is the responsibility of Depository

Participants.

To facilitate subsequent transfers, all global

securities deposited by Depository Participants

with the Depository are registered in the name

of the Depository’s partnership nominee,

Cede & Co. The deposit of global securities with

the Depository and their registration in the name

of Cede & Co. effect no change in beneficial

ownership. The Depository has no knowledge of

the actual beneficial owners of the interests in

the global securities; the Depository’s records

reflect only the identity of the Depository Participants to whose accounts interests in the global

securities are credited, which may or may not

be the beneficial owners. The participants will

remain responsible for keeping account of their

holdings on behalf of their customers.

The information in this section concerning

the Depository and the DTC Book-Entry System

has been obtained from sources that we believe

to be reliable, but we take no responsibility for

its accuracy.

Conveyance of notices and other communications by the Depository to Depository Participants, by Depository Participants to indirect

participants, and by Depository Participants and

S-8

�SUPPLEMENTAL PLAN OF DISTRIBUTION

Following the solicitation of orders, the

agents, severally and not jointly, may purchase

FreddieNotes from us through the purchasing

agent as principal for their own accounts.

Unless otherwise set forth in the applicable Pricing Supplement, any FreddieNote sold to an

agent as principal will be purchased by the

purchasing agent from us at a discount to the

principal amount not to exceed the concession

applicable to an agency sale of a FreddieNote

of identical maturity. Unless otherwise set forth

in the applicable Pricing Supplement, such FreddieNotes will be resold to one or more investors

and other purchasers at a fixed public offering

price.

Under the terms of the current Medium and

Long Term Debt Securities Master Dealer

Agreement entered into between Freddie Mac

and each of the agents listed below, which

incorporates the Amendment to Medium and

Long Term Debt Securities Master Dealer

Agreement, dated as of April 2, 2001, among

Freddie Mac and each of Citigroup, Edward D.

Jones & Co., L.P., Merrill Lynch, Pierce, Fenner & Smith Incorporated, Morgan Stanley, RBC

Wealth Management, UBS Financial Services

and Wells Fargo Advisors as agents, the

Amendment to Medium and Long Term Debt

Securities Master Dealer Agreement, dated as

of February 13, 2003, between Freddie Mac and

Banc of America Securities LLC, the Amendment to Medium and Long Term Debt Securities

Master Dealer Agreement, dated as of July 28,

2006 between Freddie Mac and WM Financial

Services and the Amendment to Medium and

Long Term Debt Securities Master Dealer

Agreement, dated as of February 22, 2008,

between Freddie Mac and Incapital LLC (as

successor to LaSalle Financial Services, Inc.

(formerly known as ABN AMRO Incorporated),

(collectively, the “Master Dealer Agreement”),

FreddieNotes are offered from time to time by

us through the agents. The agents have agreed

to use their reasonable best efforts to solicit

purchases of FreddieNotes.

In addition, the purchasing agent may, and

with our consent the other agents may, offer

FreddieNotes they have purchased as principal

to other dealers that are part of the selling

group. The purchasing agent may sell FreddieNotes to other dealers at a discount not in

excess of the discount it receives when purchasing such FreddieNotes from us. And, if with our

consent the other agents sell FreddieNotes to

dealers, unless otherwise specified in the applicable Pricing Supplement, the discount allowed

to any dealer will not, during the distribution of

FreddieNotes, exceed the discount received by

such agent from the purchasing agent. After the

initial public offering of FreddieNotes to be

resold by an agent to investors, the public offering price (in the case of FreddieNotes to be

resold at a fixed public offering price), concession and discount may be changed.

We will pay the agents, through

Incapital LLC, the purchasing agent, a commission to be divided among the agents as they

shall agree for FreddieNotes sold through the

agents on an agency basis. Unless otherwise

agreed, the commission will range from 0.20%

to 2.50% of the principal amount for each

FreddieNote sold, depending upon the maturity.

Commissions with respect to FreddieNotes with

maturities in excess of 30 years will be negotiated between us and the purchasing agent at

the time of sale. We will have the sole right to

accept offers to purchase FreddieNotes and

may reject any proposed purchase of FreddieNotes in whole or in part. Each agent will have

the right, in its discretion reasonably exercised,

to reject any proposed purchase of FreddieNotes, in whole or in part, received by it on an

agency basis. We reserve the right to withdraw,

cancel or modify the offer without notice.

Each agent may be deemed to be an

“underwriter” within the meaning of the Securities Act of 1933. We have agreed to indemnify

the agents against certain liabilities, including

liabilities under the Securities Act of 1933.

No FreddieNote will have an established

trading market when issued. We do not intend

to apply for the listing of FreddieNotes on any

securities exchange, but we have been advised

by the agents that the agents intend to make a

market in FreddieNotes as permitted by applicable laws and regulations. The agents are not

obligated to do so, however, and the agents

may discontinue making a market at any time

without notice. No assurance can be given as to

the liquidity of any trading market for any FreddieNotes. All secondary trading in FreddieNotes

S-9

�will settle in immediately available funds. See

“Description of FreddieNotes — Book-Entry System” in this Offering Circular Supplement.

any effect that the transactions described above

may have on the price of FreddieNotes. In addition, we and the purchasing agent make no

representation that the purchasing agent will

engage in such transactions or that such transactions, once commenced, will be continued. If

the purchasing agent engages in such transactions, it will do so on its own behalf and not as

our agent.

In connection with an offering of FreddieNotes, the purchasing agent may engage in

certain transactions that stabilize, maintain or

otherwise affect the market price in connection

with any offering of FreddieNotes. Those transactions may include stabilizing bids or purchases for the purpose of pegging, fixing or

maintaining the market price of FreddieNotes

and the purchase of FreddieNotes to cover syndicate short positions. The purchasing agent

may create a short position in FreddieNotes in

connection with an offering of FreddieNotes by

selling FreddieNotes with a principal amount

greater than that set forth on the cover page of

the applicable Pricing Supplement, and may

reduce that short position by purchasing FreddieNotes in the open market. In general, purchases of a security for the purpose of

stabilization or to reduce a short position could

cause the price of the security to be higher than

it might be in the absence of such purchases.

We and the purchasing agent make no representation or prediction as to the direction or

magnitude of

Other selling group members include broker-dealers and other securities firms that have

executed dealer agreements with the purchasing

agent. In the dealer agreements, the selling

group members have agreed to market and sell

FreddieNotes in accordance with the terms of

those agreements and all applicable laws and

regulations. You may access the list of selling

group members on the Internet at www.freddiemac.com/freddienotes.

The agents and their affiliates may engage

in various general financing and banking transactions with us and our affiliates in the ordinary

course of business.

VALIDITY OF NOTES

The legality of FreddieNotes will be passed

upon for us by our General Counsel (or one of

our Deputy General Counsels).

S-10

�ANNEX A

REPAYMENT ELECTION FORM

FREDDIE MAC

FREDDIENOTES

CUSIP NO.

To: Freddie Mac

The undersigned financial institution (the “Financial Institution”) represents the following:

• The Financial Institution has received a written request for repayment from the executor or other

survivor representative (the “Survivor Representative”) of the deceased beneficial owner

listed below (the “Deceased Beneficial Owner”) of FreddieNotes (CUSIP

No.

) (the “Notes”).

• At the time of his or her death, the Deceased Beneficial Owner owned Notes in the principal

amount listed below, and the Financial Institution currently holds such Notes as a direct or

indirect participant in The Depository Trust Company (the “Depositary”).

The Financial Institution agrees to the following terms:

• The Financial Institution shall follow the instructions (the “Instructions”) accompanying this

Repayment Election Form (the “Form”).

• The Financial Institution shall make all records specified in the Instructions supporting the

above representations available to Freddie Mac for inspection and review within five Business

Days of Freddie Mac’s request.

• If the Financial Institution or Freddie Mac, in either’s reasonable discretion, deems any of the

records specified in the Instructions supporting the above representations unsatisfactory to

substantiate a claim for repayment, the Financial Institution shall not be obligated to submit this

Form, and Freddie Mac may deny repayment. If the Financial Institution cannot substantiate a

claim for repayment, it shall notify Freddie Mac immediately.

• Other than as described in the Offering Circular Supplement in the limited situation involving

tenders of FreddieNotes that are not accepted during one calendar year as a result of the

“Annual Put Limitation,” repayment elections may not be withdrawn.

• The Financial Institution agrees to indemnify and hold harmless Freddie Mac (and its Global

Agent indicated in paragraph 14 of the Instructions to this Form) against and from any and all

claims, liabilities, costs, losses, expenses, suits and damages resulting from the Financial

Institution’s above representations and request for repayment on behalf of the Survivor

Representative.

A-1

�REPAYMENT ELECTION FORM

CUSIP No.

(1)

Name of Deceased Beneficial Owner

(2)

Date of Death

(3)

Name of Survivor Representative Requesting Repayment

(4)

Name of Financial Institution Requesting Repayment

(5)

Signature of Representative of Financial Institution Requesting Repayment

(6)

Principal Amount of Requested Repayment

(7)

Date of Election

(8)

Date Requested for Repayment

(9)

(10) U.S. Bank’s Delivery Versus Payment

Financial Institution Representative:

Instructions*:

Name:

U.S. Bank Trust National Association

Phone Number:

DTC Participant Number 2897

Fax Number:

Mailing Address (no P.O. Boxes):

E-mail Address:

TO BE COMPLETED BY FREDDIE MAC:

(A)

(B)

(C)

(D)

(E)

(F)

Election Number**:

Delivery and Payment Date:

Principal Amount:

Accrued Interest:

Date of Receipt of Form by Freddie Mac:

Date of Acknowledgment by Freddie Mac:

* Delivery of the Notes subject to repayment must be made on the repayment date and not prior to the

repayment date. Delivery should be made in accordance with U.S. Bank’s Delivery Versus Payment

Instructions as provided on line (10) above. If the repayment date is not an Interest Payment Date, the

repayment amount will include accrued interest.

** To be assigned by Freddie Mac upon receipt of this Form. An acknowledgement, in the form of a copy of this

document with the assigned Election Number, will be returned to the party and location designated on line (9)

above.

A-2

�INSTRUCTIONS FOR COMPLETING REPAYMENT ELECTION FORM

AND EXERCISING REPAYMENT OPTION

Capitalized terms used and not defined herein have the meanings defined in the accompanying

Repayment Election Form.

1. Collect and retain for a period of at least three years (A) satisfactory evidence of the authority

of the Survivor Representative, (B) satisfactory evidence of death of the Deceased Beneficial

Owner, (C) satisfactory evidence that the Deceased Beneficial Owner beneficially owned, at

the time of his or her death, the Notes being submitted for repayment, and (D) any necessary

tax waivers. For purposes of determining whether Freddie Mac will deem Notes beneficially

owned by an individual at the time of death, the following rules shall apply:

• Notes beneficially owned by tenants by the entirety or joint tenants will be regarded as

beneficially owned by a single owner. The death of a tenant by the entirety or joint tenant

will be deemed the death of the beneficial owner, and the Notes beneficially owned will

become eligible for repayment. The death of a person beneficially owning a Note by

tenancy in common will be deemed the death of a holder of a Note only with respect to the

deceased holder’s interest in the Note so held by tenancy in common, unless a husband

and wife are the tenants in common, in which case the death of either will be deemed the

death of the holder of the Note, and the entire principal amount of the Note so held will be

eligible for repayment.

• Notes beneficially owned by a trust will be regarded as beneficially owned by each

beneficiary of the trust to the extent of that beneficiary’s interest in the trust (however, a

trust’s beneficiaries, collectively, cannot be beneficial owners of more Notes than are

owned by the trust). The death of a beneficiary of a trust will be deemed the death of the

beneficial owner of the Notes beneficially owned by the trust to the extent of that

beneficiary’s interest in the trust. The death of an individual who was a tenant by the

entirety or joint tenant in a tenancy, which is the beneficiary of a trust, will be deemed the

death of the beneficiary of the trust. The death of an individual who was a tenant in

common in a tenancy, which is the beneficiary of a trust, will be deemed the death of the

beneficiary of the trust only with respect to the deceased holder’s beneficial interest in the

Note, unless a husband and wife are the tenants in common, in which case the death of

either will be deemed the death of the beneficiary of the trust.

• The death of a person who, during his or her lifetime, was entitled to substantially all of the

beneficial interest in a Note will be deemed the death of the beneficial owner of that Note,

regardless of the registration of ownership, if such beneficial interest can be satisfactorily

established. Such beneficial interest will exist in many cases of street name or nominee

ownership, ownership by a trustee, ownership under the Uniform Gift to Minors Act and

community property or other joint ownership arrangements between spouses. Beneficial

interest will be evidenced by such factors as the power to sell or otherwise dispose of a

Note, the right to receive the proceeds of sale or disposition and the right to receive

interest and principal payments on a Note.

2. Provide CUSIP Number for the Notes to be repaid at top of both pages of the Repayment

Election Form.

3. Indicate the name of the Deceased Beneficial Owner on line (1).

4. Indicate the date of death of the Deceased Beneficial Owner on line (2).

5. Indicate the name of the Survivor Representative requesting repayment on line (3).

6. Indicate the name of the Financial Institution requesting repayment on line (4).

A-3

�7. Affix the authorized signature of the Financial Institution’s representative on line (5).

THE SIGNATURE MUST BE MEDALLION SIGNATURE GUARANTEED.

8. Indicate the principal amount of Notes to be repaid on line (6).

9. Indicate the date this Form was completed on line (7).

10. Indicate the date of requested repayment on line (8). The date of requested repayment may

not be earlier than the first January 15, April 15, July 15 or October 15 to occur at least

20 calendar days after the date of Freddie Mac’s acceptance of the Notes for repayment,

unless such date is not a business day, in which case the date of requested payment may be

no earlier than the next succeeding business day. For example, if the acceptance date for

Notes tendered were April 1, 2011, the earliest repayment date you could elect would be

July 15, 2011.

11. Indicate the name, mailing address (no P.O. boxes, please), e-mail address, telephone

number and facsimile-transmission number of the party to whom the acknowledgment of this

election may be sent on line (9).

12. Leave lines (A), (B), (C), (D), (E) and (F) blank.

13. Mail or otherwise deliver an original copy of the completed Form to Freddie Mac’s Global

Agent as follows:

U.S. Bank Corporate Trust Services

Attn: Specialized Finance

EP-MN-WS2N

60 Livingston Avenue

St. Paul, MN 55107

FACSIMILE TRANSMISSIONS OF THE REPAYMENT ELECTION FORM

WILL NOT BE ACCEPTED.

14. If the acknowledgement of Freddie Mac’s receipt of this Form, including the assigned Election

Number, is not received within 15 business days of the date such information is sent to the

Global Agent, contact Freddie Mac Investor Relations at (571) 382-3700 or toll free at

888-882-6275.

For assistance with the Form or any questions relating thereto, please contact Freddie Mac

Investor Relations at (571) 382-3700 or toll free at 888-882-6275.

A-4

�®

FreddieNotes

Federal Home Loan

Mortgage Corporation

FreddieNotes

®

Offering Circular Supplement

dated February 25, 2011

to

Offering Circular dated

February 25, 2011

�