Fill and Sign the West Virginia Contractor Agreement Form

Useful tips for finishing your ‘West Virginia Contractor Agreement Form’ online

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the leading digital signature service for individuals and businesses. Bid farewell to the laborious task of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and authorize documents online. Utilize the robust features integrated into this user-friendly and affordable platform to transform your method of document management. Whether you need to sign forms or gather signatures, airSlate SignNow manages it all seamlessly, with just a few clicks.

Follow this detailed guide:

- Sign in to your account or initiate a free trial with our service.

- Select +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘West Virginia Contractor Agreement Form’ in the editor.

- Click Me (Fill Out Now) to fill out the form on your end.

- Add and designate fillable fields for others (if necessary).

- Continue with the Send Invite options to solicit eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

Don’t be concerned if you need to work with others on your West Virginia Contractor Agreement Form or send it for notarization—our solution provides everything necessary to accomplish such objectives. Sign up with airSlate SignNow today and enhance your document management to a new level!

FAQs

-

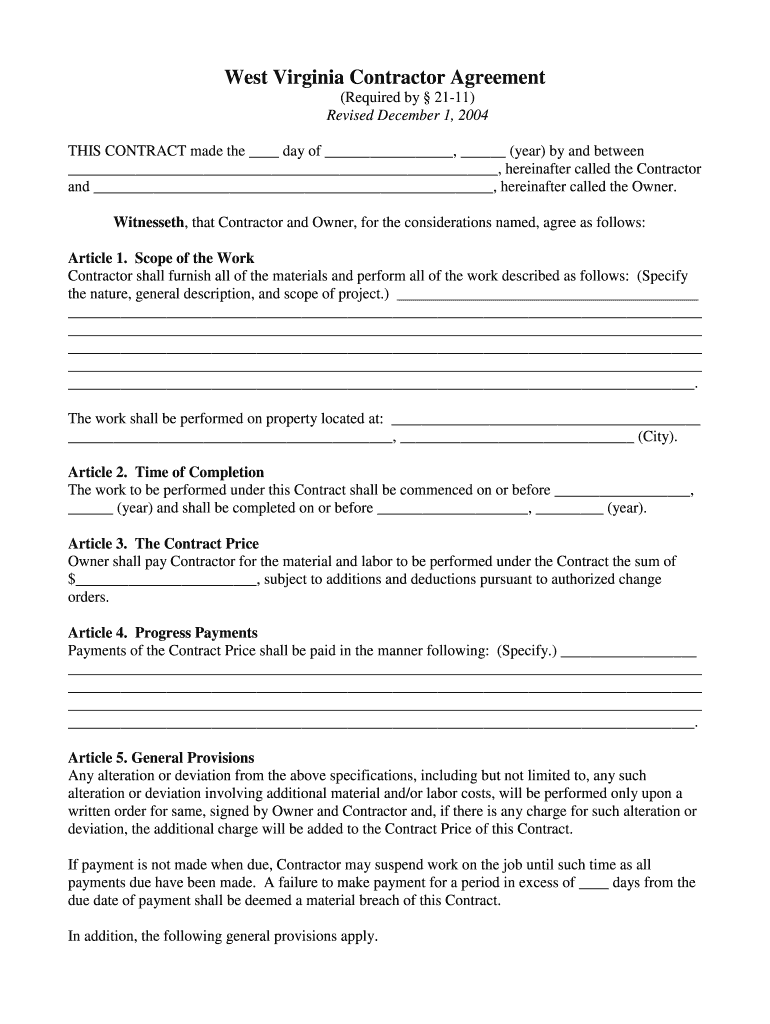

What is a West Virginia Contractor Agreement?

A West Virginia Contractor Agreement is a legal document that outlines the terms and conditions between a contractor and a client in West Virginia. This agreement typically includes details about the scope of work, payment terms, and timelines. Using airSlate SignNow, you can easily create and eSign this essential document to ensure that both parties are protected.

-

How can airSlate SignNow help me create a West Virginia Contractor Agreement?

airSlate SignNow provides an intuitive platform to create a West Virginia Contractor Agreement quickly. You can customize templates to suit your specific needs and include necessary clauses. The user-friendly interface allows you to draft, send, and eSign documents in just a few clicks.

-

Is there a cost associated with using airSlate SignNow for a West Virginia Contractor Agreement?

Yes, airSlate SignNow offers various pricing plans that cater to different business sizes and needs. You can choose a plan that fits your budget and provides the features necessary for managing your West Virginia Contractor Agreement efficiently. Plus, there are often trial options available to test the service before committing.

-

What features does airSlate SignNow offer for managing a West Virginia Contractor Agreement?

airSlate SignNow includes features like document templates, eSignature capabilities, and real-time tracking for your West Virginia Contractor Agreement. You can also integrate with other tools and platforms to streamline your workflow, ensuring that your agreements are managed seamlessly.

-

Can I integrate airSlate SignNow with other software for my West Virginia Contractor Agreement?

Absolutely! airSlate SignNow integrates with various applications, including CRM systems and cloud storage services, to enhance your document management process. This allows you to seamlessly manage your West Virginia Contractor Agreement alongside other business operations.

-

What are the benefits of using airSlate SignNow for my West Virginia Contractor Agreement?

Using airSlate SignNow for your West Virginia Contractor Agreement offers several benefits, including increased efficiency, reduced paperwork, and enhanced security of your documents. The platform allows for quick eSigning, which accelerates the contract process and helps you maintain compliance with local laws.

-

Is it legally binding to eSign a West Virginia Contractor Agreement using airSlate SignNow?

Yes, eSigning a West Virginia Contractor Agreement through airSlate SignNow is legally binding, as it complies with the Electronic Signatures in Global and National Commerce (ESIGN) Act. This means that your electronically signed agreements are valid and enforceable in a court of law.

Find out other west virginia contractor agreement form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles