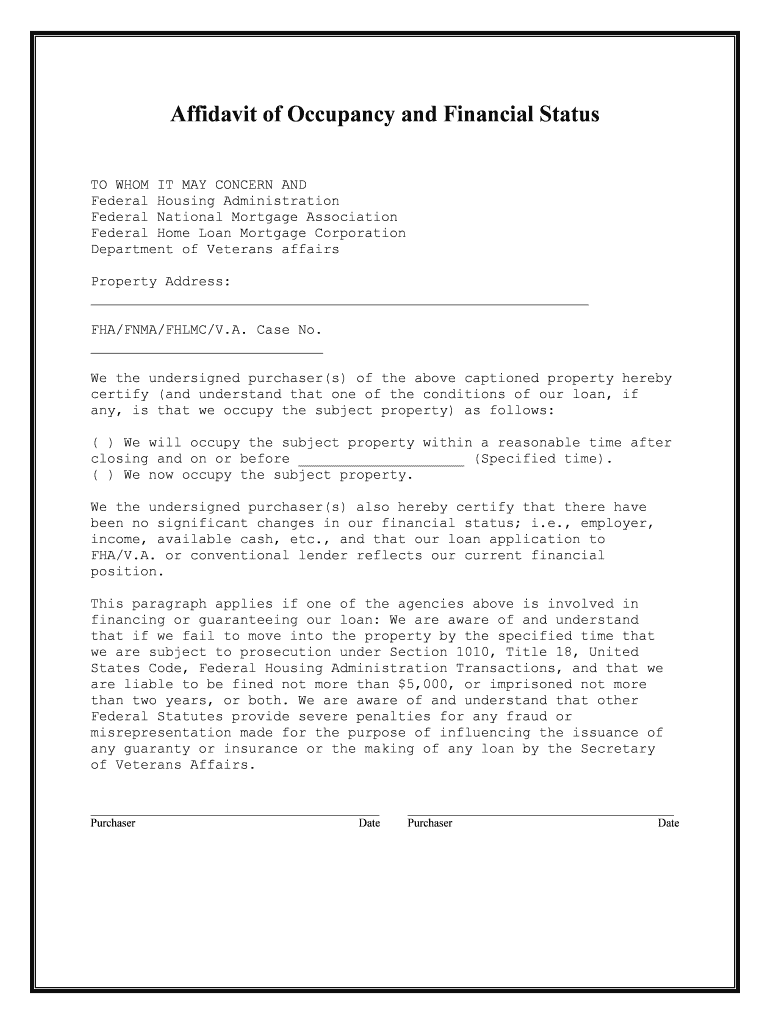

Fill and Sign the What is the Difference between a Conventional Fha and Va Form

Useful suggestions for finishing your ‘What Is The Difference Between A Conventional Fha And Va ’ online

Are you fed up with the inconvenience of handling documents? Look no further than airSlate SignNow, the premier eSignature solution for individuals and organizations. Bid farewell to the laborious process of printing and scanning papers. With airSlate SignNow, you can effortlessly complete and sign documents online. Utilize the powerful features incorporated into this user-friendly and cost-effective platform and transform your approach to document management. Whether you need to approve forms or gather signatures, airSlate SignNow manages it all efficiently, needing just a few clicks.

Follow these comprehensive guidelines:

- Sign in to your account or sign up for a free trial with our service.

- Click +Create to upload a file from your device, cloud, or our form library.

- Open your ‘What Is The Difference Between A Conventional Fha And Va ’ in the editor.

- Click Me (Fill Out Now) to prepare the document on your end.

- Add and assign fillable fields for other parties (if needed).

- Proceed with the Send Invite settings to request eSignatures from others.

- Download, print your version, or convert it into a reusable template.

No need to worry if you need to collaborate with others on your What Is The Difference Between A Conventional Fha And Va or send it for notarization—our solution has everything you need to complete such tasks. Create an account with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

What is the difference between a Conventional, FHA, and VA loan?

The primary difference between a Conventional, FHA, and VA loan lies in their eligibility requirements and insurance. Conventional loans are not insured by the government and typically require higher credit scores. FHA loans are backed by the Federal Housing Administration and are designed for low-to-moderate-income borrowers, while VA loans are available to veterans and active-duty military members, offering favorable terms without a down payment.

-

What are the benefits of choosing an FHA loan over a Conventional loan?

Choosing an FHA loan can be beneficial for first-time homebuyers or those with lower credit scores, as it allows for a lower down payment and more flexible credit requirements. This makes it easier for individuals to qualify for a mortgage. Understanding what is the difference between a Conventional, FHA, and VA loan can help you make an informed decision based on your financial situation.

-

Are there any upfront costs associated with VA loans?

Yes, VA loans may have an upfront funding fee, which can vary based on the borrower's service history and down payment amount. However, this fee can often be rolled into the loan amount, making it easier for veterans to manage costs. Knowing what is the difference between a Conventional, FHA, and VA loan can help you assess the overall affordability of each option.

-

How do interest rates compare between Conventional, FHA, and VA loans?

Interest rates can vary signNowly between Conventional, FHA, and VA loans. Generally, FHA loans may have slightly higher rates due to their insurance costs, while VA loans often offer lower rates due to their government backing. Understanding what is the difference between a Conventional, FHA, and VA loan can help you choose the most cost-effective option for your mortgage.

-

What are the credit score requirements for each loan type?

Conventional loans typically require a credit score of at least 620, while FHA loans can be obtained with scores as low as 580, or even lower with a larger down payment. VA loans do not have a strict minimum credit score requirement, but lenders often prefer scores above 620. Knowing what is the difference between a Conventional, FHA, and VA loan can guide you in selecting the right loan based on your credit profile.

-

Can I refinance a Conventional, FHA, or VA loan?

Yes, all three loan types can be refinanced, but the processes and requirements may differ. FHA loans offer streamlined refinancing options, while VA loans provide a unique Interest Rate Reduction Refinance Loan (IRRRL) program. Understanding what is the difference between a Conventional, FHA, and VA loan can help you determine the best refinancing strategy for your needs.

-

What are the typical closing costs for each loan type?

Closing costs can vary widely depending on the loan type and lender, but FHA and VA loans often have lower closing costs compared to Conventional loans. FHA loans may include mortgage insurance premiums, while VA loans may have a funding fee. Knowing what is the difference between a Conventional, FHA, and VA loan can help you budget for these expenses effectively.

The best way to complete and sign your what is the difference between a conventional fha and va form

Find out other what is the difference between a conventional fha and va form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles