Sign Collateral Debenture

- Quick to start

- Easy-to-use

- 24/7 support

Simplified document journeys for small teams and individuals

We spread the word about digital transformation

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Top-notch document management with airSlate SignNow

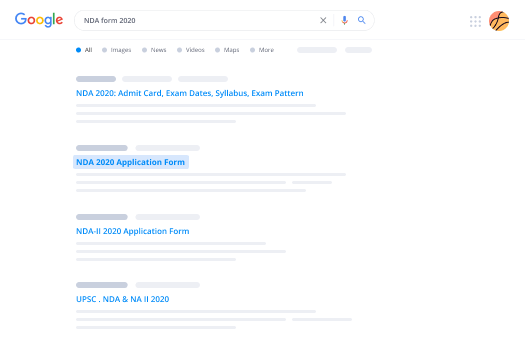

Gain access to a rich form catalog

Generate reusable templates

Collect signatures via secure links

Keep documents protected

Enhance collaboration

eSign by means of API integrations

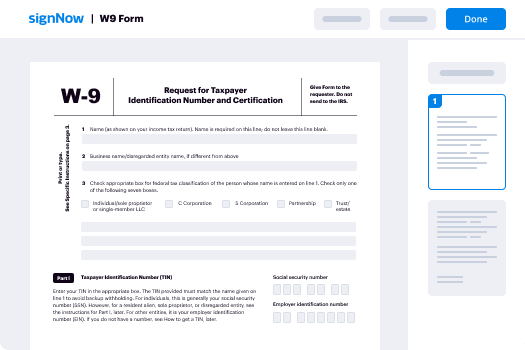

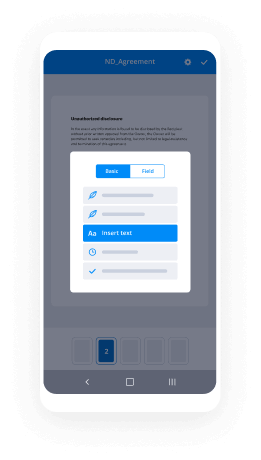

Quick guide on how to build, complete, and sign collateral debenture

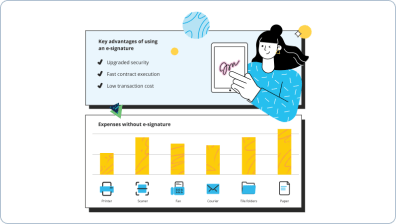

Think of all the paper that you waste to print collateral debenture, not counting the countless other documents that are dozens of pages long that your organization uses weekly. That's a lot of wasted paper. It directly correlates to wasted natural resources and, of course, as well as budget. With airSlate SignNow eSignature, you can go digital, decreasing waste and increasing productivity.

Follow the steps below to modify and indicator collateral debenture within minutes:

- Launch your browser and go to signnow.com.

- Join for a free trial run or log in using your email or Google/Facebook credentials.

- Click on User Avatar -> My Account at the top-right area of the page.

- Customize your User Profile by adding personal data and adjusting settings.

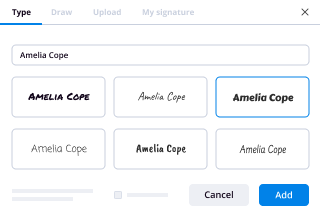

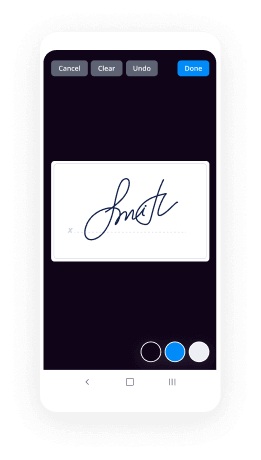

- Create and manage your Default Signature(s).

- Go back to the dashboard page.

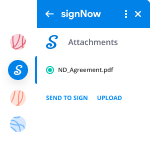

- Hover over the Upload and Create button and choose the needed option.

- Click the Prepare and Send button next to the document's name.

- Input the name and email address of all signers in the pop-up window that opens.

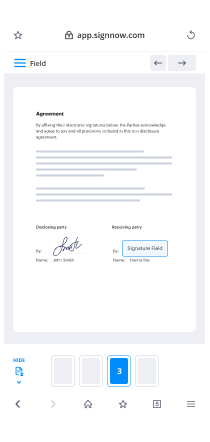

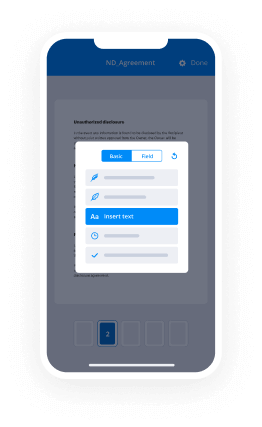

- Use the Start adding fields menu to begin to modify document and self sign them.

- Click SAVE AND INVITE when you're done.

- Continue to configure your eSignature workflow using advanced features.

It can't get any easier to sign a collateral debenture than that. If creating, editing, signing and tracking multiple templates and forms sounds like an administrative hassle for your business, give advanced eSignature by airSlate SignNow a try.

How it works

Rate your experience

What is the debenture suspense account

A debenture suspense account is a temporary holding account used in accounting to manage funds related to debentures that have not yet been allocated to a specific purpose. This account serves to track the proceeds from debentures until they are fully utilized or assigned to particular projects or investments. It ensures that financial records remain accurate while providing a clear overview of outstanding debenture transactions.

How to use the debenture suspense account

To effectively use a debenture suspense account, businesses should first identify the funds received from debenture issuances. These funds are recorded in the suspense account until they are designated for specific uses, such as investment in assets or repayment of liabilities. Regular monitoring of the account is essential to ensure timely allocation of funds and to maintain accurate financial reporting.

Steps to complete the debenture suspense account

Completing a debenture suspense account involves several key steps:

- Record the receipt of funds from debenture issuances in the suspense account.

- Determine the intended use of the funds, such as investments or debt repayment.

- Transfer the funds from the suspense account to the appropriate accounts once the purpose is established.

- Regularly review the suspense account to ensure all funds are allocated in a timely manner.

Legal use of the debenture suspense account

The legal use of a debenture suspense account varies by jurisdiction, but generally, it must comply with accounting standards and regulations. Companies must ensure that funds are appropriately documented and that any transfers from the suspense account are properly authorized. Maintaining transparency in the handling of these funds is crucial to avoid legal complications.

Security & Compliance Guidelines

When managing a debenture suspense account, it is important to adhere to security and compliance guidelines to protect sensitive financial information. This includes implementing robust access controls, using secure electronic signatures for transactions, and ensuring that all documentation is stored securely. Regular audits and compliance checks can help maintain the integrity of the account and safeguard against potential fraud.

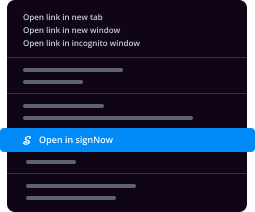

Sending & Signing Methods (Web / Mobile / App)

Users can complete and sign documents related to the debenture suspense account electronically using airSlate SignNow. This platform allows for seamless document management via web, mobile, or app interfaces. Users can fill out necessary forms, request signatures from relevant parties, and securely share completed documents, all while maintaining a clear digital audit trail.

Examples of using the debenture suspense account

Common examples of using a debenture suspense account include:

- Holding proceeds from a debenture issuance until a specific investment opportunity arises.

- Tracking funds that are awaiting allocation for debt repayment or other financial obligations.

- Managing temporary funds that may be used for operational expenses while awaiting finalization of a project.

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

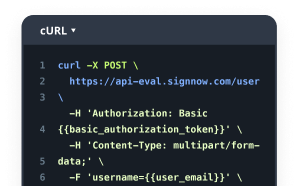

Intuitive UI and API. Sign and send documents from your apps in minutes.

FAQs

-

What is a debenture suspense account?

A debenture suspense account is a temporary holding account used to manage funds related to debentures until they are allocated to the appropriate accounts. This account helps in tracking and organizing financial transactions related to debentures, ensuring accurate financial reporting.

-

How does airSlate SignNow support debenture suspense account management?

airSlate SignNow provides tools that streamline the documentation process for managing a debenture suspense account. With our eSigning capabilities, you can quickly send and sign necessary documents, ensuring that all transactions related to the debenture suspense account are processed efficiently.

-

What are the pricing options for using airSlate SignNow for debenture suspense accounts?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our cost-effective solution allows you to manage your debenture suspense account without breaking the bank, ensuring you get the best value for your investment.

-

Can I integrate airSlate SignNow with my existing accounting software for debenture suspense accounts?

Yes, airSlate SignNow seamlessly integrates with various accounting software, making it easy to manage your debenture suspense account. This integration ensures that all your financial data is synchronized, allowing for accurate tracking and reporting.

-

What features does airSlate SignNow offer for managing debenture suspense accounts?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure eSigning, all of which enhance the management of your debenture suspense account. These features help streamline processes and improve overall efficiency.

-

How can airSlate SignNow improve the efficiency of my debenture suspense account processes?

By using airSlate SignNow, you can automate document workflows related to your debenture suspense account, reducing manual errors and saving time. Our platform simplifies the signing process, allowing for quicker approvals and better management of funds.

-

Is airSlate SignNow secure for handling sensitive information related to debenture suspense accounts?

Absolutely! airSlate SignNow employs advanced security measures to protect sensitive information related to your debenture suspense account. Our platform is compliant with industry standards, ensuring that your data remains safe and confidential.

Collateral debenture

Trusted eSignature solution - collateral debenture

Join over 28 million airSlate SignNow users

Get more for collateral debenture

- Start Your eSignature Journey: Google Docs online ...

- Start Your eSignature Journey: Google forms eSignature

- Start Your eSignature Journey: hand signature online

- Start Your eSignature Journey: HIPAA compliant ...

- Start Your eSignature Journey: how can I create an ...

- Start Your eSignature Journey: how can I do my ...

- Find All You Need to Know: how can I sign a PDF ...

- Find All You Need to Know: how can I sign a PDF online?

The ins and outs of eSignature