Sign Convertible Debenture

- Quick to start

- Easy-to-use

- 24/7 support

Simplified document journeys for small teams and individuals

We spread the word about digital transformation

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Superior form management with airSlate SignNow

Gain access to a rich form collection

Make reusable templates

Collect signatures through secure links

Keep paperwork safe

Improve collaboration

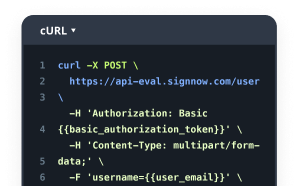

eSign via API integrations

Your complete how-to guide - convertible debenture

Nowadays, you probably won't find a company that doesn't use contemporary technological innovation to atomize workflow. An electronic signature is not the future, but the present. Modern day businesses with their turnover simply don't want to give up web-based programs that provide sophisticated data file processing automation tools, including Sign Convertible Debenture function.

How to deal with Sign Convertible Debenture airSlate SignNow function:

-

After you get to our internet site, Login or register your profile if you don't have one, it will require you a couple of seconds.

-

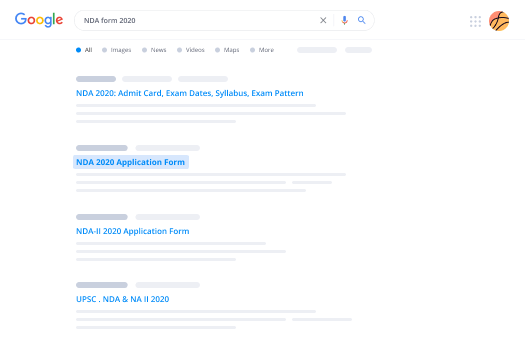

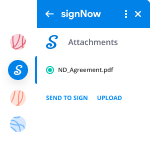

Upload the needed document or choose one from your library folders: Documents, Archive, Templates.

-

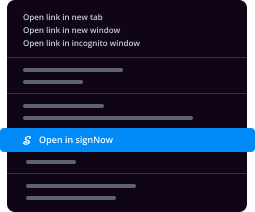

Due to the cloud-structured storage compatibility, you can quickly import the needed doc from preferred clouds with practically any device.

-

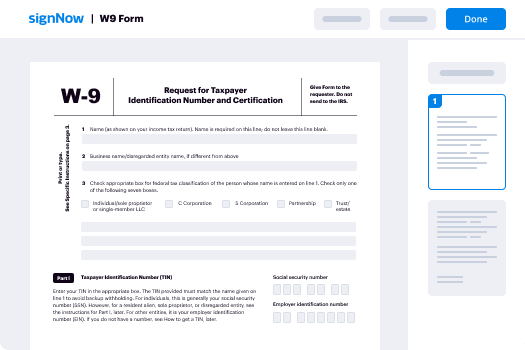

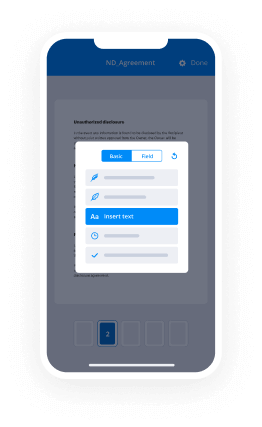

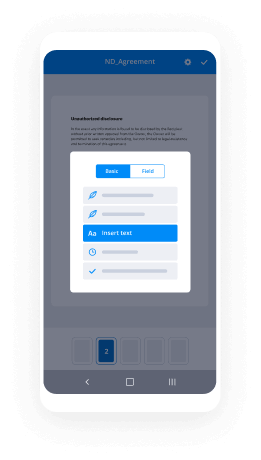

You'll discover your data document launched within the advanced PDF Editor where you can make changes prior to move forward.

-

Type text, place pictures, include annotations or fillable areas to be done further.

-

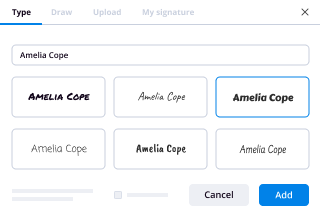

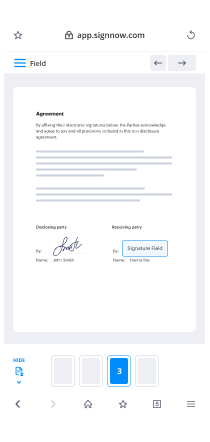

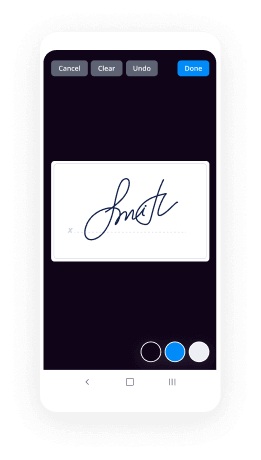

Use My Signature button for self-signing or include Signature Fields to send out the eSign require to one or multiple recipients.

-

Apply the DONE button when completed to go on with Sign Convertible Debenture function.

airSlate SignNow browser solution is vital to improve the effectiveness and performance of all operational procedures. Sign Convertible Debenture is one of the capabilities that will help. Utilizing the internet-based application today is actually a basic need, not just a competing edge. Try it out now!

How it works

Rate your experience

What is the convertible debenture template

A convertible debenture template is a standardized document used by companies to outline the terms of a convertible debenture, which is a type of debt security that can be converted into equity shares. This template typically includes essential details such as the principal amount, interest rate, conversion terms, and maturity date. By utilizing a convertible debenture template, businesses can ensure that all necessary legal and financial terms are clearly defined and agreed upon by all parties involved.

How to use the convertible debenture template

To use the convertible debenture template effectively, start by downloading the template from a trusted source. Carefully fill in the required fields with accurate information, including the names of the issuer and the investor, the amount of the debenture, and the specific terms of conversion. Once completed, the document can be sent electronically for signatures. Using airSlate SignNow, you can easily upload the filled template, add signature fields, and send it to relevant parties for eSignature. This streamlines the process, ensuring that all stakeholders can sign the document securely and efficiently.

Steps to complete the convertible debenture template

Completing the convertible debenture template involves several straightforward steps:

- Download the convertible debenture template from a reliable source.

- Open the template in your preferred document editor.

- Fill in the issuer's name and investor's details.

- Specify the principal amount and interest rate.

- Detail the conversion terms, including conversion price and conditions.

- Include the maturity date and any other relevant clauses.

- Review the document for accuracy and completeness.

After completing these steps, you can upload the document to airSlate SignNow for electronic signing.

Key elements of the convertible debenture template

The key elements of a convertible debenture template typically include:

- Principal amount: The total amount of money being borrowed.

- Interest rate: The rate at which interest will accrue on the debenture.

- Conversion terms: Conditions under which the debenture can be converted into equity.

- Maturity date: The date by which the principal must be repaid.

- Governing law: The legal jurisdiction that governs the agreement.

Including these elements ensures that the convertible debenture is clear and legally binding.

Legal use of the convertible debenture template

The legal use of a convertible debenture template requires adherence to federal and state laws governing securities. It is essential to ensure that the terms outlined in the template comply with the Securities Act and any applicable state regulations. This includes proper disclosures and filings with regulatory bodies. By using airSlate SignNow, businesses can maintain compliance by securely managing and storing signed documents, ensuring that all legal requirements are met during the electronic signing process.

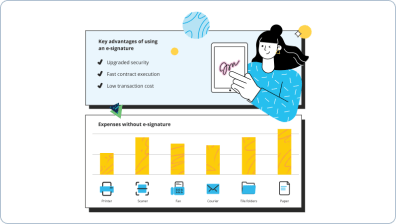

Digital vs. Paper-Based Signing

Digital signing of the convertible debenture template offers several advantages over traditional paper-based signing. Electronic signatures are legally recognized under the Electronic Signatures in Global and National Commerce (ESIGN) Act, making them valid and enforceable. Digital signing enhances efficiency by allowing documents to be signed from anywhere, reduces the risk of lost paperwork, and speeds up the overall process. Using airSlate SignNow, users can track the signing status in real-time, ensuring a smooth workflow.

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

Intuitive UI and API. Sign and send documents from your apps in minutes.

FAQs

-

What is a convertible debenture template?

A convertible debenture template is a standardized document that outlines the terms and conditions of a convertible debenture. This template helps businesses create legally binding agreements that can be easily customized to fit specific needs. Using a convertible debenture template streamlines the process of issuing debentures and ensures compliance with legal requirements.

-

How can I create a convertible debenture template using airSlate SignNow?

Creating a convertible debenture template with airSlate SignNow is simple and efficient. You can start by selecting a pre-designed template or create one from scratch using our intuitive editor. Once your template is ready, you can easily send it for eSignature, ensuring a quick turnaround for your agreements.

-

What are the benefits of using a convertible debenture template?

Using a convertible debenture template offers several benefits, including time savings and reduced legal costs. It provides a clear structure for your agreements, minimizing the risk of errors or omissions. Additionally, a well-crafted template can enhance your professional image and facilitate smoother negotiations with investors.

-

Is the convertible debenture template customizable?

Yes, the convertible debenture template is fully customizable to meet your specific requirements. You can modify terms, conditions, and clauses to align with your business needs. This flexibility ensures that your agreements accurately reflect the intentions of both parties involved.

-

What pricing options are available for airSlate SignNow's convertible debenture template?

airSlate SignNow offers competitive pricing plans that include access to the convertible debenture template. You can choose from various subscription tiers based on your business size and needs. Each plan provides essential features for document management and eSigning, ensuring you get the best value for your investment.

-

Can I integrate the convertible debenture template with other software?

Absolutely! airSlate SignNow allows seamless integration with various software applications, enhancing your workflow. You can connect your convertible debenture template with CRM systems, cloud storage, and other tools to streamline document management and eSigning processes.

-

How secure is the convertible debenture template when using airSlate SignNow?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and security protocols to protect your convertible debenture template and all associated documents. You can confidently send and store sensitive information, knowing that it is safeguarded against unauthorized access.

Convertible debenture

Trusted eSignature solution - convertible debenture

Join over 28 million airSlate SignNow users

Get more for convertible debenture

- Enjoy Flexible eSignature Workflows: how can I sign ...

- Enjoy Flexible eSignature Workflows: how can you sign ...

- Start Your eSignature Journey: how do I create an ...

- Start Your eSignature Journey: how do I do an online ...

- Start Your eSignature Journey: how do I get an online ...

- Find All You Need to Know: how do I sign a PDF document ...

- Start Your eSignature Journey: how do I sign a ...

- Enjoy Flexible eSignature Workflows: how do I sign ...

The ins and outs of eSignature