Sign Demand Note

- Quick to start

- Easy-to-use

- 24/7 support

Simplified document journeys for small teams and individuals

We spread the word about digital transformation

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Superior document management with airSlate SignNow

Get access to a robust form library

Create reusable templates

Collect signatures via links

Keep paperwork safe

Enhance collaboration

eSign through API integrations

Your complete how-to guide - demand note

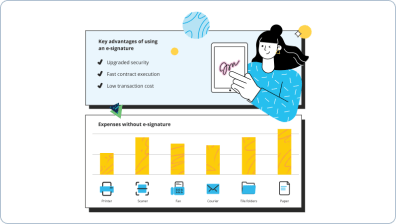

These days, it is likely you won't find an organization that doesn't use modern day technological innovation to atomize work-flow. A digital signature is not the future, but the present. Modern day organizations using their turnover simply cannot afford to quit browser software offering innovative document management automation tools, such as Sign Demand Note function.

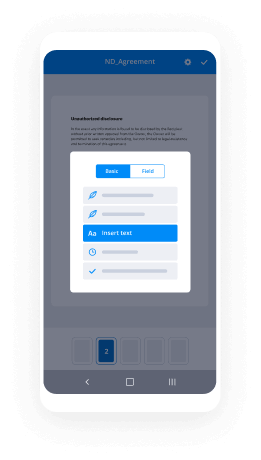

How to handle Sign Demand Note airSlate SignNow function:

-

After you enter our website, Login or create your account if you don't have one, it will require you a couple of seconds.

-

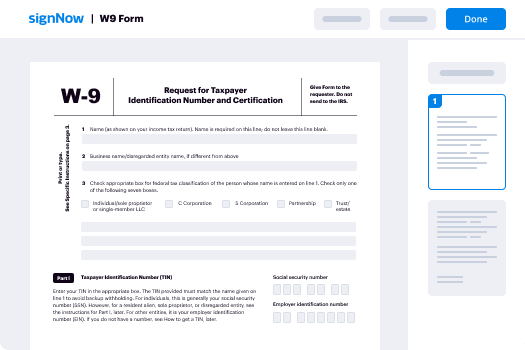

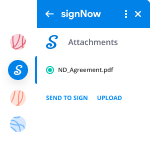

Upload the needed record or pick one from your catalogue folders: Documents, Archive, Templates.

-

As a result of cloud-based storage compatibility, you may quickly upload the needed doc from favored clouds with almost any device.

-

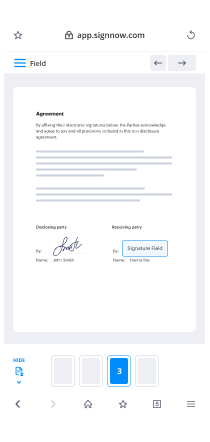

You'll get your data document opened within the up-to-date PDF Editor where you can include alterations prior to proceed.

-

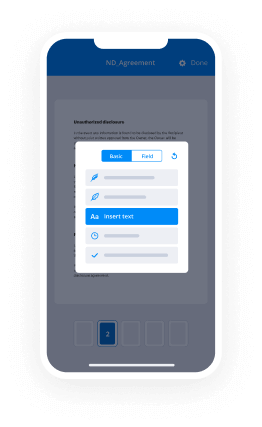

Type text, place images, add annotations or fillable areas to be completed further.

-

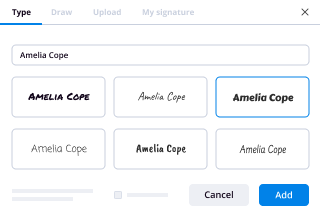

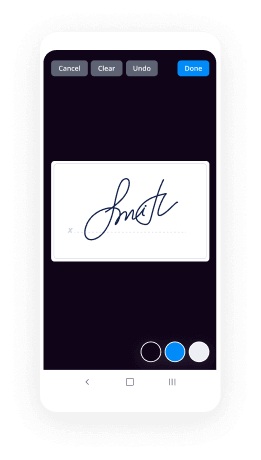

Use My Signature button for self-signing or place Signature Fields to send the signing request to one or multiple users.

-

Tap the DONE button when completed to go on with Sign Demand Note function.

airSlate SignNow web-based solution is vital to improve the effectiveness and performance of all working processes. Sign Demand Note is among the capabilities that will help. While using internet-based application nowadays is a basic need, not much of a competitive advantage. Try it out now!

How it works

Rate your experience

What is the gm demand notes

The gm demand notes are financial instruments that allow investors to deposit funds with a financial institution, typically offering a higher interest rate than traditional savings accounts. These notes are designed for individuals seeking liquidity while earning interest on their deposits. They are often issued by banks and can be redeemed upon request, making them a flexible investment option.

How to use the gm demand notes

Using gm demand notes involves a straightforward process. Investors can open an account with a bank that offers these notes, deposit funds, and begin earning interest. The notes can be accessed easily, allowing for quick withdrawals when needed. To manage these notes electronically, users can utilize platforms like airSlate SignNow to complete necessary documentation, request signatures, and securely store their agreements.

Steps to complete the gm demand notes

Completing gm demand notes electronically is efficient and user-friendly. Here are the steps to follow:

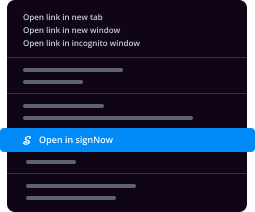

- Access the gm demand notes document through your airSlate SignNow account.

- Fill in the required fields, including personal information and investment details.

- Review the document to ensure accuracy.

- Send the document for eSignature to relevant parties, if needed.

- Once signed, save a copy of the completed document for your records.

Legal use of the gm demand notes

gm demand notes are legally binding agreements that require adherence to specific regulations. It is essential to understand the terms outlined in the notes, including interest rates and withdrawal conditions. By utilizing electronic signature platforms like airSlate SignNow, users can ensure that their agreements comply with legal standards, providing a secure and efficient way to manage their financial documents.

Security & Compliance Guidelines

When dealing with gm demand notes, security and compliance are paramount. Users should ensure that their electronic signatures are obtained through secure platforms that comply with industry regulations. airSlate SignNow offers robust security features, including encryption and secure storage, to protect sensitive information. Regular audits and compliance checks help maintain the integrity of the eSignature process.

Sending & Signing Methods (Web / Mobile / App)

gm demand notes can be sent and signed through various methods, including web browsers, mobile devices, and dedicated applications. Users can easily upload the document to airSlate SignNow, fill it out, and send it for signature from any device. This flexibility allows for quick transactions and enhances the overall user experience, ensuring that important financial agreements are managed efficiently.

Examples of using the gm demand notes

Investors commonly use gm demand notes for various purposes, such as saving for short-term goals or managing cash reserves. For example, a business may utilize these notes to hold funds temporarily while waiting for an investment opportunity. Individuals might also use them to earn interest on savings that they plan to access in the near future. The versatility of gm demand notes makes them a valuable tool for both personal and business finance.

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

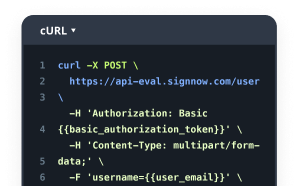

Intuitive UI and API. Sign and send documents from your apps in minutes.

FAQs

-

What is an ally demand note?

An ally demand note is a financial instrument that allows a lender to demand repayment from a borrower at any time. This type of note is often used in business transactions to ensure liquidity and flexibility. With airSlate SignNow, you can easily create and manage ally demand notes digitally.

-

How does airSlate SignNow help with ally demand notes?

airSlate SignNow streamlines the process of creating, sending, and eSigning ally demand notes. Our platform provides templates and tools that simplify document management, ensuring that your ally demand notes are legally binding and securely stored. This efficiency saves time and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for ally demand notes?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You can choose from monthly or annual subscriptions, with options that include features specifically designed for managing ally demand notes. Visit our pricing page for detailed information on the best plan for your needs.

-

Can I integrate airSlate SignNow with other software for ally demand notes?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow for ally demand notes. Whether you use CRM systems, cloud storage, or accounting software, our integrations ensure that your documents are easily accessible and manageable. This connectivity boosts productivity and collaboration.

-

What are the benefits of using airSlate SignNow for ally demand notes?

Using airSlate SignNow for ally demand notes offers numerous benefits, including increased efficiency, enhanced security, and reduced paper usage. Our platform allows for quick eSigning and tracking of documents, ensuring that you stay organized and compliant. Additionally, the user-friendly interface makes it easy for all parties involved.

-

Is airSlate SignNow secure for handling ally demand notes?

Absolutely! airSlate SignNow employs advanced security measures to protect your ally demand notes and sensitive information. We use encryption, secure cloud storage, and compliance with industry standards to ensure that your documents are safe from unauthorized access. You can trust us to keep your data secure.

-

How can I track the status of my ally demand notes in airSlate SignNow?

With airSlate SignNow, you can easily track the status of your ally demand notes in real-time. Our platform provides notifications and updates on document views, eSignatures, and completion status. This feature allows you to stay informed and manage your documents effectively.

Demand note

Trusted eSignature solution - demand note

Join over 28 million airSlate SignNow users

Get more for demand note

- Start Your eSignature Journey: eSignature company

- Start Your eSignature Journey: eSignature contracts

- Start Your eSignature Journey: eSignature cost

- Start Your eSignature Journey: eSignature designers

- Start Your eSignature Journey: eSignature example

- Start Your eSignature Journey: eSignature features

- Start Your eSignature Journey: eSignature free online

- Start Your eSignature Journey: eSignature legality

The ins and outs of eSignature