Start Your eSignature Journey: eSign for Banks

- Quick to start

- Easy-to-use

- 24/7 support

Simplified document journeys for small teams and individuals

We spread the word about digital transformation

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Quick guide on how to use eSign for banks feature

Is your organization ready to reduce inefficiencies by about three-quarters or higher? With airSlate SignNow eSignature, weeks of contract negotiation turn into days, and hours of signature gathering become minutes. You won't need to learn everything from the ground up thanks to the user-friendly interface and easy-to-follow instructions.

Complete the following steps below to use the eSign for banks functionality in minutes:

- Launch your web browser and visit signnow.com.

- Sign up for a free trial or log in utilizing your email or Google/Facebook credentials.

- Click User Avatar -> My Account at the top-right area of the page.

- Customize your User Profile by adding personal information and altering configurations.

- Make and manage your Default Signature(s).

- Go back to the dashboard page.

- Hover over the Upload and Create button and choose the appropriate option.

- Click the Prepare and Send key next to the document's name.

- Enter the name and email address of all signers in the pop-up screen that opens.

- Make use of the Start adding fields menu to proceed to edit document and self sign them.

- Click on SAVE AND INVITE when you're done.

- Continue to configure your eSignature workflow employing advanced features.

It can't be simpler to use the eSign for banks feature. It's accessible on your mobile devices as well. Install the airSlate SignNow application for iOS or Android and run your custom-made eSignature workflows even while on the go. Skip printing and scanning, time-consuming submitting, and expensive papers shipping.

How it works

Rate your experience

What is the esign for banks

The esign for banks refers to the electronic signature process specifically tailored for banking transactions and documents. This method allows customers and financial institutions to sign contracts, agreements, and forms digitally, streamlining operations and enhancing efficiency. With the rise of digital banking, the use of eSignatures has become essential for securely completing transactions while ensuring compliance with regulatory standards.

How to use the esign for banks

Using the esign for banks involves several straightforward steps. First, users can upload the required document to the airSlate SignNow platform. Once uploaded, fields can be added for signatures, dates, and other necessary information. After setting up the document, it can be sent to the relevant parties for their eSignatures. Recipients receive a notification and can easily sign the document from any device, ensuring a smooth and efficient process.

Steps to complete the esign for banks

Completing the esign for banks is a simple process that can be broken down into clear steps:

- Log into your airSlate SignNow account and select the document you need to eSign.

- Upload the document to the platform, ensuring it is in a compatible format.

- Add signature fields and any other required fields to the document.

- Send the document for signature to the appropriate parties.

- Once all signatures are collected, the completed document is securely stored and can be downloaded or shared as needed.

Legal use of the esign for banks

The legal use of the esign for banks is governed by the Electronic Signatures in Global and National Commerce (ESIGN) Act, which establishes the validity of electronic signatures in the United States. This legislation affirms that eSignatures hold the same legal weight as traditional handwritten signatures, provided that all parties consent to use electronic means for signing. Banks must ensure compliance with these regulations to maintain the integrity of their electronic transactions.

Security & Compliance Guidelines

When using the esign for banks, security and compliance are paramount. Banks should implement robust security measures, such as encryption and secure access controls, to protect sensitive information. Compliance with regulations, including the Gramm-Leach-Bliley Act and the General Data Protection Regulation (GDPR), is essential to safeguard customer data. Regular audits and updates to security protocols help maintain a secure eSignature environment.

Examples of using the esign for banks

There are numerous applications for the esign for banks, including:

- Loan agreements: Customers can eSign loan documents quickly, reducing processing time.

- Account openings: New customers can complete and sign account applications online.

- Compliance documents: Financial institutions can send compliance forms for eSignature to ensure regulatory adherence.

Documents You Can Sign

With the esign for banks, a variety of documents can be signed electronically, including:

- Loan applications

- Account opening forms

- Service agreements

- Disclosure statements

- Compliance documents

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

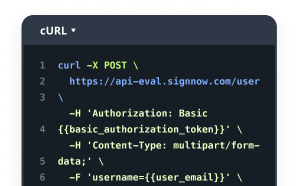

Intuitive UI and API. Sign and send documents from your apps in minutes.

FAQs

-

What is esign for banks and how does it work?

Esign for banks refers to the electronic signature solutions specifically designed for the banking sector. It allows banks to securely send, sign, and manage documents online, streamlining the process and enhancing customer experience. With airSlate SignNow, banks can ensure compliance and security while reducing paperwork.

-

What are the key features of airSlate SignNow for banks?

AirSlate SignNow offers a range of features tailored for esign for banks, including customizable templates, secure document storage, and real-time tracking of signatures. Additionally, it supports multiple file formats and integrates seamlessly with existing banking systems, making it a versatile choice for financial institutions.

-

How does airSlate SignNow ensure the security of documents?

Security is paramount in esign for banks, and airSlate SignNow employs advanced encryption protocols to protect sensitive information. The platform also includes features like two-factor authentication and audit trails, ensuring that all transactions are secure and compliant with industry regulations.

-

What are the benefits of using esign for banks?

Using esign for banks signNowly reduces the time and costs associated with traditional paper-based processes. It enhances customer satisfaction by allowing clients to sign documents from anywhere, at any time. Additionally, it helps banks improve operational efficiency and reduce their environmental footprint.

-

Is airSlate SignNow cost-effective for banks?

Yes, airSlate SignNow is designed to be a cost-effective solution for banks looking to implement esign capabilities. With flexible pricing plans, banks can choose a package that fits their needs without compromising on features. This affordability makes it accessible for institutions of all sizes.

-

Can airSlate SignNow integrate with other banking software?

Absolutely! AirSlate SignNow offers robust integrations with various banking software and CRM systems, making it easy to incorporate esign for banks into existing workflows. This seamless integration helps banks maintain efficiency and ensures a smooth transition to digital processes.

-

How can airSlate SignNow improve customer experience for banks?

By implementing esign for banks through airSlate SignNow, financial institutions can provide a faster and more convenient signing experience for their customers. Clients can complete transactions online without the need for physical visits, leading to higher satisfaction and retention rates.