Enjoy Flexible eSignature Workflows: eSign Loan Documents

- Quick to start

- Easy-to-use

- 24/7 support

Simplified document journeys for small teams and individuals

We spread the word about digital transformation

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

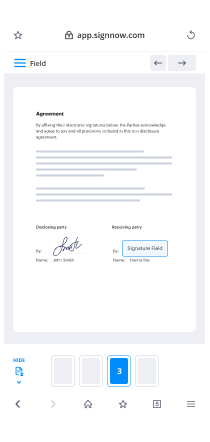

Quick-start guide on how to eSign loan documents

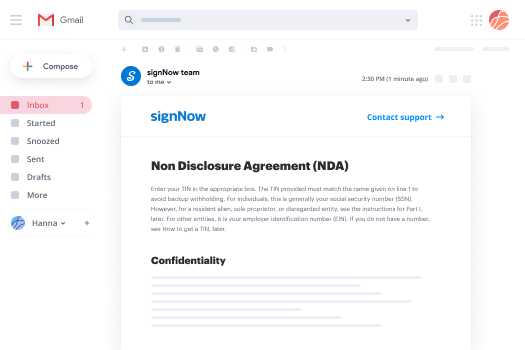

Every business needs signatures, and every business is looking to enhance the procedure of gathering them. Get professional document management with airSlate SignNow. You can eSign loan documents, build fillable templates, set up eSignature invites, send out signing links, work together in teams, and a lot more. Figure out how to streamline the collecting of signatures digitally.

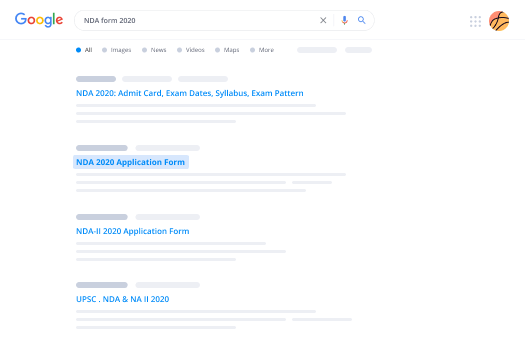

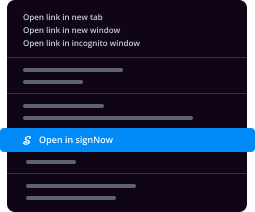

Follow the steps listed below to eSign loan documents in minutes:

- Launch your browser and go to signnow.com.

- Sign up for a free trial run or log in with your email or Google/Facebook credentials.

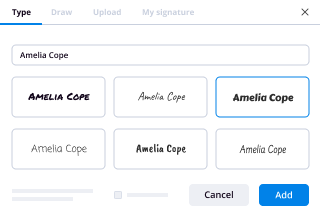

- Click on User Avatar -> My Account at the top-right area of the page.

- Personalize your User Profile by adding personal data and adjusting configurations.

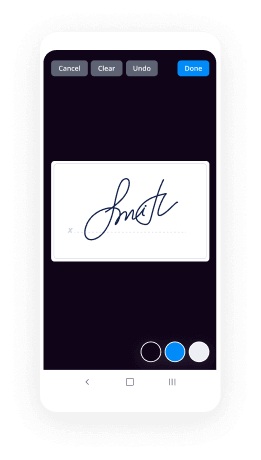

- Make and manage your Default Signature(s).

- Return to the dashboard page.

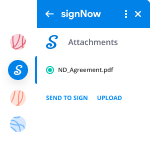

- Hover over the Upload and Create button and select the needed option.

- Click the Prepare and Send button next to the document's title.

- Type the email address and name of all signers in the pop-up window that opens.

- Use the Start adding fields menu to proceed to modify document and self sign them.

- Click on SAVE AND INVITE when completed.

- Continue to customize your eSignature workflow using extra features.

It couldn't be easier to eSign loan documents than that. Also, you can install the free airSlate SignNow application to the mobile phone and gain access to your account wherever you happen to be without being tied to your computer or workplace. Go digital and begin signing documents online.

How it works

Rate your experience

What is the esign loan documents

The esign loan documents are digital versions of traditional loan agreements that allow users to complete, sign, and manage their loan transactions electronically. These documents are designed to facilitate the borrowing process by providing a secure and efficient way to handle necessary paperwork. By using electronic signatures, borrowers can streamline their interactions with lenders, reducing the time and effort required to finalize loan agreements.

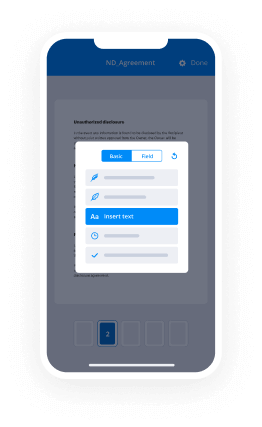

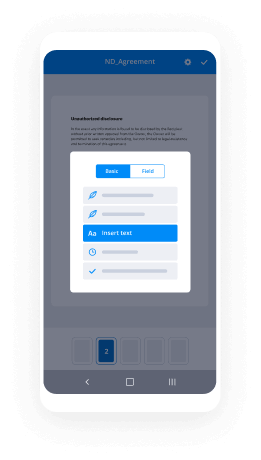

How to use the esign loan documents

To use the esign loan documents, begin by accessing the document through airSlate SignNow. Users can fill out the required fields directly within the document interface. Once completed, the document can be sent for signature to all necessary parties. Recipients will receive an email notification prompting them to review and sign the document electronically. This process eliminates the need for printing, scanning, or mailing physical copies, making it a convenient option for all involved.

Steps to complete the esign loan documents

Completing the esign loan documents involves several straightforward steps:

- Access the document through airSlate SignNow and log in to your account.

- Fill in the required information, such as loan amount, borrower details, and terms.

- Review the document for accuracy before sending it for signature.

- Click on the option to send the document for signature to the relevant parties.

- Monitor the signing process through your airSlate SignNow dashboard to ensure all parties have signed.

- Once all signatures are obtained, securely store the completed document for your records.

Legal use of the esign loan documents

The esign loan documents are legally binding under the Electronic Signatures in Global and National Commerce (ESIGN) Act, which grants electronic signatures the same legal standing as handwritten signatures in the United States. This means that as long as all parties consent to the use of electronic signatures and the process complies with applicable laws, the esign loan documents can be used effectively in legal transactions.

Security & Compliance Guidelines

When using esign loan documents, security and compliance are paramount. airSlate SignNow employs advanced encryption methods to protect sensitive information during transmission and storage. Users should ensure that they are following best practices, such as using strong passwords and enabling two-factor authentication. Additionally, it is important to maintain compliance with relevant regulations, including the Gramm-Leach-Bliley Act, which governs the protection of personal financial information.

Examples of using the esign loan documents

Common scenarios for using esign loan documents include:

- Personal loans, where individuals can quickly sign agreements without the need for in-person meetings.

- Mortgage agreements, allowing homebuyers to finalize their loans efficiently.

- Business loans, where entrepreneurs can expedite funding by electronically signing required documents.

Timeframes & Processing Delays

Timeframes for processing esign loan documents can vary based on several factors, including the number of signers and their responsiveness. Typically, once the document is sent for signature, it can be signed within minutes. However, delays may occur if recipients take longer to review or sign the document. To minimize processing delays, it is helpful to communicate with all parties involved and ensure they are aware of the signing process.

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

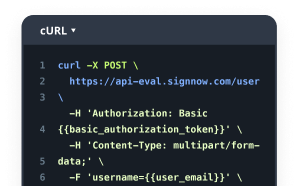

Intuitive UI and API. Sign and send documents from your apps in minutes.

FAQs

-

What are the benefits of using airSlate SignNow to esign loan documents?

Using airSlate SignNow to esign loan documents streamlines the signing process, making it faster and more efficient. It eliminates the need for physical paperwork, allowing you to complete transactions from anywhere. Additionally, it enhances security with encrypted signatures, ensuring your sensitive information remains protected.

-

How does airSlate SignNow ensure the security of esigned loan documents?

airSlate SignNow employs advanced encryption and secure cloud storage to protect your esigned loan documents. Each signature is legally binding and complies with e-signature laws, ensuring that your documents are safe and valid. This level of security gives you peace of mind when handling sensitive financial information.

-

Can I integrate airSlate SignNow with other software for managing loan documents?

Yes, airSlate SignNow offers seamless integrations with various software platforms, including CRM systems and document management tools. This allows you to esign loan documents directly within your existing workflows, enhancing productivity and reducing the time spent on administrative tasks. Integration options make it easy to customize your document management process.

-

What is the pricing structure for airSlate SignNow when esigning loan documents?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. You can choose from monthly or annual subscriptions, with options that include features specifically designed for esigning loan documents. This cost-effective solution ensures you only pay for the features you need.

-

Is it easy to use airSlate SignNow for esigning loan documents?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to esign loan documents without extensive training. The intuitive interface guides you through the signing process, allowing you to send and receive documents quickly and efficiently.

-

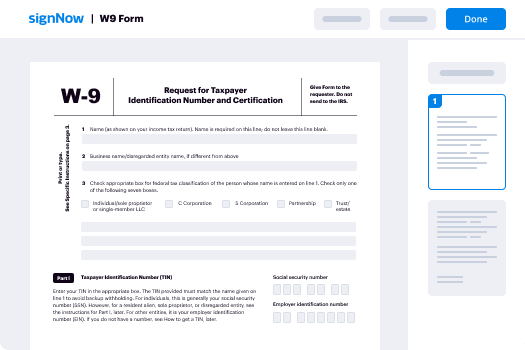

What types of loan documents can I esign using airSlate SignNow?

You can esign a variety of loan documents using airSlate SignNow, including mortgage agreements, personal loan contracts, and business loan applications. The platform supports multiple document formats, ensuring you can handle all your loan-related paperwork digitally. This versatility makes it an ideal solution for financial institutions and borrowers alike.

-

How does airSlate SignNow improve the efficiency of loan processing?

By allowing users to esign loan documents electronically, airSlate SignNow signNowly reduces the time required for document turnaround. This efficiency leads to faster loan approvals and enhances customer satisfaction. The automated reminders and tracking features also help keep the process on schedule.

Ways to eSign loan documents with airSlate SignNow

Join over 28 million airSlate SignNow users

Get more for esign loan documents

- Explore Your Digital Signature – Questions Answered: ...

- Explore Your Digital Signature – Questions Answered: ...

- Start Your eSignature Journey: W-9 form online ...

- Explore Your Digital Signature – Questions Answered: ...

- Find All You Need to Know: add eSign to PDF

- Unlock the Power of eSignature: best eSign software

- Start Your eSignature Journey: capture signature online

- Start Your eSignature Journey: create an electronic ...