Sign Exchange of Shares Agreement

- Quick to start

- Easy-to-use

- 24/7 support

Simplified document journeys for small teams and individuals

We spread the word about digital transformation

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Excellent document management with airSlate SignNow

Get access to a rich form collection

Generate reusable templates

Collect signatures through secure links

Keep documents protected

Enhance collaboration

eSign via API integrations

Quick guide on how to create, complete, and sign exchange of shares agreement

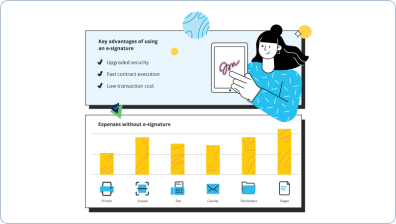

Think of all the paper that you waste to print exchange of shares agreement, not counting the countless other documents that are dozens of pages long that your organization uses weekly. That's a lot of wasted paper. It directly correlates to wasted natural resources and, of course, as well as spending budget. With airSlate SignNow eSignature, you can go paperless, reducing waste and improving productivity.

Follow the steps below to revise and indication exchange of shares agreement in minutes:

- Open your web browser and visit signnow.com.

- Subscribe for a free trial or log in with your email or Google/Facebook credentials.

- Click User Avatar -> My Account at the top-right corner of the page.

- Personalize your User Profile by adding personal information and altering settings.

- Design and manage your Default Signature(s).

- Get back to the dashboard page.

- Hover over the Upload and Create button and select the needed option.

- Click the Prepare and Send key next to the document's name.

- Input the email address and name of all signers in the pop-up box that opens.

- Use the Start adding fields option to begin to edit document and self sign them.

- Click SAVE AND INVITE when completed.

- Continue to configure your eSignature workflow employing more features.

It can't get any easier to sign a exchange of shares agreement than that. If creating, editing, signing and tracking numerous documents and forms sounds like an administrative burden for your teams, give advanced eSignature by airSlate SignNow a try.

How it works

Rate your experience

What is the shares agreement template

A shares agreement template is a legal document that outlines the terms and conditions under which shares are bought, sold, or transferred between parties. This template is essential for businesses and individuals engaging in stock transactions, ensuring clarity and compliance with relevant laws. It typically includes details such as the number of shares involved, the price per share, and the rights and obligations of each party. By using a shares agreement template, parties can streamline their transactions and reduce the risk of misunderstandings.

How to use the shares agreement template

Using a shares agreement template involves filling out the necessary information specific to the transaction. Users can easily access the template through airSlate SignNow, where they can fill in details such as the names of the parties involved, share quantities, and any special conditions. Once the template is completed, it can be sent for electronic signature. This process simplifies the signing experience, allowing all parties to sign the document securely from anywhere, whether on a computer or mobile device.

Steps to complete the shares agreement template

Completing the shares agreement template is straightforward when using airSlate SignNow. Here are the steps to follow:

- Access the shares agreement template on airSlate SignNow.

- Fill in the required fields, including party names, share details, and transaction terms.

- Review the document for accuracy to ensure all information is correct.

- Click on the option to send for signature, entering the email addresses of all parties involved.

- Each party will receive an email notification to review and eSign the document.

- Once all signatures are collected, the completed shares agreement will be securely stored in your airSlate SignNow account.

Key elements of the shares agreement template

Several key elements are typically included in a shares agreement template to ensure it serves its purpose effectively. These elements include:

- Parties involved: Names and contact information of all parties participating in the agreement.

- Share details: Number of shares being transferred, their class, and any associated rights.

- Purchase price: The agreed-upon price per share and total transaction value.

- Closing date: The date when the transaction will be finalized.

- Representations and warranties: Statements made by each party regarding their authority and the shares being transferred.

Legal use of the shares agreement template

The shares agreement template is legally binding when properly filled out and signed by all parties. It is important to ensure that the template complies with state laws and regulations governing share transactions. By utilizing airSlate SignNow's electronic signature capabilities, users can maintain the legal integrity of the document while benefiting from a streamlined process. This electronic format is recognized by courts and regulatory bodies, ensuring that the agreement holds up under scrutiny.

Security & Compliance Guidelines

When using the shares agreement template through airSlate SignNow, security and compliance are paramount. The platform employs advanced encryption methods to protect sensitive information during transmission and storage. Users should ensure that they comply with relevant regulations, such as the Electronic Signatures in Global and National Commerce (ESIGN) Act, which validates electronic signatures in the United States. Adhering to these guidelines helps maintain the integrity of the shares agreement and protects the interests of all parties involved.

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

Intuitive UI and API. Sign and send documents from your apps in minutes.

FAQs

-

What is a shares agreement template?

A shares agreement template is a legal document that outlines the terms and conditions of a shareholding arrangement between parties. It typically includes details such as the number of shares, ownership rights, and responsibilities of each party. Using a shares agreement template can help ensure clarity and prevent disputes in business transactions.

-

How can I create a shares agreement template using airSlate SignNow?

Creating a shares agreement template with airSlate SignNow is simple and efficient. You can start by selecting a pre-designed template or create your own from scratch. The platform allows you to customize the document to fit your specific needs, ensuring that all necessary details are included.

-

What are the benefits of using a shares agreement template?

Using a shares agreement template streamlines the process of drafting legal documents, saving you time and reducing errors. It ensures that all essential elements are covered, providing peace of mind for all parties involved. Additionally, it can enhance professionalism and credibility in business dealings.

-

Is there a cost associated with using the shares agreement template on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that include access to shares agreement templates. The cost varies based on the features and level of service you choose. However, the platform is designed to be cost-effective, providing excellent value for businesses looking to manage their documents efficiently.

-

Can I integrate the shares agreement template with other software?

Absolutely! airSlate SignNow supports integrations with various software applications, allowing you to streamline your workflow. You can easily connect your shares agreement template with CRM systems, cloud storage, and other tools to enhance productivity and collaboration.

-

How secure is my data when using the shares agreement template on airSlate SignNow?

Security is a top priority for airSlate SignNow. When using the shares agreement template, your data is protected with advanced encryption and secure storage solutions. This ensures that your sensitive information remains confidential and safe from unauthorized access.

-

Can I customize the shares agreement template to fit my business needs?

Yes, the shares agreement template on airSlate SignNow is fully customizable. You can modify sections, add specific clauses, and tailor the document to meet your unique business requirements. This flexibility allows you to create a shares agreement that accurately reflects your intentions.

Exchange of shares agreement

Trusted eSignature solution - exchange of shares agreement

Join over 28 million airSlate SignNow users

Get more for exchange of shares agreement

- Unlock the Power of eSignature: free online handwritten ...

- Unlock the Power of eSignature: free online HTML ...

- Find All You Need to Know: free online PDF editor ...

- Find All You Need to Know: free online PDF fill and ...

- Find All You Need to Know: free online PDF sign and ...

- Start Your eSignature Journey: free online signature

- Start Your eSignature Journey: free online signature ...

- Start Your eSignature Journey: free online signature ...

The ins and outs of eSignature