Start Your eSignature Journey: IRS eSignature

- Quick to start

- Easy-to-use

- 24/7 support

Simplified document journeys for small teams and individuals

We spread the word about digital transformation

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Quick guide on how to use IRS eSignature feature

Is your organization willing to decrease inefficiencies by three-quarters or more? With airSlate SignNow eSignature, weeks of contract approval turn into days, and hours of signature gathering become minutes. You won't need to learn everything from the ground up due to the clear interface and step-by-step guides.

Take the following steps listed below to use the IRS eSignature functionality in minutes:

- Open your browser and go to signnow.com.

- Sign up for a free trial or log in utilizing your electronic mail or Google/Facebook credentials.

- Select User Avatar -> My Account at the top-right area of the page.

- Modify your User Profile with your personal data and adjusting configurations.

- Design and manage your Default Signature(s).

- Return to the dashboard page.

- Hover over the Upload and Create button and choose the appropriate option.

- Click on the Prepare and Send button next to the document's title.

- Type the name and email address of all signers in the pop-up box that opens.

- Use the Start adding fields menu to begin to edit file and self sign them.

- Click SAVE AND INVITE when you're done.

- Continue to configure your eSignature workflow employing more features.

It can't get any simpler to use the IRS eSignature feature. It's available on your mobile phones as well. Install the airSlate SignNow application for iOS or Android and run your custom eSignature workflows even when on the move. Forget printing and scanning, time-consuming filing, and expensive papers shipping.

How it works

Rate your experience

What is the IRS eSignature Requirements

The IRS eSignature requirements refer to the guidelines and standards set by the Internal Revenue Service for electronically signing tax documents. These requirements ensure that electronic signatures are legally binding and secure, allowing taxpayers and professionals to submit forms electronically without the need for physical signatures. The IRS recognizes eSignatures as valid under specific conditions, which include the use of secure methods that authenticate the signer's identity and maintain the integrity of the document.

How to Use the IRS eSignature Requirements

To use the IRS eSignature requirements effectively, individuals and businesses must follow a few key steps. First, ensure that the eSignature solution complies with IRS guidelines. This includes using a platform that provides secure authentication methods, such as multi-factor authentication or unique PINs. Next, prepare the necessary tax documents for eSigning. With airSlate SignNow, users can easily upload their forms, fill them out, and send them for signature. Once all parties have signed, the completed document can be securely stored or shared as needed.

Steps to Complete the IRS eSignature Requirements

Completing the IRS eSignature requirements involves several straightforward steps:

- Choose a compliant eSignature platform, such as airSlate SignNow.

- Upload the tax document that requires an eSignature.

- Fill out the document as necessary, ensuring all required fields are completed.

- Send the document for signature to the relevant parties.

- Once signed, download and securely store the completed document.

By following these steps, users can ensure their electronic signatures meet IRS standards and facilitate efficient tax filing.

Legal Use of the IRS eSignature Requirements

The legal use of IRS eSignature requirements is grounded in federal law, which recognizes electronic signatures as equivalent to handwritten signatures when certain conditions are met. The eSignature must be unique to the signer, created using a secure method, and linked to the signed document in a way that prevents alteration. This legal framework allows taxpayers to submit forms electronically while maintaining compliance with IRS regulations.

Security & Compliance Guidelines

Security and compliance are critical when using eSignatures for IRS documents. Users should ensure that the eSignature platform employs robust security measures, such as encryption and secure data storage. Compliance with the IRS eSignature requirements also necessitates proper authentication of signers, which may include verifying identity through secure methods. Regular audits and adherence to best practices in electronic document management further enhance security and compliance.

Examples of Using the IRS eSignature Requirements

Examples of using the IRS eSignature requirements include filing tax returns, submitting forms like the 4506-T for tax transcripts, and signing agreements related to tax matters. Businesses can streamline their tax processes by utilizing eSignatures for documents that require multiple signatures, reducing the time and effort needed to gather physical signatures. With airSlate SignNow, users can manage these documents efficiently, ensuring compliance with IRS standards.

Timeframes & Processing Delays

Timeframes for processing IRS documents with eSignatures can vary based on the complexity of the form and the number of signatures required. Generally, eSigned documents are processed more quickly than their paper counterparts, as they eliminate the need for mailing and physical handling. However, users should account for potential delays if additional information is needed or if there are issues with the eSignature verification process. Planning ahead and allowing sufficient time for processing can help mitigate any delays.

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

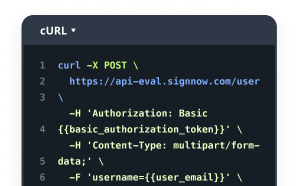

Intuitive UI and API. Sign and send documents from your apps in minutes.

FAQs

-

What are the IRS e signature requirements for tax documents?

The IRS e signature requirements state that electronic signatures must be created using a secure method that ensures the signer's identity. This includes using a unique PIN or password, and the signature must be linked to the document in a way that prevents alteration. airSlate SignNow complies with these requirements, making it easy for businesses to eSign tax documents securely.

-

How does airSlate SignNow meet IRS e signature requirements?

airSlate SignNow meets IRS e signature requirements by providing a secure platform that ensures the authenticity and integrity of electronic signatures. Our solution uses advanced encryption and authentication methods to verify the identity of signers. This guarantees that your documents are compliant with IRS regulations.

-

Are there any costs associated with using airSlate SignNow for IRS e signature requirements?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are cost-effective and designed to provide value while ensuring compliance with IRS e signature requirements. You can choose a plan that fits your budget and usage needs.

-

What features does airSlate SignNow offer to help with IRS e signature requirements?

airSlate SignNow offers features such as secure document storage, customizable templates, and audit trails that help meet IRS e signature requirements. These features ensure that your documents are not only signed electronically but also stored securely and tracked for compliance purposes.

-

Can I integrate airSlate SignNow with other software to meet IRS e signature requirements?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to streamline your workflow while meeting IRS e signature requirements. Whether you use CRM systems, accounting software, or other tools, our integrations enhance efficiency and compliance.

-

What benefits does airSlate SignNow provide for businesses regarding IRS e signature requirements?

Using airSlate SignNow provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. By meeting IRS e signature requirements, businesses can ensure compliance while speeding up the signing process, ultimately improving customer satisfaction and operational productivity.

-

Is airSlate SignNow suitable for small businesses regarding IRS e signature requirements?

Yes, airSlate SignNow is an excellent choice for small businesses looking to comply with IRS e signature requirements. Our user-friendly platform is designed to be cost-effective and easy to use, making it accessible for businesses of all sizes to manage their electronic signatures efficiently.