Mortgage Brokers Get Paid Faster with eSignatures

- Quick to start

- Easy-to-use

- 24/7 support

Simplified document journeys for small teams and individuals

We spread the word about digital transformation

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Get the most from your eSignatures with airSlate SignNow

Speed up work with documents

Revise samples securely

Share files

Employ Mortgage brokers get paid faster with esignatures

Integrate eSignatures via API

Build straightforward workflows

Your complete how-to guide - mortgage brokers get paid faster with esignatures

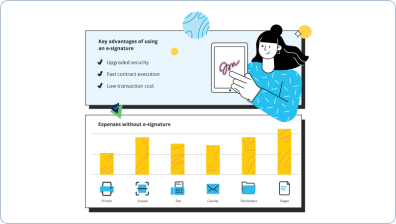

Nowadays, it is likely you won't find an organization that doesn't use modern technological innovation to atomize workflow. An electronic signature is not the future, but the present. Present day companies with their turnover simply don't want to quit on-line software offering superior data file management automation tools, such as Mortgage brokers get paid faster with eSignatures option.

How to manage Mortgage brokers get paid faster with eSignatures airSlate SignNow function:

-

After you enter our internet site, Login or make your account if you don't have one, it will require you a couple of seconds.

-

Upload the needed data file or choose one from your catalogue folders: Documents, Archive, Templates.

-

As a result of cloud-structured storage compatibility, you can quickly upload the needed doc from preferred clouds with virtually any gadget.

-

You'll get your data file launched within the up-to-date PDF Editor where you can add adjustments prior to continue.

-

Type text, put in graphics, include annotations or fillable boxes to be completed further.

-

Use My Signature button for self-signing or add Signature Fields to email the signing require to a single or multiple recipients.

-

Apply the DONE button when finished to continue with Mortgage brokers get paid faster with eSignatures function.

airSlate SignNow web-based platform is vital to boost the efficiency and performance of all working processes. Mortgage brokers get paid faster with eSignatures is among the capabilities that can help. Utilizing the internet-based application today is actually a basic need, not just a competitive advantage. Try it now!

How it works

Rate your experience

What is the esign service for brokerages

The esign service for brokerages is a digital solution that enables mortgage brokers to efficiently manage the signing of documents electronically. This service allows users to send, receive, and store eSigned documents securely, streamlining the workflow for mortgage transactions. By utilizing electronic signatures, brokerages can enhance their operational efficiency, reduce paperwork, and improve client satisfaction.

How to use the esign service for brokerages

Using the esign service for brokerages involves several straightforward steps. First, users can create or upload the necessary documents, such as mortgage applications or disclosures, to the airSlate SignNow platform. Next, they can specify the recipients who need to sign the documents. Once the documents are prepared, users can send them for signature via email or through a secure link. Recipients can then review, fill out, and sign the documents electronically, ensuring a smooth and fast process.

Steps to complete the esign service for brokerages

To complete the esign service for brokerages, follow these steps:

- Log into your airSlate SignNow account.

- Create a new document or upload an existing one.

- Specify the fields that need to be filled out or signed.

- Add the email addresses of the signers.

- Send the document for signature.

- Monitor the signing process through your dashboard.

- Receive the completed document once all parties have signed.

Legal use of the esign service for brokerages

The legal use of the esign service for brokerages is governed by the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These laws establish the validity of electronic signatures and ensure that eSigned documents hold the same legal weight as traditional handwritten signatures. It is essential for brokerages to comply with these regulations to ensure the enforceability of their electronic agreements.

Security & Compliance Guidelines

Security and compliance are critical when using the esign service for brokerages. airSlate SignNow employs advanced encryption methods to protect sensitive information during transmission and storage. Additionally, the platform adheres to industry standards and regulations to ensure compliance with federal and state laws. Users should implement best practices, such as enabling two-factor authentication and regularly reviewing access permissions, to further enhance document security.

Documents You Can Sign

Brokerages can use the esign service to sign a variety of documents, including:

- Mortgage applications

- Loan disclosures

- Broker agreements

- Client consent forms

- Closing documents

This flexibility allows brokerages to streamline their processes and ensure that all necessary documentation is completed efficiently.

Sending & Signing Methods (Web / Mobile / App)

The esign service for brokerages offers multiple methods for sending and signing documents. Users can access the platform via web browsers, mobile devices, or dedicated applications. This versatility ensures that documents can be signed anytime and anywhere, accommodating the busy schedules of mortgage brokers and their clients. The user-friendly interface simplifies the process, making it easy to manage documents on the go.

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

Intuitive UI and API. Sign and send documents from your apps in minutes.

FAQs

-

What is an esign service for brokerages?

An esign service for brokerages is a digital solution that allows real estate professionals to send, sign, and manage documents electronically. This service streamlines the transaction process, making it faster and more efficient. With airSlate SignNow, brokerages can enhance their workflow and improve client satisfaction.

-

How does airSlate SignNow's esign service for brokerages work?

airSlate SignNow's esign service for brokerages enables users to upload documents, add signature fields, and send them to clients for signing. Clients can sign documents from any device, ensuring a seamless experience. The platform also provides tracking and notifications, so you always know the status of your documents.

-

What are the key features of the esign service for brokerages?

Key features of the esign service for brokerages include customizable templates, secure document storage, and real-time tracking. Additionally, airSlate SignNow offers integrations with popular CRM systems, making it easy to incorporate into your existing workflow. These features help brokerages save time and reduce paperwork.

-

Is the esign service for brokerages cost-effective?

Yes, airSlate SignNow's esign service for brokerages is designed to be cost-effective, offering various pricing plans to suit different business needs. By reducing the time spent on paperwork and improving efficiency, brokerages can save money in the long run. The platform also eliminates the need for physical document storage, further cutting costs.

-

Can I integrate airSlate SignNow with other tools I use?

Absolutely! The esign service for brokerages from airSlate SignNow offers seamless integrations with various tools, including CRM systems, cloud storage services, and productivity applications. This flexibility allows brokerages to streamline their processes and enhance collaboration across teams.

-

What are the benefits of using an esign service for brokerages?

Using an esign service for brokerages like airSlate SignNow provides numerous benefits, including faster transaction times, improved client experience, and enhanced security. Digital signatures are legally binding and reduce the risk of document loss. Additionally, the service helps brokerages stay organized and compliant with industry regulations.

-

Is the esign service for brokerages secure?

Yes, security is a top priority for airSlate SignNow's esign service for brokerages. The platform employs advanced encryption and authentication measures to protect sensitive information. This ensures that all documents are securely signed and stored, giving you peace of mind while conducting business.

Mortgage brokers get paid faster with esignatures

Trusted eSignature solution - mortgage brokers get paid faster with esignatures

Join over 28 million airSlate SignNow users

Get more for mortgage brokers get paid faster with esignatures

- Update Your Email Signature on Gmail Easily with ...

- Change My Email Signature in Outlook with airSlate ...

- How to Update Signature Easily with airSlate SignNow

- How to Update My Outlook Signature Easily with airSlate ...

- How to Change My Signature on Google Mail with airSlate ...

- Change Signature in Outlook Email Made Simple with ...

- Streamline Your Workflow with Copy Paste Electronic ...

- Add Signature to Google Email Easily with airSlate ...

The ins and outs of eSignature