W9 Online Signature

- Quick to start

- Easy-to-use

- 24/7 support

Simplified document journeys for small teams and individuals

We spread the word about digital transformation

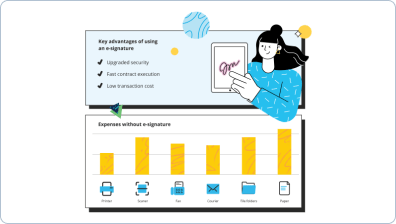

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Take full advantage of your eSignatures with airSlate SignNow

Speed up work with documentation

Modify samples safely

Share templates

Utilize W9 online signature

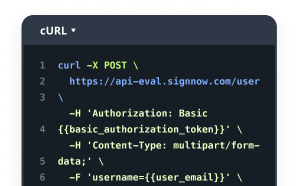

Incorporate eSignatures with API

Create straightforward workflows

Quick-start guide on how to use w9 online signature feature

Is your organization ready to cut inefficiencies by three-quarters or more? With airSlate SignNow eSignature, weeks of contract negotiation become days, and hours of signature gathering turn into minutes. You won't need to learn everything from the ground up thanks to the user-friendly interface and easy-to-follow guides.

Take the following steps below to use the w9 online signature functionality in a matter of minutes:

- Open your browser and access signnow.com.

- Subscribe for a free trial or log in utilizing your email or Google/Facebook credentials.

- Select User Avatar -> My Account at the top-right area of the page.

- Modify your User Profile by adding personal information and changing settings.

- Make and manage your Default Signature(s).

- Return to the dashboard page.

- Hover over the Upload and Create button and choose the needed option.

- Click the Prepare and Send option next to the document's name.

- Input the name and email address of all signers in the pop-up screen that opens.

- Use the Start adding fields menu to proceed to modify document and self sign them.

- Click SAVE AND INVITE when accomplished.

- Continue to configure your eSignature workflow using extra features.

It can't get any easier to use the w9 online signature feature. It's available on your mobile devices as well. Install the airSlate SignNow application for iOS or Android and manage your custom eSignature workflows even when on the move. Skip printing and scanning, labor-intensive submitting, and costly papers delivery.

How it works

Rate your experience

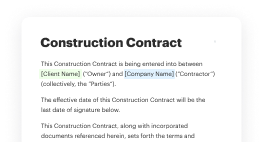

What is the w9 online

The W-9 form is a tax document used in the United States by businesses to request the taxpayer identification number (TIN) of a contractor or vendor. Completing the W-9 online streamlines this process, allowing users to fill out, sign, and manage the form electronically. This digital approach enhances efficiency and reduces the need for physical paperwork, making it easier for businesses to maintain accurate records and comply with tax regulations.

How to use the w9 online

Using the W-9 online involves a few straightforward steps. Users can access the form through airSlate SignNow, where they can fill in their information, including name, business name, TIN, and address. Once the form is completed, users can eSign it directly within the platform. After signing, the W-9 can be securely shared with the requesting party via email or stored in the user's airSlate SignNow account for future reference.

Steps to complete the w9 online

To complete the W-9 online using airSlate SignNow, follow these steps:

- Log in to your airSlate SignNow account or create a new one.

- Access the W-9 form from the document library or create a new one using the online generator.

- Fill in the required fields, including your name, business name (if applicable), and TIN.

- Review the information for accuracy.

- eSign the document by clicking on the designated signature area.

- Save the completed W-9 to your account or send it to the requester.

Legal use of the w9 online

The electronic version of the W-9 is legally valid in the United States, provided it meets the IRS requirements for electronic signatures. Using airSlate SignNow ensures compliance with these regulations, as the platform adheres to stringent security and authentication measures. This makes it a reliable option for businesses needing to collect W-9 forms from contractors and vendors.

Security & Compliance Guidelines

When handling the W-9 online, it is crucial to prioritize security and compliance. airSlate SignNow employs advanced encryption methods to protect sensitive information during transmission and storage. Users should ensure that they are using secure internet connections and verify the identity of the individuals they share the W-9 with. Additionally, airSlate SignNow complies with relevant regulations, including the ESIGN Act and UETA, ensuring that eSignatures are legally binding.

Examples of using the w9 online

Businesses commonly use the W-9 online for various purposes, such as:

- Hiring independent contractors and freelancers who need to provide their taxpayer information.

- Onboarding new vendors for services or products.

- Preparing for year-end tax reporting, where accurate TINs are essential for issuing 1099 forms.

Sending & Signing Methods (Web / Mobile / App)

airSlate SignNow offers versatile options for sending and signing the W-9 online. Users can complete the form on the web, mobile devices, or through the airSlate SignNow app. This flexibility allows users to fill out and sign the W-9 from anywhere, making it convenient for both the signer and the requester. Once completed, the document can be easily shared via email or stored securely in the cloud.

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

Intuitive UI and API. Sign and send documents from your apps in minutes.

FAQs

-

What is a W9 online form and why do I need it?

A W9 online form is a tax document used in the United States to provide your taxpayer identification number to businesses that pay you. Using a W9 online simplifies the process, making it easy to fill out and submit electronically, ensuring accuracy and compliance.

-

How does airSlate SignNow facilitate filling out a W9 online?

airSlate SignNow offers a user-friendly interface that allows you to complete your W9 online quickly. With features like auto-fill and eSignature capabilities, you can ensure that your form is filled out correctly and submitted without hassle.

-

Is there a cost associated with using airSlate SignNow for W9 online forms?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. You can choose a plan that fits your budget while enjoying the benefits of a secure and efficient way to manage your W9 online.

-

Can I integrate airSlate SignNow with other software for managing W9 online forms?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage your W9 online forms alongside your existing workflows. This integration enhances productivity and ensures that all your documents are in one place.

-

What are the benefits of using airSlate SignNow for W9 online submissions?

Using airSlate SignNow for W9 online submissions offers numerous benefits, including enhanced security, ease of use, and faster processing times. You can track the status of your submissions and ensure that your documents are always compliant with tax regulations.

-

Is it safe to submit my W9 online through airSlate SignNow?

Yes, submitting your W9 online through airSlate SignNow is safe. The platform employs advanced encryption and security measures to protect your sensitive information, ensuring that your data remains confidential and secure.

-

How can I access my completed W9 online forms?

Once you complete your W9 online using airSlate SignNow, you can easily access your forms through your account dashboard. This allows you to download, print, or share your completed documents whenever you need them.

W9 online signature

Trusted eSignature solution - w9 online signature

Join over 28 million airSlate SignNow users

The ins and outs of eSignature