Fill and Sign the 095 Clauses Relating to Accounting Matters Form

Useful advice for setting up your ‘095 Clauses Relating To Accounting Matters’ digitally

Are you fed up with the complexity of managing paperwork? Look no further than airSlate SignNow, the ultimate eSignature platform for individuals and businesses. Bid farewell to the tedious procedure of printing and scanning documents. With airSlate SignNow, you can seamlessly complete and sign documents online. Take advantage of the comprehensive tools integrated into this user-friendly and affordable platform and transform your method of handling documents. Whether you need to authorize forms or gather electronic signatures, airSlate SignNow manages everything effortlessly, requiring only a few clicks.

Adhere to this detailed guide:

- Sign in to your account or create a free trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our template gallery.

- Open your ‘095 Clauses Relating To Accounting Matters’ in the editor.

- Click Me (Fill Out Now) to prepare the document on your behalf.

- Add and assign fillable fields for others (if necessary).

- Proceed with the Send Invite options to solicit eSignatures from others.

- Download, print your copy, or transform it into a reusable template.

No need to worry if you want to collaborate with others on your 095 Clauses Relating To Accounting Matters or send it for notarization—our solution has everything you need to accomplish those tasks. Sign up with airSlate SignNow today and elevate your document management to a new standard!

FAQs

-

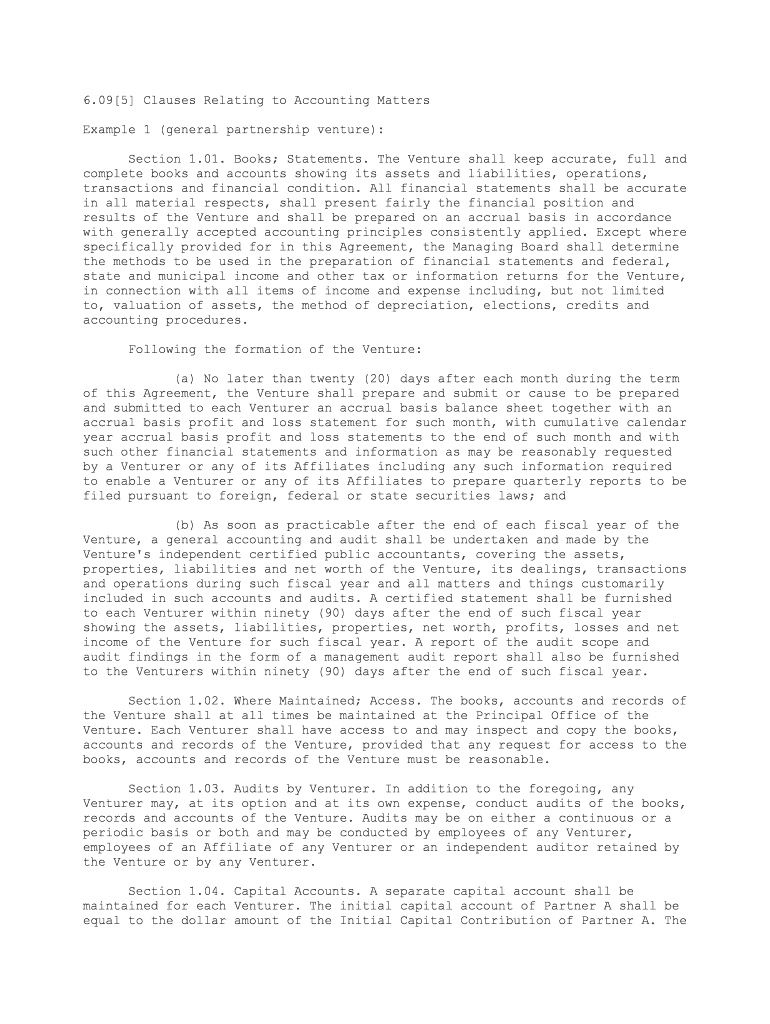

What are 095 Clauses Relating To Accounting Matters in contracts?

095 Clauses Relating To Accounting Matters are specific provisions included in contracts that outline the accounting responsibilities and obligations of parties involved. These clauses ensure clarity in financial reporting and compliance, making them crucial for businesses looking to maintain transparency and adhere to regulations.

-

How can airSlate SignNow help with 095 Clauses Relating To Accounting Matters?

airSlate SignNow streamlines the process of managing contracts that contain 095 Clauses Relating To Accounting Matters by providing an easy-to-use platform for document creation and eSigning. Our solution ensures that these important clauses are clearly outlined and agreed upon, helping to minimize disputes and enhance accountability.

-

Is airSlate SignNow cost-effective for managing 095 Clauses Relating To Accounting Matters?

Yes, airSlate SignNow offers a cost-effective solution for businesses looking to manage 095 Clauses Relating To Accounting Matters. With various pricing plans tailored to different business needs, you can choose the one that best fits your budget while still ensuring compliance and efficiency in your contract management.

-

What features does airSlate SignNow offer for handling 095 Clauses Relating To Accounting Matters?

airSlate SignNow provides features like customizable templates, secure eSigning, and document tracking, making it ideal for handling 095 Clauses Relating To Accounting Matters. These tools help ensure that all contractual obligations are met and that documents are easily accessible and manageable.

-

Can airSlate SignNow integrate with other software for 095 Clauses Relating To Accounting Matters?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and business management software, allowing you to efficiently handle 095 Clauses Relating To Accounting Matters. This interoperability ensures that your contract management is aligned with your overall business processes.

-

What are the benefits of using airSlate SignNow for 095 Clauses Relating To Accounting Matters?

Using airSlate SignNow for 095 Clauses Relating To Accounting Matters provides signNow benefits, including improved efficiency, enhanced compliance, and reduced risk of errors. Our platform helps centralize document management, making it easier to track obligations and maintain accurate records.

-

How secure is airSlate SignNow for managing 095 Clauses Relating To Accounting Matters?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect documents, including those containing 095 Clauses Relating To Accounting Matters. You can trust our platform to safeguard your sensitive information while ensuring compliance with legal standards.

The best way to complete and sign your 095 clauses relating to accounting matters form

Find out other 095 clauses relating to accounting matters form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles