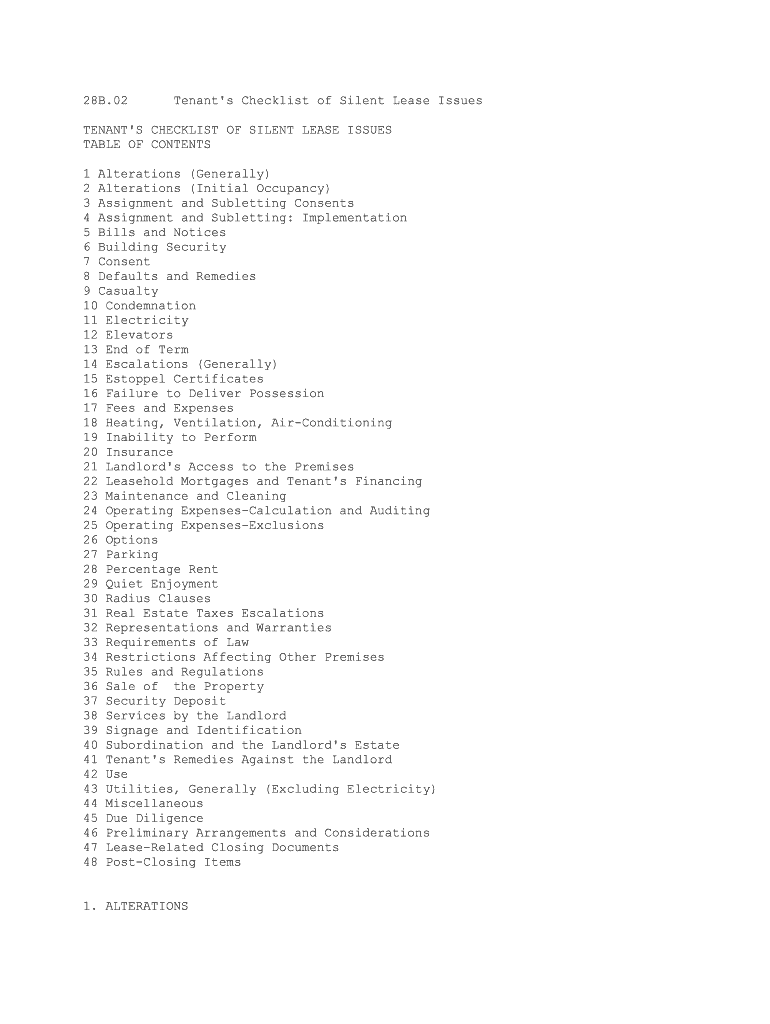

28B.02 Tenant's Checklist of Silent Lease IssuesTENANT'S CHECKLIST OF SILENT LEASE ISSUES

TABLE OF CONTENTS

1 Alterations (Generally)

2 Alterations (Initial Occupancy)

3 Assignment and Subletting Consents

4 Assignment and Subletting: Implementation

5 Bills and Notices

6 Building Security7 Consent

8 Defaults and Remedies

9 Casualty

10 Condemnation

11 Electricity

12 Elevators

13 End of Term

14 Escalations (Generally)

15 Estoppel Certificates

16 Failure to Deliver Possession

17 Fees and Expenses

18 Heating, Ventilation, Air-Conditioning

19 Inability to Perform

20 Insurance

21 Landlord's Access to the Premises

22 Leasehold Mortgages and Tenant's Financing

23 Maintenance and Cleaning

24 Operating Expenses-Calculation and Auditing

25 Operating Expenses-Exclusions

26 Options

27 Parking

28 Percentage Rent

29 Quiet Enjoyment

30 Radius Clauses

31 Real Estate Taxes Escalations

32 Representations and Warranties

33 Requirements of Law

34 Restrictions Affecting Other Premises

35 Rules and Regulations

36 Sale of the Property

37 Security Deposit

38 Services by the Landlord

39 Signage and Identification

40 Subordination and the Landlord's Estate

41 Tenant's Remedies Against the Landlord42 Use

43 Utilities, Generally (Excluding Electricity)

44 Miscellaneous

45 Due Diligence

46 Preliminary Arrangements and Considerations

47 Lease-Related Closing Documents

48 Post-Closing Items

1. ALTERATIONS

1.1 Acceptable Contractors. Attach as an appendix a list of pre-approved

contractors, architects, etc. If the landlord has approval rights, have the

landlord pre-approve as many names as possible.

1.2 Consent Requirements. The landlord should agree to be reasonable about

approving any nonstructural tenant alterations. Prohibit the landlord from

requiring the tenant to make any changes in alterations that would increase

their cost, except any changes necessary because the tenant's plans do not

comply with law.

1.3 When Consent Not Required. Try to persuade the landlord to agree to

limit any requirement for the landlord's consent to alterations. For example,

the landlord's consent might not be required for decorative or minor (less than

a stated cost?) alterations or partition walls. Changes in the economy and work

structure may make it necessary for many tenants to have more flexibility than

in the past to relocate partition walls or make other nonpermanent changes. If

the tenant regards its space arrangements, designs, and office layouts as

proprietary information, the tenant may want the landlord to let the tenant make

any alterations permitted by law, with no need to obtain the landlord's consent

or even to deliver plans to the landlord. (The preceding suggestion reflects

concerns that were for the most part confined to "dotcom" tenants. The demise of

so many "dotcom" tenants may minimize the likelihood that this issue will

actually arise in future lease negotiations, but it may remain an important

issue for some tenants.)

1.4 Flexibility. The tenant will want to maintain some flexibility in

choosing its architects, engineers, other consultants and contractors. It will

not want to be limited to the landlord's approved list.

1.5 Multiple Floors. A multi-floor tenant may want the right to construct

internal stairs and drill through floors for cabling. Such a tenant may also

want the right to use the building's internal fire staircases for access between

floors. Where the landlord permits inter-floor cut through for a staircase, the

landlord will generally require the tenant to restore, either specifically or

under a general alteration restoration clause. The tenant should seek to negate

that requirement.

1.6 Risers, Etc. The tenant may want to use riser spaces, shafts,

chambers, and chases to run ducts, pipes, wires and cables. Although,

conceptually, limiting each tenant to its proportionate share of this space

seems fair, such a limitation may not allow the tenant to meet its needs,

especially if the landlord's building is inadequate (as a whole) to meet the

needs of modern tenants. Try to have conduits and risers exclusively allocated

to the tenant, not shared. At a minimum, try to control who else may use them,

and how. Provisions concerning riser use may need to be coordinated with those

concerning telecommunications access. (The entire area of telecommunications is

one where many landlords ignore applicable provisions of federal law that

mandate free access. Instead, landlords seek to impose restrictions and fees

that may simply be void.)

1.7 Limit Fees. If the tenant agrees to reimburse the landlord for fees of

its architects, engineers, or other consultants in connection with the

landlord's review of any alterations, the tenant will want to limit or negotiate

those fees. More generally, assuming the tenant uses its own architect and the

tenant's architect is competent and licensed, why should the tenant agree to pay

the landlord's architect at all?

1.8 Time to Remove Liens. If the tenant's work produces liens, the tenant

will want enough time to remove them, taking into account procedural

requirements of applicable law and related delays. The landlord should agree not

to pay any lien that the tenant has bonded.

1.9 Use of Sidewalk. A ground floor tenant may want the right to install

awnings, canopies, and crowd control barriers on the sidewalk.

1.10 Americans with Disabilities Act of 1990 (the "ADA"). The tenant

should have no duty to bring any elements of the existing building into ADA

compliance (e.g., elevator buttons), unless (perhaps) the tenant actually alters

that particular element of the building.

1.11 Permits. The landlord should agree to cooperate with the tenant in

the process of applying for building permits and other governmental approvals

for the tenant's work.

1.12 Right to Finance Alterations. The tenant may want the right to

finance alterations, perhaps even on a secured or quasi-secured basis. What

cooperation will the tenant need from the landlord? What documents will the

tenant's lender probably request? Require the landlord to assist as needed. If

the landlord will not let the tenant grant liens to secure equipment financing,

perhaps ask the landlord to provide the financing instead, with repayment built

into the rent or documented separately.

2. ALTERATIONS (INITIAL OCCUPANCY)

2.1 Landlord's Space Preparation. The lease should define how the landlord

will prepare the space for the tenant, including landlord's responsibilities for

asbestos abatement or removal, demolition, refireproofing, leveling of floors if

raw space, and closing of floor penetrations. Does the space contain any unusual

existing improvements, such as vaults, that the tenant will want the landlord to

remove? If the landlord's work is late or defective, treat this as a failure to

deliver possession.

2.2 Consent to Tenant's Initial Work and Anticipated Work. The landlord

should consent in advance to the tenant's initial alterations and any

anticipated future alterations.

2.3 Existing Violations. The landlord should agree to cure any violations

existing against the building that may prevent or interfere with the tenant's

intended alterations.

2.4 Credit Issues. Is the landlord creditworthy? If the landlord fails to

build out or contribute to the tenant's work, what are the tenant's remedies?

Most leases say that the landlord has no liability beyond its interest in the

premises (if that). At a minimum, the tenant will want a right to offset against

rent-with an interest factor-for any landlord contribution not paid or work not

performed. If the landlord has a construction loan in place for the very purpose

(in part) of paying for the tenant's improvements, the tenant might be able to

obtain a direct right to receive those advances as part of negotiating the

nondisturbance agreement with the lender.

2.5 Building Systems. Are the existing building systems adequate? Should

the landlord agree to complete any upgrades? When? Should the landlord construct

any new installations outside the tenant's premises? What about HVAC, fire

safety or other system connections? Signage? Does the tenant have any special

electrical requirements? Does the tenant require any space outside the premises

to install electrical or other equipment for its own use? A backup generator?2.6 Staging or Storage Area. Will the tenant need any staging area, "lay-

down" area, or storage area for its construction activities and move-in program?

If the building has a loading dock or outside hoist, the tenant may want the

right to some guaranteed usage or priority, particularly while it moves in and

out of the building.

2.7 Substantial Completion. If the landlord performs the tenant's initial

alterations, "substantial completion" should require the landlord to have

installed and activated all communications systems, utilities, and interior

elevator service. Consider requiring the landlord to deliver a permanent

certificate of occupancy, because a temporary certificate of occupancy, which

expires after ninety days, may not suffice.

2.8 New York City Commercial Rent and Occupancy Tax. New York City

commercial tenants pay a "commercial rent and occupancy tax" that is almost

unique to New York City. In a particularly formalistic application of that tax,

city tax officials will impose a commercial rent tax on the rent that a tenant

would have paid but for an express rent credit that the lease gives the tenant

to compensate the tenant for work it performed to build out its space. The city

treats that credit as if it were a "deemed" payment of rent, hence a taxable

event. If the parties achieve the same economic result through a free rent

period or some other dollar adjustment of the rent that is not expressly tied to

the cost of the tenant's work, no commercial rent tax is due on the rent

forgone. So a wise New York City tenant will ask for a free rent period or a

general rent abatement rather than a rent credit tied in any way to the cost of

the tenant's alterations.

2.9 Tax Implications of Build-Out Allowances. When a landlord contributes

funds to a tenant's alterations, that payment may create immediate taxable

income to the tenant, though the landlord cannot recoup the same outlay except

through depreciation on a schedule of up to thirty-nine years, regardless of the

lease term. Only the Internal Revenue Service wins. The tenant may wish to

negotiate instead that the landlord owns (and depreciates) the tenant's

improvements for tax purposes, in exchange for some other benefit to the tenant.

As an alternative, the parties might characterize the allowance as reimbursement

for current expenses, such as the tenant's cost of moving, buying out its

existing lease, or purchasing tangible personal property like furniture,

fixtures or equipment. Although the tenant may still suffer taxable income, the

recharacterization will improve the landlord's position by giving the landlord

either a current deduction or a much shorter depreciation period. The parties

can shift this benefit to the tenant by adjusting other economics of the lease.

Consider having an engineer or appraiser prepare a cost segregation study to

determine which property can be depreciated over such shorter periods.

3. ASSIGNMENT AND SUBLETTING CONSENTS

3.1 Landlord's Consent. Ideally, allow the tenant to assign or sublet

without the landlord's approval. At a minimum, such consent should not be

unreasonably withheld. Try to provide that the landlord's consent will be

automatically given if specified objectives and easy criteria (e.g., net worth,

reputation, no felony convictions, experience, and proposed use) are met. Set

standards for reasonableness. Rent should not be a criterion for approving

subleases. (The tenant must keep paying rent no matter what.) Don't always

assume the conditions and procedures for assignment and subletting should match.

Even if the lease tightly restricts assignment, the tenant may be able to argue

for greater flexibility on subletting.3.2 Simple Approval Procedure. Make the approval process as simple and

expeditious (and as early in the transaction closing process) as possible.

Instead of requiring the tenant to submit to the landlord fully executed

assignment or subletting documents, ask the landlord to agree to approve or

disapprove the transaction in principle-before the tenant even starts its

marketing-based solely on the tenant's anticipated pricing. As a fallback, defer

the landlord's approval only until the tenant has delivered a term sheet, the

identity of a proposed assignee or subtenant , and (in the case of an assignment

only) copies of the proposed assignee's financial statements. These early

approval procedures are particularly important if the landlord can recapture the

space upon any assignment or subletting.

3.3 Consent Form. Attach as an exhibit the required form for the

landlord's consent to any transfer. Goal: prevent the landlord from adding new

conditions and restrictions when consenting to a particular transaction.

Although such conditions and restrictions may be inconsistent with the lease,

the tenant may agree to them because there is no choice or simply because the

tenant is was not paying careful enough attention at the time.

3.4 Carve-Out for Affiliates. Expressly permit any assignments and

subleases to affiliates (defined as broadly as possible) or successors, or in

connection with the sale of the tenant's business. If the tenant operates

multiple locations, a "sale of business" should include the sale of a single

location or, worst case, some reasonable group of locations. Define "affiliate"

to include trusts, estates, and foundations in which the tenant or its officers

are involved. The lease should impose no burdens at all (brokerage commissions,

recapture rights, etc.) for affiliate transactions.

3.5 Suppliers, Vendors, Customers and Others. Let the tenant sublet to its

suppliers, vendors, or customers, as appropriate for the tenant's business

convenience. Will the tenant or its principals form joint ventures or other new

businesses (e.g., the formerly hot "Internet incubators") that should be able to

share the tenant's space without any need for landlord approval?

3.6 Licensees. The tenant should not need the landlord's consent to grant

bona fide concessions or licenses.

3.7 Recapture Right. If the tenant requests approval of an assignment or

subletting, but the landlord elects to "recapture" the space, the tenant may

want to have the right to withdraw the request. If the landlord elects not to

exercise a recapture right, the landlord's consent to the proposed assignment or

sublease should not be unreasonably withheld, conditioned or delayed.

3.8 Assignment/Sublet Involving Other Tenants. The tenant should obtain

the landlord's prior consent to any assignment or subletting between the tenant

and other tenants in the building, whether the tenant is providing or receiving

the additional space., Ask the landlord to waive in advance (for the benefit of

this tenant) any provisions in other tenants' leases that would prohibit or

limit such transactions or discussions.

4. ASSIGNMENT AND SUBLETTING IMPLEMENTATION

4.1 Assignor and Guarantor Protections. As a general legal proposition,

when the tenant assigns the lease, the tenant remains liable for any default by

the assignee, and even any default by a subsequent assignee. To facilitate

future transactions, the tenant may want to try to mitigate that long-term post-

assignment exposure (which may severely constrain the tenant's flexibility when

negotiating a future assignment). Ideally, try to have the lease provide that

both the assignor and any lease guarantor are released from liability if the

tenant assigns the lease and satisfies certain conditions. (If the tenant cannot

obtain this protection, then the tenant may ultimately need to structure any

future lease transfer as a sublease.) As a backup, try to have the landlord

agree to give any unreleased assignor and guarantor notice of any assignee's

default and an opportunity to cure it. (In such a case, assignor and guarantor

liability would terminate if the landlord did not give the notice.) An

unreleased assignor and guarantor might also want a right to obtain a "new

lease" if the landlord terminates the lease and the unreleased assignor and

guarantor later performs the tenant's obligations. If the landlord and the

assignee modify the lease, a typical boilerplate provision may say that the

unreleased assignor (and its guarantor) are fully liable under the modification.

Although such boilerplate may be appropriate in the context of an affiliate

guaranty, it is not appropriate for an unreleased assignor of a lease. Insist

that in such case the assignor's and guarantor's liability will never exceed

what it would have been under the original lease.4.2 Stock Transfers. If a lease treats an equity transfer as an assignment

for consent purposes, the lease should not, then, treat it so for purposes of

requiring the assignee to assume the lease, except where the equity consists of

a general partnership interest in the tenant. (Many landlords' forms are written

in a way that might require such an assumption of liability.) If the lease deems

an equity transfer to constitute a lease assignment, the tenant may want to

exclude any or all of the following: mergers, initial public offerings, any

change of corporate control of a substantial operating company, transfers of

publicly traded stock, the sale of all or substantially all of the tenant's

assets (excluding cash or cash equivalents on the tenant's balance sheet),

transfers among affiliates, and any transfer resulting from an exercise of

remedies by a bona fide pledgee.

4.3 Assignment of Security Deposit. A tenant will want the right to assign

the security deposit to any assignee of the lease. If the security is a letter

of credit, the landlord should cooperate in substituting one letter of credit

for another if the tenant assigns the lease or merely changes banks.

4.4 Confidentiality. The landlord should agree to keep confidential any

financial information that a prospective assignee or tenant furnishes. The

landlord should agree to sign a standard confidentiality agreement if a

prospective assignee or subtenant requests it. Such an agreement would include a

requirement to return any confidential information if a transaction dies.

Similar requirements should apply for final sublease documents delivered to the landlord.

4.5 Splitting the Lease. The tenant may want the right to sever a large

lease into two or more separate and independent leases, to facilitate assignment

in pieces-a more flexible exit strategy.

4.6 Protections for Subtenants. The landlord should agree to give

"nondisturbance" or "recognition" rights to subtenants if the tenant satisfies

certain tests. The lease should also give subtenants as much flexibility as

possible-perhaps the same flexibility as the tenant-regarding future assignments

and subletting.

4.7 Participation in "Profits." If the landlord will participate in any

"profits" that the tenant realizes from assignment or subletting, define the

tenant's costs as broadly and inclusively as possible. For example, include

brokerage commissions, professional fees, build-out, costs (including rent

payable to the landlord) of carrying the space vacant during a reasonable

marketing period, any free rent period, transfer taxes, cost of furniture

included in the transaction, and the unamortized balance of the tenant's

original improvements to the space. Try to let the tenant claim all these

deductions at the beginning of the sublease term, rather than amortize them

(typically without interest) over the term of the sublease. The tenant's profit

participation payments to the landlord should be due only to the extent the

tenant actually receives the anticipated "profit." If the subtenant or assignee

defaults, the tenant should be able to stop paying and perhaps insist on the

right to recalculate any payments already made.

4.8 Multiple Lease Transfers. If the landlord is entitled to a "profit"

payment for any assignment or sublease, the tenant may want to negotiate a

"basis adjustment" in the case of future transactions. For example, suppose an

assignee pays $1 million for a lease assignment, and the landlord receives 50%

of that payment. What happens when the new tenant, the assignee, later assigns

that lease again? At that point, the landlord has already "taxed" the first $1

million of increased value of the tenant's leasehold. The lease should let the

assignee treat that lease purchase payment as part of the assignee's cost of the

lease when subleasing or assigning to someone else. The tenant's deductions

should include any consideration that the tenant paid to acquire the lease,

straight-lined over the remaining term of the lease.

4.9 Bills and Administration. If the tenant sublets, try to have the

landlord agree to bill the subtenant directly for any services the landlord

provides to the subtenant, and any other landlord sundry charges that apply to

the subleased part of the premises. Although the tenant cannot expect to be

relieved of liability for these charges if the subtenant does not pay, the

tenant can save time and effort by extricating itself from the billing process.

The same goes for any other function-e.g., requesting overtime HVAC or other

building services-where the tenant might otherwise act as a mere communications

channel between the subtenant and the landlord. The tenant will, however, want

to see copies of bills and notices of unpaid amounts to avoid unpleasant

surprises.

4.10 Transfer Defaults. Try to persuade the landlord to commit to

providing notice and an opportunity to cure if the tenant violates a lease

restriction on transfer. Just like any other default under the lease, here

cure could consist of rescission of the transfer. Why should this particular

default always constitute an automatic event of default?

4.11 Guarantor. If the tenant can assign without the landlord's consent,

the tenant also needs the right to replace any guarantor with a replacement

guarantor that meets certain criteria. If the assignee delivers such a

replacement guarantor-or if the landlord consents to an assignment without

requiring a new guarantor-the first guarantor should be released automatically.

5. BILLS AND NOTICES

5.1 Attorneys and Managing Agents. Let attorneys and managing agents give

notices on behalf of their clients. This should apply not only to any attorney

or managing agent identified in the lease, but also to any future replacement,

whether or not the party making the change has formally notified the other party

of the change.5.2 Copies. If the landlord gives the tenant any notice, the landlord

should agree to give a copy to the tenant's central leasing personnel, and

perhaps to other specified recipients (counsel and the like). If the tenant

delivered a letter of credit in place of a security deposit, backed by a

reimbursement agreement signed by a third party (e.g., the tenant's venture

capitalist), then the landlord should also agree to give that third party a copy

of any notice from the landlord, or at least any notice of default.

5.3 Delivery. The landlord should deliver bills and notices by personal

service or nationally recognized overnight courier. State when notices become

effective.

5.4 Notices Until Lease Commencement Date. Until the lease commencement

date, the landlord should deliver all notices to the tenant's existing address,

not the premises.

5.5 Delivery Notices. Require the landlord to provide written notice of

delivery of any part of the premises. The premises should not be deemed

delivered until the tenant has received that notice and, perhaps, a certain

period of time has elapsed. (The tenant is often not ready to begin using the

space immediately. The more process and the more delay the tenant builds into

the rent commencement date, the less rent the tenant will need to pay for space

it is not ready to use.)

5.6 Deemed Waivers. If the tenant will be deemed to have waived any claims

because of its failure to assert them within a specified period (e.g.,

objections to the landlord's delivery of the premises), then the lease should

require the landlord to remind the tenant of the deemed waiver provisions as

part of the notice that triggers the waiver.

6. BUILDING SECURITY

6.1 Description of Program. Describe (and require the landlord to provide)

a security program (including package scanning and messenger interception, lobby

attendant, the tenant's own lobby desk, security guards, keycards, night access

doors, and specified operating hours), in accordance with criteria set forth in

the lease.

6.2 Tenant's Security. Let the tenant establish its own security system

and connect that system to the landlord's system. The tenant may want the

ability to install blast resistant glass or film on exterior windows.

6.3 New Measures. The landlord should be required to obtain the tenant's

consent for any new security measures (e.g., messenger interception) or changes

in existing measures. The tenant should also seek the right to require

subsequent changes to the landlord's security program if the tenant determines

changes are appropriate. A tenant's exercise of these consent or control rights

should impose no liability on that tenant for criminal actions of third parties

or other adverse events.

7. CONSENTS

7.1 Quick Exercise. The landlord should be required to grant or deny any

required consent quickly. Silence should be deemed to constitute consent after a

stated period. (As a compromise, the tenant might agree to remind the landlord

of the response deadline in its consent request and/or to give a reminder notice

if the landlord has not responded within a certain time.) Any failure to consent

must specify all grounds for that failure. Those grounds must be reasonable.7.2 Use of Name. The landlord should consent to the tenant's use of the

building's name and likeness in the tenant's promotional and publicity

materials.

7.3 Site Plan. For new construction, the tenant may want the right to

consent to the landlord's site plan (particularly as it relates to parking) and

any changes.

7.4 Press Releases. The landlord should obtain the tenant's approval of

press releases, tombstones, and announcements about the lease. The landlord

should not disclose any terms of the lease without the tenant's consent.

7.5 Pre-Consent. Are there any future changes in the tenant's needs for

which the tenant wants the landlord's consent today in the lease (e.g., a

pending merger, change of name, change of business)?

7.6 Consent. Insist that no landlord consent may be unreasonably withheld,

conditioned or delayed.

7.7 Tenant Consent Rights. Does any tenant anticipate any matters for

which the landlord should seek the tenant's consent (e.g., changes in building

security)? Indicate in the lease that such consent will be required.

7.8 Damages. For unreasonable denial of consent, try to trim back the

standard lease language by which the tenant waives any right to recover damages.

Perhaps the tenant should be able to obtain damages up to a specified dollar

amount. The tenant's position is particularly compelling where the lease

requires the landlord's consent in connection with the sale of the tenant's

business, and the landlord withholds consent-in violation of the lease-and thus

derails the tenant's entire transaction.

8. DEFAULTS AND REMEDIES

8.1 Notice and Opportunity to Cure. The tenant should have the right to

notice of, and the opportunity to cure, any monetary or other default.

8.2 Default Triggered by Bankruptcy. Although "ipso facto" clauses are

typically unenforceable against a debtor-tenant, beware of any event of default

triggered by someone else's bankruptcy, for example, that of a guarantor. A

landlord can typically declare and enforce any such event of default against the

tenant without a problem.

8.3 Limitation on Landlord's Remedies. Limit the landlord's remedies (for

example, to exclude lease termination or eviction) for defaults or disputes

below a threshold level of materiality. Why should the risk of lease termination

hang over the tenant for every possible lease default or alleged default, and

hence almost every conceivable (even minor) dispute with the landlord? Also ask

the landlord to waive any right to recover consequential damages from the tenant.

8.4 Nonmonetary Defaults. The tenant might want to eliminate all

"nonmonetary" defaults. This can be accomplished by requiring the landlord to

convert any "nonmonetary" default into a monetary default by curing it and

sending the tenant a bill for reimbursement (a provision common in old

Woolworth's leases-though apparently it was not enough to save the chain from

oblivion). As an alternative, provide that so long as the tenant remains current

in its monetary obligations, the landlord cannot exercise certain remedies

(e.g., lease termination) for a nonmonetary default until the landlord has

obtained a court order. (In practice, a court will often put the landlord in the

same position anyway, regardless of what the lease says, such as through the

"Yellowstone" procedure in New York.)8.5 Future Equipment Financing. Require the landlord-as well as its

mortgagee-to waive or subordinate any statutory or other liens on fixtures,

equipment, and other personal property of the tenant, either in all cases or if

the tenant's asset-based lender requests it. To allow such a lender to exercise

its remedies and remove any financed equipment, the landlord should also agree

to enter into a landlord's consent to give the lender (for example) a brief

lease extension if the lease terminates and the right to conduct an auction on

the premises.

8.6 Holdover Rent for Partial Months. Prorate holdover rent on a per diem

basis for partial months. (As a practical matter, that may be the single most

important concession for a tenant to request in the typical "boilerplate" of any

lease, which will usually impose a month's holdover rent for a day's delay in

moving out.) Consider building in a short-term right to hold over at the same

rent, to give the tenant some flexibility in case of delays in relocating.

8.7 Mitigation of Damages. The landlord must seek to mitigate damages.

(New York still imposes no such requirement on commercial landlords.) For

example, the landlord must try to relet the premises. If the landlord does

mitigate its damages, it must credit any money collected against the tenant's

liability.

8.8 Waiver of Self-Help. Ask the landlord to waive any right of self-help

(to retake possession) and any right to lock out the tenant.

8.9 Acceleration of Rent. If the landlord has the right to accelerate all

rent as liquidated damages, first try to eliminate this remedy. If you can't,

seek the following: (1) the tenant gets credit for fair and reasonable rental

value, and (2) the highest possible discount rate (for example, prime rate

rather than 4% per annum).

8.10 Default by Subtenant. Extend the tenant's cure period in the case of

nonmonetary subtenant defaults to allow the tenant time to enforce the sublease

and, if necessary, to obtain possession of the subleased premises.

8.11 Statute of Limitations. Limit the landlord's right to collect

unbilled rent once a certain amount of time has passed (e.g., eighteen months).

8.12 Piercing the Veil. Require the landlord to waive any theory that

might let the landlord "pierce the corporate veil" of the tenant named in the

lease. The landlord should acknowledge it has no claims against the tenant's

principals or affiliates under any circumstances (including tort-based theories

relating to the lease or the premises), except to the extent they have actually

signed a guaranty.

9. CASUALTY

9.1 Right to Terminate. If a material casualty occurs and the landlord

either cannot or does not restore the premises within a specified time period,

or if the casualty occurs during the last two or three years of the lease term,

let the tenant terminate the lease.

9.2 Adverse Impact on Business. Provide that the tenant can terminate the

lease or abate rent if a casualty or other event (e.g., a terrorist attack

affecting some other building)-or restoration from a casualty-causes any

temporary or permanent material change in the tenant's permitted use (e.g., loss

of nonconforming use status), access, parking, traffic volume, pedestrian

volume, or visibility of the premises.

9.3 Extent of Restoration; Interaction with Loan Documents. Ideally,

require the landlord to restore in all cases-whether or not the landlord has

adequate insurance proceeds, i.e., whether or not it has adequately insured the

building. Beware of the terms of subordination, nondisturbance and attornment

agreements, which may, in effect, modify the restoration requirements of the

lease to conform to those of the loan documents. If the tenant negotiates a

broad obligation to restore but the landlord's loan documents let the lender

take the money and run, then the tenant loses if, as is often the case, it

agreed in a subordination, nondisturbance and attornment agreement that the loan

documents would govern. A major tenant will usually not tolerate this result.

9.4 Abatement During Restoration. Try to abate rent, escalations,

alteration fees and any other payments during all restoration-both the

landlord's and the tenant's-especially if major fixtures need to be restored.

The landlord should refund prepaid rent and other items. These measures will

often be a "win-win" for both parties, because the landlord often can insure the

loss (on a property-wide basis) more easily and economically than can all the

tenants individually.

9.5 Other Premises. If a casualty affects only improvements outside the

tenant's premises, the landlord cannot terminate the tenant's lease unless the

landlord: (1) makes the tenant whole, and (2) terminates all other similarly

situated leases.

9.6 Landlord's Waiver of Right to Sue. Even without a waiver of

subrogation, the landlord should agree not to sue the tenant for negligently

causing a casualty that a typical casualty insurance policy would have covered.

9.7 Lease Extension. Ask the landlord to agree to extend the lease

termination date to compensate the tenant after a loss, for any period when the

tenant could not use and occupy the premises. Even if the lease terminates, if

the premises are tenantable and may legally be occupied, seek some short

extension of the term to give the tenant additional time to operate and ease the

transition to new premises.

9.8 Time to Restore. Negate (or limit) any landlord right to obtain an

extension of time to restore in the case of a force majeure event.

10. CONDEMNATION

10.1 Partial. Require the landlord to restore the premises in the case of

a partial condemnation, at least to the extent of available condemnation

proceeds. If the partial condemnation affects the premises or more than ___% of

the whole building, the tenant may still want the right to terminate the lease.

10.2 Separate Claim. A tenant wants to be able to submit a separate claim

to the condemning authority for: (1) the value of the leasehold estate, and (2)

moving expenses, trade fixtures, goodwill, advertising and printing costs, phone

lines and damages for interruption of business. Landlords and lenders rarely

tolerate item (1), but may accept it provided that the tenant's award does not

diminish sums payable to the landlord and its lender.

10.3 Physical Impairments. The tenant may want a right to terminate or abate

rent if any condemnation, including a road widening or other change, materially

and adversely affects the tenant's business, such as by impairing parking,

access (e.g., loss of curb cuts), traffic volume, or visibility.

11. ELECTRICITY

11.1 Totalized Submeter Readings. The readings from multiple submeters

should be totalized, using a third-party service and appropriate security

controls to limit access to submetering equipment and computers.

11.2 Usage Survey. Let either party, not just the landlord, initiate a

usage survey.

11.3 Rate for Submetered Electricity. The tenant should pay for submetered

electricity using the same tariff under which the landlord purchases

electricity. If the landlord purchases electricity from a private provider, the

rate the tenant pays should not exceed the public utility's rate.

11.4 Sufficient Wattage. The landlord should assure the tenant that the

existing electrical system provides enough power for the tenant's present and

anticipated needs.

11.5 Additional Electrical Capacity. The tenant should be able to obtain

more electrical capacity if needed, quickly, at a defined or ascertainable cost.

The landlord should reserve a certain number of watts per foot for the tenant,

even if the tenant will not be using it initially. (If the tenant later needs

more electricity but the building has no available capacity, the resulting

delays in obtaining additional capacity may hurt the tenant's business.)

11.6 Location for Power Delivery. Specify the delivery point for

electrical power.

11.7 Tenant's Emergency Generator. Let the tenant install an emergency

generator and fuel tank (or other arrangements for fuel storage and refueling).

Allocate ownership, responsibilities (including responsibilities for regular

testing and refueling), and costs between the landlord and the tenant. The

tenant should have no duty to remove this equipment at the end of the term.

11.8 Backup Electrical Operation. The landlord should give the tenant

prior notice before any scheduled electrical shutdown or testing of the

landlord's emergency generators. Limit the frequency of such shutdowns and the

periods when the landlord can test its emergency generators. (These generators,

when running, can produce background noise about as subtle as jet engines.)

11.9 Building Generator. Gives the tenant the right to use the building

generator. The landlord should reserve a certain amount of generator capacity

for the tenant and agree to keep the fuel tanks full.

11.10 Capacity. The landlord should allow the tenant to reserve additional

riser space and additional capacity in the buss duct or other main electrical

distribution system.

11.11 Retroactivity. Try to limit the period during which the landlord can

retroactively bill the tenant for increased rates or usage.

12. ELEVATORS

12.1 Freight Elevators for Moving. Ask to use the freight elevators

without charge to move in and move out. The tenant should seek the use of

several elevators-e.g., all the passenger elevators in the building-on weekends

and at night for the same purposes. Ideally, all this elevator usage should be free.

12.2 Night Service. The lease should provide that "night service" for

elevators (restricted or limited service) cannot begin before a specified time.

Require a minimum number of elevators to be in service at all times.

12.3 Changing Elevator Banks. Prohibit the landlord from reconfiguring

elevator banks. If the tenant's space is the first stop, it should remain so.

12.4 Exclusive Service. The tenant may want exclusive elevator service for

certain floors. The tenant may want cars not being used to be parked at, or

returned to, the tenant's floor for the tenant's convenience.

12.5 Routine Repairs. Require the landlord to perform routine elevator

repairs and maintenance only outside business hours.

12.6 Waiting Time. Specify the maximum average waiting time for elevators.

12.7 Security Measures. The tenant should have approval rights over the

institution and modification of elevator security measures, including 24-hour

keycards and turnstiles to the elevator area. Does the tenant want to require

any such measures?

12.8 Service Contract. Require the landlord to maintain an elevator

service contract that obligates the maintenance contractor to respond to a stuck

elevator within ___ minutes.

13. END OF TERM

13.1 Duty to Restore. The tenant will want to disclaim any obligation to

restore (i.e., remove the tenant's alterations) at the end of the term. As a

compromise measure, the tenant might agree to remove any tenant's improvements

that are unusual , particularly difficult to remove, or improperly made, or if

the landlord reasonably required restoration as a condition to consenting to the

tenant's work. But, what's "reasonable"? Instead, try to specify an objective

test for determining what the tenant must remove. Require the landlord to give a

reminder notice at least ___ months, but no more than ___ months, before the end

of the term if the landlord intends to enforce the restoration requirement.

13.2 Restoration. If the tenant must restore, then let the tenant: (a)

perform any necessary restoration work rather than pay the landlord to do it;

(b) enter the premises for some reasonable period after the end of the lease

term as needed; (c) during the post-term restoration period, pay only an

equitable per diem payment rather than holdover rent; and (d) meet only a

"substantial completion" standard rather than a higher standard that might apply

to delivery of new space. Once the tenant notifies the landlord that the work is

done, the landlord should have a short time to object; silence should be deemed

approval. Require the landlord to specify all objections, and in reasonable

detail, within the objection period, . If the landlord's objections are minor

and the tenant resolves them within a reasonable period, the tenant should no

longer be required to pay any rent during that reasonable period.13.3 Condition of Returned Premises. The tenant should have no duty to

return the premises in any particular condition. For example, it should have no

obligation to replace a worn-out compressor in the last year of the term.

13.4 Removal of Personal Property. Let the tenant enter the premises for a

short time after the lease expires to remove the tenant's personal property.

13.5 Demolition Clause. If the tenant cannot negotiate away a "demolition"

clause, then the landlord should not be able to terminate under that clause

unless the landlord: (1) gives reasonable notice; (2) acts in good faith; (3)

terminates the leases of all other tenants; (4) has entered into a binding

noncancellable demolition agreement; (5) has obtained a demolition permit; and

(6) deposits the lease termination payment in escrow.

13.6 "For Rent" Signs. The landlord should not post "for rent" signs until

the term has actually ended.

13.7 New Location Sign. For a reasonable time after the lease has

terminated, the tenant may want to be able to install a sign directing customers

to the tenant's new location.

13.8 Prepaid Rent. Upon any termination not arising out of the tenant's

default, the landlord must promptly refund prepaid rent and other payments

together with accrued interest and an administrative fee if not paid promptly.

13.9 Holdover Rent. Holdover rent should not apply for some limited period

when the parties are negotiating a lease extension in good faith for the

premises or for space in another building. Try to eliminate holdover rent at any

time when a new tenant is not ready to occupy the premises. Also, try to

negotiate the right to a short-term lease extension to avoid holdover rent

problems or if a retail tenant wants to stay through the holiday season.

13.10 Subtenant Problems. Sometimes a tenant cannot vacate solely because

a subtenant fails to surrender its subleased premises. To protect the tenant in

such a case, try to limit the tenant's liability, by having it apply only to the

part of the premises that the subtenant failed to surrender or, at most, to the

entire floor that includes those premises. Absent such a concession, the tenant

may be liable for holdover rent for the entire leased premises, even though the

tenant moved out and the subtenant's holdover affects only a tiny corner of one floor.1

13.11 Receipt and Release. Require the landlord to issue a receipt and

release upon request at the end of the lease term.

14. ESCALATIONS (GENERALLY)

14.1 Proportionate Share Computation. In computing the tenant's

proportionate share, if the rentable square footage (the numerator) includes the

tenant's share of the common areas, confirm that the denominator also includes

all the common areas. If the square footage of the building is increased, the

denominator should increase accordingly. Exclude basement/mezzanine space from

the numerator. Avoid contributing to the landlord's land banking or costs of

carrying dead space.14.2 Over-Reimbursement. Do all of the tenants' percentages add up to

100%, or is the landlord being over-reimbursed for escalations? Are the anchor

tenants paying their share, or is that share being shifted to the other tenants?

14.3 Mixed Uses. In a mixed-use building (including office with retail on

the ground floor), are all tenant types being treated the same way or at least

equitably? Should they be? Should certain parts of the project be excluded from

the tenant's escalation formulas? More generally, the existence of multiple uses

in the same building can make any allocations much harder to understand and much

more subjective (i.e., it creates much more room for abuse, and makes the abuse

that much harder to find). If possible, the tenant should contribute only to an

allocation of costs within the particular single-use component of the project

that the tenant actually occupies.

14.4 Occupiable Space. The lease should allocate escalations based on

occupiable space (as the denominator), not occupied space. Let the landlord pay

the full operating costs for all unoccupied space.

14.5 Multiple Escalations. The lease should not allow multiple escalations

that give the landlord duplicative recoupment of a cost increase, or double-

count any charges included in operating expenses or elsewhere. For example, the

marketing director's salary should be either an operating expense or a charge to

the marketing fund, but not both. Anything treated as "real estate taxes" should

not also be treated as "operating expenses." These principles can be expressed

both generically and/or by combing through and comparing the various

definitions.

14.6 Lease Termination During Calendar Year. Apportion escalations in the

event that the lease terminates during a calendar year. (Otherwise, the landlord

could argue that annual calculation procedures obligate the tenant to contribute

to an entire year's escalations.)

14.7 "Base Year." Any "base year" should fully include all expenses. Were

any expenses not yet being fully incurred? Did any exclusions apply? Was the

landlord not providing full building services?

14.8 Cap on Escalations. to the tenant might try to negotiate an annual

limit on escalations-either a specific dollar figure, a percentage, a percentage

of CPI, or the comparable cost increases in a "basket" of comparable buildings,

if such information can be obtained.

14.9 Free Rent Period. Does the "free rent" period apply to escalations or

just base rent?

14.10 "Porter's Wage" Escalation. For "porter's wage" escalations, the

lease should exclude fringe benefits and the value of "time off." Try to limit

the measure to reflect only the base hourly rate. If fringe benefits cannot be

excluded, try to define how they are calculated.

14.11 Consumer Price Index Adjustment. For a consumer price index (CPI)

adjustment, the lease should measure any increase consistently from the starting

year of the lease, rather than from the preceding year's CPI. The adjustment

clause should specify exactly which CPI index is being used and what happens if

that index stops being issued.

14.12 Escalations Below Base. State that if an escalation amount falls

below the original base, the tenant should receive a credit against fixed rent.

14.13 Fixed Rent Increases. To avoid controversy over calculating

escalations, consider negotiating fixed rent increases in place of all pass-

throughs of expenses.

14.14 Waiver of Escalations. Escalations should be deemed waived if not

billed within a certain period.

15. ESTOPPEL CERTIFICATES

15.1 By Whom. Both the landlord and the tenant should agree to furnish

estoppel certificates. (How often?)

15.2 Who Can Rely. Make sure subtenants and assignees can rely on the

landlord's estoppel certificate, not just lenders.

15.3 Form. Attach an acceptable form of estoppel certificate as an exhibit

to prevent subsequent issues. Limit the assurances the tenant must provide, both

substantively and by adding "knowledge" requirements and as many other

qualifiers as possible. Avoid restating the terms of the lease; tell the lender

to read the lease and rely on the estoppel certificate only for comfort that the

lease has not secretly been amended.

15.4 Legal Fees. Should the landlord reimburse the tenant for its legal

fees in researching and preparing future estoppel certificates?

15.5 "Knowledge." Qualify appropriate sections of any estoppel certificate

to apply only to the tenant's knowledge, especially for issues of additional

rent. Alternatively, the tenant should reserve its rights on these claims. A

typical 10-day requirement to deliver an estoppel certificate is too short for

the tenant to conduct adequate due diligence to knowingly surrender claims

involving complicated and potentially debatable billing of operating expenses

and utility charges. This is particularly true when the tenant is a large company.

15.6 Conflict of Terms. If the estoppel certificate and the lease

conflict, the lease should govern. The delivery of an estoppel certificate

should not be deemed to waive or modify any rights or remedies of the signer.

15.7 Failure to Sign. Negate any liability of the tenant (e.g., claims of

"tortious interference") if the tenant does not sign the estoppel certificate.

Limit the landlord's remedy to an injunction, a deemed estoppel, or a nuisance fee.

16. FAILURE TO DELIVER POSSESSION

16.1 Remedies. Let the tenant terminate or receive a substantial rent

abatement if the landlord does not deliver possession by a certain date (also

try to get day-for-day-or better-rent credit for the delay). Consider requiring

the landlord to pay for or provide temporary space or pay the tenant's holdover

damages in its present space. If the lease sets a formula for any payment or

credit to the tenant for delayed delivery, courts may test it as "liquidated

damages," although when a New York court recently did so, that particular ruling

was reversed on appeal. Just in case, though, add the typical recitations that

attempt to validate any liquidated damages clause.16.2 Lender's Approval. If the lease is conditioned on a lender's (or any

other) approval, set an outside date for approval and let the tenant terminate

if the landlord misses that date. Try to have the landlord deliver the approval

when the parties sign the lease, particularly if the tenant is under timing

pressure to resolve its occupancy arrangements.

16.3 Termination of Lease. If the tenant terminates the lease because the

landlord does not timely deliver possession, the landlord should refund all

payments and redeliver any other documents (such as letters of credit) delivered

on lease signing. Also ask the landlord to agree to compensate the tenant for

the tenant's costs.

16.4 Late Delivery of Premises. The landlord should push back all rent

abatements and adjustments as well as the expiration date (and base years, at

some point) if the landlord delivers the space late.

16.5 Seasonal Businesses. For seasonal businesses, the tenant may not want

to be obligated to initially open for business during its slow season. Try to

control periods or dates during which the landlord may deliver the premises. A

certain day of the week? Not during the holiday season?

17. FEES AND EXPENSES

17.1 Reasonableness. Limit fees and expenses to those which are

reasonable, actual, and out-of-pocket. Do not agree to allow fees "as set by

landlord" or as "modified from time to time" or "based on landlord's standard

schedule." The tenant should not be required to pay fees for any review of plans

or possible subtenants by the landlord's internal personnel, even if those

persons are professionals.

17.2 Legal Fees and Expenses. Exclude legal fees and expenses relating to

a claimed default if no default exists or the landlord otherwise does not prevail.

17.3 Reimbursement to Prevailing Party. Make the obligation to reimburse

attorneys' fees run both ways. Whoever prevails should recover attorneys' fees,

including the value of in-house counsel's time.

18. HEATING, VENTILATION, AIR-CONDITIONING

18.1 Specifications. Specify required HVAC service, with variations by day

of week and season, both during and outside business hours. Require the landlord

to air-condition all interior public areas. Obtain the right to test air quality

from time to time.

18.2 Rates. The lease should state the rates (and the basis of rates) for

overtime HVAC. Squeeze out any profit component. If the landlord later charges

any other tenant a lower rate, the tenant should get the benefit of that lower rate.

18.3 Allocation of Charges. Allocate overtime HVAC charges among multiple

simultaneous users.

18.4 Notice for Overtime. Minimize or eliminate any prior notice

requirement for overtime HVAC.

18.5 Discount. Give the tenant a discount on overtime HVAC if the tenant

commits in advance to specified levels of usage.

18.6 Miscellaneous Issues. Should the tenant have the right to install

supplemental HVAC? How much condenser water must the landlord provide? Chilled

water? Who owns the equipment? Who pays costs? Who must repair/restore? Should

the tenant be able to reconfigure building standard HVAC as needed for

supplemental service? Will the tenant need access to fresh-air louvers? Where?

18.7 Water Treatment. Require the landlord to add appropriate chemicals to

any HVAC-related water lines, to prevent pipe corrosion and system breakdowns.

The landlord should maintain records of these treatments and give them to the

tenant upon request.

19. INABILITY TO PERFORM

19.1 Force Majeure. Give force majeure protections to the tenant, not just

the landlord. The landlord must give notice of a force majeure event within a

specified time, or lose the right to claim such event as force majeure. Any

delays that result from a contractor that the landlord required the tenant to

use (or perhaps even merely approved) should constitute force majeure.

19.2 Right to Cure. Let the tenant cure the problem if the landlord fails

to perform-even if that failure is caused by "force majeure." If the landlord

fails to reimburse the tenant's cure costs, then let the tenant offset rent.

Consider the interaction between this rent offset and any rent abatement arising

from casualty and condemnation.

19.3 Force Majeure Exceptions. Although "force majeure" clauses always

have a certain logic and fairness to them, should the tenant always allow the

landlord the potentially open-ended extensions of time that a "force majeure"

clause might justify? If the lease requires the landlord to restore after

casualty within a certain time, should the landlord be entitled to an endless

extension of time? What about delivery of the premises? What about maintenance

of the roof? At some point, the "force majeure" clock should stop ticking or the

"rent abatement" clock should start ticking, perhaps at double speed-even for

"force majeure" delays.

20. INSURANCE

20.1 Common Standard. The tenant should have no obligation to provide more

insurance than similar tenants customarily maintain in similar buildings, or to

provide insurance at rates that are not reasonable.

20.2 Type of Insurance. The tenant should be allowed to carry blanket

insurance, self-insure, or use a "captive" carrier. In the case of a large

corporate tenant, the insurance requirements should conform to the tenant's

company-wide insurance program.

20.3 Waiver of Subrogation. Insurance policies should contain a waiver of

subrogation clause. The lease should then contain matching waiver and release language.

20.4 Property and Liability Insurance. The landlord should carry property

and liability insurance, and provide evidence of such insurance on the tenant's request.

20.5 Effect of Sublease. To the extent that the tenant subleases the

premises, the lease should state that the subtenant's insurance coverage and

insurance certificates (if otherwise substantially in compliance with the lease)

will meet the tenant's insurance obligations.

20.6 Landlord's Deductible. A major tenant may care about the size of the

landlord's deductible (both a minimum and a maximum) and how that deductible

will be funded in the event of a casualty. Whose risk is the deductible? Will

that payment constitute an operating expense?

20.7 Insurance Advice. Send the insurance and casualty provisions of the

lease to the tenant's insurance advisor for review and comment.

20.8 Terrorism Insurance. To the extent that the definition of "operating

expenses" includes insurance the landlord obtains, decide how to treat the cost

of terrorism insurance for purposes of the base year. Given the gyrations in

cost and availability of terrorism insurance, any base year since September 2001

may include an artificially high or artificially low cost for terrorism

insurance. As one solution, the tenant might exclude terrorism insurance from

operating expenses completely. Make it the landlord's problem as a risk of

owning real estate.

21. LANDLORD'S ACCESS TO THE PREMISES

21.1 Prior Notice. How much and what type of prior notice should the

landlord give to gain access to the tenant's premises?

21.2 Purpose of Access. Limit the landlord's access to certain defined

purposes (e.g., repairs, inspection, or to show the premises to prospective

future tenants within the last ___ months of the term only).

21.3 Frequency. Limit how often the landlord can enter the premises.

21.4 Sensitive Areas. Should the lease prohibit or restrict landlord

access to "special spaces" (bank vault, securities vault, network control rooms,

and the like) for cleaning and other purposes? If the tenant regards its entire

operation as proprietary and "top secret," then perhaps the lease should not

allow the landlord access at all, absent an emergency.

21.5 Time of Access. Should access be limited to certain hours (business

hours, after hours)?

21.6 Authorized Personnel. Precisely who among the landlord's employees,

agents and contractors should have access?

21.7 Presence of Tenant's Representative. The tenant may want its

representative to be present whenever the landlord is on the tenant's premises.

This is particularly important in any area where the tenant has sensitive,

dangerous, or expensive personal property.

21.8 Disruption and Security. Require the landlord to minimize

interference with the tenant's business and comply with the tenant's reasonable

instructions and security requirements, even if this requires the landlord to

use overtime labor.21.9 Placement of Pipes and Conduits. If the landlord wants to reserve the

right to install pipes and conduits, the tenant may want to limit exactly where-

such as only within existing walls or above ceilings. Should the landlord be

required to minimize any damage associated with the installation or maintenance

of these conduits?

21.10 Storage of Materials. If the landlord stores materials in the

premises for making repairs, limit that right to apply only to those materials

necessary for repairs within the premises. This can be particularly problematic

if the premises includes a terrace-a tempting storage area for long-term

exterior projects. In any case, the landlord should store materials in the

premises only for short periods.

21.11 Repair Work Outside Business Hours. If the landlord's work in or

affecting the premises will cause inconvenience, noise, odors, or the like, the

landlord should work only outside business hours. If the tenant needs the

landlord to repair any critical area or function quickly, require the landlord

to do so, even if the landlord must hire overtime labor.

21.12 Hazardous Materials. If the landlord will use hazardous materials

for any work in or affecting the premises, the landlord should agree to notify

the tenant in advance and provide "material safety data sheet" disclosures.

22. LEASEHOLD MORTGAGES AND TENANT'S FINANCING

22.1 Landlord's Consent. Ask the landlord to consent in advance to the

tenant's grant of leasehold mortgage(s). The leasehold mortgagee should have the

rights to: (1) receive notice of default from the landlord, (2) cure, and (3)

obtain a new lease from the landlord if the original lease terminates (other

than a scheduled termination in accordance with its terms).

22.2 Equity Pledges. If the tenant's owners pledge their equity as

collateral for a loan, the pledgee may want protections under the lease like

those afforded a leasehold mortgagee.

22.3 Financing, Generally. Does the tenant anticipate entering into any

other financing arrangements that might affect the landlord, the lease, or the

premises? If so, consider adding appropriate language to the lease to preserve

the tenant's flexibility.

23. MAINTENANCE AND CLEANING

23.1 Structural Repairs. Require the landlord to maintain and repair the

"structure" of the building (including the roof, the foundation, and other

structural elements) and maintain and repair common areas, parking lots, garages

and sidewalks. Define "structural" (broadly) to avoid future disputes over what

it means. Try to have it cover as much of the building as possible except

improvements unique to a particular tenant.

23.2 Building and Systems Maintenance. The landlord should maintain

electrical, plumbing, sewage, HVAC, and other building systems, at least to the

point of entry into the premises. Consider whether to require the landlord to

maintain service contracts. Let the tenant and its advisors inspect building systems.

23.3 Standard for Maintenance. The landlord should maintain the building

and common areas (including any empty shop spaces, and all common areas on any

multi-tenant floor, whether or not fully occupied) in an attractive and first-

class manner. "Maintenance" should include provision of security. Require the

landlord to repaint and recarpet periodically.

23.4 Cleaning Standards. Specify standards for the landlord's cleaning

services, both within the premises and in common areas. Limit the scope of

possible "extras." Try to define the pricing of "extras." Cleaning standards are

an economic issue. Review and negotiate them accordingly. If the cleaning

standards say the landlord does not need to clean any "computer areas," how much

space will this exclude for a modern office? If the landlord wants to disclaim

any responsibility for cleaning of certain areas (food preparation, etc.),

obtain a credit for the value per square foot of the "building standard"

cleaning not provided. As an alternative, ask the landlord to give the tenant an

allowance. Then the tenant should only be responsible to pay for any cleaning

that is above standard (considered for the space as a whole).

23.5 Cleaning Hours. Specify the earliest time at which cleaning may

commence.

23.6 Right to Terminate. The tenant may want to be able to terminate the

landlord's cleaning services and take over cleaning of all common areas or just

the premises, with a rent credit.

23.7 Garbage Removal. Define the location, access, timing, and other

arrangements for garbage removal. The landlord should provide separate recycling

containers or areas.

23.8 Repairs Covered by Insurance. Require the landlord to make repairs-

even if otherwise the tenant's obligation-where the need arises from an event

covered by insurance that the landlord carried or should have carried.

24. OPERATING EXPENSES -CALCULATION AND AUDITING

24.1 Statement by Professional. An independent managing agent or (better)

a certified public accountant should prepare the statement of operating

expenses. Attach as a lease exhibit the landlord's operating expense statements

for the preceding few years. Ask the landlord to confirm that: (a) these were

the statements actually used for pass-throughs to existing tenants; and (b)

future operating expenses will be calculated the same way.

24.2 Time for Revision. Set a time limit for the landlord's revisions to

operating expense statements-and make that limit