Fill and Sign the 2016 Form 1120 F Us Income Tax Return of a Foreign Corporation

Useful suggestions for finalizing your ‘2016 Form 1120 F Us Income Tax Return Of A Foreign Corporation’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the leading electronic signature solution for individuals and businesses. Say farewell to the monotonous process of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Leverage the robust features embedded in this user-friendly and affordable platform and transform your approach to document management. Whether you need to approve forms or gather eSignatures, airSlate SignNow manages it all seamlessly, requiring just a few clicks.

Adhere to this step-by-step guide:

- Log into your account or initiate a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our library of templates.

- Open your ‘2016 Form 1120 F Us Income Tax Return Of A Foreign Corporation’ in the editor.

- Click Me (Fill Out Now) to fill out the form on your end.

- Include and assign fillable fields for others (if required).

- Proceed with the Send Invite options to request eSignatures from others.

- Save, print your version, or turn it into a reusable template.

No need to worry if you have to collaborate with others on your 2016 Form 1120 F Us Income Tax Return Of A Foreign Corporation or send it for notarization—our platform has everything you need to accomplish such tasks. Sign up with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

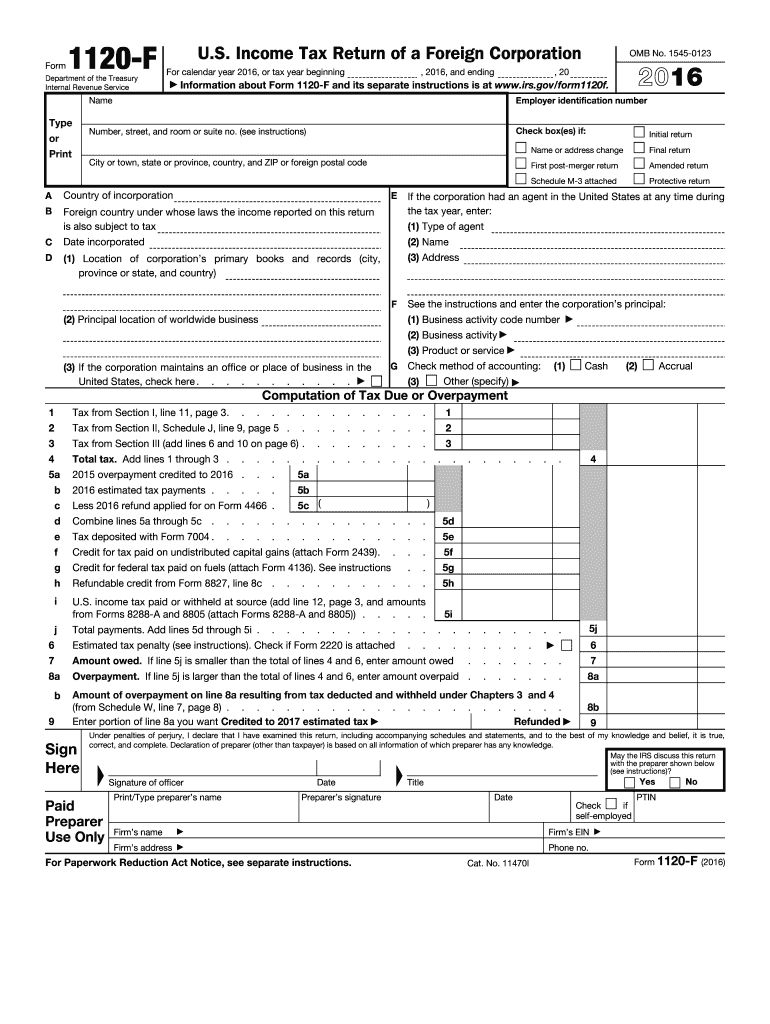

What is the Form 1120 F U S Income Tax Return Of A Foreign Corporation?

The Form 1120 F U S Income Tax Return Of A Foreign Corporation is a tax form used by foreign corporations to report their income, gains, losses, deductions, and credits to the IRS. This form is essential for compliance with U.S. tax laws and is required if the foreign corporation has income effectively connected with a U.S. trade or business.

-

How can airSlate SignNow help with the Form 1120 F U S Income Tax Return Of A Foreign Corporation?

airSlate SignNow simplifies the process of preparing and submitting the Form 1120 F U S Income Tax Return Of A Foreign Corporation by providing an easy-to-use platform for eSigning and managing documents. With our solution, you can efficiently collect signatures and ensure your tax forms are securely stored and easily accessible.

-

What features does airSlate SignNow offer for managing Form 1120 F U S Income Tax Return Of A Foreign Corporation?

AirSlate SignNow offers features such as customizable templates, automated workflows, and secure cloud storage specifically designed for tax forms like the Form 1120 F U S Income Tax Return Of A Foreign Corporation. These features streamline the eSigning process and enhance collaboration among team members.

-

Is airSlate SignNow cost-effective for businesses filing Form 1120 F U S Income Tax Return Of A Foreign Corporation?

Yes, airSlate SignNow is a cost-effective solution for businesses needing to file the Form 1120 F U S Income Tax Return Of A Foreign Corporation. Our pricing plans are designed to fit various business sizes and budgets, ensuring that you can manage your tax documents without breaking the bank.

-

Can I integrate airSlate SignNow with accounting software for Form 1120 F U S Income Tax Return Of A Foreign Corporation?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software platforms, making it easier to manage the Form 1120 F U S Income Tax Return Of A Foreign Corporation. This integration helps streamline your tax filing process by allowing you to pull in necessary data directly from your accounting systems.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for your tax document management, including the Form 1120 F U S Income Tax Return Of A Foreign Corporation, offers numerous benefits. You gain enhanced security, reduced turnaround times for document signing, and improved compliance with U.S. tax regulations, all of which contribute to a more efficient filing process.

-

How secure is airSlate SignNow for handling Form 1120 F U S Income Tax Return Of A Foreign Corporation?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and secure access controls to protect sensitive information related to the Form 1120 F U S Income Tax Return Of A Foreign Corporation, ensuring that your documents and data remain confidential and secure throughout the signing process.

Find out other 2016 form 1120 f us income tax return of a foreign corporation

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles