Fill and Sign the 2017 Virginia Resident Form 760 Individual Income Tax Return

Practical advice on preparing your ‘2017 Virginia Resident Form 760 Individual Income Tax Return’ online

Are you fatigued by the burden of handling paperwork? Look no further than airSlate SignNow, the leading digital signature platform for individuals and small to medium-sized businesses. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign paperwork online. Utilize the powerful features incorporated into this straightforward and affordable platform and transform your method of document management. Whether you need to authorize forms or collect digital signatures, airSlate SignNow manages it all effortlessly, with just a few clicks.

Follow this comprehensive guide:

- Sign in to your account or sign up for a free trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our form library.

- Open your ‘2017 Virginia Resident Form 760 Individual Income Tax Return’ in the editor.

- Click Me (Fill Out Now) to prepare the form on your side.

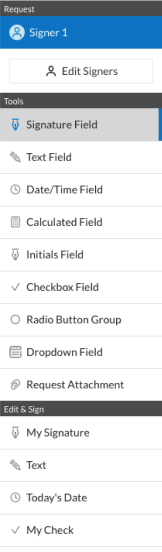

- Add and assign fillable fields for others (if necessary).

- Proceed with the Send Invite settings to request eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

Don’t fret if you need to collaborate with your teammates on your 2017 Virginia Resident Form 760 Individual Income Tax Return or send it for notarization—our platform provides everything you require to accomplish such tasks. Register with airSlate SignNow today and elevate your document management to new heights!

FAQs

-

What is the Virginia Resident Form 760 Individual Income Tax Return?

The Virginia Resident Form 760 Individual Income Tax Return is the official document used by Virginia residents to report their income and determine their state tax liability. This form includes various sections for income, deductions, and credits, ensuring accurate tax reporting. By using airSlate SignNow, you can easily eSign and submit your Virginia Resident Form 760, streamlining the tax filing process.

-

How can airSlate SignNow help with the Virginia Resident Form 760 Individual Income Tax Return?

airSlate SignNow simplifies the process of preparing and eSigning the Virginia Resident Form 760 Individual Income Tax Return. With its user-friendly interface, you can upload your documents, fill them out, and securely sign them online. This ensures that your tax return is completed accurately and submitted on time, enhancing your overall filing experience.

-

What features does airSlate SignNow offer for managing the Virginia Resident Form 760?

airSlate SignNow offers a range of features to assist with the Virginia Resident Form 760 Individual Income Tax Return. These include customizable templates, document sharing, and cloud storage for easy access. Additionally, its robust eSignature functionality ensures your form is legally compliant and securely stored.

-

Is airSlate SignNow a cost-effective solution for filing the Virginia Resident Form 760?

Yes, airSlate SignNow provides a cost-effective solution for filing the Virginia Resident Form 760 Individual Income Tax Return. With competitive pricing plans, you can choose the one that best suits your needs without compromising on quality. This makes it an ideal choice for individuals and businesses looking to streamline their tax filing process affordably.

-

Can I integrate airSlate SignNow with other accounting software for my Virginia Resident Form 760?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing you to manage your Virginia Resident Form 760 Individual Income Tax Return alongside your financial records. This integration simplifies data transfer and ensures your tax information is always up to date and accurate.

-

What are the benefits of using airSlate SignNow for my Virginia Resident Form 760?

Using airSlate SignNow for your Virginia Resident Form 760 Individual Income Tax Return offers numerous benefits, including time savings and enhanced accuracy. The platform allows you to eSign documents quickly, reducing the time spent on paperwork. Additionally, its security features protect your sensitive tax information, giving you peace of mind.

-

Is it easy to learn how to use airSlate SignNow for the Virginia Resident Form 760?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to learn how to use it for the Virginia Resident Form 760 Individual Income Tax Return. The intuitive interface guides you through the document preparation and eSigning process, allowing even first-time users to navigate the platform with confidence.

Related searches to 2017 virginia resident form 760 individual income tax return

Find out other 2017 virginia resident form 760 individual income tax return

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles