TREASURY SERVICES

Best Practices for

Implementing a Health

Savings Account (HSA)

Program

Implementing a successful HSA program is largely dependent on

educating employees about their benefits and motivating them to

enroll. Choosing the right HSA administrator to partner with is also a

critical success factor. This white paper outlines key best practices

that can help your firm effectively build and manage an HSA program.

TABLE OF CONTENTS

Case Study in Best

Practices – J.P. Morgan................................. 2

1. Best Practices: Designing

an HSA Program ........................................... 3

2. Best Practices: Selecting

an HSA Administrator................................... 5

3. Best Practices: Communicating

Effectively to Employees............................... 7

Conclusion ....................................................8

About the Authors ........................................9

About J.P. Morgan ........................................9

For more information, please contact your

J.P. Morgan Treasury Services representative

or visit jpmorgan.com/visit/hsa.

©2009 JPMorgan Chase & Co. All Rights Reserved. JPMorgan Chase Bank, N.A. Member FDIC

All services are subject to applicable laws and regulations and service terms.

1

�BEST PRACTICES FOR IMPLEMENTING A HEALTH SAVINGS ACCOUNT (HSA) PROGRAM

Many companies are finding that the addition of an HSA option to their healthcare benefits menu presents a

viable, practical solution to the health insurance challenges they face. Since its introduction five years ago, the

Health Savings Account market has seen significant growth across many industries. By year-end 2008, there

were an estimated three million HSAs with deposits of more than $3 billion – and the number of HSAs is

expected to quadruple by 2012 (Figure 1)1.

Case Study in Best

Practices – J.P. Morgan

An early entrant into the industry, J.P. Morgan

administers HSA programs for nearly 10,000

companies and provides HSA cash and

investment services for hundreds of

thousands of individuals nationwide.

As our employer clients’ adoption of HSAs

has grown, J.P. Morgan’s healthcare team has

gained significant experience working with

clients in all aspects of HSA programs, from

program discovery through implementation

and ongoing administration and management.

Key to any company’s success is to develop a

framework that can help it achieve both

short- and long-term program goals.

The framework used by J.P. Morgan’s most

successful companies is based on three

sets of best practices:

1. Best Practices for Designing a

Program to meet short- and long-term

enrollment goals.

• Controlling rising healthcare costs

Number of HSAs (millions)

8.0%

12.5

Number of HSAs

Percentage with HSAs

7.0%

6.0%

10

Share of Insured (%)

In speaking with benefit managers, financial

officers and other decision-makers, they give

the following principal reasons for introducing

a health plan that includes an HSA option:

3. Best Practices for Effectively

Communicating the benefits of an

HSA to employees.

14

12

The best practices presented here reflect the

experience gathered in meeting the needs of

companies representing the full spectrum of

American employers — ranging from those

with just two people on their payroll to firms

with more than 100,000 employees.

2. Best Practices for Selecting an HSA

Administrator with the requisite expertise

and core capabilities to meet your firm’s

and your employees’ needs. This includes

identifying an HSA that is easy to use for

both human resource administrators and

a diverse workforce.

9.1

5.0%

8

6.5

4.0%

6

3.0%

4.5

4

3.0

2

0.7

1.4

2.0%

1.9

1.0%

0.0%

0

2005

2006

2007

2008

2009

2010

2011

2012

Figure 1: Current and Estimated HSA Growth

(Figure 2)

• Introducing consumer choice as a factor

in healthcare purchase decisions

• Facilitating employees’ opportunity to

increase retirement savings

• Providing an additional savings vehicle

to help meet retiree medical costs

Healthcare premiums continue to outpace

other key indicators of affordability, including

inflation and workers’ earnings. In response,

many companies have sought lower-cost

alternatives such as HSA-compatible benefits

to mitigate the impact of healthcare inflation

on themselves and their employees.

1

2

20%

Health Insurance Premiums

Workers’ Earnings

Overall Compensation

18.0%

18%

16%

13.9%

14%

14.0%

12.9%

12.0%

12%

10.9%

10%

8.2%

8.5%

8%

6%

5.3%

11.2%

9.2%

7.7%

6.1%

4%

2%

0.8%

0%

2.6%

1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007

Figure 2: Increase in Health Insurance Premiums Compared to Other Indicators 2

Source: HSAs: Moving Beyond Growing Pains, Celent, 2008

Source: Kaiser Family Foundation/HRET Survey of Employer Health Benefits, 2007

©2009 JPMorgan Chase & Co. All Rights Reserved. JPMorgan Chase Bank, N.A. Member FDIC. All services are subject to applicable laws and regulations and service terms.

2

�BEST PRACTICES FOR IMPLEMENTING A HEALTH SAVINGS ACCOUNT (HSA) PROGRAM

1. Best Practices:

Designing an HSA Program

The groundwork for designing an effective

HSA program for your firm is gaining a clear

understanding of what HSAs are and the value

of this healthcare option to both companies

and their employees.

unexpected healthcare expenses incurred in

later life. Funds may be carried over from

year to year, and owners have the potential

for greater earnings by investing through an

HSA investment account. Unlike FSAs, there is

no “use it or lose it” provision. Unused funds

can also be withdrawn on a taxable basis for

any purpose after age 655, so HSA funds can

even contribute to a more secure retirement.

What is a Health Savings

Account?

Why do companies value HSAs?

An HSA is a special tax-advantaged account

owned by an individual who can use the funds

to pay for current or future medical expenses.

HSAs offer tangible cost benefits while

providing employees with the flexibility to

manage their healthcare needs.

Funds may be deposited via payroll deduction,

by employer contributions or by employee

direct deposits3. Once deposited, the money

earns interest tax-free year after year. Funds

can be withdrawn tax-free at any time if they

are used for qualified medical expenses.

CDHPs help companies control their rising

healthcare premiums. At the same time, they

reduce a company’s tax liabilities when

employees make pretax contributions. HSAs

also allow firms to offer an appealing

healthcare program with affordable rates and

competitive features. If designed

appropriately, an HSA program is a benefit

that enhances a company’s ability to attract

and retain top talent, because it offers every

employee greater control over his or her

healthcare decision-making.

For employees to be eligible to open an HSA,

they must enroll in a qualified high-deductible

health plan (HDHP)4. The HSA and the HDHP in

combination is an example of what is

commonly referred to as a consumer-driven

health plan (CDHP). CDHPs encompass a

number of healthcare strategies that

encourage consumers to become involved in

their healthcare and health coverage

decisions. Other examples of CDHP products

are Flexible Spending Accounts (FSAs) and

Health Reimbursement Arrangements (HRAs).

Why do employees value HSAs?

Contributions to HSAs are free from federal

and most state taxes. Therefore, an HSA can

help employees save substantially on all kinds

of qualified medical expenses — from

deductibles and copays in a company’s HDHP

to pharmacy bills, dental care, vision care and

much more.

Because the account is fully portable for life,

the money accumulated in an HSA belongs to

employees even if they change jobs. Unused

HSA balances that grow over time can

eventually be used to help offset large or

3

Key decision factors

for employees

While the tax and asset accumulation benefits

associated with an HSA are compelling, the

underlying health benefit is most important to

the majority of employees.

When making their benefits selection,

employees tend to focus primarily on the

health coverage related to an HSA program.

Their key decision factors are deductible

levels, out-of-pocket limits and preventive

coverage. Each of these factors tends to be

weighed against the associated premium

differentials. Employees may also regard

moving from a traditional health benefit plan

with copayments or low deductibles to a

consumer-driven health plan as a significant

benefits change. However, for many

employees, a closer look at overall CDHP

For the 2009 tax year, the maximum annual contribution is $3,000 for individuals and $5,950 for families.

In 2009, the Treasury Department and Internal Revenue Service define an HDHP as a plan with a minimum single/family

deductible of $1,150/$2,300.

5

Withdrawals for nonqualified expenses may be made prior to age 65, but will incur a 10% federal tax penalty, except in the

case of distributions made after death or disability of the accountholder.

4

benefits and medical coverage levels can

reveal that they are more advantageous than

traditional options (e.g., PPOs and HMOs),

which often do not provide first-dollar

coverage for preventive services.

HSAs at a Glance

• An HSA holder must have a qualified

high-deductible health plan.

• �Contributions to an HSA are free from

federal tax and most state tax.

• �HSA assets can earn interest and be invested.

• �HSA balances roll over from year to year.

— No “use it or lose it” provision as

with FSAs

• �HSA assets are the property of the

accountholder, not the employer.

• �HSAs are portable — employees keep

their HSAs even if they change jobs.

• �HSA assets can be spent on qualified

medical expenses.

— Otherwise, income tax and penalties will

apply.

— Individuals are responsible for

determining whether an expense

is qualified; there is no third-party

substantiation.

• �Most HSAs have debit card access and

many offer online bill pay and paper checks.

• �Employers, employees and individuals can

all contribute to an HSA.

Keep it simple

Companies that are successful at introducing

an HSA plan help employees make the best

healthcare choices. They begin by carefully

designing a CDHP that is simple to understand

and easy to use. J.P. Morgan clients have

found it beneficial to provide a manageable

number of overall healthcare options during

enrollment periods. For example, smaller

companies may want to limit their healthcare

options to one or two choices, while larger

companies may not want to exceed four

options. Too many choices in the start-up

phase may lead to employee confusion. Many

employees will tend to select a plan based on

a single factor — cost, for example — rather

©2009 JPMorgan Chase & Co. All Rights Reserved. JPMorgan Chase Bank, N.A. Member FDIC. All services are subject to applicable laws and regulations and service terms.

3

�BEST PRACTICES FOR IMPLEMENTING A HEALTH SAVINGS ACCOUNT (HSA) PROGRAM

than more completely evaluating how the

offering addresses their needs. Additionally,

plan selection and cost estimator tools can

help employees evaluate which health plan is

most appropriate for them. More information

on these important decision support tools is

outlined in the Best Practices: Communicating

Effectively to Employees section on page 7.

If multiple plans are offered, subtle changes in

the previous years’ healthcare options (e.g.,

changing plan names or reordering options)

create a greater likelihood that employees will

take the time to reexplore their benefits for

the coming year. To further encourage

employee participation in a new HSA plan,

employers can choose to offer lower

deductibles, higher levels of coinsurance and

front-loaded or accelerated HSA funding.

Preventive care

and healthful living

Companies experiencing significant

participation in their HSA plan tend to provide

employees with 100% coverage (not subject

to the deductible) for preventive care services

such as routine physicals, immunizations, etc.

In fact, according to America’s Health

Insurance Plans (AHIP)6, 84% of all HSA/HDHP

policies purchased in the group market

provide this level of benefit.

Many clients believe preventive care is the

key to keeping costs down, providing

financial incentives to employees who follow

a recommended regimen of care. Incentives

can also be tied to activities that promote a

healthful lifestyle such as smoking cessation

programs and enrollment in companysponsored programs that can directly affect

employees’ ability to stay healthy.

of credit also help offset large claims incurred

early in the year and/or early in the

payroll/contribution cycle.

Influence of early/ongoing

communication

Companies with high rates of HSA enrollment

tend to communicate early in the benefits

cycle regarding plan changes and to

emphasize to their employees the relationship

between benefit levels and the associated

"true” costs of healthcare. These companies

also find that subsequent changes to coverage

levels are more easily understood, especially

when the employer continues to promote

employee education on healthcare costs. A

more complete analysis of communications

approaches leading up to and moving beyond

the enrollment period is discussed on page 7

under Best Practices: Communicating

Effectively to Employees.

The impact of employer

contributions on employee

saving activity

Employers that contribute to HSAs

demonstrate their commitment to an HSA

program. This commitment can be further

reinforced by developing programs to engage

and educate employees about the spending

and saving advantages of HSAs.

6

Employee contributions in groups that

do not receive any employer funds are

contributing 23% less, and their

balances average $1,332.

• Matching contributions may be the

most effective way to encourage HSA

participation.

—

Companies that matched contributions

experienced higher enrollment rates

and had employees with 25% higher

balances compared to firms that

contributed in a lump-sum or a set

amount allocated over the payroll

cycles. Typically, employers match

between 50% and 100% of HSA

contributions.

Key Considerations in HSA Design

• Keep it simple and offer a manageable

number of health plan options.

• Provide comparable benefit levels

and cover preventive care at 100%.

• Plan for future design modifications

and incentives for positive behavior changes.

• Consider a line of credit to help offset

unexpected medical expenses early in the

year.

• Encourage participation by matching HSA

contributions or by providing lump-sum

funding early in the year.

In 2008, J.P. Morgan conducted a client

analysis of programs where employer

contributions were made. Some of the key

findings included:

• �Almost half of all employers were making

contributions to employee HSAs.

—

These employers contributed $775 on

average per account annually, with the

average employee contribution

equaling $1,725 — for a total average

contribution of $2,500.

—

The average annual spend in 2008

was $1,876, indicating that most

employees save money via the

HSA but are willing to spend when

necessary.

Offering a line of credit

Some employers offer a line of credit to help

employees cover any unexpected medical

expenses that exceed the balance in their

HSA. This option is designed to provide a

sense of security for those employees more

accustomed to lower out-of-pocket expenses.

Employees can choose to reimburse

themselves from the HSA at a later time. Lines

—

America’s Health Insurance Plans (AHIP): A Survey of Preventive Benefits in Health Savings Account (HSA) Plans, July 2007

©2009 JPMorgan Chase & Co. All Rights Reserved. JPMorgan Chase Bank, N.A. Member FDIC. All services are subject to applicable laws and regulations and service terms.

4

�BEST PRACTICES FOR IMPLEMENTING A HEALTH SAVINGS ACCOUNT (HSA) PROGRAM

2. Best Practices: Selecting

an HSA Administrator

Employers new to HSAs may be working with

a new type of benefits administrator — an

HSA custodian or trustee. A requirement of

the Medicare Modernization Act of 2003 is

that HSA assets be held by a qualified entity,

typically a bank or other financial institution.

Most companies have found that the best

financial institutions provide much more than

a place to house HSA assets. In fact, the right

HSA administrator can play an integral part in

helping firms increase HSA participation and

employee satisfaction. Employers therefore

usually conduct a careful inquiry into the

products, capabilities and track record of

potential HSA administrators, focusing on

the following:

Demonstrated success: The administrator

should be asked to demonstrate its success in

implementing these programs in terms of HSA

enrollment and penetration rates7, providing

case studies and references. Implementation

teams with truly significant experience in

benefits administration and in working with

benefits areas are often key to a firm’s ability

to start up and maintain a successful program

for years to come.

Most companies have found

that the best financial

institutions provide much

more than a place to house

HSA assets.

Administrative capabilities: Firms

should carefully consider the ease of both

administration and implementation.

Administrators’ capabilities are a vital

consideration, particularly for employers

with a high volume of enrollment and

ongoing status changes due to a dynamic

workforce. A simple enrollment process,

either Web or paper based, is essential.

7

HSA Calculators

Flyers and Reminders

HSA Educational Video with Real-Life Examples

Product Overview Document (and Templates)

Awareness Posters

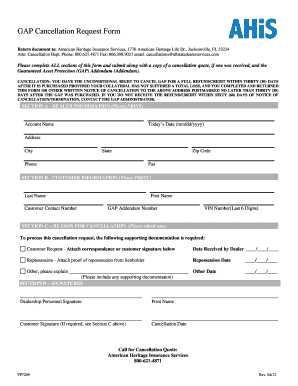

Figure 3: Tools for communicating your HSA program are available. J.P. Morgan has

developed employee-facing marketing materials under its consumer brand, Chase.

Comprehensive reporting is also critical to the

effective management of an HSA program as

is a dedicated support team that provides

assistance when needed.

Outstanding employee communications:

Administrators should provide turnkey

communication materials that can be

customized for the firm. One example is an

interactive HSA adoption kit (Figure 3).

A trusted custodian: Administrators should

have a good reputation; excellent track

record; strong balance sheet; sophisticated

offering of core banking, transaction and

investment services; integrated asset

management capabilities and a strong

financial base. For those employers with a

regional or national employee base, a large

retail/branch/ATM presence may also

be important.

Important considerations

Does the HSA administrator you are

evaluating offer these key elements?

• A full menu of customizable marketing

communications and enrollment materials

for your employees

• A simple enrollment process for your

employees, either Web or paper based

• Comprehensive reporting that allows you to

manage your HSA program and respond to

management requests

• A dedicated support team to provide

assistance when you need it

• A strong reputation and balance sheet that

you can depend on through difficult times

Penetration rate is the rate of eligible health plan enrollees to active HSA participants.

©2009 JPMorgan Chase & Co. All Rights Reserved. JPMorgan Chase Bank, N.A. Member FDIC. All services are subject to applicable laws and regulations and service terms.

5

�BEST PRACTICES FOR IMPLEMENTING A HEALTH SAVINGS ACCOUNT (HSA) PROGRAM

An implementation checklist

HSA CASE STUDY #1

Selecting the appropriate administrator and executing seamless implementation require careful

consideration and planning. This checklist is designed to help employers begin to identify key

attributes of quality administrators.

A manufacturing company in the Midwest with

1,000 eligible employees used a hands-on

approach when designing its HSA program. The

benefits staff emphasized controlling healthcare

1. Select the administrator and the team

— Ability to preallocate a fund mix for future

investments?

• Confirm that your overall HSA strategies are

aligned with those of the administrator:

— Quick turnaround times for cash/

investment transfers?

— Are the accounts going to be used to

— Does the administrator provide education

and tools to match the needs of your

employees?

• Evaluate the administrator’s length of time

traditional options. The program included full

coverage for preventive care and premium

discounts (nonuse of tobacco and online risk

assessments).

spend, save, invest for the future, or all

of the above?

costs and offered HSAs as a full replacement to

3. Analyze the functionality made

available to the employer

• Will the program be easy to administer

for internal support teams?

The company committed to contributing 60% of

the annual deductible to the HSAs and

determined that a mix of lump-sum funding and

contributions over the payroll cycles was the

— Coordinating payroll deductions

best funding strategy. In January, employees

offering HSA services and number of clients

— Sending files to the custodian

received half of their annual employer

supported.

— Authorizing changes

contribution. The remaining 50% contribution

— Accessing online tools for basic program

was divided throughout the next

• Inquire about the implementation team’s

experience working in:

— Banking

administration

• What type of reporting is provided to

11 months.

Selecting an HSA administrator included an

— Healthcare

help manage the program and measure success?

extensive RFP process with finalist meetings,

— Benefits

Reporting suites should help employers identify:

presentations and the contacting of HSA

2. Examine the HSA’s specific features

and functionality

— Account volumes and status

administrator references. After making its final

— Balances at program level

selection, the company worked with the

— Funding confirmations and

administrator to set project timelines.

• The HSA should provide basic services

as well as more advanced functionality:

transaction history

played a major part in the success of the

funding contributions

program. Beginning six months prior to

— Debit cards and paper checks to access

funds

A well-organized communications plan also

— Reconciliation reports for

— Analysis of investments programs

— Simple Web site and clear statements

enrollment, the HSA administrator conducted

Train the Trainer sessions to ensure that the

— Call Center expertise for live help

4. Design the communications plan

staff was prepared for enrollment sessions as

— Low-/no-fee access to large ATM networks

• Early in the evaluation process, request details

well as questions from employees. The company

— Integrated access to investments

— Online and phone-based self-service and

reporting

• Can the offering adapt to the needs of a diverse

workforce?

— Are there multiple options for account

enrollment (paper and electronic)?

— Can a line of credit be offered to help

provide a safety net for employees?

— Are there options for employees to service

about the HSA administrator’s capabilities to

posted FAQs and educational materials on the

support the planning and implementation of a

corporate intranet and encouraged employees

customizable communications program for your

to learn more.

employees.

• Ensure that your HSA administrator can support

these three key elements in any communications

plan:

One month prior to enrollment, letters were

mailed to the homes of employees to further

educate them and their families. In addition,

both one-on-one and small-group employee

— Training: In partnership with the

HSA administrator, you may want

comprehensive training for human

meetings were conducted with Human

Resources and the HSA administrator to provide

subject matter expertise.

resources, benefits and supervisory

their accounts (e.g., Web-based self-

personnel (commonly referred to as Train

Within the first year, the company experienced a

service, live customer service support)?

the Trainer sessions).

10% reduction in overall medical claims. More

— Are customer service representatives

HSA experts?

• Are features for investors included such as:

— Integrated investment functionality?

— A wide range of funds and risk levels for a

diverse employee base?

— Customization of printed materials,

than 65% of employees had HSA savings left for

including access to standard

future years. Additionally, the number of

communications templates

inquiries and discussions on healthcare from the

— Webinar/on-site support for open

enrollment

employee base increased, as well as awareness

about healthcare costs. To continue to promote

enrollment, the company did not increase

premiums in the second year.

©2009 JPMorgan Chase & Co. All Rights Reserved. JPMorgan Chase Bank, N.A. Member FDIC. All services are subject to applicable laws and regulations and service terms.

6

�BEST PRACTICES FOR IMPLEMENTING A HEALTH SAVINGS ACCOUNT (HSA) PROGRAM

3. Best Practices:

Communicating Effectively

to Employees

Encouraging employees to take ownership of

their healthcare/benefits decisions can be a

challenge. Studies show the same challenge

surrounded the growth of 401(k) plans in the

1980s. Employees tend to delay or be

disengaged from retirement and healthcare

decisions, which they view as complex and

difficult. The result is often inaction or

suboptimal decisions that may not be in the

employee's long-term interests8.

Experienced HSA administrators can help

employees overcome common hurdles posed

by any benefits change. In fact, next

to employer contributions and a strong

underlying health plan, the HSA

administrators’ communication capabilities

play the most important role in helping to

drive enrollment and the achievement of key

program goals.

Employers have learned that a well thoughtout, staged employee communications plan

rolled out over several months in advance of

the actual enrollment period allows

employees time to fully understand the new

benefits — and reduces confusion during the

busy enrollment season. Employee

communications plans will vary based on a

company’s size and needs, however, you’ll

find a sample HSA employee communications

plan below.

Professionally developed, extensive

communication tools can provide answers to

questions and address concerns about HSAs.

Examples of employee-facing materials that

J.P. Morgan developed for clients to leverage

throughout their HSA enrollment and

adoption efforts can be found on page 5.

Sample HSA Communications Plan

4 to 6 Months Prior

to Enrollment

2 to 4 Months Prior

to Enrollment

1 Month Prior

to Enrollment

Open

Enrollment

Post

Enrollment

Preintroduce open enrollment

by increasing HSA awareness.

Communicate HSA/CDHP

details. Provide comparisons

to traditional options.

Communicate final HSA/CDHP

details.

Keep employees engaged

with ongoing support and

preparation for next year’s

plan.

GOALS

Raise general awareness about

benefits changes and strategy.

Provide details on HSA 101.

Promote full suite of HSA

resources.

Offer tools to help employees

understand options for new

benefit year.

SENIOR MANAGEMENT

Demonstrate senior

management commitment.

Provide ongoing messaging

and participation in benefit

events, if applicable.

Recognize there will be

questions; assure employees

the company will assist them.

Consider following up with

employees on impact new plan

has had to overall benefit

expenses.

COMPANY COMMUNICATIONS

Use existing communications

channels to reinforce

management messages as

well as to archive information

for future reference.

HSA 101: Introduction of

HSA concept with access to

introductory videos,

condensed brochures and

printed materials

• HSA education

Consider a separate mailing to

employee homes to ensure that

the spouse/family members

are involved in the decision

process.

• Postcards to home address

• Reference materials that

• Full brochures

• Direct marketing to reinforce

•

company commitment

• Paycheck inserts

• Details on employee

premium amounts

•

•

•

•

are easy to distribute

Flyers with key HSA

information (i.e., Qualified

Medical Expenses, overview

of how investment account

works, etc.)

Information Sessions with

Open Q&A

Program Web site

HSA & HDHP info; links to

tools and FAQs

Benefits hotline

• Schedule regular

communications with

accountholders.

• Some topic ideas:

— Investment reminders

— Contribution information

— Tips for using the HSA

ADDITIONAL INFORMATION

Provide external resources for

more detailed information on

HSAs for employees.

8

• Employer contribution

information

• Education on Investment

options of an HSA

• Potential fees to employees

Access interactive tools,

including plan comparison

information.

Employee Benefits Research Institute, Issue Brief 320 – 8/2008

©2009 JPMorgan Chase & Co. All Rights Reserved. JPMorgan Chase Bank, N.A. Member FDIC. All services are subject to applicable laws and regulations and service terms.

7

�BEST PRACTICES FOR IMPLEMENTING A HEALTH SAVINGS ACCOUNT (HSA) PROGRAM

HSA CASE STUDY #2

A technology company with more than 30,000

eligible employees worldwide promoted HSAs as

a long-term savings vehicle and an integral part

of employer-provided retirement benefits. HSAs

were offered along with three other traditional

healthcare options. The company provided

100% coverage for preventive care and

contributed 50% of the HSA’s deductible. As an

added incentive, the entire employer

contribution was funded in the first payroll

Decision-support tools

Real-life examples and hands-on tools are

of significant help to employees trying to

become better consumers of healthcare

benefits. These tools can be sourced from

both the firm’s health insurance provider

and/or the HSA administrator. The available

tools range from simple calculators to genuine

decision-support aids using actual data to help

demonstrate the advantages of an HSA for

any specific employee.

cycle. Employees could also receive additional

HSA contributions upon successful completion

of wellness activities.

The process for selecting an HSA administrator

included an extensive RFP process with finalist

meetings and presentations. Once a decision

was reached, the company worked with the new

Basic HSA savings calculators

An HSA savings calculator is an easy-to-use

quick reference tool that educates the

employee on basic HSA math, including:

• Estimating his/her annual HSA contribution

administrator to set project timelines and

• Adding catch-up contributions, if eligible

outline specific program requirements.

• Adding employer and/or incentive

A phased communication program was used to

introduce HSAs to employees. Information on

HSAs was communicated to employees via the

corporate intranet four months prior to their

enrollment period in conjunction with the

contributions, if eligible

• Knowing the annual contribution limits

• Estimating payroll deductions based on

the above

company’s 401(k) plan. The company worked

with J.P. Morgan to create an employee Web site

Tax calculator

for HSA education and health plan information.

This is an easy-to-use tool that estimates

the impact of HSA contributions on the

employee’s state and federal income taxes.

One month before enrollment, e-mails were sent

to all employees with HSA information and links

to educational materials, including video

tutorials. Employee meetings were conducted

nationwide by J.P. Morgan to provide subject

matter expertise (both one-on-one and smallgroup meetings). Additionally, employees had

access to custom plan selection tools and

savings calculators to help estimate total out-ofpocket costs across the plans.

Future HSA value calculator

Similar to retirement calculators, this tool

allows users to make contribution and

distribution assumptions as well as estimate

future HSA balances by incorporating time

horizons and estimated rates of return on

cash and/or investments over time.

Their well-organized and extensive employee

communication plan paid off. The company met

100% of its enrollment goal for year one. Going

forward, they plan to look to further integrate

their 401(k) plan and HSAs to provide

employees with a more holistic approach to

retirement savings.

Plan selection and cost

estimator tools

These detailed yet intuitive cost-modeling

and projection tools can help employees

understand and more confidently evaluate a

consumer-directed healthcare plan and taxpreferred accounts such as HSAs. These

tools perform a side-by-side comparison of

traditional medical plans with new HSA plans,

allowing employees to select with more

confidence. Although many comparison tools

are available, the more sophisticated ones

include the following features:

• �Use of actual plan designs (e.g.,

deductible levels, coinsurance) offered

by the employer

• Integration of true cost data from the

health insurance company to help better

predict the costs of office visits,

procedures, chronic conditions,

medications and more. Administrators

can work directly with the insurance

company to obtain this data. The

information can help illustrate to

employees the effect that different types

of healthcare providers and services can

have on costs and HSA balances and what

their costs are over time.

When evaluating a custom tool, employers

need to look carefully at the tool’s capabilities

to combine cost estimation, plan selection and

long-term HSA accumulation modeling.

After the enrollment period, an effective way

to reinforce a company’s ongoing

commitment to its HSA program is to provide

employees with regular communications that

highlight product features and regulatory

impacts and also encourage account usage.

Conclusion

HSAs continue to grow in popularity. In

combination with HDHPs, they have become

a viable alternative to traditional health

insurance options. Successful programs

provide good features, great service and

an experienced, knowledgeable partner

to help employers engage and educate

their workforce.

Many clients have found that the key to

success in HSA implementation and

administration is to carefully consider a

range of new concepts and ideas, including

those we have presented in this paper:

• Best Practices for Designing a Program

to meet your short- and long-term

enrollment goals

• Best Practices for Selecting an HSA

Administrator with the requisite expertise

and core capabilities to meet your

firm’s and employees’ needs

©2009 JPMorgan Chase & Co. All Rights Reserved. JPMorgan Chase Bank, N.A. Member FDIC. All services are subject to applicable laws and regulations and service terms.

8

�BEST PRACTICES FOR IMPLEMENTING A HEALTH SAVINGS ACCOUNT (HSA) PROGRAM

• Best Practices for Effectively

Communicating the benefits of an

HSA to your employees

Lessons learned in these areas have yielded

successful programs for thousands of

J.P. Morgan clients. Considering these options

can help ensure that your firm’s benefit

offering is competitive in the marketplace,

while providing the best value for both your

employees and your company.

About the Authors

About J.P. Morgan

Healthcare Solutions

J.P. Morgan Healthcare Solutions provides

a comprehensive suite of products, services

and financial settlement tools for consumers,

insurers, physicians, hospitals and other

healthcare providers through two core

businesses, Consumer-Directed Healthcare

and Business-to-Business Solutions.

J.P. Morgan Healthcare Solutions is part of

the firm’s Treasury Services business.

David Josephs

Treasury Services

Managing Director and Head of ConsumerDirected Healthcare

The Treasury Services business of J.P. Morgan

is a top-ranked, full-service provider of

innovative payment, collection, liquidity

and investment management, trade finance,

commercial card and information solutions

to corporations, financial services institutions,

middle market companies, small businesses,

governments and municipalities worldwide.

With more than 50,000 clients and a

presence in 39 countries, J.P. Morgan

Treasury Services is the world’s largest

provider of treasury management services

and is a division of J.P. Morgan Bank, N.A.,

member FDIC.

David has worked on J.P. Morgan’s CDH and

HSA programs from their inception. His

experience prior to joining the bank includes

working directly for health insurers as well as

for nearly 10 years as a management

consultant to health plans and healthcare

providers on strategy, operations and revenue

cycle challenges. David served five years in

Washington D.C. as a legislative assistant to a

member of Congress and U.S. Senator,

handling healthcare issues. David earned a

B.A. in History from Wesleyan University and

an MBA from the Kellogg Graduate School of

Management at Northwestern University.

For information on HSAs, and to learn

Jason Kessler

more about J.P. Morgan’s best practices in

Vice President, HSA Product Manager

administering HSA programs, please visit

Jason has an extensive background in

healthcare product management, HSA

program design and all aspects of building

the necessary infrastructure to help

employers and employees navigate today’s

complex healthcare market. Jason spent the

previous 10 years working for leading health

insurance companies and HSA administrators.

He holds a B.A. from the University at Buffalo

and an MBA from the Lubin School of Business

at Pace University.

jpmorgan.com/visit/hsa, or contact Jason

Kessler at jason.b.kessler@jpmchase.com,

or your J.P. Morgan Treasury Services

representative.

©2009 JPMorgan Chase & Co. All Rights Reserved. JPMorgan Chase Bank, N.A. Member FDIC. All services are subject to applicable laws and regulations and service terms.

9

�