Fill and Sign the Archdiocese of Galveston Houston Petrine Privilage Form

Useful Advice on Getting Your ‘Archdiocese Of Galveston Houston Petrine Privilage Form’ Ready Online

Are you fed up with the burdens of handling paperwork? Look no further than airSlate SignNow, the premier eSignature platform for individuals and small to medium-sized businesses. Bid farewell to the tedious process of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign paperwork digitally. Take advantage of the robust capabilities integrated into this user-friendly and economical platform, transforming your method of paperwork management. Whether you need to sign forms or collect digital signatures, airSlate SignNow manages it all effortlessly, with just a few clicks.

Adhere to this detailed guide:

- Sign in to your account or enroll for a complimentary trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our form library.

- Access your ‘Archdiocese Of Galveston Houston Petrine Privilage Form’ in the editor.

- Click Me (Fill Out Now) to finish the document on your end.

- Add and assign fillable fields for others (if needed).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Save, print your version, or transform it into a reusable template.

Don't fret if you need to work with your colleagues on your Archdiocese Of Galveston Houston Petrine Privilage Form or send it for notarization—our platform provides you with everything necessary to achieve those tasks. Register with airSlate SignNow today and enhance your document management to a new horizon!

FAQs

-

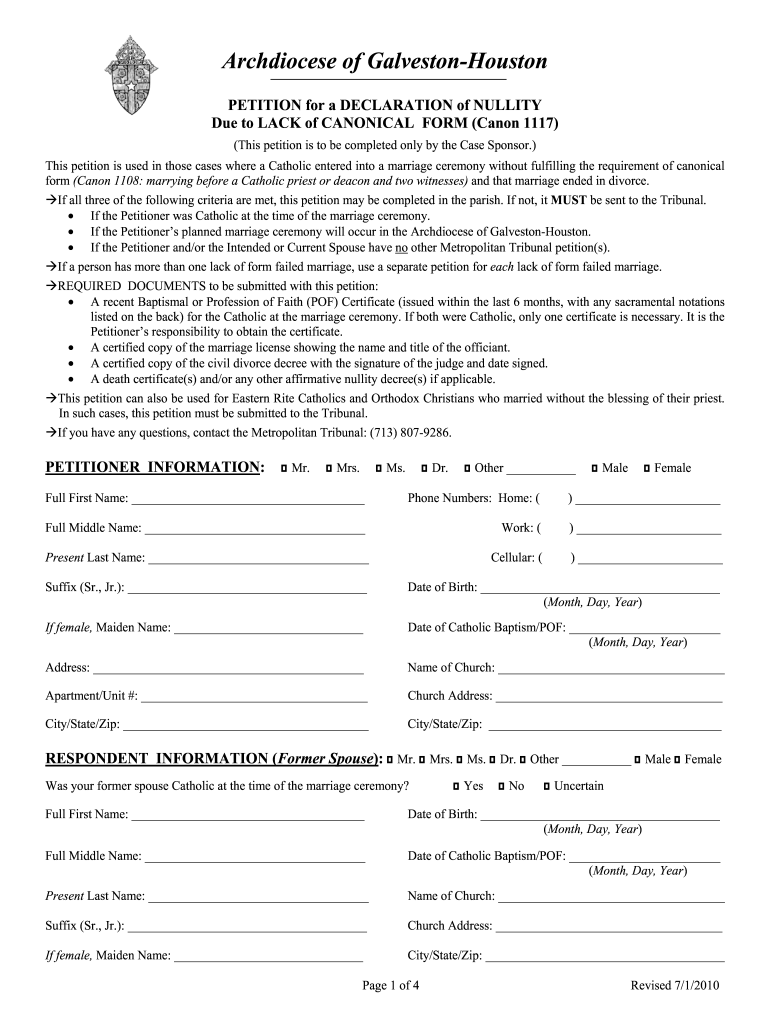

What is a Declaration Of Nullity Based On What Is Called A Lack Of Canonical Form?

A Declaration Of Nullity Based On What Is Called A Lack Of Canonical Form is a formal statement issued by a church authority, indicating that a marriage is invalid due to not adhering to the required canonical procedures. This declaration is important for individuals seeking to remarry within the church. Understanding this process is essential for anyone navigating marital issues.

-

How can airSlate SignNow assist with the Declaration Of Nullity Based On What Is Called A Lack Of Canonical Form?

airSlate SignNow simplifies the process of creating and managing documents related to the Declaration Of Nullity Based On What Is Called A Lack Of Canonical Form. Our platform allows users to easily draft, edit, and securely sign necessary documents online, ensuring a smooth process for all parties involved.

-

What are the costs associated with using airSlate SignNow for a Declaration Of Nullity?

airSlate SignNow offers a range of pricing plans to suit different needs, starting from a basic plan that provides essential features for processing the Declaration Of Nullity Based On What Is Called A Lack Of Canonical Form. Our competitive pricing ensures that you can manage your documents without breaking the bank.

-

Are there any specific features for handling legal documents like the Declaration Of Nullity Based On What Is Called A Lack Of Canonical Form?

Yes, airSlate SignNow includes specific features designed for legal documents, such as customizable templates and secure electronic signatures. These features ensure that your Declaration Of Nullity Based On What Is Called A Lack Of Canonical Form is handled with the utmost care and compliance with legal standards.

-

Can I integrate airSlate SignNow with other tools for processing a Declaration Of Nullity Based On What Is Called A Lack Of Canonical Form?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to streamline your workflow when dealing with the Declaration Of Nullity Based On What Is Called A Lack Of Canonical Form. Whether using CRM systems or document management software, our integrations enhance your efficiency.

-

What benefits does airSlate SignNow provide when managing a Declaration Of Nullity Based On What Is Called A Lack Of Canonical Form?

Using airSlate SignNow to manage your Declaration Of Nullity Based On What Is Called A Lack Of Canonical Form offers numerous benefits, including improved efficiency, reduced paperwork, and enhanced security. Our electronic signature solution ensures that your documents are signed and processed quickly, saving you time and effort.

-

Is airSlate SignNow user-friendly for creating a Declaration Of Nullity Based On What Is Called A Lack Of Canonical Form?

Yes, airSlate SignNow is designed with user-friendliness in mind. Our intuitive interface allows users of all skill levels to create and manage a Declaration Of Nullity Based On What Is Called A Lack Of Canonical Form effortlessly, providing helpful guides and support along the way.

Find out other archdiocese of galveston houston petrine privilage form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles