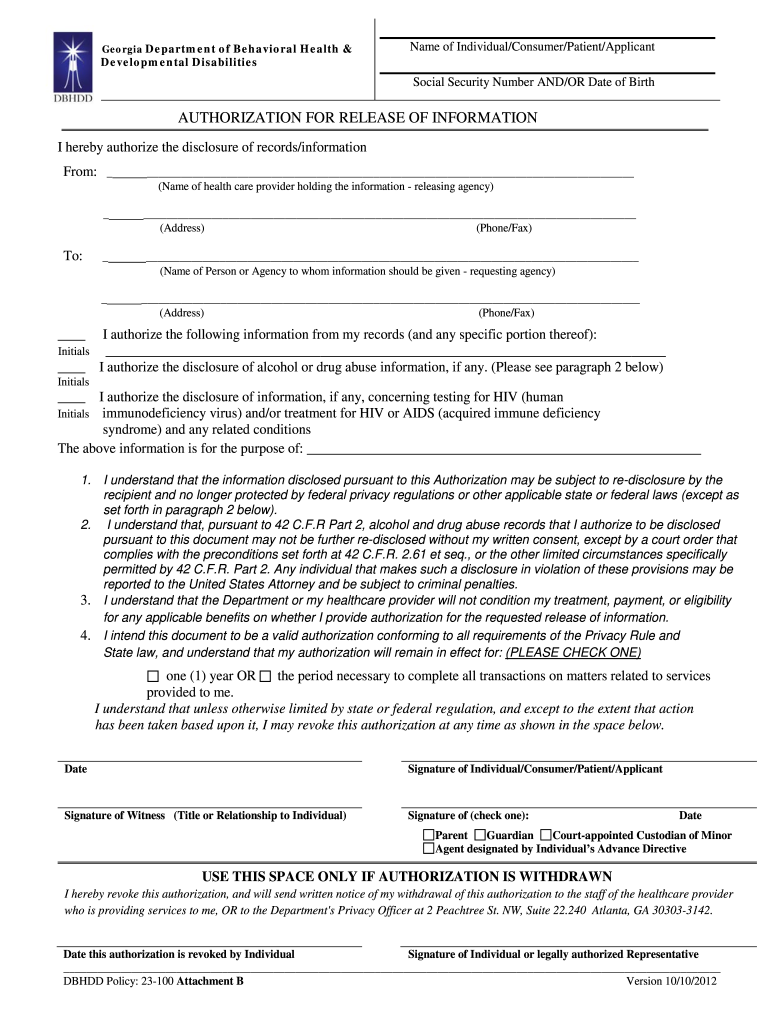

Fill and Sign the Authorization for Release of Information Form Dbhddorg

Useful suggestions for completing your ‘Authorization For Release Of Information Form Dbhddorg’ online

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the premier electronic signature solution for individuals and businesses. Bid farewell to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and endorse paperwork online. Leverage the robust features offered by this user-centric and cost-effective platform and transform your approach to document management. Whether you need to authorize forms or collect signatures, airSlate SignNow takes care of it all seamlessly, needing just a few clicks.

Adhere to this comprehensive guide:

- Log into your account or initiate a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template repository.

- Access your ‘Authorization For Release Of Information Form Dbhddorg’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and assign fillable fields for other participants (if needed).

- Proceed with the Send Invite settings to request eSignatures from others.

- Download, print your copy, or convert it into a multi-usable template.

Don’t be concerned if you need to work with your colleagues on your Authorization For Release Of Information Form Dbhddorg or send it for notarization—our solution offers everything you require to achieve such tasks. Create an account with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

What is Dbhdd Policystat and how does it work?

Dbhdd Policystat is a digital document management solution designed to streamline policy management and compliance for organizations. It enables users to create, distribute, and eSign policies easily, ensuring that all team members are informed and compliant. By leveraging airSlate SignNow's features, Dbhdd Policystat facilitates efficient document workflows and enhances organizational transparency.

-

How does Dbhdd Policystat benefit my organization?

Using Dbhdd Policystat can signNowly improve your organization’s operational efficiency. It allows for quick access to important policies and procedures, reducing the time spent searching for documents. Additionally, the eSigning feature ensures that all approvals are legally binding and securely stored, which enhances compliance and accountability.

-

What are the key features of Dbhdd Policystat?

Dbhdd Policystat offers a range of features including customizable templates, automated reminders for policy reviews, and secure electronic signatures through airSlate SignNow. These features work together to simplify the policy management process, making it easier for organizations to maintain up-to-date documentation and ensure all team members are informed.

-

Is Dbhdd Policystat suitable for small businesses?

Absolutely! Dbhdd Policystat is designed to be cost-effective and user-friendly, making it ideal for small businesses looking to enhance their policy management processes. With its intuitive interface and affordable pricing options, small organizations can easily implement Dbhdd Policystat without needing extensive resources.

-

What pricing options are available for Dbhdd Policystat?

Dbhdd Policystat offers flexible pricing plans to accommodate organizations of all sizes. Users can choose from monthly or annual subscriptions, with options that scale according to the number of users and features needed. This ensures that you only pay for what you need, making Dbhdd Policystat a budget-friendly solution.

-

Can Dbhdd Policystat integrate with other tools?

Yes, Dbhdd Policystat can seamlessly integrate with various tools and platforms to enhance your workflow. By utilizing airSlate SignNow's integration capabilities, you can connect Dbhdd Policystat with popular applications like Google Drive, Microsoft Office, and more. This allows for a smoother data transfer and document management experience.

-

How secure is Dbhdd Policystat for managing sensitive documents?

Security is a top priority for Dbhdd Policystat, especially when managing sensitive documents. The platform employs advanced encryption protocols and secure storage solutions to protect your data. With airSlate SignNow, you can rest assured that your documents are safe from unauthorized access and bsignNowes.

Find out other authorization for release of information form dbhddorg

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles