Fill and Sign the California Sales and Use Tax Certificate Form

Helpful tips on getting your ‘California Sales And Use Tax Certificate Form’ online

Are you fed up with the trouble of managing documentation? Look no further than airSlate SignNow, the premier eSignature solution for individuals and organizations. Bid farewell to the tedious routine of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign documents online. Take advantage of the powerful features embedded in this user-friendly and cost-effective platform and transform your document management approach. Whether you need to authorize forms or collect electronic signatures, airSlate SignNow manages everything seamlessly, with just a few clicks.

Adhere to this detailed guide:

- Sign in to your account or initiate a free trial with our service.

- Select +Create to upload a document from your device, cloud storage, or our template collection.

- Open your ‘California Sales And Use Tax Certificate Form’ in the editor.

- Click Me (Fill Out Now) to fill out the form on your end.

- Add and designate fillable fields for other participants (if necessary).

- Proceed with the Send Invite settings to request eSignatures from others.

- Save, print your version, or convert it into a reusable template.

No need to worry if you need to collaborate with your colleagues on your California Sales And Use Tax Certificate Form or send it for notarization—our platform provides everything you need to achieve such goals. Create an account with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

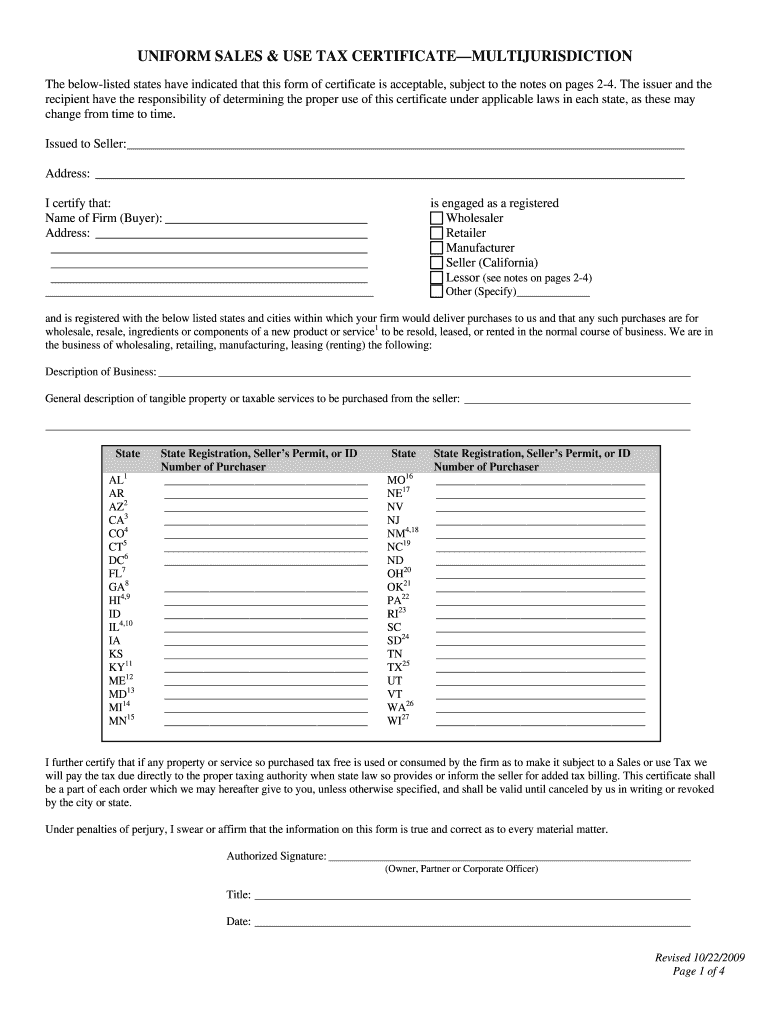

What is the California Sales And Use Tax Certificate Form?

The California Sales And Use Tax Certificate Form is a document that allows businesses to purchase goods without paying sales tax. This certificate is essential for businesses that resell products, as it helps them avoid double taxation. By using this form, you can streamline your purchasing processes and ensure compliance with California tax laws.

-

How do I obtain a California Sales And Use Tax Certificate Form?

To obtain a California Sales And Use Tax Certificate Form, you can apply online through the California Department of Tax and Fee Administration website. Alternatively, you can download the form, fill it out, and submit it to the appropriate tax office. It's crucial to ensure that all information is accurate to avoid delays in the processing of your application.

-

What are the benefits of using the California Sales And Use Tax Certificate Form?

Using the California Sales And Use Tax Certificate Form offers several benefits, including tax savings on purchases made for resale. This form helps businesses maintain compliance with state tax regulations, reducing the risk of penalties. Additionally, it simplifies the purchasing process, making it easier for businesses to manage their expenses.

-

Is there a fee associated with the California Sales And Use Tax Certificate Form?

There is no fee to apply for a California Sales And Use Tax Certificate Form. However, businesses must ensure they meet the qualifications for tax-exempt purchases. Maintaining accurate records is essential to uphold the validity of the certificate and avoid any potential tax liabilities.

-

Can I use the California Sales And Use Tax Certificate Form for online purchases?

Yes, you can use the California Sales And Use Tax Certificate Form for online purchases from sellers who accept it. When making online transactions, simply provide the certificate to the seller to claim your tax exemption. Ensure that the seller is registered to do business in California and accepts this form for tax exemption.

-

How does airSlate SignNow facilitate the eSigning of the California Sales And Use Tax Certificate Form?

airSlate SignNow provides an easy-to-use platform for digitally signing the California Sales And Use Tax Certificate Form. With its secure features, you can ensure that your documents are signed quickly and legally binding. The platform also allows for seamless sharing and tracking of the certificate, enhancing efficiency in your business operations.

-

What integrations does airSlate SignNow offer to streamline the use of the California Sales And Use Tax Certificate Form?

airSlate SignNow offers various integrations with popular business applications like Salesforce, Google Drive, and Dropbox. These integrations allow users to easily access and manage the California Sales And Use Tax Certificate Form alongside their existing workflows. This compatibility ensures that you can efficiently handle all your documentation needs within a single platform.

Find out other california sales and use tax certificate form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles