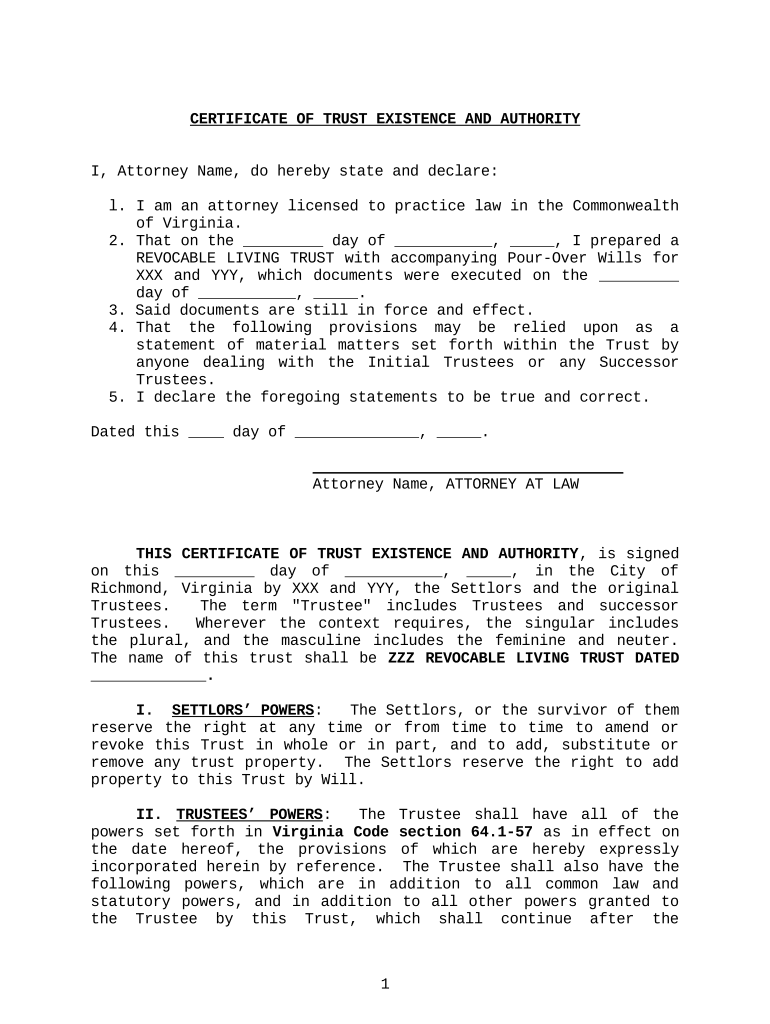

1CERTIFICATE OF TRUST EXISTENCE AND AUTHORITY

I, Attorney Name, do hereby state and declare:

l. I am an attorney licensed to practice law in the Commonwealth

of Virginia.

2. That on the _________ day of ___________, _____, I prepared a

REVOCABLE LIVING TRUST with accompanying Pour-Over Wills for

XXX and YYY, which documents were executed on the _________

day of ___________, _____.

3. Said documents are still in force and effect.

4. That the following provisions may be relied upon as a

statement of material matters set forth within the Trust by

anyone dealing with the Initial Trustees or any Successor

Trustees.

5. I declare the foregoing statements to be true and correct.

Dated this ____ day of ______________, _____.

___________________________________

Attorney Name, ATTORNEY AT LAW

THIS CERTIFICATE OF TRUST EXISTENCE AND AUTHORITY , is signed

on this _________ day of ___________, _____, in the City of

Richmond, Virginia by XXX and YYY, the Settlors and the original

Trustees. The term "Trustee" includes Trustees and successor

Trustees. Wherever the context requires, the singular includes

the plural, and the masculine includes the feminine and neuter.

The name of this trust shall be ZZZ REVOCABLE LIVING TRUST DATED

_____________.

I. SETTLORS’ POWERS : The Settlors, or the survivor of them

reserve the right at any time or from time to time to amend or

revoke this Trust in whole or in part, and to add, substitute or

remove any trust property. The Settlors reserve the right to add

property to this Trust by Will.

II. TRUSTEES’ POWERS : The Trustee shall have all of the

powers set forth in Virginia Code section 64.1-57 as in effect on

the date hereof, the provisions of which are hereby expressly

incorporated herein by reference. The Trustee shall also have the

following powers, which are in addition to all common law and

statutory powers, and in addition to all other powers granted to

the Trustee by this Trust, which shall continue after the

2termination of any of the trusts created by this Trust for the

purpose of the distribution of all or any portion of the trust

property, and which may be exercised at any time by the Trustee

without approval from any court:

A. To purchase or sell at public or private sale, or to

exchange, grant options to purchase, lease, pledge,

improve, repair, manage, insure, operate, control, and

mortgage, in such manner and on such terms as the

Trustee in its sole discretion may deem advisable, any

property, real or personal, which at any time may

constitute a part of the trust property.

B. To purchase any assets from each Settlor’s estate at

fair market value in such quantities as the Trustee

deems advisable, and to loan all or a portion of the

trust property to each Settlor’s testamentary estate,

upon such terms and in such amount as the Trustee deems

advisable, and with or without taking security.

C. To borrow money for any purpose, with or without

security and to pledge securities or other property,

without regard for the term of the trust(s).

D. To execute all deeds, assignments, leases or other

instruments necessary or proper for the exercise of any

power granted to the Trustee.

E. To invest or reinvest in and retain as an investment

any property which in the opinion of the Trustee is

suitable for the purposes of the Trust, although of a

kind or an amount which otherwise might not be regarded

as a proper trust investment, and specifically, but

without limitation, to invest in one or more mutual

funds, limited partnerships, and annuity funds;

provided, however, that either Settlor may specify in a

writing delivered to any Trustee other than a Settlor,

the kind, amount and date of any investment of all or

part of the Settlor's share of the trust property to be

made by the Trustee and the broker-dealer or registered

representative through whom the investment shall be

made.

F. To enter into any withdrawal plan with any mutual

funds authorizing payment to the Settlors, the survivor

of them or to any other beneficiary, of a specified

monthly or quarterly amount payable from income

dividends, capital gains distributions, and, to the

3extent necessary, from the proceeds of liquidation of

shares of any mutual fund, to enter into any

accumulation plan with any mutual fund authorizing

reinvestment of income dividends and capital gains

distributions and permitting further periodic or other

investments in any mutual fund, to deposit shares of any

mutual fund with a custodian or other agent, and to keep

any or all securities constituting a part or all of the

trust property in the name of a custodian or other agent

pursuant to any withdrawal plan or accumulation plan.

Neither the custodian nor other agent, nor the fund, nor

its transfer agent shall be under any duty to inquire

beyond the provisions of this subparagraph into the

powers or duties of the Trustee, and to that extent the

provisions of this subparagraph shall supersede any

other provisions of this Trust. Neither the custodian,

nor other agent, nor the fund, nor its transfer agent

shall be required to see to the application of any

payments made pursuant to any withdrawal plan, nor shall

they assume the responsibility for the validity of this

Declaration of Trust or any of its provisions.

G. To vote either in person or by general or limited

proxy, or to refrain from voting, any corporate stock

for any purpose not inconsistent with the trust(s) as

will in the sole discretion of the Trustee be most

beneficial for the Settlors during their lifetimes, and

thereafter for the named beneficiaries.

H. To deposit any securities constituting a part or all

of the trust property with or under the direction of any

committee formed to protect the securities and to

participate in, consent to or carry out any

reorganization, consolidation, merger, liquidation,

readjustment of the financial structure, or sale of the

assets of any corporation or other organization and to

exercise conversion and subscription rights, and hold

any property received pursuant to any exchange, deposit,

conversion or subscription as part of the trust

property.

I. To keep any or all securities or other property

constituting a part or all of the trust property in the

name of another person, or of a partnership or

corporation, or in the name of the Trustee, or of any

one or more or them, without disclosing their fiduciary

capacity.

4J. To determine how all receipts from any source and

all disbursements for any purpose shall be credited,

charged or apportioned between the trust property and

the income of the trust property, all without regard to

general rules of law, and specifically, but without

limitation, to make that determination in regard to

stock and cash dividend rights, and all other receipts

in respect of the ownership of stock.

K. To purchase or retain stock which pays dividends in

whole or in part, otherwise than in cash.

L. To pay, prosecute, extend, renew, modify, contest or

compromise, upon such terms as the Trustee may

determine, and upon such evidence as the Trustee may

deem sufficient, any obligation or claim, including

taxes, either in favor of or against the trust property,

or the income of the trust property.

M. To employ attorneys, banks, brokers, custodians,

investment counsel and other agents, and to delegate to

them duties, rights and powers of the Trustee,

including, among others, the right to vote on shares of

stock constituting a part or all of the trust property,

for periods and purposes as the Trustee in its sole

discretion may deem advisable. Any agent shall be

eligible to be so employed and to receive and retain

reasonable compensation or commissions for services

rendered, the same to be in addition to the compensation

which such Trustee would otherwise be entitled to

receive for services as a Trustee.

N. To receive property in trust from the Settlors, or

from any other person, whether by will or otherwise.

O. To determine whether and to what extent income of

the trust property shall be transferred to the trust

property with respect to the amortization, depreciation

or depletion of any of the trust property, all without

regard to the general rules of law on the subject.

P. To hold, manage, invest and account for the

principal of each trust under Article 3 either as a

separate fund or commingled with the principal of any or

all of the other trusts as a single fund, as the Trustee

in its sole discretion may determine, and if commingled

as a single fund, making the division only upon books of

account and allocating to each trust its proportionate

5part of the principal and income of the common fund, and

charging against each trust its proportionate part of

the common expenses, which expenses may be further

apportioned between the income and principal of each

trust under subparagraphs (J) and (O).

Q. To buy, sell and trade in securities of any nature,

including short sales, on margin, and for such purposes

may maintain and operate margin accounts with brokers,

and may pledge any securities held or purchased by them

with such brokers as security for loans and advances.

R. To allow the surviving spouse to occupy and use

until his or her death, the home (or any interest

therein) used by either or both Settlors as a principal

residence at the time of the decedent Settlor’s death.

The surviving spouse shall not be required to pay rent

for such use of the home, and upon his or her direction,

may have the Trustee sell such house and reinvest such

proceeds as the surviving spouse so directs.

S. To elect the mode of payment which appears to be the

most advantageous to the trust and beneficiaries, if not

previously elected, of any employee benefit plans or

retirement plans wherein the Trustee is named as

beneficiary.

T. To continue to participate in any business or other

enterprise at the risk of the trust estate and to effect

incorporation, dissolution or other change in the form

of organization of the business or enterprise.

At any time that either of the Settlors or any successor

Trustee is acting as a Trustee, the sole signature of a Settlor or

of a successor Trustee as a Trustee shall be sufficient to execute

proxies or powers of attorney, to vote any securities or other

assets, to execute stock powers or other endorsements of

securities or any other negotiable instruments registered, issued

or drawn in the name of or to the order of the Trustee for the

purpose of effecting assignment, transfer or delivery, and to sign

checks or orders to pay on deposits, accounts or credit balances

of the Trustee with any bank, banker, broker or trust company.

No person or corporation dealing with the Trustee shall be

required to investigate the Trustee's authority for entering into

any transaction or to see to the application of the proceeds of

any transaction.

6III. TRUSTEES : Any Trustee may resign at any time by giving

at least thirty (30) days written notice of its intention to do

so, delivered personally or by registered mail to the remaining

Trustee, or if none, to at least one beneficiary. In the case of

death, resignation, disability, or incapacity of any prior

Trustee, established by receipt of a written certificate to that

effect from the prior Trustee’s physician, or if none, or if

unavailable, from a licensed medical doctor of the succeeding

Trustee’s own choosing, the person or organization named in the

next succeeding item of Article 16 A shall be the Trustee, and the

person or organization named in the following item of Article 16 A

shall be the successor Trustee. Any Trustee may in its discretion

appoint a Co-trustee. The last successor Trustee may appoint a

successor Trustee. Any successor Trustee shall be deemed to be in

office and entitled to act upon delivery of its written acceptance

of this Trust to an acting Trustee, or if none, to at least one

beneficiary. Any Co-trustee may delegate its powers in writing to

the other Trustee for a period not to exceed six (6) months, may

revoke that designation, and may successively renew it. Any

successor Trustee shall have all the powers, immunities and

discretions given to the original Trustee. No Trustee shall be

required to give bond for the performance of its duties, or if

required by law, no surety shall be required on such bond.

IV. TRUSTEE AMENDMENT OF ADMINISTRATIVE PROVISIONS : The

Trustee may, upon giving notice to each beneficiary, amend, either

in whole or in part, any administrative provision of this Trust

which causes unanticipated tax liability, or conform the

administrative provisions of the Trust to the requirements of the

taxing authorities. The Trustee is, therefore, expressly

authorized to enter into any agreements with the Internal Revenue

Service or any other governmental body and to execute any

documents as will, in the discretion of the Trustee, tend to

minimize the taxes resulting from this Trust.

V. CERTIFIED COPIES : To the same effect as if it were

the original, anyone may rely upon a copy certified by a notary

public to be a true copy of this Declaration of Trust (and

attachments, if any). Anyone may rely fully upon any statements

of fact certified by one who appears from the original Declaration

or an executed counterpart or a certified copy to be the Trustee.

VI. ESSENTIAL INFORMATION :

A. Place of Residence and Names:

1. City and State: Richmond, Virginia.

2. Settlors: __________________________________.

73. Original Trustees:

_________________________________.

4. First Successor Trustee: _____________________ of

__________________.

5. Second Successor Trustee: ______________________ of

_________________.

REPRODUCTIONS OF THIS EXECUTED ORIGINAL (WITH REPRODUCED

SIGNATURES) SHALL BE DEEMED TO BE ORIGINAL COUNTERPARTS OF THIS

CERTIFICATE .

Signed and dated this _________ day of ___________, _____.

_____________________________

XXX

Settlor and Trustee

_____________________________

YYY

Settlor and Trustee

COMMONWEALTH OF VIRGINIA )

COUNTY OF _______________)

Personally appeared above-named Settlors and Trustees, XXX

and YYY, and duly acknowledged that they executed the preceding

instrument as their free act and deed, before me, this _________

day of ___________, _____.

(SEAL)

________________________________

Notary Public

My commission expires: ________________________________