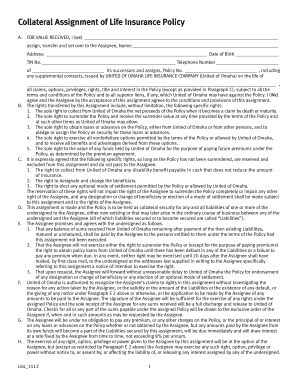

Fill and Sign the Collateral Assignment of Life Insurance Policy Mutual of Omaha Form

Valuable advice on preparing your ‘Collateral Assignment Of Life Insurance Policy Mutual Of Omaha’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the premier electronic signature solution for individuals and small to medium-sized businesses. Bid farewell to the tedious steps of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Take advantage of the powerful features integrated into this intuitive and cost-effective platform and transform your method of document handling. Whether you need to approve forms or gather electronic signatures, airSlate SignNow manages everything with simplicity, needing just a few clicks.

Follow this detailed guide:

- Log in to your account or sign up for a complimentary trial of our service.

- Click +Create to upload a file from your device, cloud storage, or our template repository.

- Open your ‘Collateral Assignment Of Life Insurance Policy Mutual Of Omaha’ in the editor.

- Click Me (Fill Out Now) to finalize the form on your end.

- Add and designate fillable fields for additional users (if necessary).

- Proceed with the Send Invite options to solicit eSignatures from others.

- Save, print your version, or convert it into a reusable template.

No need to worry if you have to work together with others on your Collateral Assignment Of Life Insurance Policy Mutual Of Omaha or send it for notarization—our service offers all you require to complete such tasks. Sign up with airSlate SignNow today and enhance your document management to a higher level!

FAQs

-

What is a Collateral Assignment Of Life Insurance Policy with Mutual Of Omaha?

A Collateral Assignment Of Life Insurance Policy with Mutual Of Omaha is a legal agreement where the policyholder assigns a portion of their life insurance benefits to a lender or creditor as collateral for a loan. This ensures that the lender receives insurance proceeds in case of the policyholder's death, thereby securing the loan. Understanding this process can help you protect your financial interests while securing necessary funding.

-

How does airSlate SignNow facilitate the Collateral Assignment Of Life Insurance Policy with Mutual Of Omaha?

AirSlate SignNow simplifies the process of creating and signing a Collateral Assignment Of Life Insurance Policy with Mutual Of Omaha by providing a user-friendly eSigning platform. You can easily upload your documents, add necessary fields for signatures, and send them for signing in minutes. This streamlines the process, ensuring that all parties can complete the assignment quickly and securely.

-

Are there any fees associated with using airSlate SignNow for Collateral Assignment Of Life Insurance Policy with Mutual Of Omaha?

AirSlate SignNow offers competitive pricing plans that cater to different business needs, including options tailored for managing Collateral Assignment Of Life Insurance Policy with Mutual Of Omaha. While there may be nominal fees for certain advanced features, basic eSigning capabilities are affordable and often come with free trial options. This makes it a cost-effective choice for managing important documents.

-

What features does airSlate SignNow offer for managing life insurance assignments?

AirSlate SignNow provides several features specifically designed to assist with Collateral Assignment Of Life Insurance Policy with Mutual Of Omaha, such as customizable templates, automated workflows, and secure cloud storage. These tools help ensure that your documents are correctly formatted, signed, and stored securely, making it easy to manage your life insurance assignments efficiently.

-

Can I integrate airSlate SignNow with other software for managing life insurance policies?

Yes, airSlate SignNow offers seamless integrations with various CRM and document management systems, enhancing your ability to manage Collateral Assignment Of Life Insurance Policy with Mutual Of Omaha. Integrating with tools you already use can streamline your workflow, allowing for a more efficient document management process. This flexibility can save you time and improve overall productivity.

-

What are the benefits of using airSlate SignNow for life insurance assignments?

Using airSlate SignNow for your Collateral Assignment Of Life Insurance Policy with Mutual Of Omaha offers numerous benefits, including increased efficiency, enhanced security, and improved compliance. The platform ensures that your documents are securely signed and stored, reducing the risk of errors and delays. Additionally, the ease of use allows you to focus more on your business rather than on paperwork.

-

Is airSlate SignNow compliant with industry regulations for life insurance documentation?

Absolutely! AirSlate SignNow is designed to comply with industry regulations, ensuring that your Collateral Assignment Of Life Insurance Policy with Mutual Of Omaha meets all necessary legal standards. The platform employs advanced security measures to protect sensitive information and maintains compliance with eSignature laws, providing peace of mind as you manage your life insurance assignments.

Find out other collateral assignment of life insurance policy mutual of omaha form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles