MULTISTATE FORM US-00472C

CONTRACT FOR THE SALE AND PURCHASE OF REAL ESTATE

NO BROKER - VACANT COMMERCIAL LAND

WARNING: THIS CONTRACT HAS SUBSTANTIAL LEGAL CONSEQUENCES AND THE

PARTIES ARE ADVISED TO CONSULT LEGAL AND TAX COUNSEL.

FOR VALUABLE CONSIDERATION OF TEN DOLLARS and other good and valuable consideration, the

receipt and sufficiency of which is hereby acknowledged, ___________________________________________________

______________________________________ (Seller), whether one or more, and _______________________________

__________________________________________________ (Buyer), whether one or more, do hereby covenant, contract

and agree as follows:

1. AGREEMENT TO SALE AND PURCHASE: Seller agrees to sell, and Buyer agrees to buy from Seller the

property described as follows: (complete adequately to identify property)

Lot , Block , Addition

City of , _ County, State of .

Address: (Address/Zip Code), or as described on attached

exhibit.

Together with all fixtures and attachments to said land except the following:

All property sold by this contract is called the "Property."

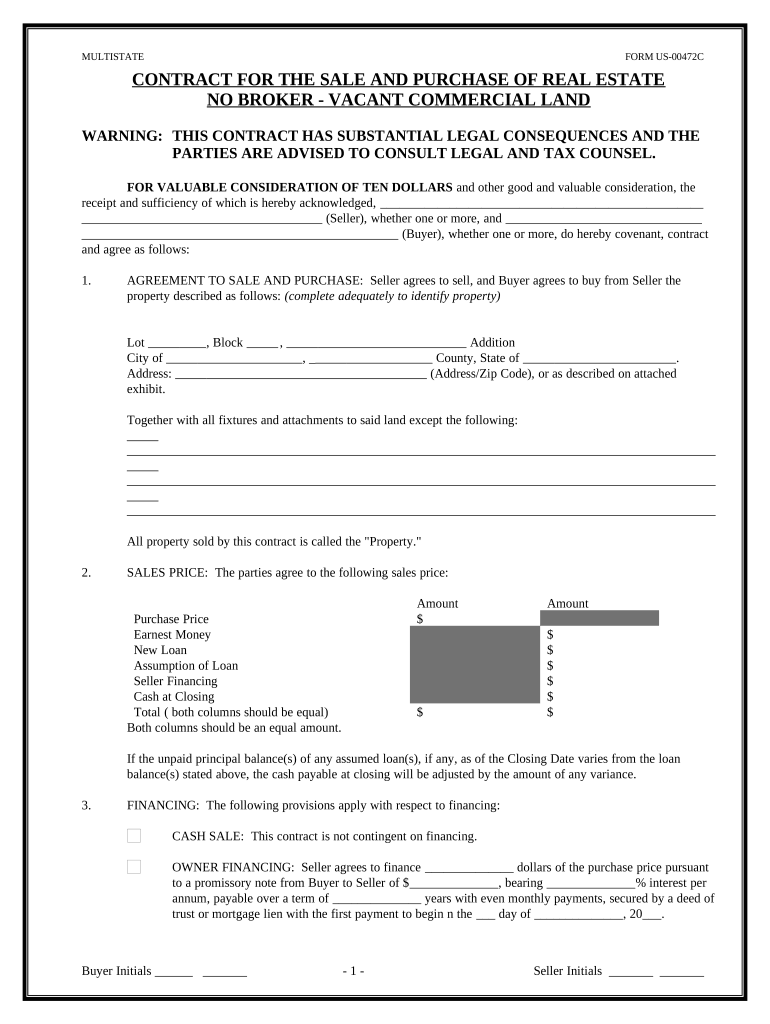

2. SALES PRICE: The parties agree to the following sales price:

Amount Amount

Purchase Price $

Earnest Money $

New Loan $

Assumption of Loan $

Seller Financing $

Cash at Closing $

Total ( both columns should be equal) $ $

Both columns should be an equal amount.

If the unpaid principal balance(s) of any assumed loan(s), if any, as of the Closing Date varies from the loan

balance(s) stated above, the cash payable at closing will be adjusted by the amount of any variance.

3. FINANCING: The following provisions apply with respect to financing:

CASH SALE: This contract is not contingent on financing.

OWNER FINANCING: Seller agrees to finance ______________ dollars of the purchase price pursuant

to a promissory note from Buyer to Seller of $ ______________ , bearing ______________ % interest per

annum, payable over a term of ______________ years with even monthly payments, secured by a deed of

trust or mortgage lien with the first payment to begin n the ___ day of ______________ , 20 ___ .

Buyer Initials ______ _______ - 1 - Seller Initials _______ _______

MULTISTATE FORM US-00472C

NEW LOAN OR ASSUMPTION: This contract is contingent on Buyer obtaining financing. Within ___

days after the effective date of this contract Buyer shall apply for all financing or noteholder’s approval

of any assumption and make every reasonable effort to obtain financing or assumption approval.

Financing or assumption approval will be deemed to have been obtained when the lender determines that

Buyer has satisfied all of lender's financial requirements (those items relating to Buyer's net worth,

income and creditworthiness). If financing or assumption approval is not obtained within ___ days after

the effective date hereof, this contract will terminate and the earnest money will be refunded to Buyer

Existing Loan Review. If an existing loan is not to be released at closing, Seller shall provide copies of

the loan documents (including note, deed of trust or mortgage, modifications) to Buyer within ___

calendar days from acceptance of this contract. This contract is conditional upon Buyer's review and

approval of the provisions of such loan documents. Buyer consents to the provisions of such loan

documents if no written objection is received by Seller from Buyer within ___ calendar days from

Buyer's receipt of such documents. If the lender's approval of a transfer of the Property is required, this

contract is conditional upon Buyer's obtaining such approval without change in the terms of such loan,

except as may be agreed by Buyer. If lender's approval is not obtained on or before

___________________________ , ____________ , this contract shall be terminated on such date. The

Seller shall shall not, be released from liability under such existing loan If Seller is to be released

and release approval is not obtained, Seller may nevertheless elect to proceed to closing, or terminate this

agreement in the sole discretion of Seller.

Credit Information. If Buyer is to pay all or part of the purchase price by executing a promissory note in

favor of Seller or if an existing loan is not to be released at closing, this contract is conditional upon

Seller's approval of Buyer's financial ability and creditworthiness, which approval shall be at Seller's sole

and absolute discretion. In such case: (l) Buyer shall supply to Seller on or before

___________________ , __________ , at, Buyer's expense, information and documents concerning

Buyer's financial, employment and credit condition; (2) Buyer consents that Seller may verify Buyer's

financial ability and creditworthiness; (3) any such information and documents received by Seller shall be

held by Seller in confidence, and not released to others except to protect Seller's interest in this

transaction; (4) if Seller does not provide written notice of Seller's disapproval to Buyer on or before

_______________________ , _____________ , then Seller waives this condition

4. EARNEST MONEY: Buyer shall deposit $ _____________ as earnest money with ________________________

upon execution of this contract by both parties.

5. PROPERTY CONDITION:

Buyer hereby represents that he has personally inspected and examined the above mentioned property and accepts

the property in it's "as-is" and present condition.

6. UTILITIES: Water is provided to the property by ________________________ , Sewer is provided by

________________________ . Gas is provided by _____________ . Electricity is provided by _____________ .

Other: _____________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

The present condition of all utility access to the property is accepted by Buyer.

Seller is not aware of the existence of wetlands, shoreland, or flood plain on or affecting the real property except

as follows: .

Seller knows of no hazardous substances or petroleum products having been placed, stored, or released from or

on the real property by any person in violation of any law, nor of any underground storage tanks having been

located on the real property at any time, except as follows: .

Buyer Initials ______ _______ - 2 - Seller Initials _______ _______

MULTISTATE FORM US-00472C

7. CLOSING: The closing of the sale will be on or before ___________________ , 20 ___ unless extended pursuant

to the terms hereof.

Closing may be extended to within 7 days after objections to matters disclosed in the title abstract, certificate or

Commitment or by the survey have been cured.

The closing date may also be extended by written agreement of the parties.

8. TITLE AND CONVEYANCE: Seller is to convey title to Buyer by Warranty Deed or _____________________ (as

appropriate) and provide Buyer with a Certificate of Title prepared by an attorney, title or abstract company upon

whose Certificate or report title insurance may be obtained from a title insurance company qualified to do and doing

business in the state of ______________________ . Seller shall, prior to or at closing, satisfy all outstanding

mortgages, deeds of trust and special liens affecting the subject property which are not specifically assumed by

Buyer herein. Title shall be good and marketable, subject only to (a) covenants, conditions and restrictions of record,

(b) public, private utility easements and roads and rights-of-way, (c) applicable zoning ordinances, protective

covenants and prior mineral reservations, (d) special and other assessments on the property, if any, (e) general taxes

for the year _________ and subsequent years and

(e) other: ____________________________________________________________________________ . A title

report shall be provided to Buyer at least 5 days prior to closing. If there are title defects, Seller shall notify Buyer

within 5 days of closing and Buyer, at Buyer's option, may either (a) if defects cannot be cured by designated closing

date, cancel this contract, in which case all earnest money deposited shall be returned, (b) accept title as is, or (c) if

the defects are of such character that they can be remedied by legal action within a reasonable time, permit Seller

such reasonable time to perform curative work at Seller's expense. In the event that the curative work is performed

by Seller, the time specified herein for closing of this sale shall be extended for a reasonable period necessary for

such action. Seller represents that the property may be legally used as zoned and that no government agency has

served any notice to Seller requiring repairs, alterations or corrections of any existing condition except as stated

herein.

9. APPRAISAL, SURVEY AND TERMITE INSPECTION: Any appraisal of the property shall be the responsibility

of Buyer Seller. A survey is not required required, the cost of which shall be paid by Seller

Buyer. If a survey is required it shall be obtained within 5 days of closing.

10. POSSESSION AND TITLE: Seller shall deliver possession of the Property to Buyer at closing. Title shall be

conveyed to Buyer, if more than one as ( ) Joint tenants with rights of survivorship, tenants in common,

Other: _________________________________________________ . Prior to closing the property shall remain in

the possession of Seller.

11. CLOSING COSTS AND EXPENSES: The following closing costs shall be paid as provided. (Leave blank if the

closing cost does not apply.)

Closing Costs Buyer Seller Both*

Attorney Fees

Title Insurance

Title Abstract or Certificate

Recording Fees

Appraisal

Survey

If contingent on rezoning, cost and expenses of rezoning

Other:

Buyer Initials ______ _______ - 3 - Seller Initials _______ _______

MULTISTATE FORM US-00472C

Closing Costs Buyer Seller Both*

All other closing costs

* 50/50 between buyer and seller.

12. PRORATIONS: Taxes for the current year, interest, maintenance fees, assessments, dues and rents, if any, will be

prorated through the Closing Date. If taxes for the current year vary from the amount prorated at closing, the

parties shall adjust the prorations when tax statements for the current year are available

13. DEFAULT: If Buyer fails to comply with this contract, Buyer will be in default, and Seller may either (a) enforce

specific performance, seek such other relief as may be provided by law, or both, or (b) terminate this contract and

receive the earnest money as liquidated damages, thereby releasing both parties from this contract. If, due to

factors beyond Seller’s control, Seller fails within the time allowed to make any non-casualty repairs or deliver

evidence of clean title, Buyer may either (a) extend the time for performance up to 15 days and the Closing Date

will be extended as necessary or (b) terminate this contract as the sole remedy and receive a refund of the earnest

money. If Seller fails to comply with this contract for any other reason, Seller will be in default and Buyer may

either (a) enforce specific performance, seek such other relief as may be provided by law, or both, or (b) terminate

this contract and receive the earnest money, thereby releasing both parties from this contract.

14. ATTORNEY'S FEES: The prevailing party in any legal proceeding brought under or with respect to the

transaction described in this contract is entitled to recover from the non-prevailing party all costs of such

proceeding and reasonable attorney’s fees.

15. REPRESENTATIONS: Seller represents that as of the Closing Date (a) there will be no liens, assessments, or

security interests against the Property which will not be satisfied out of the sales proceeds unless securing payment

of any loans assumed by Buyer and (b) assumed loans will not be in default. If any representation in this contract

is untrue on the Closing Date, this contract may be terminated by Buyer and the earnest money will be refunded to

Buyer. All representations contained in this contract will survive closing.

16. FEDERAL TAX REQUIREMENT: If Seller is a "foreign person", as defined by applicable law, or if Seller fails

to deliver an affidavit that Seller is not a "foreign person", then Buyer shall withhold from the sales proceeds an

amount sufficient to comply with applicable tax law and deliver the same to the Internal Revenue Service together

with appropriate tax forms. IRS regulations require filing written reports if cash in excess of specified amounts is

received in the transaction.

17. AGREEMENT OF PARTIES: This contract contains the entire agreement of the parties and cannot be changed

except by their written agreement.

18. NOTICES: All notices from one party to the other must be in writing and are effective when mailed to, hand-

delivered at, or transmitted by facsimile machine as follows:

To Buyer at: To Seller at:

Telephone ( ) Telephone ( )

Buyer Initials ______ _______ - 4 - Seller Initials _______ _______

MULTISTATE FORM US-00472C

Facsimile ( ) Facsimile ( )

19. ASSIGNMENT: This agreement may not be assigned by Buyer without the consent of Seller. This agreement

may be assigned by Seller and shall be binding on the heirs and assigns of the parties hereto.

20. PRIOR AGREEMENTS: This contract incorporates all prior agreements between the parties, contains the entire and

final agreement of the parties, and cannot be changed except by their written consent. Neither party has relied upon

any statement or representation made by the other party or any sales representative bringing the parties together.

Neither party shall be bound by any terms, conditions, oral statements, warranties, or representations not herein

contained. Each party acknowledges that he has read and understands this contract. The provisions of this contract

shall apply to and bind the heirs, executors, administrators, successors and assigns of the respective parties hereto.

When herein used, the singular includes the plural and the masculine includes the feminine as the context may

require.

21. NO BROKER OR AGENTS: The parties represent that neither party has employed the services of a real estate

broker or agent in connection with the property, or that if such agents have been employed, that the party employing

said agent shall pay any and all expenses outside the closing of this agreement.

22. EMINENT DOMAIN: If the property is condemned by eminent domain after the effective date hereof, the Seller

and Buyer shall agree to continue the closing, or a portion thereof, or cancel this Contract. If the parties cannot agree,

this contract shall remain valid with Buyer being entitled to any condemnation proceeds at or after closing, or

be cancelled and the earnest money returned to Buyer.

23. RECORDING: This agreement may may not be recorded in the official records of __________ County,

____________________ .

24. OTHER PROVISIONS

Seller represents that the property is is not zoned and may be used for commercial purposes, included the

following use intended by Buyer: ___________________________________ . If the property is zoned, Seller

represents that the property is zoned by ____________________________ with zoning designation

_________________________________________ .

Buyer Initials ______ _______ - 5 - Seller Initials _______ _______

MULTISTATE FORM US-00472C

TIME IS OF THE ESSENCE IN THE PERFORMANCE OF THIS AGREEMENT.

GOVERNING LAW: This contract shall be governed by the laws of the State of .

EXECUTED the ____ day of _________________, 20_____ (THE EFFECTIVE DATE).

__________________________________ ___________________________________

Buyer Seller

__________________________________ ___________________________________

Buyer Seller

EXHIBIT FOR DESCRIPTION OR ATTACH SEPARATE DESCRIPTION

Buyer Initials ______ _______ - 6 - Seller Initials _______ _______

MULTISTATE FORM US-00472C

RECEIPT

Receipt of Earnest Money is acknowledged.

Signature:__________________________ Date: _______________________, 20___

By:___________________________________

______________________________________ Telephone ( )________________________

Address

______________________________________ Facsimile ( )________________________

City State Zip Code

Buyer Initials ______ _______ - 7 - Seller Initials _______ _______