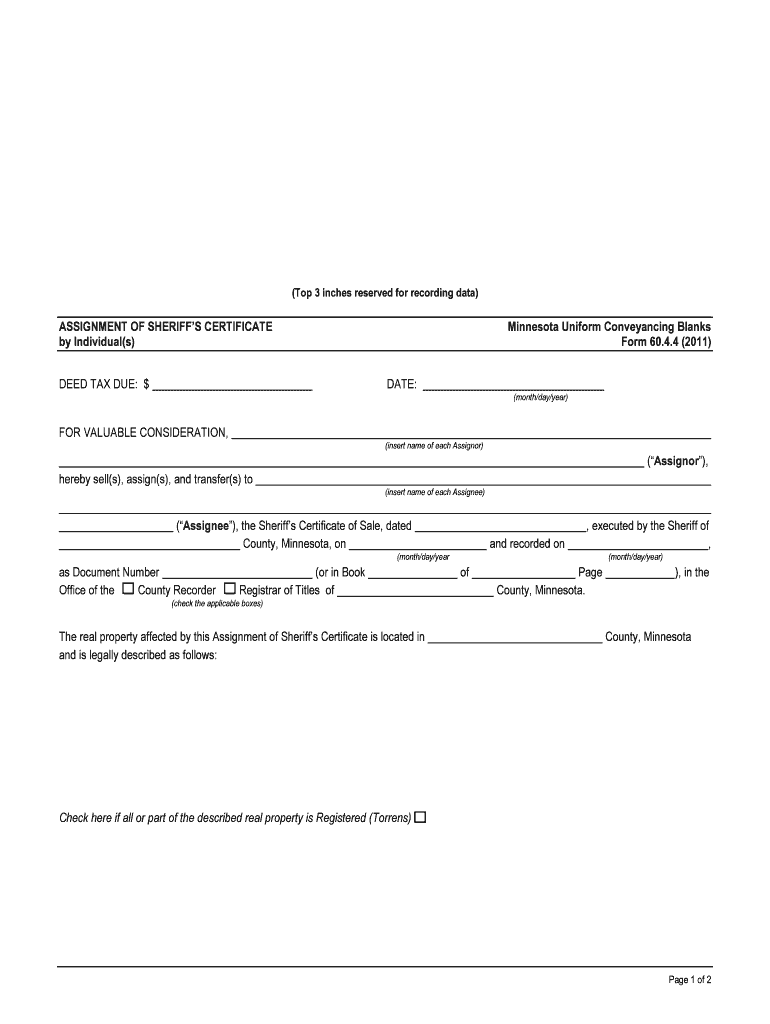

Fill and Sign the Deed Tax Due Form

Useful suggestions for finishing your ‘Deed Tax Due’ digitally

Are you fed up with the burden of handling documents? Look no further than airSlate SignNow, the leading eSignature service for individuals and businesses. Bid farewell to the lengthy process of printing and scanning files. With airSlate SignNow, you can effortlessly finalize and sign documents online. Utilize the powerful features included in this intuitive and budget-friendly platform and transform your method of document management. Whether you need to approve documents or collect eSignatures, airSlate SignNow manages it all effortlessly, with just a few clicks.

Follow this detailed guide:

- Access your account or sign up for a complimentary trial of our service.

- Select +Create to upload a file from your device, cloud storage, or our template library.

- Edit your ‘Deed Tax Due’ in the editing tool.

- Click Me (Fill Out Now) to finalize the form on your end.

- Add and designate fillable fields for others (if needed).

- Proceed with the Send Invite settings to solicit eSignatures from additional parties.

- Download or print your copy, or transform it into a reusable template.

No need to worry if you require collaboration with others on your Deed Tax Due or need to submit it for notarization—our solution supplies everything necessary to accomplish such tasks. Sign up with airSlate SignNow today and take your document management to the next level!

FAQs

-

What is DEED TAX DUE and how does it affect property transactions?

DEED TAX DUE refers to the tax that must be paid when a property is transferred from one owner to another. This tax is typically calculated based on the sale price of the property. Understanding DEED TAX DUE is crucial for both buyers and sellers to ensure compliance and avoid unexpected costs during the transaction.

-

How can airSlate SignNow help with managing DEED TAX DUE documents?

airSlate SignNow provides a streamlined platform for sending and eSigning documents related to DEED TAX DUE. Our solution simplifies the process of preparing and signing necessary paperwork, ensuring that all tax obligations are met efficiently. This helps users save time and reduce the risk of errors in their transactions.

-

Are there any fees associated with using airSlate SignNow for DEED TAX DUE transactions?

Yes, while airSlate SignNow offers a cost-effective solution for managing DEED TAX DUE documents, there may be subscription fees based on the plan you choose. We provide various pricing tiers to accommodate different business needs, ensuring you only pay for the features you require. Check our pricing page for detailed information.

-

What features does airSlate SignNow offer for handling DEED TAX DUE?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all tailored for DEED TAX DUE transactions. These tools enhance the user experience by making it easy to create, send, and manage important documents. Additionally, our platform ensures compliance with legal standards.

-

Can airSlate SignNow integrate with other software for DEED TAX DUE management?

Absolutely! airSlate SignNow offers integrations with various software applications that can assist in managing DEED TAX DUE. This includes CRM systems, accounting software, and more, allowing for a seamless workflow. Integrating these tools can enhance efficiency and ensure all aspects of the transaction are covered.

-

What are the benefits of using airSlate SignNow for DEED TAX DUE?

Using airSlate SignNow for DEED TAX DUE provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows users to complete transactions quickly and securely, minimizing the risk of delays or errors. This ultimately leads to a smoother property transfer process.

-

Is airSlate SignNow suitable for both individuals and businesses dealing with DEED TAX DUE?

Yes, airSlate SignNow is designed to cater to both individuals and businesses involved in DEED TAX DUE transactions. Whether you are a homeowner or a real estate professional, our platform offers the tools needed to manage documents effectively. This versatility makes it an ideal choice for a wide range of users.

The best way to complete and sign your deed tax due form

Find out other deed tax due form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles