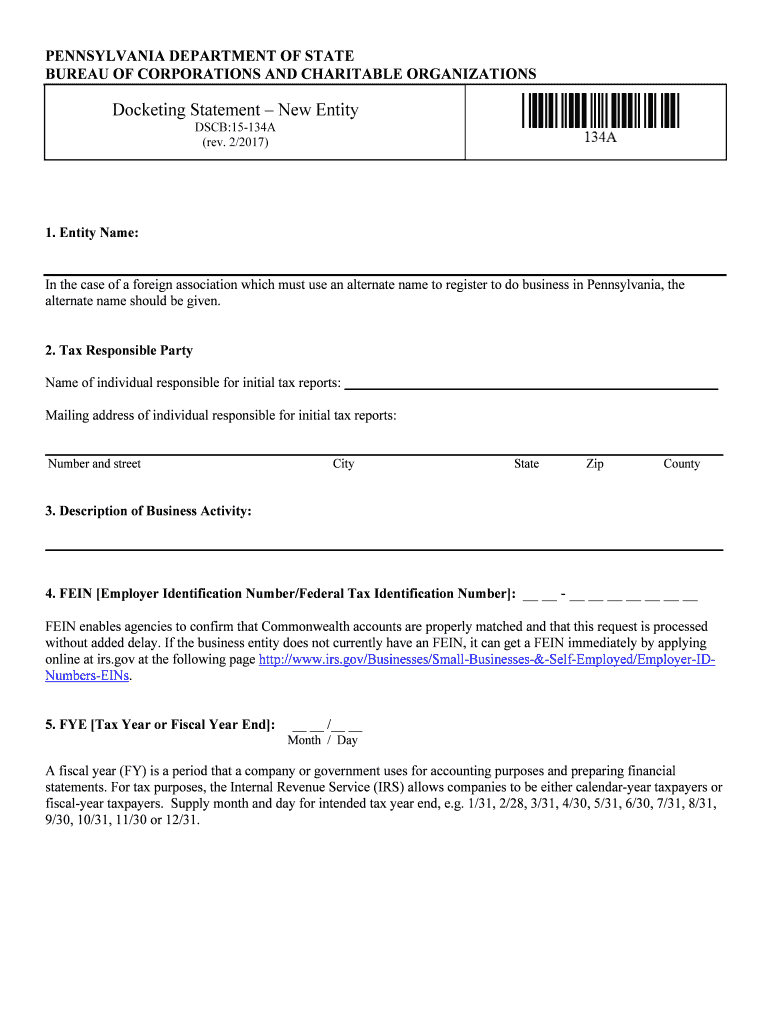

PENNSYLVANIA DEPARTMENT OF STATE

BUREAU OF CORPORATIONS AND CHARITABLE ORGANIZATIONS

1. Entity Name:

In the case of a foreign association which must use an alternate name to register to do business in Pennsylvania, the

alternate name should be given.

2. Tax Responsible Party

Name of individual responsible for initial tax reports: ______________________________________________________

Mailing a ddress of individual r esponsible for initial tax reports :

__________________________________________________________________________________________________

Number and street City State Zip County

3. Description of Business Activity:

__________________________________________________________________________________________________

4. FEIN [Employer Identification Number /Federal Tax Identification Number]:

__ __ - __ __ __ __ __ __ __

FEIN enables agencies to confirm that Commonwealth accounts are properly matched and that this request is proces sed

without added delay. If the business entity does not currently have an FEIN, it can get a FEIN immediately by applying

online at irs.gov at the f ollowing page

http://www.irs.gov/Businesses/Small -Businesses -&-Self -Employed/Employer- ID-

Numbers- EINs .

5. FYE [Tax Year or Fiscal Year End] : __ __ /__ __

Month / Day

A fiscal year (FY) is a period that a company or government uses for accounti ng purposes and preparing financial

statements . For tax purposes, the Internal Revenue Service (IRS) allows companies to be e ither calendar -year taxpayers or

fiscal -year taxpayers . Supply month and day for intended tax year end, e.g. 1/31, 2/28, 3/31, 4/30, 5/31, 6/30, 7/31, 8/31,

9/30, 10/31, 11/30 or 12/31.

Docketing Statement – New Entity

DSCB:15-134A

( rev. 2/2017 )

PENNSYLVANIA DEPARTMENT OF STATE

BUREAU OF CORPORATIONS AND CHARITABLE ORGANIZATIONS

Read all instructions prior to completing. This form may be submitted online a t

https://www.corporations.pa.gov/ .

Fee: $125

I qualify for a veteran/reservist -owned small business fee exemption (see instructions)

Check one: Domestic Nonprofit Corporation (§ 5306) Nonprofit Cooperative Corporation (§ 7102)

In compliance with the requirements of the applicable provisions (relati ng to articles of incorporation or

cooperative corporations generally), the undersigned, desiring to incorporate a nonprofit/nonprofit cooperative

corporation, hereby state(s) that:

1. The name of the corporation i s:

2. Complete part (a) or (b) – not both:

(a) The address of this corporation’s current registered office in thi s Commonwealth is:

(post office box alone is not acceptable)

Number and Street City State Zip County

(b) The name of this corporation’s commercial registered office prov ider and the county of venue is:

c/o:

Name of Commercial Registered Office Provider County

3. The corporation is incorporated under the Nonprofit Corporation Law of 1988 for the following

purpose or purposes.

4. The corporation does not contemplate pecuniary gain or profit, incidental or oth erwise.

5. Check and complete one : The corporation is organized on a nonstock basis.

The corporation is organized on a stock share basis and the aggregate

number of shares authorized is _______________________________.

Return document by mail to:

Name

Address

City State Zip Code

Return document by email to: _________________________________

DSCB:15-5306/7102 -2

10. The specified effective date, if any, is:

month day year hour, if any

IN TESTIMONY WHEREOF, the incorporator(s)

has/have signed these Articles of Incorporation this

day of ,

.

Signature

Signature

Signature

11. Additional provisions of the articles, if any, attach an 8½ x 11 sheet.

7. For Nonprofit Corporation Only: Check one : ______ The corporation shall have no members.

______ The corporation shall have members.

8. For Nonprofit Cooperative Corporation Only:

Check and complete one:

____ The corporation is a cooperative corporation and the common bond of membership am ong its

members is: .

____ The corporation is a cooperative corporation and the commo n bond of membership among its

shareholders is: .

9. The name(s) and address(es) of each incorporator(s) is (are) (all incorporators must sign below): Name(s) Address(es)

6. For unincorporated association incorporating as a nonprofit corporation only . Check if applicable :

_____ The incorporators constitute a majority of the members of the committee authorized to

incorporate such association by the requisite vote required by the organic l aw of the

association for the amendment of such organic law.

DSCB:15-5306/7102 - Instructions

Pennsylvania Department of State

Bureau of Corporations and Charitable Organizations

P.O. Box 8722

Harrisburg, PA 17105 -8722

(717) 787 -1057

W ebsite: www.dos.pa.gov/corps

Instructions for Completion of Form – (Articles of Incorporation –Nonprofit) :

A. Typewritten is preferred. If handwritten, the form shall be legible and comple ted in black or blue-black ink in order to

permit reproduction.

The nonrefundable filing fee for this form is $125 made payable to the Department of Sta te. Checks must contain a

commercially pre -printed name and address. Filers requesting a veteran/reservist -owned small business fee exemption

should attach proof of the veteran’s or reservist’s status to the Articl es of Incorporation form when submitted. For more

information on the fee exemption, see

Fees and Payments .

Enter the name and mailing address to which any correspondence regarding this filing should be sent. This field must be

completed for the Bureau to return the filing. If the filing is to be returned by email, an e mail address must be provided. An

email will be sent to address provided, containing a link and instructions on how a copy of the fi led document or

correspondence may be downloaded. Any email or mailing addresses provided on this form wil l become part of the filed

document and therefore public record.

B. Under 15 Pa.C.S. § 135(c) (relating to addresses) an actual street or rural route box numbe r must be used as an address, and the

Department of State is required to refuse to receive or file any document that sets forth only a post office box address.

C. The following, in addition to the filing fee, shall accompany this form:

(1) One copy of a completed form DSCB:15 -134A (Docketing Statement).

(2) Any nece ssary copies of form DSCB: 19-17.2 (Consent to Appropriation of Name).

(3) Any necessary governmental approvals.

D . For Domestic Nonprofit Corporation Only: For general instructions relating to the incorporation of nonprofit corpo rations

see 19 Pa. Code Ch. 41 (relating to nonprofit corporations generally). These instructions r elate to such matters as corporate

name, stated purposes, term of existence, authorized share structure, inclusion of name s of first directors in the Articles of

Incorporation, provisions on incorporation of unincorporated associations, etc.

E. For Nonprofit Cooperative Corporation Only: For general instructions relating to the incorporation of cooperative

corporations see 19 Pa. Code Ch. 51 (relating to cooperative corporations). Under 15 P a.C.S. § 7103 (relating to use of

term “cooperative” in corporate name) the corporate name in Paragraph 1 must, unless otherwise provided by s tatute,

contain one of the terms “cooperative” or “coop.” See 19 Pa. Code § 17.7 (relating to cooperative names). See also the

general instructions relating to the incorporation of nonprofit corporations, 19 Pa. Code Ch. 41 (relating to nonprofit

corporations generally). These instructions relate to such matters as corpora te name, stated purposes, term of existence,

authorized share structure, inclusion of names of first directors in the Article s of Incorporation, provisions on incorporation

of unincorporated associations, etc.

Under 15 Pa.C.S. § 7102(a) the articles of the corporation must set forth a common bond of membership among its

members or shareholders by reason of occupation, residence or otherwise.

F. One or more corporations or natural persons of full age may incorporate a nonprofit/non profit cooperative corporation.

G. Per 15 Pa.C.S. § 5307 (relating to advertisement) , the incorporators shall advertise their intention to file or the corporation

shall advertise the filing of arti cles of incorporation. Proofs of publication of such advertising should not be submitted to,

and will not be received by or filed in, the Department, but should be filed with the minutes of the corporation.

H. This form and all accompanying documents sh all be mailed to the address stated above.

DSCB:15-5306/7102 - Instructions

NONPROFIT CORPORATIONS ONLY

Purs uant to 15 Pa.C.S. § 5110, a nonprofit corporation is required to annually notify the D epartment of State of any

change of its officers. If no change of officers has occurred since the last report, the report need not b e filed. These

annual reports are submitted on form DSCB:15 -5110 (Annual Statement -Nonprofit Corporation). No fee is required for

this filing.

Please forward annual report to t he Department of State, Bureau of Corporation s and Charitable Organizations, P.O.

Box 8722, Harrisburg, PA 17105-8722. ADDITIONAL INFORMATION REGARDING NONPROFIT CORPORATIONS

Nonprofit corporations that solicit funds from citizens of the Commonw ealth of Pennsylvania must register with the

Bureau of Corporations and C haritable Organizations of the Department of State, unless exempt from registr ation

requirements. Please contact the Bureau of Corporations and Charitable Organizations at 207 North Office Building ,

Harrisburg, PA 17120, (717) 783-1720 or 1-800-732-0999 within Pennsylvania, for more information on r egistration.

Pennsylvania sales tax exempt status may be obtained from the Department of Revenue, Reg istration Division,

Exemption Unit, Department 280901, Harrisburg, PA 17128 -0901. Any other type of exempt status may be obtained or

explained by contacting your local Federal Internal Revenue Service. Please be advised that the date and signature of the Secretary of the Commonwealth indicate the filing in the

Department of State. NO CERTIFICATE OF INCORPORATION IS ISSUED for nonprofit corporations.

Valuable instructions on finalizing your ‘Docketing Statement Pa Department Of State’ online

Are you fed up with the inconvenience of managing paperwork? Your solution is here with airSlate SignNow, the leading electronic signature service for both individuals and enterprises. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can smoothly fill out and sign documents online. Utilize the powerful features integrated into this intuitive and cost-effective platform and transform your document management strategy. Whether you need to sign documents or gather eSignatures, airSlate SignNow simplifies everything with just a few clicks.

Follow this comprehensive guide:

- Access your account or register for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud, or our template collection.

- Open your ‘Docketing Statement Pa Department Of State’ in the editor.

- Select Me (Fill Out Now) to prepare the form on your end.

- Add and designate fillable fields for others (if necessary).

- Continue with the Send Invite options to solicit eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

No need to worry if you need to collaborate with your colleagues on your Docketing Statement Pa Department Of State or send it for notarization—our platform has everything required to complete such tasks. Register with airSlate SignNow today and elevate your document management to new levels!