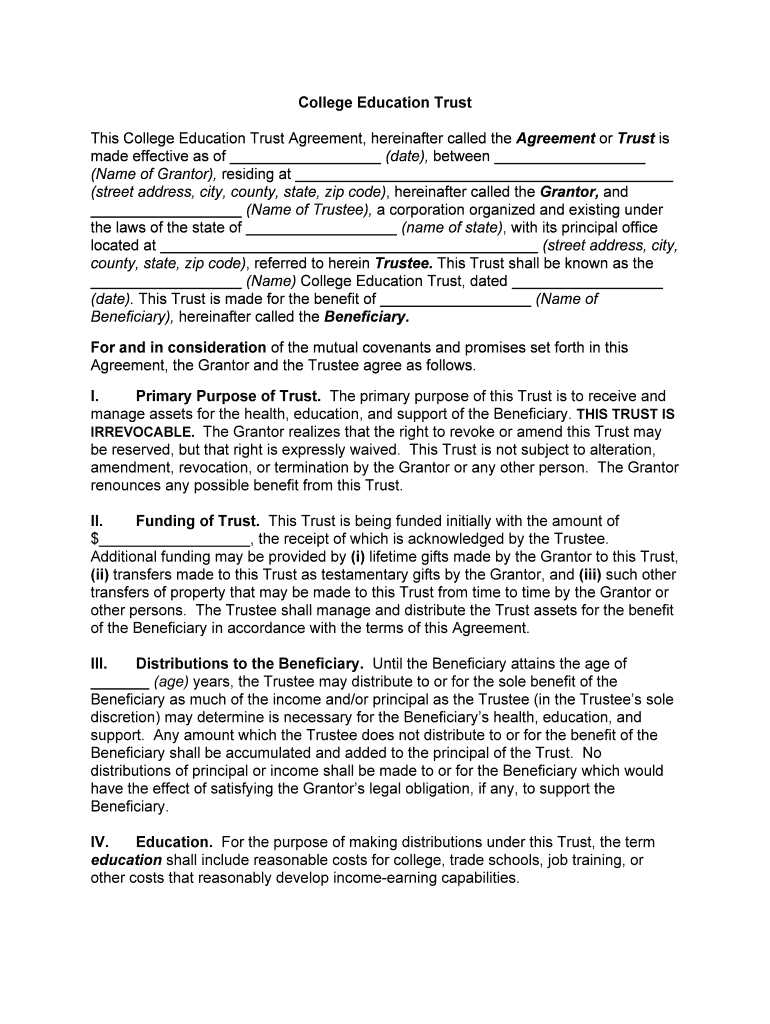

College Education Trust

This College Education Trust Agreement, hereinafter called the Agreement or Trust is

made effective as of __________________ (date), between __________________

(Name of Grantor), residing at _____________________________________________

(street address, city, county, state, zip code), hereinafter called the Grantor, and

__________________ (Name of Trustee), a corporation organized and existing under

the laws of the state of __________________ (name of state), with its principal office

located at _____________________________________________ (street address, city,

county, state, zip code), referred to herein Trustee. This Trust shall be known as the

__________________ (Name) College Education Trust, dated __________________

(date). This Trust is made for the benefit of __________________ (Name of

Beneficiary), hereinafter called the Beneficiary.

For and in consideration of the mutual covenants and promises set forth in this

Agreement, the Grantor and the Trustee agree as follows.

I. Primary Purpose of Trust. The primary purpose of this Trust is to receive and

manage assets for the health, education, and support of the Beneficiary. THIS TRUST IS

IRREVOCABLE. The Grantor realizes that the right to revoke or amend this Trust may

be reserved, but that right is expressly waived. This Trust is not subject to alteration,

amendment, revocation, or termination by the Grantor or any other person. The Grantor

renounces any possible benefit from this Trust.

II. Funding of Trust. This Trust is being funded initially with the amount of

$__________________, the receipt of which is acknowledged by the Trustee.

Additional funding may be provided by (i) lifetime gifts made by the Grantor to this Trust,

(ii) transfers made to this Trust as testamentary gifts by the Grantor, and (iii) such other

transfers of property that may be made to this Trust from time to time by the Grantor or

other persons. The Trustee shall manage and distribute the Trust assets for the benefit

of the Beneficiary in accordance with the terms of this Agreement.

III. Distributions to the Beneficiary. Until the Beneficiary attains the age of

_______ (age) years, the Trustee may distribute to or for the sole benefit of the

Beneficiary as much of the income and/or principal as the Trustee (in the Trustee’s sole

discretion) may determine is necessary for the Beneficiary’s health, education, and

support. Any amount which the Trustee does not distribute to or for the benefit of the

Beneficiary shall be accumulated and added to the principal of the Trust. No

distributions of principal or income shall be made to or for the Beneficiary which would

have the effect of satisfying the Grantor’s legal obligation, if any, to support the

Beneficiary.

IV. Education. For the purpose of making distributions under this Trust, the term

education shall include reasonable costs for college, trade schools, job training, or

other costs that reasonably develop income-earning capabilities.

V. Termination of the Trust at Age _______ (age) Years. When the Beneficiary

attains the age of _______ (age) years, the remaining Trust assets shall be distributed

to the Beneficiary and this Trust shall then terminate.

VI. Continuation of Trust. As an alternative to mandatory termination of this Trust

at age _______ (age) years, the Beneficiary may request that this Trust be continued. If

the Beneficiary makes a written request to continue this Trust within 60 days after the

Beneficiary attains the age of _______ (age) years, the Trustee shall continue the Trust

until the Beneficiary attains the age of (age) years.

A. Distributions after Age (age) Years. During this additional time period,

all of the net trust income shall be paid to the Beneficiary at least annually. In

addition, the Trustee shall distribute to or for the benefit of the Beneficiary as

much of the principal as the Trustee (in the Trustee’s sole discretion) may

determine is necessary for the Beneficiary’s health, education, and support. In

making such distributions, the Trustee shall take into consideration any other

income and property that is known by the Trustee to be available to the

Beneficiary for the above purposes.

B. Termination of the Trust If the Trust Has Been Continued Past _______ (age) Years . When the Beneficiary attains the age of _______ (age)

years, the remaining trust assets shall be distributed to the Beneficiary and this

Trust shall then terminate.

VII. Death of the Beneficiary. If the Beneficiary dies before attaining the age at

which this Trust shall terminate, the following provisions shall apply.

A. General Testamentary Power of Appointment. The Beneficiary shall

have a general testamentary power of appointment to distribute the remaining

trust assets. Having this power means that the Beneficiary may state in the

Beneficiary’s last will and testament (or in some other written document that is

signed by the Beneficiary and acknowledged before a notary public or similar

official) who will receive the remaining Trust assets, if the Beneficiary dies before

attaining the age at which this Trust shall terminate. The Beneficiary shall have

the absolute discretion to state who the beneficiaries will be. The beneficiaries

may include the Beneficiary’s estate and/or creditors. To validly exercise this

power, the Beneficiary’s will (or other document) must specifically refer to this

power. Upon distribution of the Trust assets, this Trust shall then terminate.

B. Alternate Distribution. If the Beneficiary fails to validly exercise this

general testamentary power of appointment, the Trustee shall distribute the

remaining trust assets to the Beneficiary’s then surviving descendants on a per

stirpes basis. If the Beneficiary has no surviving descendants at such time, the

remaining trust assets shall be distributed to the Beneficiary’s heirs-at-law.

Heirship shall be determined in accordance with the intestacy laws of

__________________ ( Name of State) then in effect.

C. Failure of the Trustee to Receive Notice. If the Trustee does not

receive actual notice of the existence of a will or other document exercising this

general testamentary power of appointment within 90 days after the Beneficiary’s

death, then the Trustee may distribute the Trust assets under the prior

subparagraph as if such power had not been exercised. However, if the power

really has been exercised, this paragraph shall not prevent the Beneficiary of

such a power from enforcing the power as exercised.

D. Types of Distributions. Distributions to a Beneficiary may be made (i)

outright to such Beneficiary, (ii) to any other trust that has been created for such

Beneficiary or (iii) to a custodial account for such Beneficiary under the

applicable Uniform Transfers to Minors Act (or equivalent legislation). The

Trustee shall have the sole discretion to determine which alternative to use.

VIII. Limitations on Powers. Notwithstanding any other provision of this Agreement

to the contrary, the following limitations on powers shall apply.

A. No power granted to the Trustee in this Agreement or under law shall be

construed to allow the Grantor, the Trustee, or any other person to purchase,

exchange, or otherwise deal with or dispose of all or any part of the principal or

income of this Trust for less than an adequate consideration in money or

money’s worth, or to enable the Grantor to borrow all or any part of the principal

or income of the Trust, directly or indirectly, without adequate interest or security.

B. No person, other than the Trustee acting in a fiduciary capacity, shall have

or exercise the power to vote or direct the voting of any stock or other securities

of the Trust, to control the investment(s) of the Trust either by directing

investments or reinvestments, or to reacquire or exchange any property of the

Trust by substituting other property.

IX. Protection of Beneficiary. The Beneficiary may not sell, assign, transfer, or

pledge (or in any other manner dispose of or encumber) the Beneficiary’s interest in any

part of the Trust. The interest of the Beneficiary shall not be subject to assignment,

anticipation, claims of creditors, or seizure by legal process. If the Trustee believes that

the Beneficiary’s interest is threatened to be diverted in any manner from the purposes

of this Trust, the Trustee shall withhold the income and principal from distribution, and

shall apply payment in the Trustee’s discretion in such manner as the Trustee believes

shall contribute to the health, education, and support of the Beneficiary. When the

Trustee is satisfied that such diversion is no longer effective or threatened, the Trustee

may resume the distributions of income and principal as authorized.

X. Trustee Powers. Subject to the other provisions of this Agreement, and in

addition to any other powers and authority granted by law or necessary or appropriate

for proper administration of this Trust, the Trustee (and any successor trustee) shall

have the following rights, powers, and authority, without order of court and without

notice to anyone.

A. Receive Assets. To receive, hold, maintain, administer, collect, invest

and re-invest any trust assets, and collect and apply the income, profits, and

principal of the trust in accordance with the terms of this Agreement.

B. Receive Additional Assets. To receive additional assets from other

persons and sources including assets by testamentary disposition; all such

additional assets shall be held and administered under, and be subject to, the

terms of this Agreement.

C. Retain Assets. To retain any asset, including uninvested cash or original

investments, regardless of whether it is of the kind authorized by this Agreement

for investment and whether it leaves a disproportionately large part of the Trust

invested in one type of property, for as long as the Trustee deems advisable.

D. Dispose of or Encumber Assets. To sell, option, mortgage, pledge,

lease or convey real or personal property, publicly or privately, upon such terms

and conditions as may appear to be proper, and to execute all instruments

necessary to effect such authority.

E. Settle Claims. To compromise, settle, or abandon claims in favor of or

against the Trust.

F. Manage Property. To manage real estate and personal property, borrow

money, exercise options, buy insurance, and register securities as may appear to

be proper.

G. Allocate Between Principal and Income. To make allocations of

charges and credits between principal and income as in the sole discretion of the

Trustee may appear to be proper, and to create reserves for taxes, depreciation,

and other lawful purposes.

H. Employ Professional Assistance. To employ and compensate legal

counsel and other persons deemed necessary for proper administration, and to

delegate authority when such delegation is advantageous to the Trust.

I. Distribute Property. To make division or distribution in money or kind, or

partly in either, at values to be determined by the Trustee, and the Trustee’s

judgment shall be binding upon all interested parties.

J. Enter Contracts. To bind the Trust by contracts or agreements without

assuming individual liability for such contracts.

K. Exercise Stock Ownership Rights. To vote, execute proxies to vote, join

in or oppose any plans for reorganization, and exercise any other rights incident

to the ownership of any stocks, bonds, or other properties of the Trust.

L. Duration of Powers. To continue to exercise the powers provided under

this Trust notwithstanding the termination of the Trust until all of the assets of the

Trust have been distributed.

M. Compensation and Expenses. To receive reasonable compensation for

trustee services provided under this Agreement and be exonerated from and to

pay all reasonable expenses and charges of the Trust.

N. Standard of Care. To acquire, invest, reinvest, exchange, retain, sell, and

manage trust assets, exercising the judgment and care, under the circumstances

then prevailing, that persons of prudence, discretion, and intelligence exercise in

the management of their own affairs, not in regard to speculation but in regard to

the permanent disposition of their funds, considering the probable income as well

as the probable safety of their capital. Within the limitations of that standard, the

Trustee is authorized to acquire and retain every kind of property, real, personal

or mixed, and every kind of investment, specifically including, but not by a way of

limitation, bonds, mutual funds, debentures and other corporate obligations, and

stocks, preferred or common, that persons of prudence, discretion, and

intelligence acquire or retain for their own account.

O. Methods of Distribution. To make payments to or for the benefit of the

Beneficiary (including the possibility that the Beneficiary might be under a legal

disability) in any of the following ways: (i) directly to the Beneficiary; (ii) directly

for the health, education, and support of the Beneficiary; (iii) to the legal or

natural guardian of the Beneficiary; or (iv) to anyone who at the time shall have

custody and care of the person of the Beneficiary. The Trustee shall not be

obligated to see the application of the funds so paid, but the receipt of the person

to whom the funds were paid shall be full acquittance of the Trustee.

P. Loans. To make loans to the Beneficiary for housing and support needs,

educational purposes, or to take advantage of an exceptional business

opportunity.

Q. Trustee Provisions. These additional provisions shall apply regarding the

Trustee (and any successor Trustee).

1. Successor Trustee. If at any time a Trustee cannot serve because

of the Trustee’s disability (as previously defined), death, resignation, or

other reason, __________________ (Name) is appointed as the

successor Trustee. If such appointee is unable to serve for any reason, __________________ (Name) is appointed as the alternate successor

Trustee.

2. Financial Reports. The Trustee shall provide financial reports to

the Grantor on at least an annual basis as long as the Grantor is living.

After such time, financial reports shall be provided at least annually to the

Beneficiary. If the Beneficiary is under any legal incapacity, the financial

reports shall be provided to the Beneficiary’s guardian (natural or

otherwise) or conservator. Financial reports shall include a balance sheet

that lists the assets and their values, an income statement that shows

income and expenses, and a listing of distributions on behalf of the

Beneficiary.

3. No Bond. No bond shall be required of any Trustee, unless

required by law.

4. Institutional Trustee. Any institutional trustee serving under this

Trust must have a total capital account of at least $__________________,

have an established Trust Department or Trust Division, and must be

qualified to act as a trustee under the laws of the United States or any

state of the United States. The acceptance of trusteeship by any

institutional trustee is full evidence of its agreement to these provisions.

5. Liability of the Trustee. The Trustee shall have liability only for

the Trustee’s acts and omissions that are made in bad faith. Further, a

successor Trustee shall not be liable for any acts or omissions of any prior

Trustee.

XI. Non-Court Trust. Unless required otherwise by law, the Trustee shall

administer this Trust as a non-court trust, without the necessity of notice to or approval

of any court or person. As provided by law, the Trustee may petition a court to take

jurisdiction over this Trust.

XII. Governing Law. This Agreement shall be construed in accordance with the

laws of the State of (Name).

_____________________ _____________________

(Signature of Grantor) (Signature of Trustee)

________________________ ________________________

(Printed Name of Grantor) (Printed Name and Office)

Acknowledgement