Official Form 6I

Instructions for Schedule I: Your Income

United States Bankruptcy Court 12/01/13

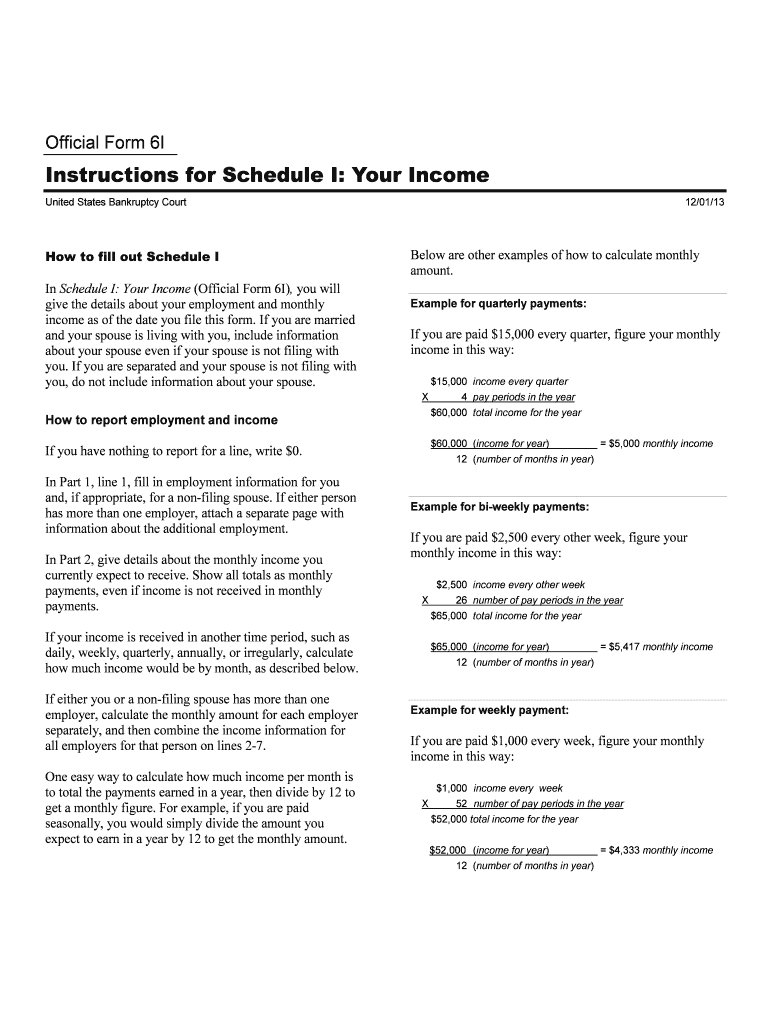

How to fill out Schedule I

In Schedule I : Your Income (Official Form 6 I), you will

give the details about your employment and monthly

income as of the date you file this form. If you are married

and your spouse is living with you, include information

about your spouse even if your spouse is not filing with

you. If you are separ ated and your spouse is not filing with

you, do not include information about your spouse.

How to report employment and income

If you have nothing to report for a line, write $0.

In Part 1, line 1 , fill in employment information for you

and , if appropriate, for a non-filing spouse. I f either person

has more than one employer , attach a separate page with

information about the additional employment .

In Part 2, give details about the monthly income you

currently expect to receive . Show all totals as monthly

payments , even if income is not received in monthly

payments .

If your income is received in another time period, such as

daily , weekly, quarterly, annual ly, or irregularly, calculate

how much income would be by month, as described below.

If either you or a non-filing spouse has more than one

employer, calculate the monthly amount for each employer

separately, and then combine the income information fo r

all employers for that person on lines 2-7.

One easy way to calculate how much income per month is

to total the payments earned in a year, then divide by 12 to

get a monthly figure. For example, if you are paid

seasonally , you would simply divide the amount you

expect to earn in a year by 12 to get the monthly amount. Below are other examples

of how to calculate monthly

amount.

Example for quarterly payments:

If you are paid $15,000 every quarter, figure your monthly

income in this way:

$ 15,000 income every quarter

X 4 pay periods in the year

$60,000 total income for the year

$60,000 (income for year ) = $5,000 monthly income

12 (number of months in year )

Example for bi -weekly payments:

If you are paid $2,500 every other week, figure your

monthly income in this way: $2,500 income every other week

X 26 number of pay periods in the year

$65,000 total income for the year

$ 65,000 (income for year ) = $5,417 monthly income

12 (number of months in year )

Example for weekly payment:

If you are paid $1,000 every week, figure your monthly

income in this way:

$1,000

income every week

X 52 number of pay periods in the year

$52,000 total income for the year

$52,000 (income for year ) = $4,333 monthly income

12 (number of months in year )

Example for irregular payments:

If you are paid $4,000 8 times a year, figure your monthly

income in this way:

$4,000 income a payment

X 8 payments a year

$32,000 income for the year

$32,000 ( income for year ) = $2,667 monthly income

12 (number of months in year )

Example for daily payments:

If you are paid $75 a day and you work about 8 days a

month, figure your monthly income in this way:

$ 75 income a day

X 96 days a year

$7,200 total income for the year

$7,200 (income for year ) = $600 monthly income

12 (number of months in year )

or this wa y:

$ 75

income a day

X 8 payments a month

$600 income for the month

In Part 2, line 11 , fill in amounts that other people provide to

pay the expenses you list on Schedule J: Your Expenses . For

example, if you and a person to whom you are not married

pay all household expenses together and you list all your joint

household expenses on Schedule J, you must list the amounts

that person contributes monthly to pay the household

expenses on line 11. If you have a roommate and you divide

the rent and utilities, do not list the amounts your roommate

pays on line 11 if you have listed only your share of those

expenses on Schedule J. Do not list on line 11 contributions

that you already disclosed elsewhere on the form. Note that the i

ncome you report on Schedule I may be

different from the income you report on other bankruptcy

forms. For example, the Statement of Current Monthly

Income and Means Test Calculation (Chapter 7) (Official

Form 22A), Statement of Current Monthly Incom e (Cha pter

11) (Official Form 22B), and the Statement of Current

Monthly Income and Calculation of Commitment Period

(Chapter 13) (Official Form 22C) all use a different

definition of income and apply that definition to a different

period of time. Schedule I asks about the income that you are

now receiving , while the other forms ask about income you

received in the applicable time period before filing. So the

amount of income reported in any of those forms may be

different from the amount reported here.

If, af ter filing Schedule I , you need to file an estimate of

income in a chapter 13 case for a date after your

bankruptcy, you may complete a supplemental Schedule I.

To do so you must check the “supplement” box at the top

of the form and fill in the date.

Unde rstand the terms used in th is form

This form uses you and Debtor 1 to refer to a debtor filing

alone. A married couple may file a bankruptcy case

together— called a joint case —and in joint cases, this form

uses you to ask for information from both debtors. When

information is needed about the spouses separately, the

form uses Debtor 1 and Debtor 2 to distinguish between

them. In joint cases, one of the spouses must report

information as Debtor 1 and the other as Debtor 2. The

same person must be Debtor 1 in all of the forms.

Things to remember when filling out this form

Be as complete and accurate as possible.

If more space is needed, attach a separate sheet to this

form. On the top of any additional pages, write your

name and case number (if known).

If two married people are filing together, both are

equally responsible for supplying correct information.

Do not file these instructions with your bankruptcy filin g package. Keep them for your records.

Official Form B 6I Schedule I: Your Income page 1

Official

Form B 6I

Schedule I : Your Income

12/13

Be as complete and accurate as possible. If two married people are filing together (Debtor 1 and Debtor 2), both are equally responsible for

supplying correct information. If you are married and not filing jointly , and your spouse is living with you, include information about your spouse.

If you are separated and your spouse is not filing with you, do not include infor mation about your spouse. If more space is needed, attach a

separate sheet to this form. On the top of any additional pages, write your name and case number (if known). Answer every question.

Part 1: Describe Employment

1.Fill in your employment

information.

If you have more than one job,

attach a separate page with

information about additiona l

employers.

Include part -time, seasonal, or

self -employed work.

Occupation may Include student

or homemaker, if it applies . Debtor 1 Debtor 2 or non -filing spouse

Employment status

Employed

Not employed

Employed

Not emp loyed

Occupation __________________________________

__________________________________

Employer’s name __________________________________ __________________________________

Employer’s address ______ ____________________ __________ ___

Number Street

_________________ _____________________ _

_____________ _________________________ _

____________ __________________________ _

City State ZIP Code

_______ ______________ ______ __________ ___

Number Street

__________________ _____________________ _

______________ ____ _____________________ _

_____________ __________________________ _

City State ZIP Code

How long employed there? _______ _______

Part 2: Give Details About Monthly Income

Estimate monthly income as of the date you file this form . If you have nothing to report for any line, write $0 in the space. Include your non-filing

spouse unless you are separated .

If you or your non -filing spouse have more than one employer, combine the information for all employers for that person on the lines

below. If you need mo re space, attach a separate sheet to this form .

For Debtor 1 For Debtor 2 or non-filing spouse

2.List monthly gross wages, salary, and commissions (before all payroll

deductions ). If not paid monthly, calculate what the monthly wage would be. 2.

$________ ___ $_____ _______

3. Estimate and list monthly overtime pay. 3. + $__ _________ + $_____ _______

4. Calculate gross income. Add line 2 + line 3. 4.

$__________ $____________

Debtor 1 __________________________________________________________ _________

First Nam e Middle Nam e Last Name

Debtor 2 _____________________________________________________________ _____

( Spouse, if filing ) First Nam e Middle Nam e Last Name

United States Bankruptcy Court for the: ______________________ District of __________

Case number ___________________________________________

(If known)

Fill in this information to identify your case:

Check if this is :

An amended filing

A supplement showing post -petition

chapter 13 income as of t he following date:

________________ MM / DD / YYYY

___________________________ District of ________

Debtor 1 _______________________________________________________ Case number (if known )_____________________________________

First Nam e Middle Nam e Last Name

Official Form B 6I Schedule I: Your Income page 2

For Debtor 1 For Debtor 2 or

non -filing spouse

Copy line 4 here ............................................................................................ 4. $_____

___ ___

$_____________

5.List all payroll deductions:

5a. Tax , Medicare , and Social Security deductions 5a.

$___ _________ $___ __________

5b. Mandatory contributions for retirement plans 5b.

$________ ____ $_________ ____

5c. Voluntary contributions for retirement plans 5c.

$________ ____ $_________ ____

5d. Required repayments of retirement fund loans 5d.

$_____ ___ ____ $_____________

5e. Insurance 5e.

$_____ ___ _ ___ $_________ ____

5f. Domestic support obligations 5f.

$_____ ___ ____ $_____________

5g. Union dues 5g. $_________ ___ $_____________

5h. Other deductions. Specify: __________________________________ 5h. + $__ _____ _____ + $_____________

6. Add the payroll deductions . Add lines 5a + 5b + 5c + 5d + 5e +5f + 5g +5h. 6.

$____________ $___________ __

7. Calculate total monthly take -home pay. Subtract line 6 from line 4. 7.

$________ ____ $_______

______

8. List all other income regularly received:

8a. Net income from rental property and from operating a business, profession, or farm

Attach a statement for each property and business showing gross

receipts, ordinary and necessary business expenses, and the total

monthly net income. 8a.

$_____ ___ ____ $_____ ________

8b. Interest and dividends 8b. $_____ _______ $____ _________

8c. Family support payments that you, a non -filing spouse, or a dependent

regularly receive

Include alimony, spousal support, child support, maintenance, divorce

settlement, and property settlement. 8c. $___

____ _____ $____

_____ ____

8d. Unemployment compensation 8d. $____________ $_____________

8e. Social Security 8e.

$____________ $_________ ____

8f. Other government assistance that you regularly receive

Include cash assistance and the value (if known) of any non -cash assistance

that you receive, such as food stamps (benefits under the Supplemental

Nutrition Assistance Program) or housing subsidies.

Specify: ________________ ___________________________________ 8f. $______

______

$_____________

8g. Pension or retirement income 8g.

$____________ $_________ ____

8h. Other monthly income. Specify: __________________ _____________ 8h. + $____________ + $___ __________

9. Add all other income . Add lines 8a + 8b + 8c + 8d + 8e + 8f +8g + 8h. 9.

$_______ __ ___ $________ _____

10. Calculate monthly income. Add line 7 + line 9.

Add the entries in line 1 0 for Debtor 1 and Debtor 2 or non -filing spouse .10.

$____ _______

+ $____ ________ _ = $__ _____ __ ____

11.State all other regular contributions to the expenses that you list in Schedule J.

Include contributions from an unmarried partner, members of your household, your dependents, your roommates, and

other friends or relatives .

Do not include any amounts already included in lines 2 -10 or amounts that are not available to pay ex penses listed in Schedule J.

Specify: _______________________________________________________________________________ 11 .+ $__ __ ____ _____

12. Add the amount in the last column of line 10 to the amount in line 11. The result is the combined monthly i ncome.

Write that amount on the Summary of Schedules and Statistical Summary of Certain Liabilities and Related Data, if it applies 12. $__ _____ __ ____

Combined

monthly income

13. Do you expect an increase or decrease within the year after you file this fo rm?

No.

Yes. Explain:

Useful Suggestions for Finishing Your ‘Fillable Online Caeb Uscourts Schedule I Current Income Of ’ Online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the premier electronic signature option for both individuals and businesses. Bid farewell to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Utilize the powerful features included in this user-friendly and cost-effective platform and transform your document management approach. Whether you need to sign forms or collect eSignatures, airSlate SignNow manages it all with ease, requiring only a few clicks.

Adhere to this comprehensive guide:

- Log into your account or sign up for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form library.

- Access your ‘Fillable Online Caeb Uscourts Schedule I Current Income Of ’ in the editor.

- Click Me (Fill Out Now) to finalize the form on your end.

- Insert and designate fillable fields for others (if needed).

- Continue with the Send Invite settings to request eSignatures from others.

- Download and print your copy, or convert it into a reusable template.

Don’t fret if you need to collaborate with others on your Fillable Online Caeb Uscourts Schedule I Current Income Of or send it for notarization—our solution provides everything you need to complete such tasks. Create an account with airSlate SignNow today and enhance your document management capabilities!