Fill and Sign the Florida Business Tax Application for Business Registration Form

Beneficial advice on setting up your ‘Florida Business Tax Application For Business Registration’ online

Are you fed up with the complexities of managing paperwork? Look no further than airSlate SignNow, the premier eSignature platform for individuals and businesses. Bid farewell to the tedious process of printing and scanning documents. With airSlate SignNow, you can conveniently complete and sign paperwork online. Leverage the robust features integrated into this user-friendly and affordable platform and transform your method of document administration. Whether you need to authorize forms or collect signatures, airSlate SignNow manages it all effortlessly, needing just a few clicks.

Follow this comprehensive guide:

- Log into your account or initiate a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template collection.

- Access your ‘Florida Business Tax Application For Business Registration’ in the editor.

- Select Me (Fill Out Now) to complete the form on your end.

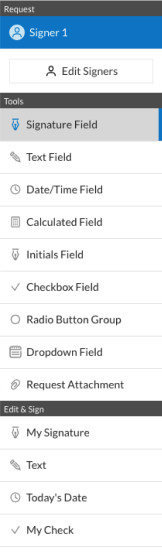

- Add and designate fillable fields for others (if necessary).

- Proceed with the Send Invite options to request eSignatures from others.

- Save, print your version, or transform it into a reusable template.

No need to worry if you need to collaborate with your colleagues on your Florida Business Tax Application For Business Registration or submit it for notarization—our solution provides everything required to complete such tasks. Register with airSlate SignNow today and enhance your document management to new levels!

FAQs

-

What is rt6 login and how does it work?

The rt6 login is the secure access point for users to enter the airSlate SignNow platform. By using your credentials, you can easily log in to manage your documents, send eSignatures, and collaborate with your team. This streamlined process ensures that you can focus on your tasks without worrying about security.

-

Is there a cost associated with rt6 login?

Accessing the rt6 login is free as part of the airSlate SignNow service. However, the platform offers various pricing plans that provide additional features and benefits. You can choose a plan that best fits your business needs while enjoying the convenience of the rt6 login.

-

What features can I access through the rt6 login?

Once you access the rt6 login, you can utilize a range of features including document creation, eSigning, and real-time collaboration. The platform also allows you to track document status and manage templates efficiently. These features enhance productivity and streamline your workflow.

-

How secure is the rt6 login process?

The rt6 login process is designed with security in mind, utilizing encryption and secure authentication methods. This ensures that your sensitive documents and personal information are protected. airSlate SignNow prioritizes user security, giving you peace of mind when accessing your account.

-

Can I integrate other tools with my rt6 login?

Yes, airSlate SignNow allows for seamless integrations with various third-party applications through your rt6 login. This includes popular tools like Google Drive, Salesforce, and more. These integrations enhance your workflow and make document management even more efficient.

-

What benefits does the rt6 login provide for businesses?

The rt6 login offers businesses a centralized platform for managing documents and eSignatures, which can signNowly improve efficiency. With easy access to all features, teams can collaborate effectively and reduce turnaround times. This ultimately leads to better productivity and streamlined operations.

-

How do I reset my password for the rt6 login?

If you need to reset your password for the rt6 login, simply click on the 'Forgot Password?' link on the login page. Follow the prompts to receive an email with instructions to create a new password. This process is quick and ensures you can regain access to your account without hassle.

The best way to complete and sign your florida business tax application for business registration form

Get more for florida business tax application for business registration form

Find out other florida business tax application for business registration form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles