Fill and Sign the Form 1099 R Distributions from Pensions Annuities Retirement or Profit Sharing Plans Iras Insurance Contracts Etc

Valuable advice on finalizing your ‘Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Iras Insurance Contracts Etc’ online

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the top eSignature solution for individuals and businesses. Bid farewell to the laborious process of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and endorse documents online. Utilize the robust features included in this user-friendly and affordable platform and transform your approach to document management. Whether you need to authorize forms or gather eSignatures, airSlate SignNow manages it all effortlessly, with just a few clicks.

Follow this detailed guide:

- Sign in to your account or initiate a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template collection.

- Open your ‘Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Iras Insurance Contracts Etc’ in the editor.

- Click Me (Fill Out Now) to prepare the document on your end.

- Add and designate fillable fields for others (if needed).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

No need to worry if you need to collaborate with your team on your Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Iras Insurance Contracts Etc or send it for notarization—our platform provides everything you need to achieve such tasks. Register with airSlate SignNow today and take your document management to a new level!

FAQs

-

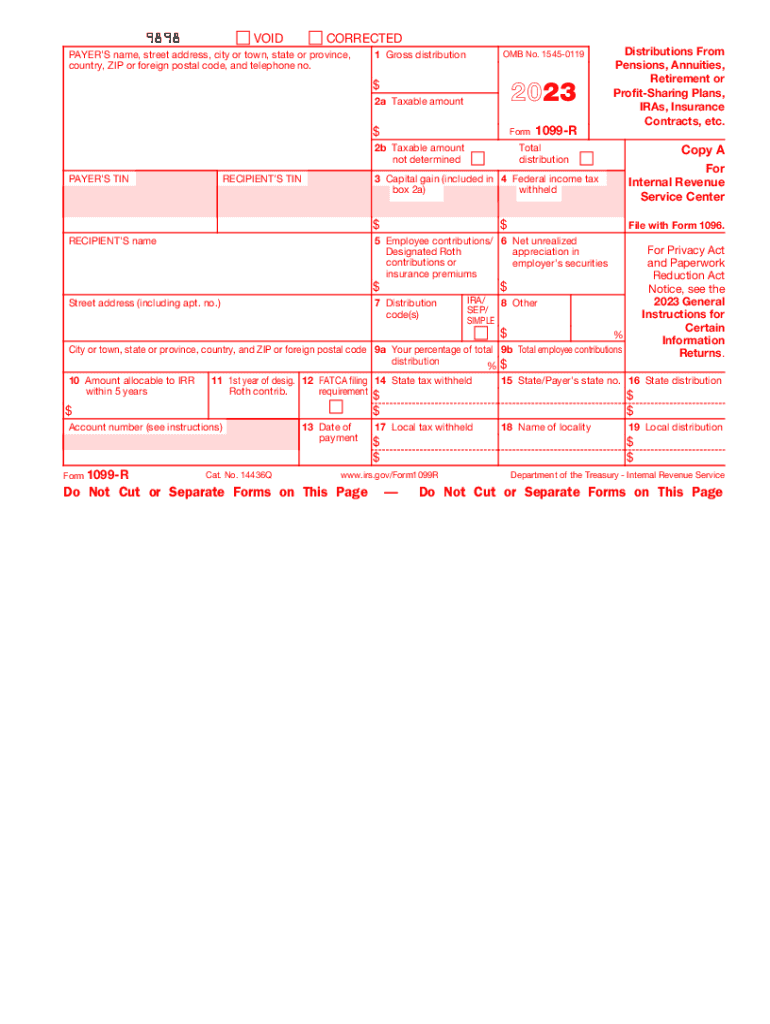

What is Form 1099 R Distributions From Pensions, Annuities, Retirement Or Profit Sharing Plans, IRAs, Insurance Contracts, Etc.?

Form 1099 R Distributions From Pensions, Annuities, Retirement Or Profit Sharing Plans, IRAs, Insurance Contracts, Etc. is a tax document used to report distributions made from various retirement accounts. It provides essential information about the amounts distributed and any tax withholdings, ensuring compliance with IRS regulations. Understanding this form is crucial for accurate tax reporting.

-

How can airSlate SignNow help with Form 1099 R distributions?

airSlate SignNow simplifies the process of managing Form 1099 R Distributions From Pensions, Annuities, Retirement Or Profit Sharing Plans, IRAs, Insurance Contracts, Etc. by allowing users to easily create, send, and eSign the necessary documents. With our intuitive platform, you can ensure that all forms are completed accurately and securely, streamlining your workflow and reducing errors.

-

What features does airSlate SignNow offer for managing Form 1099 R distributions?

airSlate SignNow provides a range of features including customizable templates, automated reminders, and secure eSignatures specifically designed for Form 1099 R Distributions From Pensions, Annuities, Retirement Or Profit Sharing Plans, IRAs, Insurance Contracts, Etc. These tools help ensure that your documents are processed efficiently and in compliance with legal requirements.

-

Is airSlate SignNow cost-effective for businesses handling Form 1099 R distributions?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, making it a cost-effective solution for managing Form 1099 R Distributions From Pensions, Annuities, Retirement Or Profit Sharing Plans, IRAs, Insurance Contracts, Etc. By streamlining the document signing process, you can save both time and resources, ultimately enhancing your bottom line.

-

Can airSlate SignNow integrate with other software for managing Form 1099 R distributions?

Absolutely! airSlate SignNow can seamlessly integrate with various accounting and financial software, allowing for efficient management of Form 1099 R Distributions From Pensions, Annuities, Retirement Or Profit Sharing Plans, IRAs, Insurance Contracts, Etc. This integration ensures that your data flows smoothly between systems, reducing manual entry and the risk of errors.

-

What benefits does eSigning provide for Form 1099 R distributions?

eSigning with airSlate SignNow offers numerous benefits for Form 1099 R Distributions From Pensions, Annuities, Retirement Or Profit Sharing Plans, IRAs, Insurance Contracts, Etc. It enhances security by providing a tamper-proof record of signatures, speeds up the approval process, and allows for real-time tracking of document status. This ultimately leads to improved efficiency and compliance.

-

How secure is airSlate SignNow for handling sensitive documents like Form 1099 R distributions?

airSlate SignNow prioritizes the security of your documents, including Form 1099 R Distributions From Pensions, Annuities, Retirement Or Profit Sharing Plans, IRAs, Insurance Contracts, Etc. We employ advanced encryption methods and comply with industry standards to protect your sensitive information, ensuring that your data remains confidential and secure throughout the signing process.

Find out other form 1099 r distributions from pensions annuities retirement or profit sharing plans iras insurance contracts etc

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles