PROPOSAL TO APPROVE THE ADOPTION OFTHE GOLF-TECHNOLOGY HOLDING, INC.

1997 STOCK OPTION AND LONG-TERM INCENTIVE PLAN

Introduction At the Annual Meeting there will be presented to Shareholders a proposal to approve the adoption of the

Golf-Technology Holding, Inc, 1997 Stock Option and Long-Term Incentive Plan (the " 1997 Plan"). The

1997 Plan was originally adopted by the Board of Directors on November 3, 1997. The 1997 Plan authorizes

the issuance of up to 1,250,000 shares of Common Stock pursuant to options to purchase Common Stock

("Options") or through grants of restricted stock. The 1997 Plan provides for the issuance of both Incentive

Stock Options and Non-Qualified Options, as those terms are defined in the Internal Revenue Code of 1986,

as amended (the "Code"). Pursuant to Code requirements, in order for stock options to qualify as Incentive

Stock Options, the plan pursuant to which such options are issued must be approved by the Shareholders of

the Company within twelve months of the adoption of the 1997 Plan by the Board of Directors. In addition,

the 1997 Plan provides for the grant of shares of restricted stock. Accordingly, if the 1997 Plan is not

approved by the Shareholders, the 1997 Plan will continue to be in effect, however only Non-Qualified

Options and restricted stock may be issuable thereunder.

The 1997 Plan is intended to promote the interests of the Company and its shareholders by providing

incentives to key employees, directors and consultants of the Company and its subsidiaries, on whose

judgment, initiative, and efforts the successful conduct of the business of the Company depends. Such

employees, as well as directors of the Company and consultants to the Company and its subsidiaries are

responsible for the management, growth, and protection of the business, and the 1997 Plan provides such

individuals with appropriate incentives and rewards to encourage them to maximize their performance and

efforts on behalf of the Company.

The full text of the 1997 Plan appears as Exhibit F to this Proxy Statement. The principal features of the 1997

Plan are summarized below, but such summary is qualified in its entirety by the full text of the 1997 Plan.

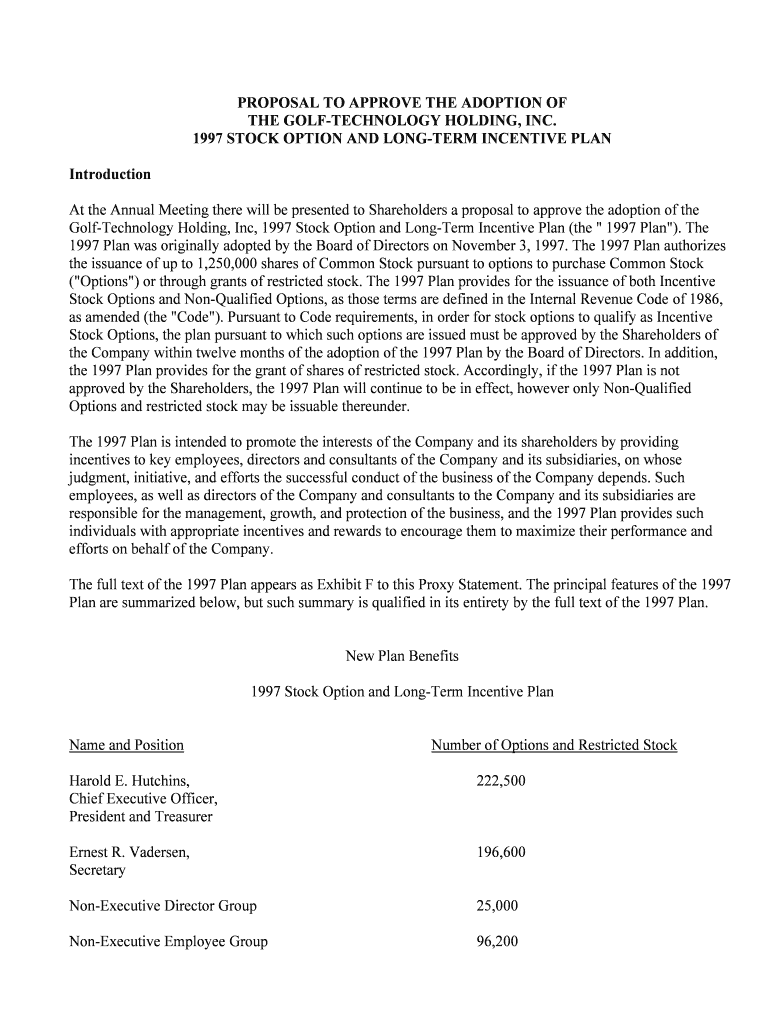

New Plan Benefits

1997 Stock Option and Long-Term Incentive Plan

Name and Position Number of Options and Restricted Stock

Harold E. Hutchins, 222,500

Chief Executive Officer,

President and Treasurer

Ernest R. Vadersen, 196,600

Secretary

Non-Executive Director Group 25,000

Non-Executive Employee Group 96,200

Player Representative and Former Employees 184,500TOTAL: 724,800

The 1997 Plan may be amended to alter the above allocation of benefits as between the persons or groups

specified above without shareholder approval. The options granted to Mr. Hutchins and Mr. Vadersen above

represent contractual obligations owed to them by the Company pursuant to their respective employment

agreements. See "Executive Compensation."

Administration of the 1997 Plan

The 1997 Plan shall be administered by the Board of Directors. The Board of Directors may appoint the

Compensation Committee or another committee of the Board of Directors (the "Committee") of two or more

of its members to administer the 1997 Plan, provided, however, the Committee shall not take any action under

the 1997 Plan unless it is at all times composed solely of not less than two "Non-Employee Directors" within

the meaning of Rule 16b-3, as promulgated under the Exchange Act.

Subject to the terms of the 1997 Plan, the Board of Directors or the Committee may determine and designate

those employees, directors and consultants of the Company and its subsidiaries to whom options or restricted

stock should be granted and the nature and terms of the options and the conditions imposed on the restricted

stock to be granted. The Board of Directors or the Committee, subject to the express provisions of the 1997

Plan, may at any time, or from time to time, suspend or terminate the 1997 Plan in whole or in part, or amend

it in such respects as the Board of Directors or Committee deems appropriate; provided, however, no

amendment, suspension or termination of the Plan shall, without the Participant's (as defined in the 1997

Plan) consent, alter or impair any of the fights or obligations under any option or restricted stock award

granted to a Participant under the 1997 Plan.

Stock Subject to the 1997 Plan

The stock subject to Options (as defined in the 1997 Plan) under the 1997 Plan shall be authorized but

unissued shares of Common Stock or shares of Common Stock reacquired by the Company in any manner.

The aggregate number of shares which may be issued by the Board of Directors or the Committee in its sole

and absolute discretion pursuant to the 1997 Plan is one million two hundred fifty thousand (1,250,000)

shares, subject to adjustment upon certain occurrences as provided in the 1997 Plan. On November 10, 1997,

the last reported sale price for the Common Stock on the Nasdaq Stock Market was $1.75 per share.

Grant of Options or Restricted Stock

Options or restricted stock may be granted by the Board of Directors or the Committee pursuant to the 1997

Plan at any time on or after the adoption of the 1997 Plan by the Board, effective as of November 3, 1997,

and prior to November 3, 2007.

Pursuant to the 1997 Plan, the Compensation Committee has granted 191,600 Non-Qualified Options to

Ernest R. Vadersen with an exercise price of $1.65 per share and 5,000 Non-Qualified Options with an

exercise price of $1.81 per share. Also, pursuant to the 1997 Plan, the Compensation Committee has granted

to Harold E. Hutchins 217,500 Non-Qualified Options with an exercise price of $1.50 and 5,000 Non-

Qualified Options with an exercise price of $1.81. Messrs. Moore, Bernstein, Movsovitz, Simon and Tewell

have each been granted 5,000 Non-Qualified Options with an exercise price of $1.81 pursuant to the 1997

Plan. The Compensation Committee has granted an aggregate of 94,700 Non-Qualified Options with an

exercise price of $1.50, 115,000 Non-Qualified Options with an exercise price of $1.65, and 71,000 shares of

Restricted Stock to nine employees and former employees of the Company and to-the Company's five player

representatives. The grants of options and restricted stock replace past grants of Incentive Stock Options

issued pursuant to stock option plans of the Company which are being superseded by the 1997 Plan and

grants thereunder.The Board of Directors or the Committee shall have the right, with the consent of the Participant, to convert

an Incentive Stock Option granted under the 1997 Plan to a Non-Qualified Option. Further, if this Proposal

No. 5 is not approved by the Shareholders all Options granted under the 1997 Plan will be Non-Qualified

Options.

Exercise of Stock Options

The exercise price per share as specified in the grant agreement relating to each Option granted under the

1997 Plan shall be determined by the Board of Directors or the Committee, provided, however, that the

exercise price per share of each Incentive Stock Option granted under the 1997 Plan shall not be less than the

fair market value, as defined in the 1997 Plan, per share of Common Stock on the date of such grant. The

exercise price per share of each Non-Qualified Option granted under the 1997 Plan may be less than or equal

to the fair market value, but not less than eighty-five percent (85%) of the fair market value, on the date of

such grant.

Subject to earlier termination upon termination of employment as provided in the 1997 Plan and the Incentive

Stock Option limitations as provided in the 1997 Plan, each Option shall expire on the date specified by the

Board of Directors or the Committee which shall be no later than ten years from the date of grant.

The Option shall either be fully exercisable on the date of grant or shall become exercisable thereafter in suc h

installments as the Board of Directors or the Committee may specify. In the absence of provisions in an

individual grant agreement or employment agreement to the contrary, Options shall vest ratably over a five

(5) year period.

If a Participant who has been granted an Option ceases to be employed by the Company and all its

subsidiaries other than for cause or by reason of retirement, death or disability, no further installments of his

or her Options shall become exercisable, and his or her Options shall terminate after the passage of ninety

(90) days from the date of termination of his or her employment, but in no event later than on their specified

expiration dates. Options granted to such Participant, to the extent they were not exercisable at the ti me of

such termination, shall expire at the close of business on the date of such termination.

If a Participant who has been granted an Option ceases to be employed by the Company and all its

subsidiaries for Cause (as defined in the 1997 Plan), all outstanding Options granted to such Participant shall

automatically expire at the commencement of business as of the date of such termination.

If a Participant who has been granted an Option ceases to be employed by the Company and all subsidiaries

by reason of Participant's death, disability or retirement, Participant or Participant's personal representati ve,

estate or beneficiary who has acquired the Option by will or by the laws of decent and distribution, shall have

the right to exercise any Options held by the participant on the date of termination of employment, to the

extent of the number of shares with respect to which the participant could have exercised on that date, at any

time prior to the specified expiration date of the Options. Options granted to such Participant, to the extent

they were not exercisable at the time of such termination, shall expire at the close of business on the date of

such termination. The effect of exercising any Incentive Stock Option on a day that is more than ninety (90)

days after the date of termination (or, in the case of a termination of employment on account of death or

disability, on a day that is more than one year after the date of such termination) will be to cause such

Incentive Stock Option to be treated as a Non-Qualified Option.

Vesting of Restricted StockAt the time of grant of shares restricted stock, the Board of Directors or the Committee may impose such

restrictions or conditions, not inconsistent with the provisions of the 1997 Plan, to the vesting of such shares

as the Board of Directors or the Committee, in its absolute discretion, deems appropriate.

In the event that the employment of a Participant with the Company shall terminate for any reason other than

cause prior to the vesting of shares of restricted stock granted to such Participant, the shares of restricted stock

shall be forfeited on the date of such termination, provided however, that the Committee may, in its sole and

absolute discretion, vest the Participant in all or any portion of shares of Restricted Stock which would

otherwise be forfeited pursuant to this provision.

In the event of the termination of a Participant's employment for cause, all shares of restricted stock granted to

such Participant which have not vested as of the date of such termination shall immediately be forfeited.

Change in Control

Subject to any required action by the shareholders of the Company, if the Company is to be consolidated with

or acquired by another entity in a merger, sale of all or substantially all of the Company's assets or otherwise,

the Committee or the board of directors of any entity assuming the obligations of the Company hereunder,

shall, as to outstanding Options, either (i) make appropriate provision for the continuation of such Options by

substituting immediately prior to such event (whether or not then exercisable) on an equitable basis for the

shares then subject to such Options the consideration payable with respect to the outstanding shares of

Common Stock in connection with an Acquisition (as defined in the 1997 Plan), (ii) upon written notice to the

Participants, provide that all Options must be exercised, to the extent then exercisable, within a specifie d

number of days of the date of such notice, at the end of which period the Options shall terminate; (iii)

terminate all Options in exchange for a cash payment equal to the excess of the fair market value of the share s

subject to such Options (to the extent then exercisable) over the exercise price thereof, or (iv) any

combination of (i), (ii) and (iii).

Subject to any required action by the shareholders of the Company, in the event that the Company shall be the

surviving corporation in any merger or consolidation (except a merger or consolidation as a result of which

the holders of shares of Common Stock receive securities of another corporation), each Option outstanding on

the date of such merger or consolidation shall pertain to and apply to the securities which a holder of the

number of shares of Common Stock subject to such Option would have received in such merger or

consolidation.

In the event of a recapitalization or reorganization of the Company (other than a transaction pursuant to which

securities of the Company or of another corporation are issued with respect to the outstanding shares of

Common Stock, a Participant upon exercising an Option shall be entitled to receive for the purchase price

paid upon such exercise the securities the Participant would have received if the Participant had exercised the

Participant's Option prior to such recapitalization or reorganization.

Federal Income Tax Consequences

Incentive Stock Options granted under the 1997 Plan are intended to be qualified incentive stock options in

accordance with the provisions of Section 422 of the Code. All other options granted under the 1997 Plan are

Non-Qualified Options not entitled to special tax treatment under Section 422 of the Code. Generally, the

grant of an Incentive Stock Option will not result in taxable income for regular income tax purposes to the

recipient at the time of the grant, and the Company will not be entitled to an income tax deduction at suc h

time. Generally, the grant of Non-Qualified Options will not result in taxable income to the recipient at the

time of the grant and the Company will not be entitled to an income tax deduction at such time.

Upon the exercise of an Incentive Stock Option granted under the 1997 Plan, the recipient will not be treated

as receiving any taxable income, and the Company will not be entitled to an income tax deduction. Upon the

exercise of a Non-Qualified Option, a Participant will recognize ordinary income, in an amount equal to the

excess of the fair market value of the underlying shares of the Company's Common Stock, at the time of

exercise, over the exercise price. The ordinary income recognized by an employee is subject to withholding

and employment taxes. The Company will receive an income tax deduction for the amount of ordinary

income recognized by the recipient at the time and in the amount that the recipient recognizes such i ncome to

the extent permitted by Section 162(m) of the Code.

Upon subsequent disposition of the shares received upon exercise of an Option, any differences between the

tax basis of the shares and the amount realized on the disposition is generally treated as long-term or short-

term capital gain or loss, depending on the holding period of shares of Common Stock; provided, that if the

shares subject to an Incentive Stock Option are disposed of prior to the expiration of two years from the date

of grant and one year from the date of exercise, the gain realized on the disposition will be treated as ordinary

income to the Participant and the Company will receive a corresponding income tax deduction.

The recipient of a grant of restricted stock will be required to recognize ordinary compensation income equal

to the fair market value of the restricted stock on the settlement date of such restricted stock. The Compa ny

will receive an income tax deduction equal to the amount of ordinary income recognized by the recipient to

the extent permitted by Section 162(m) of the Code.

The foregoing statements are intended to summarize the general principles of current federal income tax la w

applicable to options that may be granted under the 1997 Plan. The tax consequences of awards made under

the 1997 Plan are complex, subject to change, and may vary depending on the taxpayer's particular

circumstances.

Required Vote

The affirmative vote of a majority of the outstanding shares of Common Stock and Series A Preferred Stock

cast on this proposal in person or by proxy at the Annual Meeting is required for the approval of the adoption

of the 1997 Plan.

The Board of Directors recommends a vote FOR adoption of the 1997 Plan.