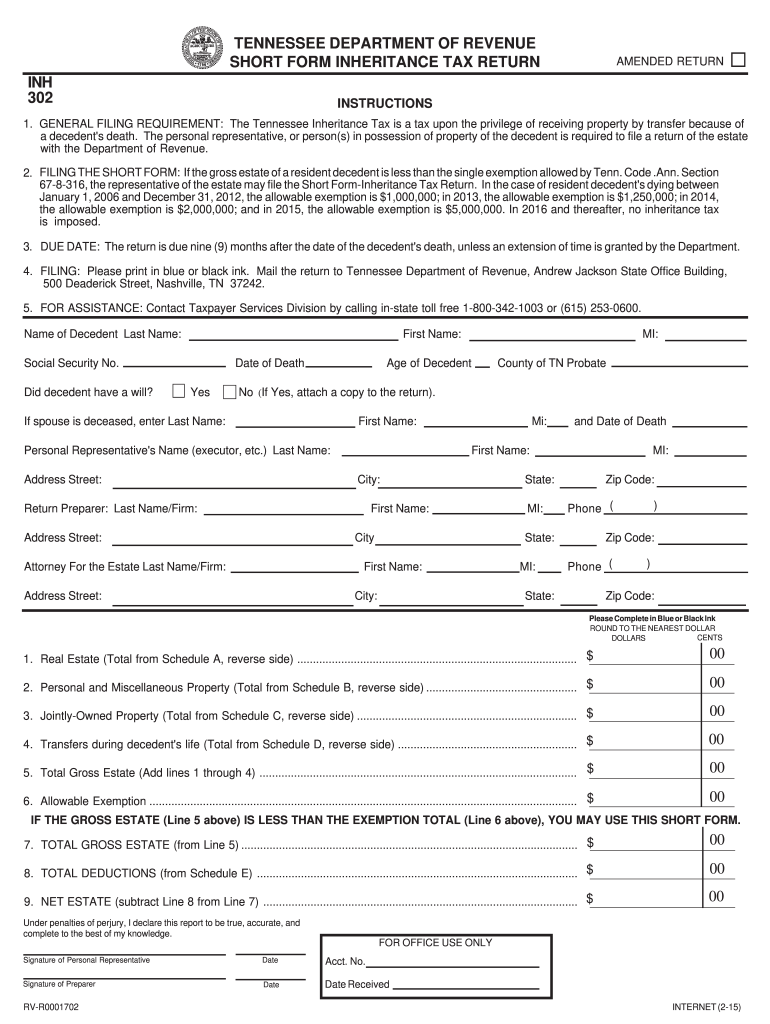

Fill and Sign the Form Inheritance Tax 2015 2019

Practical tips for preparing your ‘Form Inheritance Tax 2015 2019’ online

Are you weary of the inconvenience of handling paperwork? Look no further than airSlate SignNow, the premier eSignature solution for individuals and businesses. Bid farewell to the monotonous process of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and authorize documents online. Utilize the comprehensive features bundled within this user-friendly and cost-effective platform and transform your method of document management. Whether you need to approve documents or gather electronic signatures, airSlate SignNow manages it all effortlessly, needing just a few clicks.

Follow this detailed guide:

- Log into your account or initiate a free trial with our service.

- Select +Create to upload a file from your device, cloud storage, or our form library.

- Open your ‘Form Inheritance Tax 2015 2019’ in the editor.

- Click Me (Fill Out Now) to set up the document on your end.

- Add and designate fillable fields for others (if necessary).

- Continue with the Send Invite options to solicit eSignatures from others.

- Save, print your version, or convert it into a reusable template.

Don’t fret if you need to collaborate with others on your Form Inheritance Tax 2015 2019 or send it for notarization—our solution is equipped with everything you require to accomplish such tasks. Register with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

What are Inheritance Tax Forms and why are they important?

Inheritance Tax Forms are legal documents required to report the value of an estate and calculate any taxes owed upon a person's death. These forms are crucial for ensuring compliance with tax laws and for the proper distribution of assets. Using airSlate SignNow, you can easily create, send, and eSign these forms, making the process straightforward and efficient.

-

How can airSlate SignNow help me with Inheritance Tax Forms?

airSlate SignNow simplifies the process of managing Inheritance Tax Forms by providing a user-friendly platform for document creation and electronic signatures. Our service allows you to customize forms, track their status, and ensure they are securely signed by all parties involved. This streamlines the often complex process of estate management.

-

Are there any costs associated with using airSlate SignNow for Inheritance Tax Forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including options specifically for managing Inheritance Tax Forms. Each plan provides access to essential features that help streamline document workflows while remaining cost-effective. You can choose a plan based on the volume of documents you need to handle.

-

Can I integrate airSlate SignNow with other software for managing Inheritance Tax Forms?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, including accounting and legal software, to enhance your workflow for Inheritance Tax Forms. This integration allows you to pull in relevant data and manage documents more efficiently, saving you time and reducing the risk of errors.

-

Is my data safe when using airSlate SignNow for Inheritance Tax Forms?

Yes, your data is secure when using airSlate SignNow for managing Inheritance Tax Forms. We employ robust encryption protocols and adhere to strict compliance standards to protect your sensitive information. You can trust that your documents are safe and secure throughout the entire signing process.

-

How can I track the status of my Inheritance Tax Forms with airSlate SignNow?

airSlate SignNow provides an intuitive dashboard that allows you to track the status of your Inheritance Tax Forms in real-time. You can see when documents are sent, viewed, signed, or completed, ensuring you stay informed throughout the process. This feature helps you manage your estate documentation more effectively.

-

Can I customize my Inheritance Tax Forms using airSlate SignNow?

Yes, airSlate SignNow allows you to customize Inheritance Tax Forms to meet your specific requirements. You can add fields, adjust layouts, and include branding elements to ensure the forms are tailored to your needs. This flexibility helps create professional and compliant documents that reflect your personal or organizational style.

Find out other form inheritance tax 2015 2019

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles