§4.204 PROXY STATEMENTS: STRATEGY & FORMS

4-282© 1993 Jefren Publishing Company, Inc.

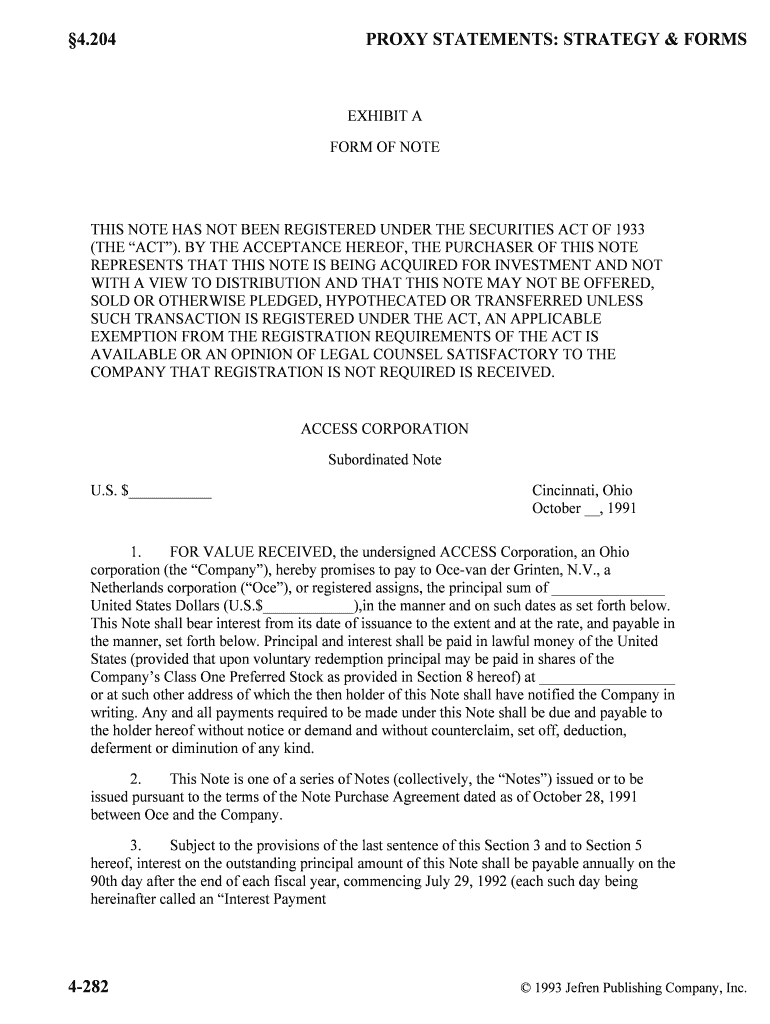

EXHIBIT A

FORM OF NOTE

THIS NOTE HAS NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933

(THE “ACT”). BY THE ACCEPTANCE HEREOF, THE PURCHASER OF THIS NOTE

REPRESENTS THAT THIS NOTE IS BEING ACQUIRED FOR INVESTMENT AND NOT

WITH A VIEW TO DISTRIBUTION AND THAT THIS NOTE MAY NOT BE OFFERED,

SOLD OR OTHERWISE PLEDGED, HYPOTHECATED OR TRANSFERRED UNLESS

SUCH TRANSACTION IS REGISTERED UNDER THE ACT, AN APPLICABLE

EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE ACT IS

AVAILABLE OR AN OPINION OF LEGAL COUNSEL SATISFACTORY TO THE

COMPANY THAT REGISTRATION IS NOT REQUIRED IS RECEIVED. ACCESS CORPORATIONSubordinated Note

U.S. $___________ Cincinnati, Ohio

October __, 1991

1. FOR VALUE RECEIVED, the undersigned ACCESS Corporation, an Ohio

corporation (the “Company”), hereby promises to pay to Oce-van der Grinten, N.V., a

Netherlands corporation (“Oce”), or registered assigns, the principal sum of _______________

United States Dollars (U.S.$____________),in the manner and on such dates as set forth below.

This Note shall bear interest from its date of issuance to the extent and at the rate, and payable in

the manner, set forth below. Principal and interest shall be paid in lawful money of the United

States (provided that upon voluntary redemption principal may be paid in shares of the

Company’s Class One Preferred Stock as provided in Section 8 hereof) at __________________

or at such other address of which the then holder of this Note shall have notified the Company in

writing. Any and all payments required to be made under this Note shall be due and payable to

the holder hereof without notice or demand and without counterclaim, set off, deduction,

deferment or diminution of any kind.

2. This Note is one of a series of Notes (collectively, the “Notes”) issued or to be

issued pursuant to the terms of the Note Purchase Agreement dated as of October 28, 1991

between Oce and the Company.

3. Subject to the provisions of the last sentence of this Section 3 and to Section 5

hereof, interest on the outstanding principal amount of this Note shall be payable annually on the

90th day after the end of each fiscal year, commencing July 29, 1992 (each such day being

hereinafter called an “Interest Payment

SALE OR PURCHASE OF CAPITAL STOCK §4.204

June 19834-283

Date” and each fiscal year ending immediately prior to an Interest Payment Date being

hereinafter called an “Interest Period”). The holder of this Note on the last business day of an

Interest Period shall be entitled to receive on the immediately following Interest Payment Date

any interest payable with respect to such Interest Period. Interest on the outstanding principal

amount of this Note shall accrue to the extent provided herein at the rate of [seven percent (7%)

per annum] [nine percent (9%) per annum] [the greater of (a) nine percent (9%) per annum or (b)

a rate equal to the prime rate as publicly announced by The Central Trust Company, N.A. (or any

successor thereto) plus three percent (3%)]. Notwithstanding the foregoing, Interest on the Notes

shall accrue and be payable with respect to any Interest Period only to the extent the amount

thereof does not exceed 50% of the Company’s net after tax earnings for such Interest Period as

determined by the Company pursuant to its generally accepted accounting principles consistently

applied, adjusted to exclude from the calculation thereof all interest expense attributable to the

Notes and the tax effect thereof (“After Tax Earnings”).

4. With respect to any Interest Period, interest on each of the Notes shall be deemed

to accrue, and interest payments on each of the Notes shall be made, so that the aggregate

interest accrued or paid, as the case may be, on such Note shall be in the same proportion to that

accrued or paid on each of the other Notes as the interest which would have accrued on such

Note for such Interest Period without giving effect to the provisions of the last sentence of

Section 3 hereof bears to the interest which would have accrued on each of the other Notes

similarly computed.

5. The Company at its option may elect to defer the payment of interest on the

Notes, provided that any such deferral is applied pro-rata to the interest payable on each of the

Notes and that no interest payment on this Note may be deferred beyond the maturity of this

Note, whether by redemption or otherwise. Interest deferred pursuant to this Section 5 shall not

bear interest.

6. (a) The Notes are subject to mandatory sinking account redemption (the Notes

to be redeemed to be selected as provided in Section 6(c) below) at a price equal to the principal

amount thereof, plus an amount equal to any interest accrued and unpaid thereon to the date

fixed for redemption (the “Redemption Date”) (for which purpose the pro rata portion of any

interest for the then current Interest Period shall be deemed to be accrued) (the “Redemption

Price”). For each fiscal year, commencing with the fiscal year ending April 30, 1995, not later

than the 90th day after the end of such fiscal year, the Company shall deposit funds to the

sinking account in an amount equal to the after tax earnings for such fiscal year in excess of the

sum of (i) $200,000, and (ii) an amount equal to the sum of all interest paid on the Notes and all

dividends paid on Class One Preferred Stock with respect to such fiscal year plus the sum of all

cash

§4.204 PROXY STATEMENTS: STRATEGY & FORMS

4-284© 1993 Jefren Publishing Company, Inc.

amounts previously paid during such fiscal year in voluntary redemption of Notes or shares of

Class One Preferred Stock. Such funds shall be used as promptly as possible for the redemption

of Notes as contemplated by this Section 6(a), to the extent not prohibited by applicable law.

Notwithstanding the foregoing, the Company shall not be required to deposit to the sinking

account in respect of any fiscal year any amount determined as provided above if and to the

extent the sum of such amount and all amounts payable in redemption of Class One Preferred

Stock with respect to such fiscal year plus the sum of any interest paid on the Notes and all

dividends paid on Class One Preferred Stock with respect to such fiscal year would exceed 60%

of the Company’s After Tax Earnings for such fiscal year.

(b) Voluntary Redemption. The Company may voluntarily redeem all or any part

of the Notes at its election expressed by resolution of the Board of Directors, at any time upon

not less than thirty (30) days prior notice to the holders of the Notes to be redeemed, given by

mail, at the Redemption Price, plus an amount equal to any interest accrued and unpaid thereon

to the Redemption Date (for which purpose the pro rata portion of any interest for the then

current Interest Period shall be deemed to be accrued). Upon voluntary redemption, the portion

of the Redemption Price equal to principal amount shall be payable in cash or, to the extent

permitted by Section 8 hereof, in shares of the Company’s Class One Preferred Stock as

provided in Section 8 hereof; the balance of the Redemption Price shall be payable in cash.

(c) Notice, etc.

(i) In order to facilitate the redemption of any Notes that may be chosen for

redemption, the Board of Directors shall be authorized to exercise its discretion to cause the

transfer books of the Company to be closed as to such Notes not more than fifty (50) days prior

to the designated Redemption Date and not prior to the giving of the notice referred to in clause

(6) (b) above.

(ii) If less than all outstanding Notes are to be redeemed, the redemption

shall be made to the extent funds are available first with respect to any outstanding Notes bearing

interest at a variable rate, second with respect to any outstanding Notes bearing interest at 9% per

annum and third with respect to any outstanding Notes bearing interest at 7% per annum and

within each such series of Notes either pro rata, by lot or in some other equitable manner as may

be prescribed by resolution of the Board of Directors.

(iii) Any notice of redemption mailed to a holder of Notes at his address as

the same shall appear on the books of the Company shall be conclusively presumed to have been

given, whether or not the holder receives the notice. Each such notice

SALE OR PURCHASE OF CAPITAL STOCK §4.204

June 19834-285

shall state the Redemption Date; the principal amount of Notes to be redeemed and, if less than

all Notes held by such holder are to be redeemed, the principal amount of such Notes to be

redeemed from him and the fact that a new Note representing any principal amount not so

redeemed will be issued without cost to such holder; the Redemption Price applicable to the

Notes to be redeemed; the place or places where such Notes are to be surrendered; and that

interest on Notes to be redeemed will cease to accrue on the Redemption Date. No defect in any

such notice to any holder of any Note shall affect the validity of the proceedings for the

redemption of any other Notes.

(d) The Company shall provide moneys or shares of the Company’s Class

One Preferred Stock to the extent permitted by Section 8 hereof for the payment of the

Redemption Price of the Notes called for redemption pursuant to paragraph (a) or (b) of this

Section 6, by depositing the amount thereof on or before the Redemption Date for the account of

the holders of the Notes entitled thereto with a bank or trust company located in New York, New

York or Cincinnati, Ohio, and having capital and surplus of at least fifty million dollars

($50,000,000). From and after the date fixed in any such notice as the Redemption Date (unless

default shall be made by the Company in providing moneys or shares sufficient for the payment

of the Redemption Price pursuant to such notice), all interest on the Notes called for redemption

shall cease to accrue and all rights of the holders thereof, except the right to receive the

Redemption Price as hereinafter provided, shall cease and terminate. After the deposit of such

amount or shares with such bank or trust company, the respective holders of record of the Notes

to be redeemed shall be entitled on and after the Redemption Date to receive the Redemption

Price at any time upon actual delivery to such bank or trust company of (i) the Notes to be

redeemed, duly endorsed in blank or accompanied by proper instruments of assignment and

transfer thereof duly endorsed in blank or (ii) if such Notes have been lost, such documentation

with respect thereto as the Company may reasonably require. Any interest accrued on funds so

deposited shall be paid to the Company from time to time and the holders of Notes to be

redeemed shall have no claim to any such interest. Any moneys or shares so deposited which

shall remain unclaimed by the holders of such Notes at the end of two (2) years after the

Redemption Date shall be paid by such bank or trust company to the Company, after which

repayment the holders of the Notes so called for redemption shall look only to the Company as

general creditors for the payment thereof, subject to applicable escheat laws.

7. Unless this Note has been previously redeemed as provided in Section 6 hereof,

the principal amount of this Note shall mature and be payable, together with all interest accrued

thereon, on November 1, 2011.

§4.204 PROXY STATEMENTS: STRATEGY & FORMS

4-286© 1993 Jefren Publishing Company, Inc.

8. At the Company’s option, upon voluntary redemption of this Note and all other

outstanding Notes as provided in Section 6(b) hereof, it may pay all, but not a portion of, the

Redemption Price equal to principal amount by issuing to the holder hereof fully paid and non-

assessable shares of the Company’s Class One Preferred Stock with a dividend rate equal to t he

interest rate on this Note, such shares to be valued at $100 per share. Such shares shall have the

terms and conditions set forth in Annex I hereto. It shall be a condition to the Company’s ri ght to

issue such shares in payment that all necessary actions (including without limitat ion amendment

of the Company’s Articles of Incorporation) shall have been taken so that such shares, when

issued, are validly authorized and issued. Any such shares shall be allocated equitably am ong the

holders of the Notes being redeemed and shall bear such legends restricting transfer under

applicable securities laws as the Company’s counsel may deem appropriate. The Compa ny may

not issue shares of Class One Preferred Stock other than as provided in this Section 8.

9. So long as any Note shall remain outstanding, no dividend whatsoever shall be

declared or paid upon or set apart for any class or series of stock of the Company, nor shall any

shares of any class or series of stock be redeemed or purchased by the Company or any

subsidiary thereof (except for purchases pursuant to any restricted stock purchase plan or other

employee benefit plan maintained by the Company), nor shall any moneys be paid to or made

available for a sinking fund for redemption or purchase of any shares of any class of stock or

series thereof, unless in each instance interest (which shall include all payments pursuant to

Section 3) on all outstanding Notes for all past Interest Periods (to the extent accrued pursuant to

Section 3) shall have been paid and the interest on all outstanding Notes for the then current

Interest Period shall have been paid and all required payments under Section 6 hereof shall have

been made.

10. (a) To the extent hereinafter provided, this Note is expressly subordinated in

right of payment to the prior payment in full of Senior Indebtedness of the Company. For the

purposes hereof, Senior Indebtedness shall be defined as the principal of (and premium, if any)

and interest on and fees and other amounts payable with respect to (i) all debt or obligations of

the Company or its subsidiaries (including debt or obligations of others guaranteed by the

Company or its subsidiaries) other than the Notes, whether outstanding on the date hereof or

hereafter created, incurred or assumed, which is (A) for money borrowed or (B) evidenced by a

note or similar instrument given in connection with the acquisition of any businesses, properties

or assets of any kind, (ii) obligations of the Company as lessee under leases required to be

capitalized on the balance sheet of the lessee under generally accepted accounting principles, (iii )

any other obligations of the Company to its creditors other than obligations to holders of shares

of its stock by reason of such

SALE OR PURCHASE OF CAPITAL STOCK §4.204

June 19834-287

share ownership, and (iv) amendments, renewals, extensions, modifications and refundings of

any such debt or obligation, unless in any case in the instrument creating or evidencing any such

debt or obligation or pursuant to which the same is outstanding it is provided that such debt or

obligation is pari passu or subordinated in right of payment to this Note of the Company. The

holder of this Note, for itself and its successors and assigns, expressly for the benefit of the

present and future holders of Senior Indebtedness, by accepting this Note, agrees to and shall be

bound by the subordination provisions of this Section 10.

(b) No payment on account of the principal of or interest on this Note shall be

made, and no holder of this Note shall be entitled to receive any such payment unless and until

full payment of all amounts currently due on Senior Indebtedness has been made or duly

provided for in money or money’s worth. No payment on account of the principal of or interest

on this Note shall be made, and no holder of this Note shall be entitled to receive any such

payment, if, at the time of such payment or application or immediately after giving effect theret o

(i) there shall exist under any Senior Indebtedness or any agreement pursuant to which any such

Senior Indebtedness is issued any default or any condition, event or act, which with notice or

lapse of time, or both, would constitute a default or (ii) such payment would itself constitute a

default or an event of default under any Senior Indebtedness or any agreement pursuant to which

any such Senior Indebtedness is issued, unless and until such default or event of default shall

have been cured or waived or cease to exist.

(c) No holder of this Note shall be entitled to accelerate the principal of this

Note, or take any legal action against the Company or any of its assets pursuant to the provisions

of this Note, if prior to the time of such acceleration or action, an event has occurred which, with

the lapse of time, the giving of notice, or otherwise, gives any holder of Senior Indebtedness the

right to accelerate such Senior Indebtedness and such holder of Senior Indebtedness has not so

accelerated such Senior Indebtedness; provided that (i) after the expiration of 365 days from the

earliest date on which any holder of Senior Indebtedness shall have become entitled to accelerate

such Senior Indebtedness, or take other action against the Company to implement collection on

the Senior Indebtedness or to realize upon collateral given as security therefor, or (ii) if the

holder of such Senior Indebtedness has so accelerated such Senior Indebtedness, then in either of

such cases of clause (i) or (ii) above, the holder of this Note shall no longer be subject to the

restrictions contained in this paragraph (c) and the holder may accelerate this Note in accordance

with its terms and take any appropriate legal action against the Company or any of its assets.

§4.204 PROXY STATEMENTS: STRATEGY & FORMS

4-288© 1993 Jefren Publishing Company, Inc.

(d) In the event of any insolvency or bankruptcy proceedings, and any

receivership, liquidation, reorganization or other similar proceedings in connection therewith,

relative to the Company or to its creditors, as such, or to its property, or in the event of any

proceedings for voluntary liquidation, dissolution, or other winding up of the Company, whether

or not involving insolvency or bankruptcy, the holders of Senior Indebtedness shall be entitled to

receive payment in full of all principal, premium, if any, and interest on all Senior Indebtedness

(pro rata to such holders on the basis of the respective amounts of Senior Indebtedness held by

such holders) before any holder of this Note is entitled to receive any payment on account of

principal or interest upon this Note and to receive for application in payment thereof any

payment or distribution of any kind or character, whether in cash, property or securities (other

than shares of stock of the Company as reorganized or readjusted or securities of the Company or

any other corporation provided for by a plan of reorganization or readjustment, the payment of

which is subordinated to the payment of all Senior Indebtedness which may at the time be

outstanding) which may be payable or deliverable in any such proceedings in respect of this

Note.

(e) In the event that, notwithstanding the foregoing, any payment or

distribution of assets of the Company, whether in cash, property or securities (other than shares

of stock of the Company as reorganized or readjusted or securities of the Company or any other

corporation provided for by a plan of reorganization or readjustment, the payment of which is

subordinated to the payment of all Senior Indebtedness which may at the time be outstanding),

shall be received by the holder of this Note contrary to the provisions of paragraph (b), (c) or (d)

of this Section 10 before all Senior Indebtedness is paid in full, or provision made for its

payment in cash, such payment or distribution shall be held in trust for the benefit of, and shall

(upon acceleration of the Senior Indebtedness) be paid over or delivered to, the holders of such

Senior Indebtedness or their representative or representatives, or to the trustee or trustees under

any indenture under which any instruments evidencing any of such Senior Indebtedness may

have been issued, for application to the payment of all Senior Indebtedness remaining unpaid to

the extent necessary to pay all such Senior Indebtedness after giving effect to any concurrent

payment or distribution, or provision for payment thereof in cash, to the holders of such Senior

Indebtedness.

(f) No right of any present or future holder of any Senior Indebtedness to

enforce subordination as herein provided shall at any time in any way be prejudiced or impaired

by the noncompliance by the Company with the terms, provisions and covenants of this Note

regardless of any knowledge thereof which any such holder may have or otherwise be charged

with. Nothing contained in this Section or elsewhere in this Note is intended

SALE OR PURCHASE OF CAPITAL STOCK §4.204

June 19834-289

to or shall impair, as between the Company, its creditors other than the holders of Senior

Indebtedness, and the holder of this Note, the obligation of the Company, which is absolute and

unconditional, to pay to the holder of this Note the principal of and the interest on this Note in

accordance with its terms, or is intended to or shall affect the relative rights of the holder of this

Note and the creditors of the Company other than the holders of Senior Indebtedness, nor,

subject to the provision of paragraph (c) of this Section 10, shall anything herein or therein

prevent the holder of this Note from exercising all remedies otherwise permitted by applicable

law upon default under this Note, subject to the rights, if any, under this Note of the Senior

Indebtedness, in respect of cash, property or securities of the Company received upon the

exercise of any such remedy.

(g) Upon the payment in full of all Senior Indebtedness to the extent such

payment in full resulted from the subordination provisions of this Note, the rights of the holder

of this Note shall be subrogated to the rights of the holders of Senior Indebtedness to receive

payments or distributions of cash, property or securities of the Company applicable to the Senior

Indebtedness until the principal of and interest on this Note shall be paid in full; and, for the

purposes of such subrogation, no payments or distributions to the holders of the Senior

Indebtedness of any cash, property or securities to which the holder of this Note would be

entitled except for the provisions of this Section, and no payment pursuant to the provisions of

this Section to or for the benefit of the holders of Senior Indebtedness by the holder of this Note

shall, as between the Company, its creditors other than holders of Senior Indebtedness, and the

holder of this Note, be deemed to be a payment by the Company to or on account of the Senior

Indebtedness. It is understood that the provisions of this Section 10 are solely for the purpose of

defining the relative rights of the holder of this Note on the one hand, and the holders of the

Senior Indebtedness, on the other.

11. (a) Subject to the provisions of Section 10 hereof, default under this Note may

be declared, the unpaid principal and accrued interest hereof may be accelerated and immediate

payment hereof may be demanded by the holder upon the occurrence of an event of default as

defined below; provided, however, that if the rights to acceleration of this Note have been

suspended for 365 days as provided in Section 10(c) hereof, upon the expiration of said period,

and thereafter, if the event of default is continuing and has not been cured, the holder of this Note

may accelerate and demand payment of this Note. The following are the events of default:

(i) The Company fails to pay the principal of any of the Notes or make any

sinking fund payment with respect to the Notes when due and such failure continues for a

period of 30 days or the Company fails to pay an installment of

§4.204 PROXY STATEMENTS: STRATEGY & FORMS

4-290© 1993 Jefren Publishing Company, Inc.

interest on any of the Notes when due (after giving effect to the deferral provisions of

Section 5 hereof) and such failure continues for a period of 30 days.

(ii) The Company is the debtor in a bankruptcy, receivership, or Chapter XI or

other insolvency proceeding, or makes an assignment for the benefit of creditors.

(b) The Company shall immediately give notice to the holder of this Note in

writing upon the occurrence of an event of default or any event which, with notice or lapse of

time or both would become an event of default.

12. This Note shall be governed by and construed in accordance with the laws of the

State of Ohio.

13. The Company waives presentment, protest and notice of dishonor of this Note.

14. This Note is a registered note and may be transferred only on the books of the

Company. The Company may treat the registered holder of this Note as the owner thereof for all

purposes. If this Note is lost, stolen, mutilated and destroyed, the Company will replace it upon

such terms and conditions, including affidavits, indemnities and bond, as may be established by

the Board of Directors.

ACCESS CORPORATION

By: ________________________________________