Prepared by U.S. Legal Forms, Inc.

Copyright - U.S. Legal Forms, Inc.

LIMITED LIABILITY COMPANY

FORMATION PACKAGE

STATE OF ALABAMA

Control Number: AL-00LLC

The contents of this package are as follows:

1.

2.

3.

4.

5.

6.

7.

8.

9.

Statutory Reference

Introduction

Forms List

Notes on Downloading the Forms

Notes on Completing the Forms

Instructions and Steps

Accessories

Sample Ledger and Certificate

Disclaimer

��LIMITED LIABILITY COMPANY

FORMATION PACKAGE – ALABAMA

Electronic Version

Statutory Reference

ALABAMA CODE, Title 10A, Chapter 5A (Alabama Limited Liability Company Act)

http://alisondb.legislature.state.al.us/alison/codeofalabama/1975/coatoc.htm

Introduction

Created by state statutes to encourage business activity, a limited liability company (LLC) is a

“hybrid” type of business organization, with characteristics of both a partnership and a

corporation and many of the advantages of both. Like a corporation, the limited liability

company is a legal entity separate from its owners who are known as “members.” Barring some

other arrangement, members normally vote on any proposed action for the LLC, with the number

of votes per member typically corresponding to his or her percentage of ownership interest in the

business. Some of the advantageous benefits of an LLC include flexible ownership and

management, protection from liability for owners, and tax advantages.

FLEXIBILITY

A limited liability company generally has fewer legal formalities to observe than a corporation,

and is simpler to create and maintain. The ownership and management of an LLC is more

flexible than a corporation and very closely resembles that of a partnership. Keeping of corporate

minutes is not required. Management and control of an LLC is vested with its members unless

stated otherwise in the LLC’s Articles of Organization (called a Certificate of Formation in some

states). The owners of an LLC are called “members” and differ from the shareholders of a

corporation because members are allowed to participate in the management of an LLC without

being appointed to a managerial position such as a director or officer of a corporation.

IRS rules now allow an LLC to choose between being taxed as a partnership or as a corporation

(most choose partnership, but see below). If an LLC has more than one member, the relationship

between those members is governed by a written operating agreement. Although an LLC used to

be required to be comprised of at least two LLC members, today most states and the IRS

recognize the single-member LLC as a legitimate business structure.

�LIMITED LIABILITY

In most cases, only the LLC is responsible for the company’s debts and the members are

protected from being individually liable. As a result, the member’s assets are typically not at risk

if the LLC is sued or cannot pay its debts. To maintain this limited liability protection for the

members the LLC must follow requirements such as holding member meetings and documenting

decisions through resolutions. However, there are some exceptions where individual members

may be held liable if he or she:

* Personally and directly injures someone

* Personally guarantees a bank loan or a business debt on which the LLC defaults

* Fails to deposit taxes withheld from employees’ wages

* Intentionally does something fraudulent, illegal, or clearly wrong that causes harm to the

company or to someone else, or

* Treats the LLC as an extension of her personal affairs, rather than as a separate legal entity.

TAXATION

Many tax benefits are available to LLCs and members including “pass through” tax treatment of

profits and losses, easy allocation of profits and losses to different members, and elimination of

payroll taxes for members’ cash withdrawals. The earnings of an LLC are not subject to

corporate taxes; instead, the profits flow through to the owners in proportion to their ownership.

However, LLC owners can instead elect to have their LLC taxed like a corporation. This may

reduce taxes for LLC owners who will regularly need to retain a significant amount of profits in

the company.

DISADVANTAGES

An LLC does not allow ownership to be transferred through sale of shares in the same way as

corporate stock ownership allows. In most jurisdictions, ownership interest may only be

transferred or created with the consent of a majority of the other members, unless the articles of

organization provide for a greater or lesser level of consent.

An LLC may abruptly cease to exist. Unless otherwise provided in the articles of organization or

a written operating agreement (which may for example allow a majority of members to vote to

continue the LLC), an LLC is dissolved at the death, withdrawal, resignation, expulsion, or

bankruptcy of any member. The LLC operating agreement can prevent this kind of abrupt ending

to your business by including certain provisions setting up guidelines for what will happen when

one member retires, dies, becomes disabled or leaves the LLC.

FORMATION

Not all businesses can operate as LLCs. Businesses in the banking, trust and insurance industry,

for example, are typically prohibited from forming LLCs. In addition, some states prohibit

�professionals such as architects, accountants, doctors and other licensed healthcare workers from

forming LLCs, requiring a Professional Limited Liability Company (PLLC) or other entity.

State laws governing LLCs vary from state to state. However, if the LLC will have significant

business or member contacts (a.k.a. "presence") within a state, it should be formed in that state.

Otherwise, it may be subject to fees and/or taxes for doing business in an outside state. If an LLC

is required to qualify to do business in an outside state, it may have to pay filing fees and

franchise taxes as a foreign LLC to the outside state.

ARTICLES OF ORGANIZATION

The existence of an LLC begins when a document typically known as the “Articles of

Organization” are filed with the Secretary of State’s Business/Corporate Division. The Articles

of Organization is the primary document constituting the legal identity of the LLC. If there are

any conflicting provisions in other LLC forms or documents (the operating agreement, member

agreements, or resolutions), the articles of organization override such provisions.

Requirements vary by state, but most states require the following minimum information:

* The name of the LLC. The name you select must not be the same as or deceptively similar to

an existing business name in your state. Most states require that the limited liability company

name be followed by the words “Limited Liability Company” or by the abbreviation “LLC.”

* The mailing address of the proposed entity.

* The name and address of a registered agent in the state of filing.

* The name and address of the LLC’s organizer.

* The LLC’s stated period of duration or date of termination (indefinite/perpetual duration is

normally allowed.

* Some states may require that your articles of organization list the name and address of each

LLC member.

* The signature of the Organizer (person filing the Articles of Organization).

* Whether the LLC will be managed by one manager, more than one manager, or the members.

REGISTERED AGENT

Most states require that an LLC have a Registered Agent at a Registered Office within the state

of formation. This Registered Office may be at an address that is different from the LLC’s

business address, but may not normally be a post office box.

The main purpose of the Registered Office/Agent requirement is to provide a public record of a

person who will accept service of process on behalf of the LLC if claims are brought against it.

Because the Articles of Organization are a public record, potential claimants can usually contact

the Secretary of State’s office to obtain LLC’s registered agent information in order to serve your

LLC with a subpoena or summons. The agent may also be used to accept official documents,

such as tax notices.

�OPERATING AGREEMENT

LLC members should enter into an Operating Agreement of some type (a detailed sample is

provided in this package). This Operating Agreement may be established either before or after

the filing of the Articles of Organization and may be either oral or in writing in many states.

Regardless of state requirements, it is preferred practice to have a written Operating Agreement.

If you don’t create a written Operating Agreement, the LLC laws of your state will govern your

LLC. The Operating Agreement is kept by the members (each should have an updated copy), and

is not filed with the government.

The LLC operating agreement may vary in complexity, but normally contains the following

information:

* Company name and address information

* Name and address information for each LLC member

* LLC management structure and operation

* Items/Funds contributed by each Member

* Fair market value of each item contributed

* Date/triggers of company dissolution, if any

* Accounting methods

* Tax treatment decisions for your LLC

* Appointment of LLC officers, if any

* Designation of a final capital pay-in date, if any

OPEN A BANK ACCOUNT

Most banks require only a copy of your Articles of Organization and your federal Employer ID

Number to open a bank account. Some, however, may also require a resolution authorizing the

opening of the account passed by the LLC’s members and a copy of the LLC Operating

Agreement. Because bank requirements vary by bank, you should contact the branch manager

and ask about their requirements for new LLC accounts.

MEMBER MEETINGS

Although a corporation’s owners’ failure to hold shareholder or director meetings may subject

the owners to liability, this is not the case for LLCs in many states. If the LLC’s Articles of

Organization or Operating Agreement do not expressly require such meetings, such liability will

normally not attach for failure to have member meetings. While many states do not require that

your limited liability company hold meetings on a regularly scheduled basis, it is advisable to

conduct member meetings to protect the integrity of the LLC’s operations and minimize

disagreements.

***

�Forms List

The following forms are available for download with this package.

AL-NAMERESV: Application for Reservation of Entity Name

AL-00LLCT: Articles of Organization

AL-LLC-TL: Sample Transmittal Letter

AL-00LLC-1: Sample Operating Agreement (Multi-Member LLC)

AL-00LLC-2: Sample Operating Arrangement (Single-Member LLC)

US-IRS-SS-4: Application for Federal Tax Identification Number & Instructions

AL-2222LLC: Sample LLC Notices & Resolutions

Instructions on using the forms are either included with the forms and/or found in the Steps to

form LLC section, below.

***

�Notes on Downloading the Forms

In order that we can provide you with the most up to date forms at all times, all forms are located

on our servers for you to down load, complete and print. Downloading instructions are provided

and we will assist if you have any problems.

From the the download page, the easiest procedure to download the forms is to right click on the

form links and select “save target as” to save each form to your hard drive.

You will have six days during which you can return to the forms download page to download the

forms again if needed. You are advised to save the forms to your computer as soon as possible to

avoid any problem with the six day limit.

***

�Notes on Completing the Forms

The forms in this package may be available in Adobe Acrobat (“.pdf”) and/or Microsoft Word

(“.doc”) format.

If available in .pdf format, the forms will contain “fillable” blanks which you can type directly

into, and print. However, you can still print the form and fill in with a typewriter or by hand if

you desire.

If available in .doc format, the forms may contain “form fields” created using Microsoft Word.

“Form fields” facilitate completion of the forms using your computer. They do not limit you

ability to print the form “in blank” and complete with a typewriter or by hand. To complete the

forms click on the gray shaded areas and type the information. For the separation agreement

complete the gray shaded areas and also make any other changes or additions to resolve all

issues.

If you do not see the gray shaded form fields, go the View menu, click on Toolbars, and then

select Forms. This will open the forms toolbar. Look for the button on the forms toolbar that

resembles a shaded letter “a”. Click in this button and the form fields, if present, will become

visible. If there are no form fields, just type into the document, underlining if necessary, to

complete the form.

Some forms may be “locked” which means that the content of the forms cannot be changed

unless the form is unlocked. You can only fill in the information in the fields. If you need to

make any changes in the body of the form, it is necessary for you “unlock” or “unprotect” the

form. IF YOU INTEND TO MAKE CHANGES TO THE CONTENT, DO SO BEFORE YOU

BEGIN TO FILL IN THE FIELDS. IF YOU UNLOCK THE DOCUMENT AFTER YOU

HAVE BEGUN TO COMPLETE THE FIELDS, WHEN YOU RELOCK, ALL

INFORMATION YOU ENTERED WILL BE LOST. To unlock click on “Tools” in the Menu

bar and then selecting “unprotect document”. You may then be prompted to enter a password. If

so, the password is “uslf”. That is uslf in lower case letters without the quotation marks. After

you make the changes relock the document before you begin to complete the fields. After any

required changes relock the form, then click on the first form field and enter the required

information. You will be able to navigate through the document from form field to form field

using your tab key. Tab to a form field and insert your data.

If you experience problems, please let us know.

***

�Steps to form LLC

Step 1:

See FORM: AL-NAMERESV

APPLICATION FOR RESERVATION OF NAME

Please note that this form boldly states CORPORATION. There is no LLClabeled name reservation form. You should call the Secretary of State’s office

(corporations division) to ask whether you can use this form to reserve a name,

perhaps marking out “CORPORATION” and writing in “LLC,” or how to go

about reserving an LLC name. Contact the office of the Secretary of State at (334)

242-5324.

The name of each limited liability company as set forth in its articles of

organization shall contain the words "Limited Liability Company" or the

abbreviation "L.L.C." or "LLC". These words or their abbreviation shall be

the last words of the name of every limited liability company formed under

the provisions of this chapter. The limited liability company name may not

contain a word or phrase which indicates or implies that it is organized for a

purpose other than one or more of the purposes contained in its articles of

organization.

You may skip this step and go to step 2, but if the limited liability company name

you have selected is not available, the Articles of Organization will be returned to

you.

Step 2:

Once you have reserved the limited liability company name, or if you have chosen

to proceed without reserving a name, complete the form entitled “Articles of

Organization.”

See FORM: AL-00LLCT

ARTICLES OF ORGANIZATION

Follow these instructions to complete the Domestic Limited Liability

Company Articles of Organization:

Article I: Provide the LLC name that you have reserved.

Article II: The duration of a LLC is perpetual. In this Article, write

“perpetual” or, if applicable, state the specified date of dissolution of the LLC.

Article III: Limited liability companies may be organized under this chapter

for any lawful purpose or purposes.

Article IV: A resident agent is another entity or individual designated to

accept service of process for the LLC. Insert the address (cannot be a P.O.

box) of the resident agent and then the name of the resident agent at that

address.

�

Step 3:

Article V: You will probably want the Articles of Organization filed by an

organizer and not by the individual members of the LLC. Provide the name

and address of the organizer here.

Article VI: If applicable, name the managers of the LLC.

Have the organizer sign and date the Articles.

File the original and two copies of the Articles of Organization in the county

where the LLC’s registered office is located. The Secretary of State’s filing fee is

$40.00. CONTACT THE JUDGE OF PROBATE TO VERIFY THE

PROBATE FILING FEE. (The probate judge collects all fees and forwards the

documents you file to the Secretary of State along with the Secretary of State’s

filing fee.)

A cover letter to send with the Articles of Organization is included in this packet.

Make sure you include an original and two copies of the Articles of Organization

in order to have a copy returned to you.

See FORM: AL-LLC-TL

SAMPLE TRANSMITTAL LETTER

Step 4:

Complete an Operating Agreement.

See FORM: AL-00LLC-1

SAMPLE OPERATING AGREEMENT (MULTI-MEMBER LLC)

For a single-member LLC,

See FORM: AL-00LLC-2

SAMPLE OPERATING ARRANGEMENT (SINGLE-MEMBER LLC)

Step 5:

Apply for a Federal Tax Identification Number. This is done with form US-IRSSS-4. Mail to your regional IRS office.

See Supplemental Form: US-IRS-SS-4

FEDERAL TAX ID APPLICATION AND INSTRUCIONS

Step 6:

Open a bank account and conduct business.

Ongoing:

Sample Notices and Resolutions are provided for your convenience.

See FORM: AL-2222LLC

Sample LLC Notices & Resolutions

***

�Accessories

U. S. Legal Forms, Inc. offers the following LLC accessories:

LLC Seal:

If you would like to order a LLC seal call U.S. Legal Forms, Inc. at (601)

825-0382. Engraved with your company name: $24.95 plus shipping, or see

http://www.uslegalbookstore.com/officeproducts/

Imprinted (or blank) Lithographed LLC Membership Certificates:

Preview

Order for your state

***

�SAMPLE OWNERSHIP LEDGER

and

SIMPLE MEMBERSHIP CERTIFICATE

��Ownership Ledger

Name and Residence

Address of LLC Member

Date of

Transfer

% Ownership

Amount Paid

Subsequent

Transfer

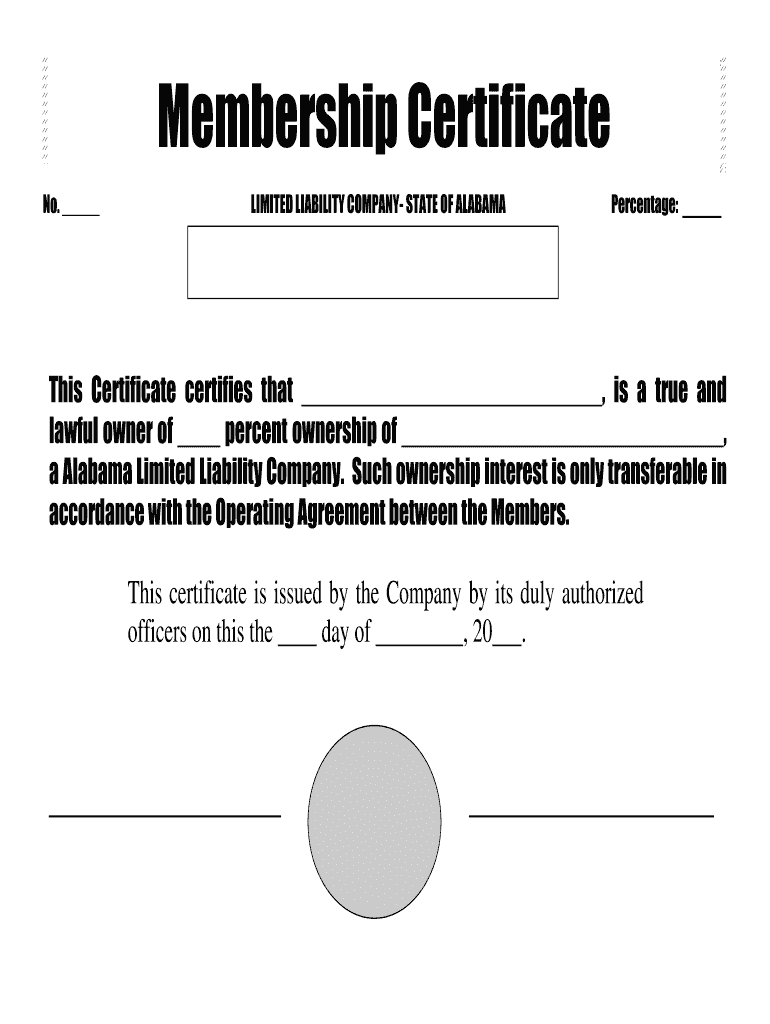

�Membership Certificate

No. _____

LIMITED LIABILITY COMPANY- STATE OF ALABAMA

Percentage:

___

This Certificate certifies that ____________________________, is a true and

lawful owner of ____ percent ownership of ______________________________,

a Alabama Limited Liability Company. Such ownership interest is only transferable in

accordance with the Operating Agreement between the Members.

This certificate is issued by the Company by its duly authorized

officers on this the ____ day of _________, 20___.

__________________

___________________

�Disclaimer

THESE MATERIALS ARE PROVIDED "AS IS" WITHOUT ANY EXPRESS OR IMPLIED

WARRANTY OF ANY KIND INCLUDING WARRANTIES OF MERCHANTABILITY,

NONINFRINGEMENT OF INTELLECTUAL PROPERTY, OR FITNESS FOR ANY PARTICULAR

PURPOSE. IN NO EVENT SHALL U. S. LEGAL FORMS, INC. OR ITS AGENTS OR OFFICERS

BE LIABLE FOR ANY DAMAGES WHATSOEVER (INCLUDING, WITHOUT LIMITATION

DAMAGES FOR LOSS OF PROFITS, BUSINESS INTERRUPTION, LOSS OF INFORMATION)

ARISING OUT OF THE USE OF OR INABILITY TO USE THE MATERIALS, EVEN IF U.S.

LEGAL FORMS, INC. HAS BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES.

If you are not an attorney, you are advised to seek the advice of an attorney for all serious legal matters.

The information and forms contained herein are not legal advice and are not to be construed as such.

Although the information contained herein is believed to be correct, no warranty of fitness or any other

warranty shall apply. All use is subject to the U.S. Legal Forms, Inc. Disclaimer and License located

here: http://www.uslegalforms.com/disclaimer.htm. To view, click on the link, or copy it into the

address window of your web browser.

If you cannot view the information contained at the link above, or do not agree to the terms

therein, you may not use the package materials. Return the package for a full refund.

***

~ Thank you for using USLF ~

�