Fill and Sign the Fpi Rental Application Tax Credit Forrentcom Form

Valuable advice on creating your ‘Fpi Rental Application Tax Credit Forrentcom’ online

Are you exhausted by the inconvenience of managing paperwork? Look no further than airSlate SignNow, the premier electronic signature platform for individuals and small to medium-sized businesses. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can easily complete and sign paperwork online. Utilize the robust tools integrated into this user-friendly and affordable platform to transform your document management methods. Whether you need to sign forms or gather signatures, airSlate SignNow streamlines everything with just a few clicks.

Adhere to this comprehensive guide:

- Access your account or sign up for a free trial with our service.

- Select +Create to upload a file from your computer, cloud storage, or our form library.

- Open your ‘Fpi Rental Application Tax Credit Forrentcom’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and allocate fillable fields for others (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

Don't worry if you need to collaborate with your colleagues on your Fpi Rental Application Tax Credit Forrentcom or send it for notarization—our platform equips you with everything you require to achieve these tasks. Register with airSlate SignNow today and elevate your document management to a new standard!

FAQs

-

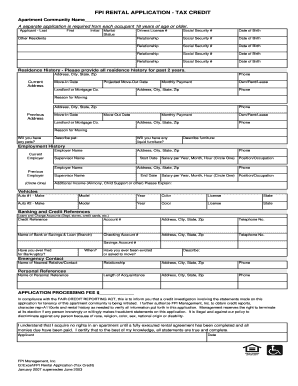

What is the FPI Rental Application Tax Credit ForRent com?

The FPI Rental Application Tax Credit ForRent com refers to a tax credit program designed to assist landlords and tenants in managing rental applications efficiently. This program helps ensure compliance with federal guidelines while providing financial relief for eligible renters. By utilizing the FPI Rental Application Tax Credit ForRent com, landlords can streamline their application processes and enhance their rental property management.

-

How can airSlate SignNow help with the FPI Rental Application Tax Credit ForRent com?

airSlate SignNow offers an easy-to-use platform for eSigning and managing documents related to the FPI Rental Application Tax Credit ForRent com. With its seamless integration, landlords can send and receive rental applications quickly, ensuring that all necessary documentation is compliant and properly executed. This efficiency not only saves time but also reduces the risk of errors in the application process.

-

What are the pricing options for using airSlate SignNow in relation to the FPI Rental Application Tax Credit ForRent com?

airSlate SignNow provides flexible pricing plans tailored to the needs of businesses utilizing the FPI Rental Application Tax Credit ForRent com. Whether you are a small landlord or a large property management company, there are affordable options available that cater to various usage levels. You can choose a plan that best fits your budget while still benefiting from the essential features needed for effective document management.

-

What features does airSlate SignNow offer for the FPI Rental Application Tax Credit ForRent com?

airSlate SignNow includes features such as customizable templates, secure eSignatures, and automated workflows specifically designed to support the FPI Rental Application Tax Credit ForRent com. These tools enable landlords to create, send, and track rental applications effortlessly. With document storage and real-time notifications, managing your rental properties becomes more streamlined than ever.

-

Is it easy to integrate airSlate SignNow with existing systems for the FPI Rental Application Tax Credit ForRent com?

Yes, airSlate SignNow is designed for easy integration with various property management systems, enhancing your workflow for the FPI Rental Application Tax Credit ForRent com. This compatibility means you can seamlessly connect your existing tools and maintain your current processes without disruption. The user-friendly interface ensures that you can start maximizing its features quickly.

-

What are the benefits of using airSlate SignNow for the FPI Rental Application Tax Credit ForRent com?

Using airSlate SignNow for the FPI Rental Application Tax Credit ForRent com provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. With automated workflows, you can minimize delays in processing applications and ensure that all necessary documentation is completed correctly. This leads to a smoother rental experience for both landlords and tenants.

-

Can airSlate SignNow help with compliance related to the FPI Rental Application Tax Credit ForRent com?

Absolutely! airSlate SignNow assists in maintaining compliance with the regulations associated with the FPI Rental Application Tax Credit ForRent com by providing legally binding eSignatures and document tracking. This helps ensure that all rental applications meet the necessary legal standards, reducing the risk of compliance issues. With a secure platform, you can confidently manage your rental documents.

Find out other fpi rental application tax credit forrentcom form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles